Dear Investors,

Concerns regarding the reserve currency status of the US Dollar continue as businesses and governments display a lack of trust in American institutions.

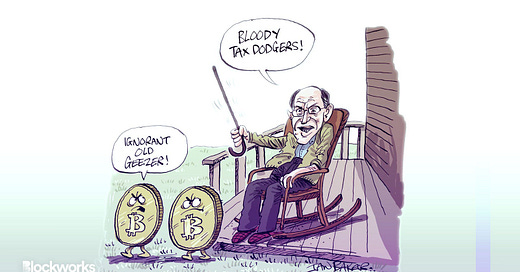

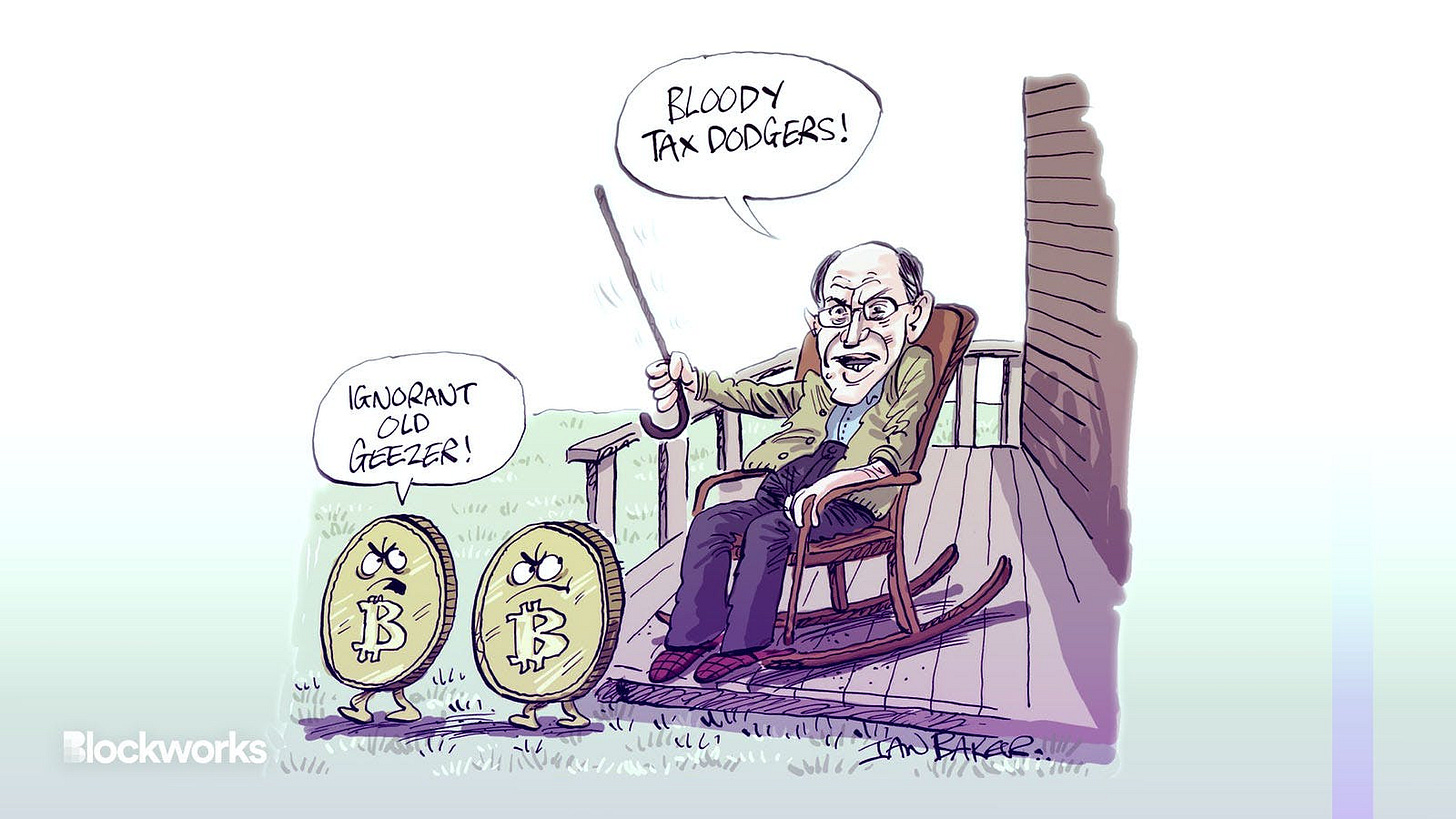

U.S. Congressman Brad Sherman Puts Foot in Mouth

During a joint hearing of two committees in the U.S. House of Representatives aimed at streamlining legislation on digital assets, California Democrat and Congressman Brad Sherman led with the following zinger…

"Crypto bros make money literally by making money, and they've made over a trillion dollars," said Sherman. "They'll accuse the U.S. government of making money out of thin air. Maybe we do, but we're the U.S. government." (Watch video here.)

Sherman referred to cryptocurrencies as a "hidden money system" that redirects capital investment away from productive industries. He also emphasized that their stated purpose is to circumvent sanctions and tax laws.

