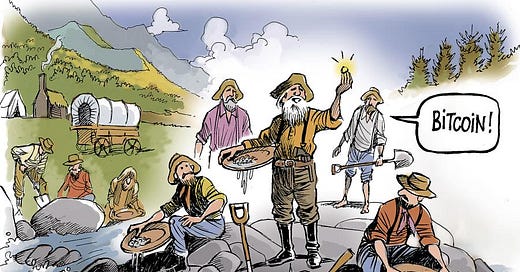

Back to the Bitcoin Basics 🤓

Dear Investors,

This week, with ongoing market volatility, it seems fitting to revisit the fundamental principles that underpin this newsletter.

This week, as we continue to experience market volatility, I thought it was a good opportunity to get to the basics and the core of what this newsletter is about.

The following is an excerpt from my upcoming book “Myth Of Money” published by Wiley:

Throughout this book, you have joined me on the journey of how I learned the ins and outs of money—its realities and its myths—firsthand. But most importantly, we talked about the challenge we all face preserving the value of what we earn within a fiat system inherently skewed towards perpetual inflation, often exceeding the target of 2%. As we close this narrative, our focus shifts towards practical strategies and innovative approaches to harness financial tools that empower us, ensuring our money endures and enhances our lives in a rapidly inflationary landscape.

Before we understand how to preserve it, we must understand what money and value actually are, and how they differ. We have discussed the classic definition of money and its intended functionalities. Most economists define money as a:

Medium of Exchange

Unit of Account, and

Store of Value

Most accept the above definition as a truism and believe that the current system of fiat meets all three categories.

At the Abundance Summit in April 2024, I attended a fireside chat led by Peter Diamandis, founder of X Prize, with Michael Saylor, CEO of Microstrategy, and one of Bitcoin’s biggest proponents. In Michael’s speech, he pointed out that the above definition is actually incredibly flawed. He pointed out that the world has thousands of fiat currencies in use, as any nation can designate its currency as legal tender—such as the Zimbabwean dollar, the Argentinian peso, or the Lebanese lira. However, many of these currencies suffer from hyperinflation and thus fail as stable mediums of exchange.

Saylor highlighted that only three currencies are globally recognized as principal units of account: the U.S. Dollar, the Euro, and the Chinese Yuan. He posited that Bitcoin is on track to become the fourth, as people in countries with volatile currencies will logically begin to reject their local currency for keeping savings or pricing significant assets, instead opting for more stable alternatives. This shift underscores the crucial role of stability in the world’s acceptance of a currency as a valid unit of account.

But what about the store of value? We've observed that the wealthiest echelons of society rarely maintain their wealth in standard currencies like U.S. dollars. Instead, their portfolios are diversified into assets such as real estate, businesses, art, and even sports teams. For instance, billionaire Mark Cuban not only owns the Dallas Mavericks of the NBA, but also holds investments in a multitude of other ventures. Similarly, affluent celebrities often own multiple properties in sought-after locations with staggering price tags: in May 2023, Beyonce and Jay-Z bought a house in Malibu for $200 million. The Toronto and Vancouver real estate markets have seen dramatic increases in value over the past decade, fueled in part by wealthy Asian investors seeking long-term investments in relatively politically and economically stable Western markets. In 2015, Canada’s National Bank Financial estimated purchases of real estate in Vancouver by Chinese nationals over the preceding year amounted to nearly one-third ($10 billion USD) of total real estate transactions in the city, causing the median price for a single-family home to jump 40 percent.

In regions where the local economic systems are less stable, individuals who seek to use real estate as a store of value face significant risks such as sudden changes in taxation, zoning laws, or even eminent domain (the government's power to seize private property for public use). Additionally, business ventures in these areas can be fraught with instability, and the resultant volatility of the local currency means that financial institutions might be vulnerable to runs. In this context, Bitcoin emerges as a compelling alternative. It provides a borderless, accessible method to safeguard wealth, offering not just a store of value but also remarkable growth, with an average annualized return of 67.4 percent since its creation in 2009. This positions Bitcoin as not merely an alternative investment but as the premier technology for savings in an increasingly uncertain global economy.

