All Eyes on CPI and Inflation 👀

Dear Investors,

Welcome to this week’s edition of the Myth of Money. If you would like to keep in closer touch, please reach out on X (formerly Twitter) below.

This week, all eyes were on the April Consumer Price Index (CPI) numbers, a key indicator of inflation and a potential determinant of whether the Federal Reserve will lower interest rates in the coming months. Lower interest rates will inevitably ignite a bull run across markets. The flip side could lead us to a long-feared recession.

The April CPI report met expectations, revealing a 3.4 percent increase in inflation from a year ago and a 0.3 percent rise month-over-month. Analysts perceived this as a positive sign, with some stating that "inflation is moving in the right direction." While inflation persists, the underlying dynamics suggest a trend towards disinflation, indicating that the pace of price increases is slowing down.

However, despite the overall CPI inflation rate of 3.4 percent, certain essential goods and services have experienced significantly higher inflation rates:

1. Car Insurance: 22.6%

2. Transportation: 11.2%

3. Hospital Services: 7.7%

4. Car Repairs: 7.6%

5. Homeowner Costs: 5.8%

6. Rent: 5.4%

7. Electricity: 5.1%

8. Food Away From Home: 4.1%

It is important to note that inflation has been above 3 percent for over three years, compounding over multiple years of already elevated prices. This ongoing high inflation in basic necessities suggests that affordability is still worsening, making it clear that we might not be ready for interest rate cuts just yet.

The Federal Reserve appears to be in a state of indecision. A true reversal of inflation would likely require a recession and a correction of prices across the board, particularly in the housing sector. However, given that this is an election year, there is a strong incentive to maintain a positive economic trajectory, which has led to a lack of drastic action. There is also fear that further rate increases could cause more bank collapses, similar to the Silicon Valley Bank incident last year, potentially trigger a commercial real estate collapse, and make it increasingly difficult for the American government to service its growing debt.

Furthermore, there seems to be a lack of cohesiveness between the continued increased budget spending on Capitol Hill and the apparent tightening efforts by the Federal Reserve.

My projection is that we are heading into a period of market volatility, with an uptrend likely leading into the November Presidential election. After the election, the new President will inevitably have to confront the economic challenges and possibly impose austerity measures to stabilize the economy or risk the U.S. dollar losing its reserve currency status.

How do we protect ourselves in this inflationary environment? Bitcoin continues to be the obvious answer as hedge to both geopolitical volatility and domestic threat of inflation. Bitcoin had recovered to $67,000 from a correction of $57,000 within days of the CPI news.

What I’m Reading This Week 📚

Pantera publishes its thesis on the TON network, its largest invest meant for the fund to date - Read here.

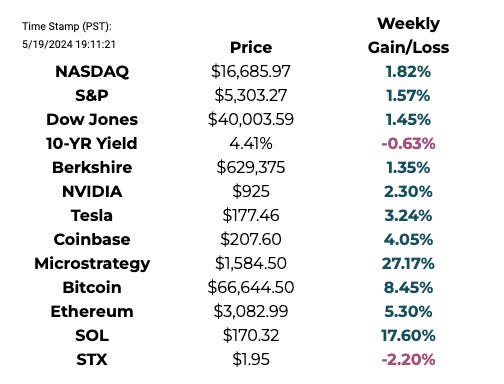

This Week By the Numbers 📈

Quick Facts:

Bill Gates liquidates $1.7 billion of his portfolio, mirroring Buffett's move to stockpile cash

Billionaire Druckenmiller says he bought five Argentinian stocks, praises Javier Milei’s policies

Russian court seizes assets worth over $700 million from UniCredit, Deutsche Bank, and Commerzbank in a move against Western lenders

China pledges $42 billion to support the struggling property market

Iran's President Ebrahim Raisi confirmed dead in helicopter crash

Russia and Iran working to create a single currency for BRICS

Video surfaces of Diddy assaulting singer Cassie (link)

Gaza aid pier opens

US Congressman Thomas Massie introduces a bill to abolish the Federal Reserve

US Senate votes to overturn SEC rule preventing highly regulated financial firms from holding Bitcoin and crypto

US Senator Cynthia Lummis posts Bitcoin laser eyes after pro-crypto legislation passes in the Senate

El Salvador mines 474 Bitcoin worth $29 million using its volcano-fueled geothermal power plant

Point72 buys $78 million of BTC ETF

Crypto rallies after another strong day of ETF inflows, May inflows may already eclipse April outflows

BlackRock blows through records with over 400 ETF holders in the first quarter, Millennium Management leads with $844 million in IBIT shares, followed by Schonfeld Strategic Advisors with $248 million and Aristeia Capital with $163 million

JPMorgan revises bitcoin production cost estimate to $45,000

According to Coinbase, ETH ETF coming sooner rather than later

Coinbase futures to list ONDO, PYTH & ZETA

Coinbase recovers after system-wide outage

TON & Tether partnership to create seamless payment solution

Roaring Kitty of GME fame returns, causing meme stocks to fly, GameStop triggers circuit breaker with shares up 54%

