Bitcoin Halving, Runes, Iran Attack and More

Dear Investors,

Welcome to this week’s edition of the Myth of Money. If you would like to keep in closer touch, please reach out on X (formerly Twitter) below.

I took a couple weeks off for a well-deserved break after closing an oversubscribed funding round for our new fund, Moonwalker Capital.

Today, we're back and ready to dive into the recent developments, as markets have seen significant volatility in the past few weeks.

Israel vs. Iran

In the early hours of last Friday, Israel launched a missile attack on Iran, marking a significant escalation in the ongoing tensions between the two nations. This strike, confirmed by US officials and believed to be retaliatory, targeted the Isfahan region in Iran. The exact scale and impact of the attack remain contested.

This recent aggression follows a period of increased hostilities, including an Israeli strike on an Iranian compound in Syria and a substantial assault by Iran against Israel. Experts believe that a two-stage missile, likely air-launched and possibly an Israeli-produced Blue Sparrow, was used in the strike.

Iran's response has been to minimize the significance of the strike. State media reported activation of air defenses in response to "suspicious objects" and denied any substantial harm to military or nuclear facilities. The International Atomic Energy Agency confirmed that Iran's nuclear sites were unscathed.

The strike's timing and location are noteworthy. Isfahan province, a critical military and nuclear hub, was likely chosen to send a strategic message. Despite the gravity of the situation, the international response has been cautious. U.S. Secretary of State Antony Blinken indicated no direct involvement in the offensive, while Israeli officials have remained largely silent about the operation.

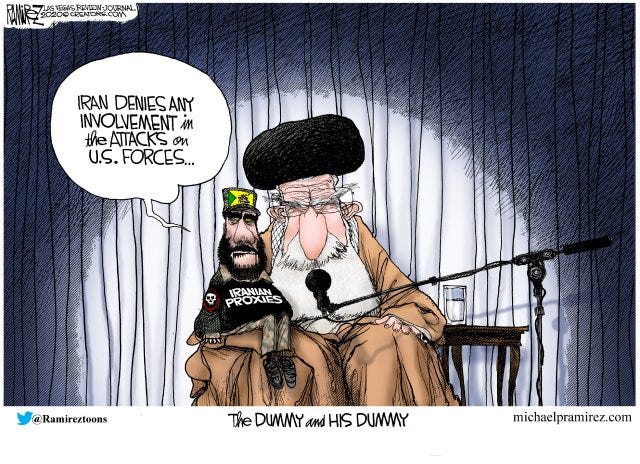

This incident follows Iran's recent aggressive actions toward Israel, which involved launching hundreds of missiles and drones. Although these were largely intercepted, they represent a significant escalation. Hamas has long been a proxy for the Islamic Republic of Iran, operating out of Gaza.

The geopolitical tensions had a brief impact on financial markets, with Bitcoin's value experiencing volatility, reaching $59k before rebounding sharply after the news of the strike.

Bitcoin Halving Officially Complete

Bitcoin's latest halving event has officially been completed, marking a significant milestone in the cryptocurrency's lifecycle.

This halving was particularly noteworthy as the first post-halving block generated an impressive 37.626 BTC in transaction fees, amounting to $2.4 million. This set a new record for fees generated from a single block. Typically, a Bitcoin block is mined approximately every 10 minutes and contains over 2,000 transactions. The halving incites a rush as users compete to have their transactions included in the first block after the event, a digital badge of honor signifying 'I was there.' In this race, one individual even paid a staggering $700,000 to ensure their transaction made it into this historic block.

Following the halving, Bitcoin transaction fees saw a significant spike. Prior to the event, the average fee was around $20, but post-halving, fees soared to as high as $240 and currently average about $128. Interestingly, despite the halving reducing mining rewards by half—hence the term 'halving'—miners are currently earning more. Before the halving, transaction fees per block were around 1 BTC; now, they've increased to approximately 5 BTC, effectively quintupling miners' fee revenue.

