An Intro to Zero-Knowledge Proofs and Rollups 🚀

Welcome to this week’s edition of Myth of Money, a weekly newsletter on thing crypto, macro, and tech, read by 13,000+ investors.

Disclaimer: The following is not intended as investment advice. Do your research.

Dear Investors,

We have started a new Myth of Money Twitter! If you enjoy this newsletter, please follow us for a daily dose of up-to-date market news here:

What are ZK Rollups?

One of the hottest trends in the crypto industry right now are ZK (zero-knowledge proof) rollups. In this week's newsletter, we are providing a brief overview of what these are and their benefits.

Rollups are a powerful scaling solution for the Ethereum network, allowing for a significant increase in the number of transactions that can be processed on-chain. By "rolling up" multiple transactions into a single transaction on the main chain, rollups provide a cost-effective and efficient way to increase the throughput of the Ethereum network.

What Are Zero-Knowledge proofs?

Let’s back up.

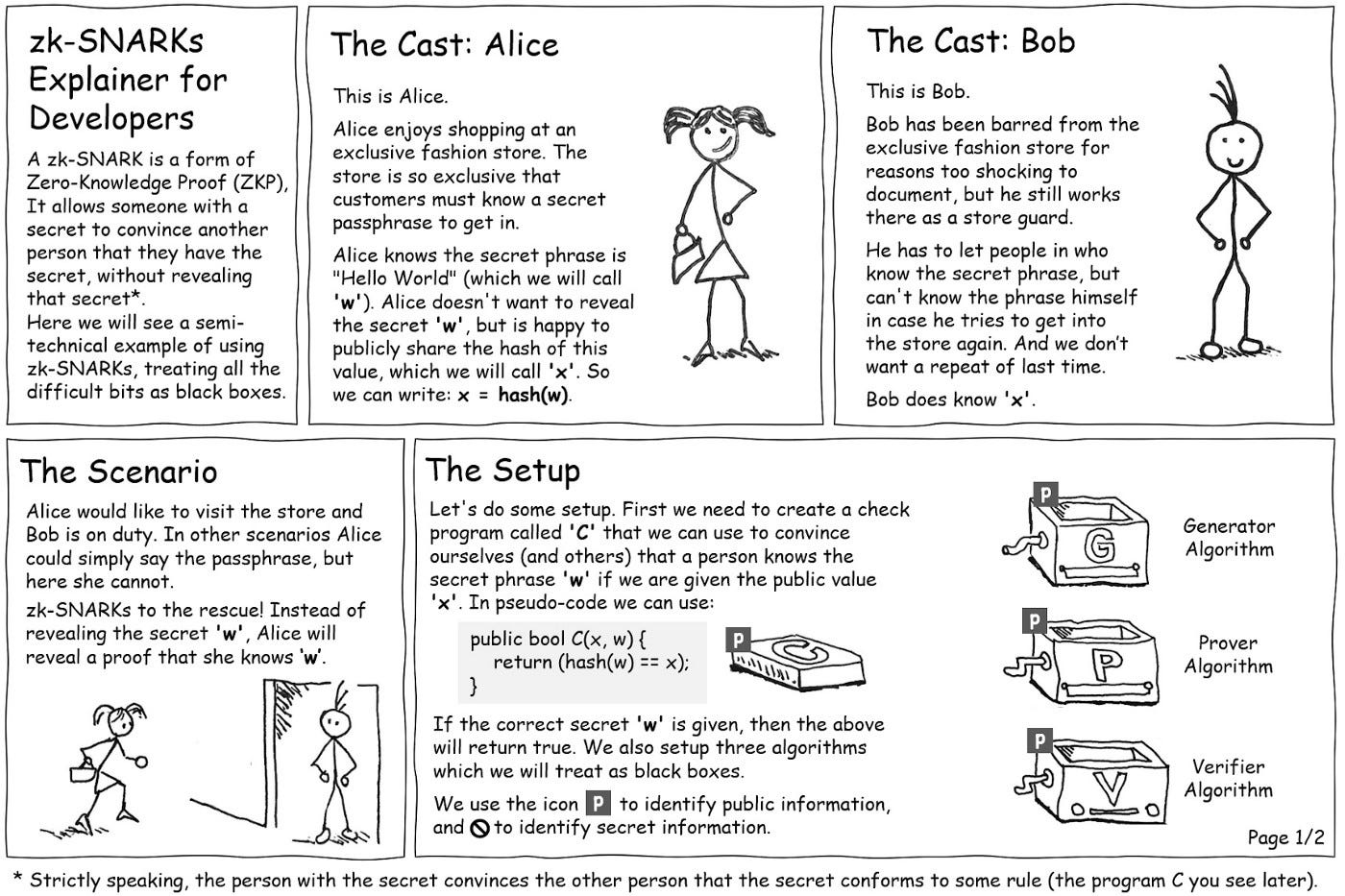

A ZK proof can allow someone with a secret to convince another person that they know that secret without revealing that secret.

The following cartoon explains it best. (Source: Medium)

Understanding Rollups on Ethereum

Rollups are a technique used on Ethereum to scale the number of transactions that can be processed on-chain. They work by "rolling up" multiple transactions into a single transaction on the main chain, which is then processed by a smart contract called a "roll-up contract."

The roll-up contract on the main chain maintains the current state of the roll-up layer. This includes account balances of the users transacting on it and the smart contract codes of the contracts that live in it. It keeps track of the state root of the transactions in the rollup layer.