Critics often argue that Bitcoin is impractical as a medium of exchange due to the high costs and complexities associated with small transactions. This challenge, however, has been largely mitigated by innovations such as the Lightning Network, a topic we explored in depth during our visit to El Salvador in Chapter 5. Yet, Bitcoin maximalists (those who believe that Bitcoin is the only digital asset that will be needed in the future and the only cryptocurrency that embodies the ideals of creator Satoshi Nakamoto) contend that Bitcoin should not be compared to traditional money, but should be viewed as digital property. Just as one wouldn't chip off a piece of a Monet painting or a Mies van der Rohe building to pay for lunch, we shouldn't expect to use Bitcoin in the same way for everyday purchases.

Wealthy individuals often leverage their assets for liquidity by taking out loans against them. As the Bitcoin ecosystem matures, Bitcoin is also becoming an asset against which one can borrow. This capability extends to everyday spending and even securing mortgages. Additionally, Bitcoin's acceptance by regulators has grown, enhancing its accessibility for those looking to capitalize on its potential for appreciation. While I advocate for storing coins on hardware wallets—as emphasized by the maxim "not your keys, not your crypto," (referring to the private keys necessary to access a hardware crypto wallet), new solutions are emerging that are more familiar to traditional investors.

A recent significant development in the crypto investing world was the regulatory approval of Bitcoin ETFs in the U.S. in January 2024. Among these, ETFs structured by renowned financial institutions like Blackrock, Franklin Templeton, and Fidelity were included, with management fees ranging from 0.19 percent to 0.90 percent. This milestone mainstreams Bitcoin investment, offering a more accessible platform for traditional investors to engage with digital assets.

If it's not #bitcoin, your money is melting.— Michael Saylor⚡️ (@saylor) May 17, 2024

What I’m Reading This Week 📚

Cobie’s extensive post on how SAFT valuations are broken.

This Week By the Numbers 📈

Quick Facts:

Donald Trump commits to promoting cryptocurrency in the USA, promising to uphold the right to self-custody for the nation's 50 million crypto holders and opposing the creation of a Central Bank Digital Currency (CBDC).

The US House passes a bill prohibiting the Federal Reserve from issuing a CBDC, reflecting growing legislative scrutiny over digital currencies.

US Senator Cynthia Lummis champions the formation of a pro-crypto coalition in Congress, signaling increasing political support for the cryptocurrency industry.

Nvidia $NVDA announces a significant ten-for-one stock split and reports a Q1 revenue of $26 billion, surpassing expectations by 5.3%.

BlackRock launches a Spot Ethereum ETF, listed on the DTCC under ticker $ETHA, as Ethereum is officially recognized as a commodity by Coinbase's Chief Legal Officer.

The crypto market sees positive movements, with BTC experiencing 10 consecutive days of ETF inflows and whales entering an accumulation phase.

FTX completes its final sale of SOL tranche to Pantera at $110, marking a notable transaction in the crypto space.

In financial markets, Goldman Sachs' CEO predicts the Fed will not lower interest rates this year, while gold prices dip as expectations for rate cuts fade.

Kabosu, the famed dog from the Dogecoin meme that spurred the popularity of $DOGE and Shiba Inu, has sadly passed away.

Netanyahu is scheduled to address Congress.

Top Stories 🗞️

Grayscale launches two new trusts investing in NEAR and STX

Crypto asset manager Grayscale Investments launched two new investment trusts for diversified crypto exposure. Grayscale Near Trust and Grayscale Stacks Trust opened on May 23, allowing individual and institutional accredited investors to access daily subscriptions. One trust is exclusively invested in NEAR, which supports the Near Protocol, while the other trust is exclusively invested in STX, which is part of the Bitcoin Layer 2 Stacks, according to a Thursday release. Grayscale's spot bitcoin exchange-traded fund GBTC maintains among the highest assets under management (AUM) compared to other crypto funds. GBTC amassed $20.08 billion worth of funds as of May 23, according to The Block's Data Dashboard.

