Blackrock Publishes Bitcoin Paper

Dear Investors,

Welcome to this week’s edition of the Myth of Money. If you would like to keep in closer touch, please reach out on X below.

In a significant move, the Federal Reserve made a jumbo half-point rate cut, signaling growing concerns about the state of the U.S. economy. According to former Fed officials, this decision reveals the central bank’s unease about rising unemployment and the broader economic outlook.

The Fed operates under a dual mandate: to control inflation and promote job creation. After aggressively hiking interest rates to curb inflation, recent months have seen a notable slowdown in job growth. This shift appears to have caught the Fed’s attention.

The rate cut raises questions about whether the Fed has insights into labor market conditions that are not yet clear to the public or investors. Fed Chair Jerome Powell says the massive influx of illegal immigrants under Kamala has RAISED the unemployment rate: "There's been quite an influx across the borders, and that is actually one of the things that's allowed the unemployment rate to rise."

So, is a recession looming? With the yield curve first inverting and then reversing, many are left wondering whether these signals point to more turbulent times ahead for the U.S. economy.

SEC Approves Bitcoin ETF Options

Meanwhile, this week’s SEC approval to list and trade Bitcoin ETF options marks a groundbreaking moment for the financial world—one that could lead to the most extraordinary surge in volatility we’ve ever seen. To provide a clearer perspective on this monumental development, let’s explore a few key aspects of Bitcoin, its interplay with regulated options markets, and the powerful potential that arises from their combination. It is, without exaggeration, the most significant advancement in the history of the cryptocurrency market.

For the first time, Bitcoin’s notional value will be “fractionally banked” through ETF options. While Bitcoin’s decentralized nature and capped supply have been its greatest strengths, they have also limited its ability to create synthetic leverage. Existing efforts, like those by Deribit, failed to fully solve the balance between counterparty risk and capital efficiency needed for broad adoption, and CME futures required too much active management. Now, with a regulated market, the OCC ensures protection from counterparty risks, allowing Bitcoin’s synthetic notional exposure to expand without the Just-Too-Dangerous (JTD) risks that have kept investors on the sidelines. In this liquidity-driven world, unlocking leverage-driven synthetic flows opens up vast potential for Bitcoin ETFs, making them far more financially useful than simple spot markets.

For the first time, Bitcoin can also be used to express duration within leverage calculations. Retail traders have long relied on perpetual swaps to take on leverage, but these instruments are flawed, operating more like a series of daily options that require constant rolling. Bitcoin options allow investors to make longer-term, duration-based portfolio allocation decisions. For those betting on the long-term, holding out-of-the-money (OTM) calls could offer far more value than a fully collateralized position that might lose 80% over the same timeframe. Bitcoin is often compared to a call option because of its premium decay and explosive upside potential. Now, you can bet on “volatility of volatility” (vol of vol) to the upside while spending the same or even less on premiums, capturing significantly more delta over longer periods—a highly attractive proposition.

Bitcoin also possesses unique volatility traits, one of the most important being the “volatility smile.” Unlike traditional equities, where upside volatility is cheaper than downside volatility (skewed toward protection), Bitcoin experiences melt-ups as frequently as it does melt-downs. This dual-sided risk forces the market to charge premiums on both ends.

Bitcoin as a Unique Diversifier in Modern Portfolios

Blackrock added fuel to the fire this week by publishing their Bitcoin Paper. You can read the full paper here, but I included a brief summary below.

Bitcoin has evolved dramatically over the past 15 years, rising from obscurity to become a widely held asset by individuals and institutions alike. With its decentralized and scarce nature, Bitcoin has proven to be a unique asset, diverging from the traditional risk-return patterns seen in equities and bonds.

Unlike traditional assets, Bitcoin’s long-term drivers are fundamentally uncorrelated with other financial markets. While it has experienced short-term price volatility and co-movement with equities during market shocks, these episodes are typically short-lived. For instance, during the market turbulence on August 5, 2024, Bitcoin dropped 7%, mirroring the S&P 500's decline. Yet, within days, it rebounded and regained its previous levels, showcasing its resilience.

Bitcoin's true value lies in its ability to function as a non-sovereign, decentralized, and fixed-supply asset. Its scarcity, portability, and global accessibility make it a potential hedge against geopolitical instability, monetary policy concerns, and traditional financial system risks. Moreover, as global concerns over U.S. debt and fiscal stability grow, Bitcoin may emerge as a favored alternative for institutional investors seeking diversification.

In the context of portfolio diversification, Bitcoin presents an interesting case. Historically, adding Bitcoin to a traditional 60/40 equity-bond portfolio in small allocations has improved the risk-adjusted returns, despite its volatility. However, large allocations to Bitcoin can significantly increase portfolio risk due to its standalone volatility.

In conclusion, while Bitcoin remains a risky asset, its long-term adoption and fundamental drivers make it an increasingly unique diversifier for portfolios, particularly in times of fiscal, monetary, or geopolitical uncertainty. For investors seeking a hedge against traditional market forces, Bitcoin offers a distinctive option that challenges conventional investment frameworks.