The Bitcoin halving is a pivotal event for several reasons. Firstly, it reduces the rate at which new bitcoins are generated, effectively halving the reward for mining new blocks. This decrease in supply, against a backdrop of consistent or increasing demand for Bitcoin, can lead to potential price increases. Secondly, the halving event is a test of Bitcoin’s economic model, particularly its deflationary aspect, which is theorized to increase value over time as the supply decreases. Lastly, each halving brings us closer to the maximum supply cap of 21 million bitcoins, further fueling long-term speculative interest and discussion around the cryptocurrency's future value. As such, the halving is not just a technical event, but a significant economic moment that attracts the attention of investors, analysts, and enthusiasts alike, keen to see how the market will react.

Runes Launches

This event marks a historic milestone in Bitcoin's journey: for the first time, the network will support the creation of memecoins directly. This breakthrough offers users the unprecedented ability to mint their own tokens, potentially giving rise to thousands of new tickers. Token creators can retain their entire supply or make them available for community claiming on the network. Additionally, the already existing Ordinals, now rebranded as pre-runes, will be distributed to holders via airdrops, while many of the newly minted Runes will be available for free claiming—subject only to network fees.

The introduction of Runes—new fungible tokens devised by Ordinals creator Casey Rodarmor—is a significant event for the Bitcoin ecosystem, poised to transform DeFi and NFT interactions on the platform. Tailored for the crypto-savvy crowd, Runes offers a wide array of opportunities for those engaged in the digital asset space, from securing distinctive tokens like PUPS and WZRD to delving into NFTs such as Bitcoin Puppets and Runestones.

Adding to the excitement, a token named after the enigmatic Satoshi Nakamoto leads the charge in generating interest in Runes, with prominent exchanges like Gate already listing these tokens. In a move that emphasizes independence from centralized financial systems, Runestones has announced that it will not pay CEX listing fees, according to spokesperson Leonidas.

To engage in minting new Runes, participants need to prepare their Bitcoin in the form of UTXOs (Unspent Transaction Outputs). These can be thought of as small packets of currency; the more packets you possess, the greater number of Runes you can create. Tools like Luminex can assist in dividing your Bitcoin into multiple UTXOs, and having your digital assets prepared in a wallet like XVerse gives you a distinct advantage.

While the enthusiasm for this new capability is undeniable, it's crucial to remember that, like all memecoins, the Runes minted may rapidly lose their value—it's fundamentally a speculative venture. However, this occasion is also a pioneering first for Bitcoin, often referred to as the 'motherchain' of cryptocurrencies, hinting at the potential for unforeseen outcomes and exciting developments in the crypto landscape.

This Week By the Numbers 📈

Quick Facts:

Jerome Powell's recent remarks indicate that little progress has been made towards lowering inflation and high interest rates may remain until 2025

The International Monetary Fund (IMF) has issued a warning to the US that the US's large fiscal deficits are exacerbating inflation, posing significant risks to the global economy

BlackRock BTC ETF records 69 consecutive days of inflows

BlackRock declares Bitcoin the most widely adopted digital asset globally

Wealth management firms expected to increase Bitcoin ETF holdings, Bitwise CEO states

Banks reportedly purchasing BTC off-market from secondary sources

Mt Gox announces expected withdrawal date in October

Grayscale introduces mini-ETF with the industry's lowest fees

$130 million liquidated from crypto market following Iran's attack on Israel

Coinbase expands its presence with a larger office in New York City

Binance secures a license in Dubai, while Kraken debuts a multi-chain wallet

Base continues to dominate Layer 2 blockchain activities

Nasdaq drops over 2%, marking its sixth consecutive loss, with Nvidia plummeting 10%

Several tech stocks see year-to-date gains wiped out in recent downturn

Top Stories 🗞️

House Passes $95 Billion Aid Package For Ukraine, Israel And Taiwan - But Not US Border

In total, the foreign assistance package totals $95 billion - which only passed after Speaker Mike Johnson cut a deal with Democrats in order to force it through by a vote of 311 to 112. The Senate is expected to pass the package, which was negotiated in conjunction with the White House, marking a victory against conservative lawmakers who insisted on protecting the US border before sending money abroad to protect those of other countries. Earlier in the day, the House passed an $8 billion aid package aimed at countering Chinese aggression towards Taiwan, as well as a bill that would force Chinese-controlled ByteDance Ltd to divest from TikTok or face a US ban. The bill also allows for the confiscation of Russian dollar assets in order to help fund more assistance to Ukraine.

