Dear Investors,

Welcome to this week’s edition of the Myth of Money. If you would like to keep in closer touch, please reach out on X below.

As I am offline this week on a personal matter, this week’s edition of the Myth of Money is brought to you from one of our associates, writer and researcher Katherine MacLellan.

Early Saturday, Israel launched a significant retaliatory strike against Iran, marking its first direct military action against the country since the 1980s. Over 100 aircraft targeted approximately 20 key military sites, focusing on facilities linked to missile production, as well as surface-to-air missile installations. This action was in response to Iran’s attack on Israel on October 1. Iran reported four soldier casualties and downplayed the damage inflicted on its assets.

Despite this escalation in tensions in the region, oil prices have shown a surprising decline: Brent crude dropped 4.09% to $72.94 per barrel, and WTI fell 0.30% to $70.18. Analysts suggest that markets may have already priced in geopolitical risk, or that immediate supply disruptions are minimal, as Israel’s strikes targeted military sites rather than oil infrastructure.

While the immediate impact on oil supply is muted, further escalation could quickly shift this outlook. Heightened geopolitical uncertainty could drive demand for safe-haven assets, with Bitcoin notably stable over the last 24 hours, possibly signaling a decoupling from traditional risk on assets amid intensified global tensions.

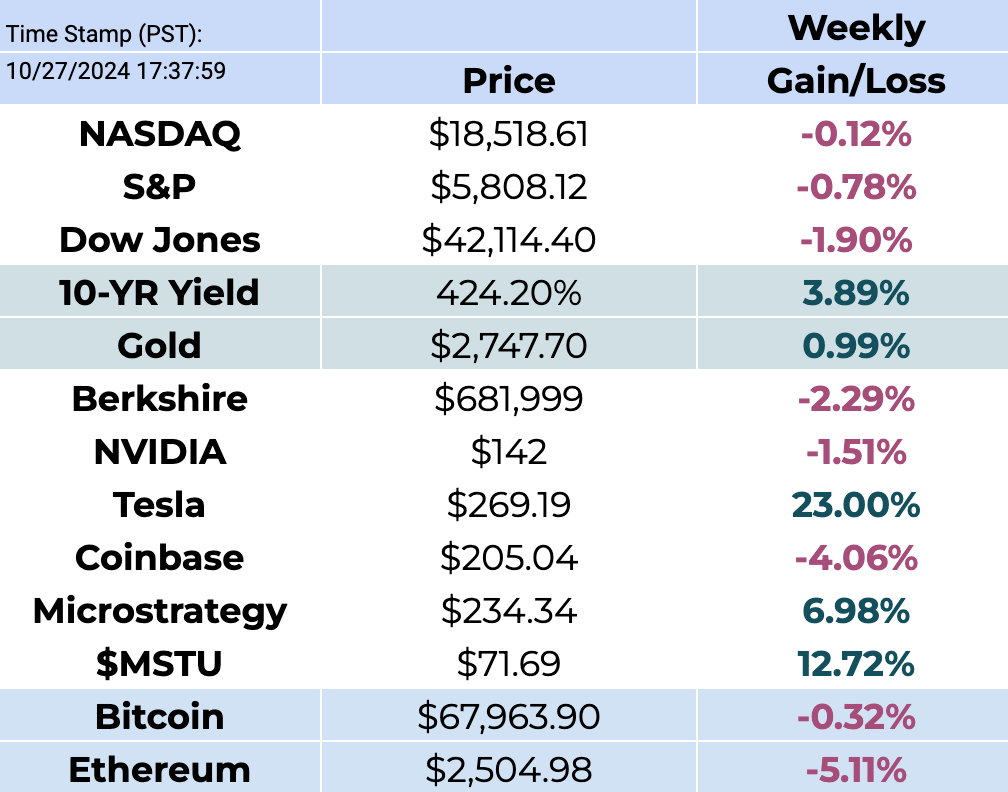

U.S. markets diverged this week as political and economic signals sent mixed messages. The Dow Jones fell 2.7% to 42,114, while the Nasdaq gained 0.2% to 18,518, and the S&P 500 dropped 1% to 5,808, ending a six-week winning streak. Rising Treasury yields and pre-election jitters are prompting caution, even as early voting accelerates in key states. The S&P 500’s 11.8% gain since August typically favors incumbents, but Harris’s stance as a “change candidate” complicates this.

