Apple Steps Into The Metaverse

Dear Investors,

Apple is set to unveil its highly anticipated headset at the Worldwide Developers Conference today, joining other tech giants in the metaverse trend.

Previously, Mark Zuckerberg made a significant move towards embracing the metaverse in November 2021 when he announced the renaming of his company from Facebook to Meta. Shortly thereafter, Bill Gates, one of Microsoft's founders, expressed his belief that within a couple of years, most virtual meetings would transition from traditional two-dimensional video grids to the metaverse—a three-dimensional digital space inhabited by avatars.

Following this, Microsoft made headlines with its $70 billion acquisition of Activision Blizzard, emphasizing the strategic importance of this deal in shaping the metaverse.

Apple is making its own move today, betting that it can capture consumer interest more successfully than Meta. Apple aims to introduce a game-changing headset that resembles ski goggles. With an expected price tag of around $3,000, its new headset could be the beginning of a long-term plan that eventually leads to a more popular virtual reality product, like a lightweight pair of glasses.

(Image credit: Future)

But is this the right course of action?

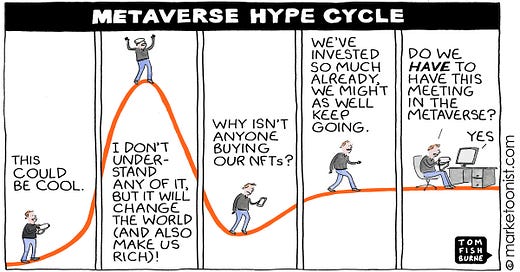

The concept of an immersive online universe that captures people's attention was more appealing to investors when individuals were confined to their homes during the peak of the pandemic. According to data from PitchBook, metaverse-related start-ups managed to raise approximately $664 million in venture capital during the first five months of 2023. This figure represents a significant decline compared to the impressive $2.93 billion raised in the same period in 2022. PitchBook reports that recent investments in metaverse start-ups have dropped to approximately a quarter of their peak in the first half of 2022.

Despite the initial excitement, enthusiasm for the metaverse has diminished over time. Technology investors have redirected their focus towards alternative trends like artificial intelligence, resulting in the metaverse somewhat losing its spotlight. Certain metaverse projects have been discontinued by companies like Disney and Microsoft, despite the initial surge of enthusiasm that surrounded them.

Meta's ambitious plan to reorient the company towards metaverse-centric technologies has incurred substantial costs. A key contributor to Meta's increased expenditure has been its hardware division, Reality Labs, which produces the Oculus headsets. This division recorded a loss of approximately $4 billion, the Q1 of 2023.

(Image Credit: EyePress News, via Reuters)

In recent months, Mr. Zuckerberg and his team have dedicated significant attention to highlighting Meta's proficiency in artificial intelligence, while emphasizing that both AI and the Metaverse remain central to their focus. Zuckerberg teased the upcoming release of Meta Quest 3, the company's latest VR headset, which is expected to be priced at $499 and potentially available later this year. Meta consumers have already spent over $1.5 billion in apps and games through Meta's Quest app store.

Some investors are betting on other industry leaders.

Roblox and Epic Games, the creators of the popular battle royale game Fortnite, offer a more captivating portrayal of a metaverse with their massive user bases, user-generated content, and thriving digital economies.

Roblox, a platform known for its diverse collection of games primarily targeted at children, experienced a remarkable 22 percent increase in daily users, reaching 66.1 million in the first quarter of 2023 compared to the previous year. Craig Donato, the Chief Business Officer of Roblox, mentioned the company's plans to expand into other immersive online experiences but acknowledged that a fully realized metaverse is still a distant prospect.

Will the Metaverse trend catch on?

In my perspective, the Metaverse holds tremendous potential, particularly in developing markets. It offers an exciting opportunity for users who may not have the means to travel, allowing them to virtually explore cultural and natural sites. Moreover, the Metaverse presents a unique proposition for brands, enabling individuals from all over the world to participate in events like Paris Fashion Week.

For remote workers and entrepreneurs, the Metaverse provides an incredible lifelike experience for conducting meetings and delivering pitches. However, for most people, the Metaverse may appear unnecessary, as real life always exerts a stronger appeal. This creates an interesting contrast in the pricing of these headsets: those who can afford the hefty price tag of $3,000 typically have less need for it, while those who cannot afford it would benefit from it the most.

What I’m Reading This Week 📚

Patience Is Beautiful - by Arthur Hayes

Former BitMex lays out the ultimate bullish case for crypto, although it will require some patience.

Throughout this essay I will delve into why, contrary to common monetary theory, due current debt to productive output conditions raising interest rates will cause the quantity of money and inflation to rise, not fall. It sets up a situation wherein regardless of which path the Fed chooses, be it to hike or cut rates, they will accelerate inflation and catalyse a general rush for the exits from the parasitic fiat monetary financial system.

This Week By the Numbers 📈

U.S. job growth gained momentum in May, while the unemployment rate rose to 3.7%, signaling a slight easing in labor market conditions. This could lead the Federal Reserve to skip an interest rate hike this month. Wage growth moderated, offering comfort to officials aiming to bring inflation back to the target of 2%.