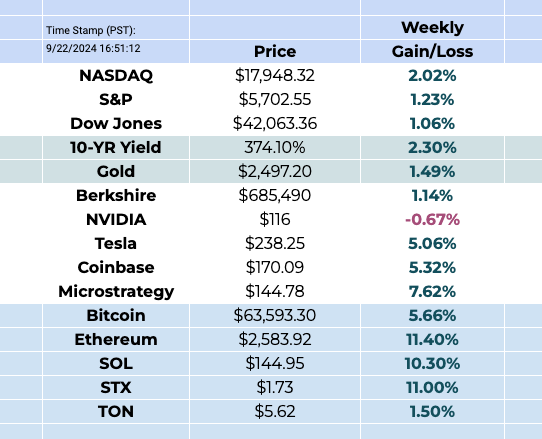

This Week By the Numbers 📈

Markets & Economy 📊

Crypto & Blockchain 🚀

SEC approves options for BlackRock's spot Bitcoin ETF

Politics & Regulation ⚖️

Kamala Harris promises to help grow "AI and digital assets" if elected President

SEC seeks sanctions against Elon Musk in its X (Twitter) takeover investigation

Top Stories 🗞️

JPMorgan Chase's Jamie Dimon 'hopes' for a soft landing, but is still skeptical

"Hopefully, we're on our way to a soft landing, said JPMorgan Chase (NYSE:JPM) Chairman and CEO Jamie Dimon at a conference on Friday. "But I wouldn't count my eggs." He said he's "a little more skeptical than other people. I give it lower odds, but I hope it's true." Regarding the potential of resurging inflation and the potential of a recession, he said, "We don't know." I think most people spend too much time on short-term data and guessing the future... most people can't guess it." Inflation has come down, and it may come down further, but there are a number of factors that point to inflation staying sticky in the long term — government deficit, the green economy, the remilitarization of the world, the restructuring of global trade, and demographics.

Crypto Exchange BingX Hacked, Onchain Data Shows Over $43M Drained

Crypto exchange BingX has been hacked for a "minor" amount of assets and the exchange plans to compensate users for any loss, the firm's chief product officer (CPO) said in a message on X. On-chain data suggests nearly $43 million was stolen from the exchange in multiple tranches, with $13.25 million ether, $2.3 million BNB, $4.4 million USDT, among other being drained. The first hack was for approximately $26 million, while a few hours afterward, hackers took an additional $16.5 million from the exchange. "The total loss is minimal and manageable. This incident will not affect our ongoing business operations," BingX CPO Vivien Lien said on X. "Trading services continue as usual. Withdrawals and deposits are temporarily delayed and are expected to be restored within 24 hours at the latest." Aside from stablecoins, hackers took more than 360 different types of altcoins.

Bitcoin Price and Hashrate Divergence May Set the Scene for a Potential Rally, Historical Data Shows

A divergence between bitcoin (BTC) price and its hashrate or network's total computing power could potentially point towards a rally in the price of the largest digital asset. Historically, these divergences have occurred only a few times in the past three years. In some cases, bitcoin prices have reached a local bottom during these events, followed by a rally as the market catches up with the rising hash rate. Bitcoin network's hashrates rise and fall depending on how many miners have their mining computers online to validate transactions. Consistent with this pattern, bitcoin has already shown signs of recovery, gaining about $9,000 since the local bottom on Sept. 6, representing a 15% increase in value. This divergence between bitcoin's (BTC) price and its hash rate started to shape up in July and then persisted into early September, when the computing power of the network reached an all-time high of 693 exahashes per second (EH/s) on a seven-day moving average, while bitcoin's price was near $54,000.

Asian Stocks Gain on China Stimulus Hopes

Asian stocks rose on expectations that China may deliver more stimulus to revive the world’s second-largest economy after the US kicked off its easing cycle. Gold touched a record high. The MSCI Asia Pacific Index climbed as shares in China, Hong Kong and South Korea advanced. US equity futures also gained. China announced plans for a rare briefing on the economy Tuesday by three top financial regulators just as it cut one of its short-term policy rates, fueling speculation that fresh stimulus is on the way.

Traders are looking for another round of measures to resuscitate China’s growth and energize the global economy. While a raft of Chinese data on Friday added to the dour picture, US statistics due later this week are likely to provide investors fresh insight about the pace and scope of further Federal Reserve easing.

“Myth Of Money” Book - Shipping this week! 🤓

As many of you know, making financial education accessible has always been a passion of mine, and I’ve always offered it for free!

After a year of hard work, I'm excited to announce that my new book, published by Wiley Publishing, will be officially available on October 1st!

This book is a thrilling blend of personal stories from the financial world, coupled with clear explanations of how things really work—from investment banking and stocks to venture capital, macroeconomics, and cryptocurrencies.

How can you support?

For individuals the book is available for sale on Amazon!

If you pre-order and leave a review, I will add you to my personal Telegram group, where I share exclusive investment tips and tricks! Just email me a screenshot of both the pre-order and review, along with your Telegram ID.

For bulk orders, we offer discounts if you order 10 or more copies for your business or educational institution. Additionally, we are setting up a donation program for corporates interested in donating books to schools. If this interests you, please reach out to me directly!

Thank you for reading this week’s edition of the Myth of Money.🚀

Were you forwarded this email? Subscribe below.

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. Currently working as a proud General Partner at Moonwalker Capital.

(More about me 👉 here).