Regardless of the election outcome, it’s going to be spendy: both candidates’ plans for multi-trillion-dollar spending will drive inflation, pushing investors toward equities in the short term and safe-haven assets like gold and Bitcoin for long-term stability. While economic indicators are strong, 62% of voters rate the economy as “bad,” weighing on consumer sentiment.

Betting Markets Signal Trump’s Edge – What to Know

As the 2024 election nears, prediction markets like Polymarket have given Trump a notable edge, contrasting with traditional polls that still indicate a tight race. This difference has sparked debate on whether prediction markets, which involve real financial stakes, might better capture sentiment.

Trump’s Market Surge: What’s Behind It?

Trump’s high odds on Polymarket may partly stem from a single French trader who has reportedly invested $28.6 million in pro-Trump bets. While Polymarket denies evidence of manipulation, some critics suggest that large individual bets could influence outcomes. However, Trump’s lead isn’t exclusive to Polymarket—U.S.-based markets like PredictIt and Kalshi also show him leading, with odds near 60%, reinforcing the pro-Trump trend.

How Much Stock to Put in Prediction Markets?

Prediction markets can offer timely insights, responding quickly to breaking news with financial incentives driving analysis. While more volatile than polls—making a 60-40 split closer to a toss-up than a guarantee—these markets provide a unique perspective that polls may lack.

Limitations to Consider

Polymarket, a crypto-based platform unavailable to U.S. users, may reflect a demographic different from that of traditional polls. Additionally, with only 150,000 active users, Polymarket is more sensitive to large bets, which can legitimately sway odds.

Bottom Line:

Prediction markets like Polymarket offer a glimpse into investor sentiment, but work best when considered alongside polls and other data. For investors, maintaining cautious optimism is key; these markets are one of many tools for evaluating election impacts on portfolios. As election day approaches, a diversified approach that balances multiple indicators will likely be the safest bet.

What I’m Reading This Week 📚

Why It’s Critical for the US to Pursue a Pro-Innovation Approach to Software Regulation

Unlike the European Union, the U.S. seems open to holding users of new technology liable for injuries or damage, rather than the technology’s creators. Here’s why the US needs to stay true to that approach.

Should You Be Nice to Your Chatbot?

Some have no qualms about treating ChatGPT like their servant; ‘Just like humans, AI can’t always be the bigger person.’

This Week By the Numbers 📈

Click for more.

🚀 Crypto & Blockchain Developments:

• SEC approves options listing for spot Bitcoin ETFs

• Perplexity AI valued at $8B, raising $500M

• Stripe acquires stablecoin platform Bridge for $1.1B

• Vitalik: staking centralization big risk to Ethereum

• Citibank debanked Ripple CEO

💼 Economic & Market Trends:

• America outperforming rest of world economically

• Fed’s beige book shows little growth across most of US

• China cuts lending rate by 25bps

• Bank of Canada cuts rate 50bps to 3.75%

• Crypto markets sideways, ETF demand six-month high

🏛️ Regulatory & Political Landscape:

• Japan's DPP pledges 20% tax cap on crypto

• Denmark proposes 42% tax on unrealized crypto gains

• Buenos Aires launches blockchain-based digital identity

• FAA publishes final regulations for air taxis

• Putin calls for alternative international payment system

💰 Corporate & Financial News:

• Nasdaq rises to ATH Friday

• Tesla rose 22% after strong Q3 results

• Boeing reported $6B loss

• IBM missed Q3 revenue estimates

• Coca-Cola beat Q3 estimates, higher prices offset demand

• Losses for McDonalds following E Coli outbreak, onions blamed

🇺🇸 US Political & Economic Developments:

• Trump considering eliminating all federal income tax

• DOJ warns Musk $1M voter giveaway may be illegal

• South Arkansas has a lot of lithium

• Microsoft tells shareholders to reject BTC buy proposal

🗣️ They Said What?