When transactions happen on the rollup layer, the state changes, and the state root needs to be updated. Instead of updating the state root for every transaction, the transactions are batched and sent to the rollup contract on the main chain. The batch includes a compressed form of the batch of transactions and an updated state root that represents the data after the batch of transactions has been processed.

The roll-up contract checks that the previous state root in the batch matches its current state root. If it does, it switches the state root to the new state root. The compressed transaction data is posted to the rollup contract as a "call data" parameter, which is the cheapest form of storage to use.

Rollups post the transaction data on-chain along with the state root, and anyone can post the new batch of transactions to the rollup contract on-chain.

Optimistic and ZK Rollups: Pros and Cons

There are two main types of rollups: Optimistic rollups and ZK rollups. Optimistic rollups "optimistically" post the new state root and transaction data to the rollup contract on the main chain without validating that the transactions have been executed correctly.

ZK rollups use zero-knowledge proofs to ensure the correctness of batches. They provide a way to validate transactions in a private, trustless manner, enabling the use of confidential transactions on the Ethereum network.

In terms of cost, Optimistic rollups cost less for posting new batches on-chain, but more for gas cost per transaction. ZK rollups cost more for posting new batches, but less for gas cost per transaction, and off-chain computation costs are higher.

In terms of speed, Optimistic rollups are slower with withdrawal waiting around 1 week, while ZK rollups are faster with withdrawal waiting under 10 minutes.

In terms of complexity, Optimistic rollups are simpler, and ZK rollups are more complex. Optimistic rollups are easier to generalize, while ZK rollups are harder.

In terms of scalability, Optimistic rollups are less scalable, while ZK rollups are more scalable.

There are several projects out on the market utilizing this innovation including - Syscoin, Mute, Loopring, Hermez, and Immutable X. As always DYOR before investing in any of these projects!

This Week By the Numbers 📈

The mini-bull run has continued for another week, with traders eagerly awaiting the upcoming FOMC meeting on January 31st.

Top Stories 🗞️

California DMV to digitize car title management system via Tezos

The California DMV is testing the digitization of car titles and transfers through a private Tezos blockchain in partnership with Tezos and blockchain firm Oxhead Alpha. A successful proof-of-concept was announced by Oxhead Alpha on January 25th. The California DMV has chosen Oxhead Alpha to develop a private Tezos testnet, known as a "shadow ledger," which will be a blockchain version of the agency's current database. The DMV aims to complete the shadow ledger within the next three months and then introduce digital wallets for holding and transferring car title NFTs, with the DMV as a mediator.

FTX Creditor List Features Netflix, Binance, Wall Street Journal

The long-awaited FTX creditor list, minus 9.7 million redacted customer names, has been released. The 116-page list, filed by the company's lawyers as part of the bankruptcy proceedings, names companies like Netflix and Apple and provides a comprehensive view of the failed crypto firm's reach and impact of its collapse. The list features media companies, universities, airlines, charities, and more. While the names of individual creditors are sealed for three months, Judge John Dorsey requested the institutions invested in FTX to be disclosed. The list includes media companies like the Wall Street Journal, Fortune, Fox Broadcasting, and CoinDesk, and big crypto firms like Coinbase and Binance. CoinDesk is listed for technical reasons due to an unfulfilled podcast sponsorship. FTX stated that the list was compiled to give broad notice to stakeholders and potential stakeholders, and names could appear for various reasons.

Sam Bankman-Fried's Brother Lobbied Members of the US Congress Using Misappropriated Funds

The founder of FTX, Sam Bankman-Fried, is under investigation and facing charges. Recent evidence shows that his brother Gabriel may have used misappropriated funds from FTX to lobby US Congress members through his organization Guarding Against Pandemics. FTX, now in bankruptcy proceedings, has accused Gabriel of using the funds to purchase a multi-million dollar property near the US Capitol. FTX's lawyers claim that Gabriel, as well as SBF's parents, are not cooperating with the investigation. Meanwhile, SBF's mother Barbara Fried is associated with a political action committee called Mind the Gap which received donations from SBF and FTX employees. The extent of their spending is still being analyzed. Previously, it was reported that SBF bought expensive properties for his parents, who reside in a $16.4 million house in the Bahamas.

Marathon forms Abu Dhabi bitcoin mining JV; initial project of 250MW

Marathon Digital, a cryptocurrency miner, is partnering with FS Innovation to establish joint venture mining facilities in Abu Dhabi. The first project will include two 250 MW digital asset mining sites, with FSI owning 80% and Marathon 20% with a cost of $406 million. Marathon has previously outsourced its mining operations, but the industry is facing challenges from high energy costs and falling bitcoin prices. Many miners are heavily in debt and some have declared bankruptcy. The cost of electricity in the UAE is $0.081 per kilowatt hour for households, lower than the $0.175 in the US.

Gemini and Genesis charged by SEC with selling unregistered securities

The SEC has charged Genesis Global Capital and Gemini with offering unregistered securities through Gemini's "Earn" program on January 12th, 2023. Genesis, a subsidiary of Digital Currency Group, entered into an agreement with Gemini in December 2020 to offer a yield-bearing crypto product, which was launched in February 2021. The product allowed Gemini customers to loan their cryptocurrency to Genesis, with the promise of repayment with interest. However, the SEC complaint alleges that the Gemini Earn program was an offer and sale of securities, which should have been registered with the SEC.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (my portfolio).

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.