Nonfarm payrolls increased by 339,000 jobs, surpassing expectations, and the economy created 93,000 more jobs in March and April than previously estimated. To keep up with population growth in the U.S., around 70,000-100,000 jobs need to be added monthly.

Crypto markets continue to plateau, as investors await the Fed to reverse interest rate policy.

Nvidia surpasses $1 trillion market cap due to positive AI-fueled earnings results.

Tesla shares soar after Elon Musk’s China visit.

Top Stories 🗞️

Biden signs debt limit bill, avoiding U.S. default

President Joe Biden on Saturday signed a bill that suspends the U.S. government's $31.4 trillion debt ceiling, averting what would have been a first-ever default with just two days to spare. The House of Representatives and the Senate passed the legislation this week after Biden and House of Representatives Speaker Kevin McCarthy reached an agreement following tense negotiations. The Treasury Department had warned it would be unable to pay all its bills on Monday if Congress had failed to act by then. Biden signed the bill at the White House a day after hailing it as a bipartisan triumph in his first-ever Oval Office address to the nation as president.

Saudi Arabia in talks to join China-based ‘Brics bank’

The New Development Bank, the Shanghai-based lender better known as the “Brics bank”, is in talks with Saudi Arabia on admitting the country as its ninth member, a move that would strengthen its funding options as founding shareholder Russia struggles under the impact of sanctions. The addition of the kingdom would reinforce ties between the bank, which was established by the world’s biggest developing economies as an alternative to western-led Bretton Woods institutions, and the world’s second-largest oil producer. “In the Middle East, we attach great importance to the Kingdom of Saudi Arabia and are currently engaged in a qualified dialogue with them,” the New Development Bank told the Financial Times in a statement.

Binance Hands Rising Star Teng Key Role to Replace CEO Zhao at Largest Crypto Exchange

The appointment of Richard Teng to oversee Binance’s regional markets outside the U.S. has positioned the one-time Abu Dhabi regulator as the most likely successor to Changpeng Zhao, who founded the world’s largest crypto exchange in 2017. The enhanced role follows a report last month that Zhao, commonly known as CZ, is looking to reduce his ownership of Binance.US, the firm's American arm – a move that's seen as something of an appeasement to U.S. regulators. Teng's knowledge and experience as a regulator will come to bear in his new role overseeing Asia, Europe, the Middle East and North Africa as the exchange, often targeted by authorities, attempts to draw a line under mounting enforcement actions related to conduct during crypto’s early years. Prior to heading up the Financial Services Regulatory Authority at Abu Dhabi Global Market (ADGM), he was chief regulatory officer of Singapore Exchange (SGX) and spent 13 years with the Monetary Authority of Singapore (MAS).

Bitcoin Retail Demand to Remain Strong Ahead of Halving Event According to JPMorgan

Retail demand for bitcoin (BTC) is likely to remain strong over the coming year ahead of the next halving event for the world’s largest cryptocurrency, JPMorgan (JPM) said in a research report Thursday. Recent increase in retail demand can be partly attributed to the advent of Bitcoin Ordinals and BRC-20 tokens, the report said, but more importantly “retail investor demand for bitcoin is likely to strengthen as we approach the April 2024 halving event.” Bitcoin halving, when mining rewards are cut by 50%, “would mechanically double bitcoin production cost to around $40,000, creating a positive psychological effect,” analysts led by Nikolaos Panigirtzoglou wrote. This is because historically the production cost has acted as an effective lower boundary to the cryptocurrency’s price, the report added. Previous halving events in 2016 and 2020 “were accompanied by a bullish trajectory for bitcoin prices” that accelerated after they occurred, the bank noted.

Metropolitan Museum of Art Will Return $550K in FTX Donations

The Metropolitan Museum of Art has agreed to return hundreds of thousands of dollars in donations it received from FTX under the leadership of founder and former CEO Sam Bankman-Fried. The museum, located on the Eastern cusp of New York City’s Central Park, is recognized as one of the country’s leading art museums and joins the growing list of organizations and individuals looking to disavow tainted FTX cash. If an agreement it reached with FTX Debtors in the exchange’s Chapter 11 bankruptcy case is approved, The Met will ultimately return $550,000, according to court documents filed Friday. The donations were made by West Realm Shires Services, the company that operated FTX.US, an FTX-branded exchange aimed at U.S. customers that collapsed alongside its international counterpart in November of last year.

Product of the Week 😋

This week I’m excited to share with you a company founded by a dear friend Brandon Hiemstra - House of Macadamias (HOM).

As a long-time reader, you know I don’t share anything here that I don’t consume myself.

Many of us are already integrating nut products such as almonds and cashews into our daily diet, but did you know that Macadamias are lower in net carbs than most popular nuts (33% less than almonds and 50% less than cashews) and have arguably the best fat profile of any nut (almost like avocado on steroids!) This is what we call a monounsaturated fat for the ultra-healthy Mediterranean diet.

Endorsed by Tim Ferriss and Joe Rogan, HOM products have no added sugar or artificial ingredients - choose from hand-sorted, macadamia bars, creamy nut butter, and cold-pressed Extra Virgin macadamia oil, perfect for cooking given its high smoke point and buttery flavor.

For a very limited time, HOM is gifting our readers a free box of Namibian Sea worth $35 plus 20% off your entire order with code MYTH20.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).