• Fed President: crypto mainly used for illegal activities

• Saylor calls self-custodians "paranoid crypto anarchists"

• Vitalik: Saylor's self-custody comments "batshit insane"

Top Stories 🗞️

Iran says it will respond ‘appropriately’ to Israeli strikes but does not seek war

Iran’s leadership has said it is weighing a response to this weekend’s Israeli airstrikes, as the country called on the UN security council to meet on Monday.

Iran’s president, Masoud Pezeshkian, said Tehran was not looking for a war but would respond “appropriately” to Israel’s strikes.

“We do not seek war but we will defend the rights of our nation and country,” Pezeshkian told a cabinet meeting on Sunday. He added: “We will give an appropriate response to the aggression of the Zionist regime.”

Iran’s mission to the UN in New York, often used as a means of communicating media messages to the west, accused the US of being complicit in the attack since Israeli warplanes attacked Iran from Iraqi airspace. “Iraqi airspace is under the occupation, command and control of the US military. Conclusion: the US complicity in this crime is certain,” it said.

Striking Boeing workers reject 35% pay rise offer

Striking Boeing workers have rejected a new offer from the plane-making giant, which included a 35% pay rise over four years. The International Association of Machinists and Aerospace Workers (IAM) union said 64% of its members voted against the proposed deal.

More than 30,000 of Boeing's employees have joined the walkout, which started on 13 September, after an initial offer was rejected. Hours earlier Boeing's boss Kelly Ortberg warned that the company is at a "crossroads" as losses at the firm surged to roughly $6bn.

US to curb AI investment in China soon

U.S. rules that will ban certain U.S. investments in artificial intelligence in China are under final review, according to a government posting, suggesting the restrictions are coming soon.

The rules, which will also require U.S. investors to notify the Treasury Department about some investments in AI and other sensitive technologies, are derived from an executive order signed by President Joe Biden in August 2023 that focused on keeping American investors' know-how from aiding China's military.

The final rules -- which will restrict outbound investment to China in AI, semiconductors and microelectronics and quantum computing -- are now under review at the Office of Management and Budget, which in the past has meant they will likely be released within the next week or so.

Russian lawmakers ratify pact with North Korea as US confirms that Pyongyang sent troops to Russia

Russian lawmakers on Thursday ratified a pact with North Korea envisioning mutual military assistance, a move that comes as the U.S. confirmed the deployment of 3,000 North Korean troops to Russia.

The lower house of the Russian parliament, the State Duma, voted quickly to endorse the “comprehensive strategic partnership” treaty that Russia’s President Vladimir Putin signed with North Korean leader King Jong Un on a visit to Pyongyang in June. The upper house is expected to follow suit soon.

The U.S. said Wednesday that 3,000 North Korean troops have been deployed to Russia and are training at several locations, calling the move very serious and warning that those forces will be “fair game” if they go into combat in Ukraine.

Nigeria drops money laundering charges against Binance exec

The Nigerian government has dropped all charges against Binance executive Tigran Gambaryan, who has been detained in prison in Nigeria for more than seven months.

A lawyer representing Nigeria’s government prosecutor, the Economic and Financial Crimes Commission (EFCC), announced the withdrawal of the charges at the Federal High Court in Abuja on Oct. 23, local news agency Premium Times reported.

The EFCC lawyer said that Gambaryan, a United States citizen, wasn’t serving a key role at Binance, whose activities were the target of the prosecution.

“Myth Of Money” Book - Shipping this week! 🤓

As many of you know, making financial education accessible has always been a passion of mine. After a year of hard work, I'm excited to announce that my new book, published by Wiley Publishing, is finally out!

This book is a thrilling blend of personal stories from the financial world, coupled with clear explanations of how things really work—from investment banking and stocks to venture capital, macroeconomics, and cryptocurrencies.

Thank you for reading this week’s edition of the Myth of Money.🚀

Were you forwarded this email? Subscribe below.

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. Currently working as a proud General Partner at Moonwalker Capital.

(More about me 👉 here).

About the Author: Katherine MacLellan

Katherine holds an MA (Hons) in Economics and International Relations from the University of St. Andrews, and a JD from Osgoode Hall. She has been thinking and writing about Bitcoin and blockchain technology since 2013.

Amazing edition! Thanks so much. Super comprehensive. Great coverage. Balanced and nuanced at the same time.