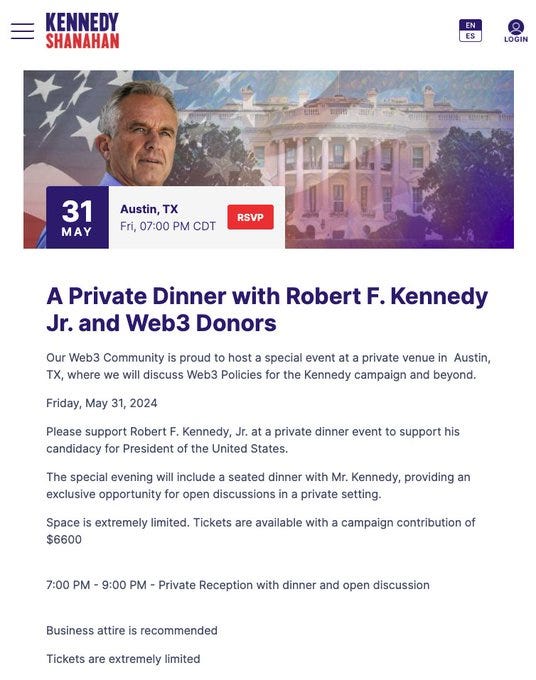

Consensus: RFK Dinner for Web 3 Whales

Heading to #Consensus2024 ? I'll be attending a dinner with RFK's Web 3 Donors

Donate to attend here - https://kennedy24.com/austinweb3

Co-hosted by: @RFKJToken

Top Stories 🗞️

Ethereum price rallies after unexpected regulatory victory

Ether’s surge was also driven by a U.S. Department of Justice indictment unsealed on May 15. The indictment accused two individuals of wire fraud and money laundering by manipulating the Ethereum blockchain. The document stated that “Ethereum is a decentralized blockchain […] without the need for a trusted intermediary” and added, “No central actor runs the Ethereum Network.” Additionally, the court noted that Ethereum smart contracts enable transactions without a trusted intermediary. These statements boosted Ether investors’ confidence, especially after the U.S. Securities and Exchange Commission issued a Wells notice to the trading platform Robinhood on May 4 over alleged securities violations related to crypto listings and custodian operations.

Biden raises tariffs on $18 billion of Chinese imports: EVs, solar panels, batteries and more

The Biden administration announced stiff new tariff rates Tuesday on $18 billion worth of Chinese imports. The White House said the tariff hikes were necessary to protect American industries from unfair competition. Starting this year, President Joe Biden will quadruple tariffs on imported Chinese electric vehicles, from 25% to 100%. The import tax on Chinese solar cells will double, from 25% to 50%. And tariffs on some Chinese steel and aluminum imports will increase more than three-fold, from 7.5% today up to 25%. The president also directed U.S. Trade Representative Katherine Tai to more than triple the tariff rates on lithium-ion batteries for EVs and lithium batteries meant for other uses. Starting in 2025, tariffs on imported Chinese semiconductors will jump from 25% to 50%.

Russia Just Found Huge Oil Reserves in Antarctica

Russia has discovered huge oil reserves in British territory in Antarctica, according to evidence submitted to the U.K. House of Commons Environment Audit Committee (EAC). The reserves uncovered contain around 511 billion barrels worth of oil, equating to around 10 times the North Sea's output over the last 50 years. Despite having no territorial claims in Antarctica, Russia, along with the U.S. and China, has been gradually escalating its presence in the region in recent years through various scientific campaigns, establishing five research stations in the territory since 1957. But concerns are now being raised that Russia is attempting to assert its influence in the area through means other than scientific research. Antarctica is governed by The Antarctic Treaty, first signed on December 1, 1959, which states that no single country owns the territory and designates the region as a continent devoted to peace and science, meaning all oil developments in the area are prohibited.

Alex Labs freezes $3.9M of exploited funds sent to CEXs after hack

Bitcoin layer-2 developer Alex Labs has successfully frozen more than $3.9 million worth of crypto that was exploited from its BNB Smart Chain bridge, according to the team’s May 16 social media post. According to the post, the attacker sent the funds to several different centralized exchanges (CEXs), which allowed them to be frozen with the cooperation of the exchanges. The team said it recovered the complete balances for 17 different tokens, including “all aBTC, sUSDT, xBTC, xUSD, ALEX, atALEX, LiSTX, LUNR, SKO, CHAX, $B20, ORDG, ORMM, ORNJ, TRIO, TX20 and STXS.” $13.7 million worth of Stacks (STX) tokens were also exploited. Of these, the attacker made the mistake of sending “about 3 million” to centralized exchanges. A total of $3.7 million is held at exchanges, whereas $9.6 million are held in wallets under the direct control of the attacker. Alex Labs has offered a 10% bounty to the attacker and a promise not to prosecute if they return the other 90% of the stolen funds.

US Senate Overturns SEC Rule Barring Firms From Holding Bitcoin

The US Senate has officially voted to overturn a US Securities and Exchange Commission (SEC) rule that prevents regulated financial firms from holding Bitcoin and other cryptocurrencies. The legislation, H.J. Res. 109, had previously passed in the US House last week. The decision approves the reversal of the SEC’s Staff Accounting Bulletin (SAB) No. 121. Subsequently, the legislative action against the regulators was met with bipartisan support. Now the joint resolution invalidating the previous SEC rule will reach the desk of the President.

My Top 10 Investment Ideas for 2024 🐸

This week, we are offering an additional free knowledge source - My Top 10 Investment Ideas for 2024, including picks across stocks and crypto, and my reasoning behind making those investments personally.

To receive this product, simply refer 3 friends using your unique shareable link 👇

Thank you for reading this week’s edition of the Myth of Money.🚀

Were you forwarded this email? Subscribe below.

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).