Yuga Labs will 'no longer touch' CryptoPunks amid new collection backlash

Yuga Labs faced a backlash over a new Punk-themed NFT collection, developed in collaboration with artist Nina Chanel Abney, criticized for "diluting" the OG CryptoPunks brand. The “Super Punk World” 500-piece collection was launched on Monday, offering “hybridized 3D sculptures that blur the lines of race and gender and reflect upon virtual versus real world identities.” “It dilutes the CryptoPunks brand with what appears to be a low quality cash grab,” Bunin said. “The best way you can steward Punks is by building the legacy, not monetizing it in such poor taste.” Yuga Labs CEO Greg Solano said Tuesday that when the company acquired the intellectual property rights for the CryptoPunks collection in March 2022, it did so “with the intention of preserving the legacy of the collection.” He explained that Yuga Labs wanted to collaborate with world-class artists to “bridge web3 with the traditional art world.” Nina Channel’s collection was part of that plan — offering it exclusively to holders of her existing “SuperCoolWorld” NFTs via a proposed randomized airdrop.

SEC approves rule change to allow creation of ether ETFs

The SEC has approved a rule change Thursday that would pave the way for ETFs that buy and hold ether, one of the world’s largest cryptocurrencies. The decision comes less than six months after the Securities and Exchange Commission approved bitcoin ETFs. Those funds have proven to be a big success for the industry, with net inflows already surpassing $12 billion, according to FactSet. Late May had long been pegged as a potential decision date for the ether funds since it coincided with a deadline for the SEC to decide whether the VanEck Ethereum ETF could proceed. Many of the companies that sponsor bitcoin ETFs — including BlackRock, Bitwise and Galaxy Digital — have also started the process of the launching an ether fund.

US House passes market structure bill to regulate the crypto industry

The U.S. House of Representatives passed a crypto market structure bill that aims to regulate the industry at large, marking the first time comprehensive crypto legislation has been voted on in the full House. The House voted 279 to 136 on Wednesday to pass the Republican-led Financial Innovation and Technology for the 21st Century Act, also known as FIT21. Seventy-one Democrats voted in support of the bill, including former Speaker of the House Rep. Nancy Pelosi of California. FIT21 would grant more power and funding to the Commodity Futures Trading Commission to oversee crypto spot markets and "digital commodities," particularly bitcoin. The bill also creates a process to allow for the secondary market trading of digital commodities if they were "initially offered as part of an investment contract." Stablecoins and anti-money laundering provisions are also in the bill. Though FIT21 is unlikely to be brought up in the Senate this year, the bill could set the stage for the next Congress in January.

China sends dozens of warplanes and ships near Taiwan

Taiwan tracked dozens of Chinese warplanes and navy vessels off its coast on Friday, the second day of a large military exercise launched by Beijing to show its anger over the self-governing island’s inauguration of new leaders who refuse to accept its insistence that Taiwan is part of China. China has issued elaborate media statements showing Taiwan being surrounded by forces from its military, the People’s Liberation Army. A new video on Friday showed animated Chinese forces approaching from all sides and Taiwan being enclosed within a circular target area while simulated missiles hit key population and military targets. Despite that, there was little sign of concern among Taiwan’s 23 million people, who have lived under threat of Chinese invasion since the two sides split during a civil war in 1949. The defense ministry said it tracked 49 Chinese warplanes and 19 navy vessels, as well as coast guard vessels, and that 35 of the planes flew across the median line in the Taiwan Strait, the de facto boundary between the two sides, over a 24-hour period from Thursday to Friday.

My Top 10 Investment Ideas for 2024 🐸

This week, we are offering an additional free knowledge source - My Top 10 Investment Ideas for 2024, including picks across stocks and crypto, and my reasoning behind making those investments personally.

To receive this product, simply refer 3 friends using your unique shareable link 👇

Thank you for reading this week’s edition of the Myth of Money.🚀

Were you forwarded this email? Subscribe below.

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).