House Votes on Tik Tok Bank

The U.S. House of Representatives passed legislation on Saturday that could lead to a ban on TikTok in the United States, however, some members voted against the bill. The vote in the lower chamber comes amid concerns over the popular social media platform being run by Chinese company ByteDance. Lawmakers in both state and federal governments have been pushing to get rid of the platform due to national security reasons despite pushback by free speech advocates. However, ByteDance has previously denied links to the Chinese government, along with claims that it shares user information with its Beijing-based parent company. The measure approved by the House would give ByteDance nine months to provide users time to export their information from the app then the Chinese company will need to sell the app or the platform will face a nationwide ban in the U.S., cutting access to roughly 170 million TikTok users across the country.

Mark Zuckerberg is now richer than Elon Musk as Meta launches new AI

The fortunes of two of tech’s biggest billionaires have been heading in opposite directions this year, with Meta Platform’s boss Mark Zuckerberg now worth a few million dollars more than Tesla CEO Elon Musk. Zuckerberg’s total net worth of $178 billion surpassed Musk’s $170 billion as of Friday, according to Bloomberg’s Billionaire Index. Their fortunes, have risen $49.9 billion and dropped $59.2 billion so far this year, respectively. Meta stock rose 1.5% on Thursday after the company announced its latest large language model, Llama 3, that will help it take on OpenAI. Llama 3 has been integrated into its Meta AI assistant, which will now be prominent across Facebook, Instagram, WhatsApp, and Messenger apps, and offer its own website. “This next generation of Llama demonstrates state-of-the-art performance on a wide range of industry benchmarks and offers new capabilities, including improved reasoning. We believe these are the best open source models of their class, period,” the company said in a statement.

Venture Capital Giant a16z Raises $7.2 Billion Amid Crypto Sector Revival

Venture capital (VC) giant Andreessen Horowitz (a16z) announced a massive $7.2 billion fundraising on April 16, 2024. The funds will strategically target several key sectors, including American Dynamism ($600 million), Apps ($1 billion), Games ($600 million), Infrastructure ($1.25 billion), and Growth ($3.75 billion). Co-founder Ben Horowitz called the raise “an important milestone” in a blog post titled “New Funds, New Era.” Echoing Horowitz’s enthusiasm, a16z General Partner Anjney Midha took to X (formerly Twitter), stating that the firm has $1.25 billion in fresh capital to invest in the future of AI infrastructure. In addition to the broader focus, General Partner Andrew Chen unveiled a16z Games Fund Two. The new fund builds on its 2022 predecessor and will target investments across various stages of game development. This includes backing early-stage startups through the SPEEDRUN accelerator program, where each select company receives $750,000 in funding.

Kennedy family endorses Biden in show of force against RFK Jr.

Members of the Kennedy family appeared en masse and in force to endorse President Biden at a campaign event in Philadelphia on Thursday. It's a public display of support that reveals a weakness Democrats privately acknowledge: Biden is likely more at risk from Robert F. Kennedy Jr.'s third-party challenge than former President Trump is. With a substantial number of voters telling pollsters they are dissatisfied with both Biden and Trump, Democrats are increasingly petrified that a Kennedy name on the ballot will throw the election to Trump. A similar fear pervaded over the potential No Labels unity ticket. But with those plans scuttled, Biden is turning his focus on the scion of the storied Kennedy family. RFK Jr.'s sister, Kerry Kennedy, invoked the legacy of her slain father, former Attorney General Robert F. Kennedy, as well as that of her uncles: former President John F. Kennedy and Sen. Ted Kennedy (D-Mass.).

My Top 10 Investment Ideas for 2024 🐸

This week, we are offering an additional free knowledge source - My Top 10 Investment Ideas for 2024, including picks across stocks and crypto, and my reasoning behind making those investments personally.

To receive this product, simply refer 3 friends using your unique shareable link 👇

Thank you for reading this week’s edition of the Myth of Money.🚀

Were you forwarded this email? Subscribe below.

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).