As the Chair of the House Financial Services Subcommittee on Capital Markets and Investor Protection, Sherman has consistently voiced criticism against cryptocurrencies, accusing "billionaire crypto bros" of attempting to impede meaningful legislation by the Federal government.

30 Countries Now Ready To Accept BRICS Currency

Meanwhile, the BRICS alliance is witnessing growing interest from countries looking to join and adopt the new currency, potentially transforming BRICS into BRICS+. Anil Sooklal, the South African ambassador, confirmed that over a dozen countries, both formally and informally, have applied to join BRICS.

What is BRICS?

BRICS is an abbreviation representing five regional economies: Brazil, Russia, India, China, and South Africa. Originally, the term "BRIC" was coined in 2001 by Goldman Sachs economist Jim O'Neill to refer to the fast-growing economies that were projected to collectively dominate the global economy by 2050. South Africa joined the group in 2010, expanding it to BRICS.

Together, the BRICS countries encompass a vast area of 39,746,220 square kilometers (15,346,100 square miles) and have an estimated population of approximately 3.21 billion people, accounting for about 26.7% of the world's land surface and 41.5% of the global population. Brazil, Russia, India, and China rank among the ten largest countries globally in terms of population, area, and GDP. All five nations are members of the G20, with a combined nominal GDP of US$28.06 trillion, equivalent to around 26.6% of the world's gross product. Moreover, the BRICS countries possess an estimated US$4.46 trillion in combined foreign reserves as of 2018.

The alliance's strength would increase after expansion, as the combined GDPs of member countries could surpass those of the U.S. and other Western powers. This shift may challenge the dominance of the U.S. dollar and the Euro, as developing nations seek alternatives. Consequently, BRICS is in a better position than ever before to shape a new global financial order.

According to the latest report, 25 countries are ready to join BRICS and adopt the new currency for international trade. The list includes Afghanistan, Algeria, Argentina, Bahrain, Bangladesh, Belarus, Egypt, Indonesia, Iran, Kazakhstan, Mexico, Nicaragua, Nigeria, Pakistan, Saudi Arabia, Senegal, Sudan, Syria, the United Arab Emirates, Thailand, Tunisia, Turkey, Uruguay, Venezuela, and Zimbabwe.

With Brazil, Russia, India, China, and South Africa already members, a total of 30 countries are now working together to challenge the U.S. dollar's status as the global reserve currency. The forthcoming BRICS currency could possess the potential to diminish the dollar's international dominance.

The inclusion of oil-rich countries among those interested in joining BRICS could potentially exert pressure on European nations to adopt the new currency instead of the dollar for oil transactions. Pakistan has already expressed its intention to utilize the Chinese yuan for cross-border payments when purchasing Russian oil.

U.S. Regulators Continue to Battle with Crypto

As global leaders continue to challenge American hegemony, a growing divide is emerging within the United States. Republicans are advocating for pro-cryptocurrency regulations, while Democrats are taking a contrasting stance, opposing such regulations. This division has prompted numerous companies to consider exploring regulatory alternatives in foreign jurisdictions.

This week’s regulation rundown:

This Week By the Numbers 📈

Last month, the consumer price index (CPI) increased by 0.4%, meeting Wall Street expectations, driven by higher shelter, used vehicle, and gas prices. The annual inflation rate was 4.9%, slightly lower than estimated, indicating a potential downward trend. Excluding volatile food and energy categories, core CPI rose by 0.4% monthly and 5.5% annually, aligning with expectations. The market responded positively, with futures turning positive and Treasury yields declining.

It is important to note that this indicator represents a slowdown in inflation rather than a decline. The average American is still facing higher-than-normal prices.

Shelter costs increased 8.1% annually. Among grocery store indexes, four displayed declines, with milk experiencing a 2% drop and egg prices decreasing by 1.5% (which is still an annual gain of a whopping 21.4%).

I have been saying this for a while - even if the Fed takes a break from raising rates next month, more hikes are coming. The Fed has no choice but to contain inflation, which means more pain for both the American and global economy.

Top Stories 🗞️

Elon Musk taps NBCUniversal advertising sales chief Linda Yaccarino to succeed him as Twitter’s CEO

Newly appointed Twitter CEO Linda Yaccarino said in a tweet on Saturday that she has been inspired by owner Elon Musk's vision to create a brighter future and is excited to help to transform the social media platform. Musk, who has served as CEO since his $44 billion buyout of Twitter last October, announced her appointment on Friday. Yaccarino, who as advertising chief for Comcast Corp's NBCUniversal spent several years modernizing its ad business, said she is committed to Twitter's future, and said user feedback is vital to build Twitter 2.0. Yaccarino will take over a social media platform that has been trying to reverse a plunge in ad revenue and is beset with challenges, along with a heavy debt load. Since Musk acquired Twitter, advertisers have fled the platform, worried that their ads could appear next to inappropriate content after the company lost nearly 80% of staff. Musk earlier this year acknowledged that Twitter had suffered a massive decline in ad revenue.

Binance Is Integrating the Bitcoin Lightning Network

The recent surge in Bitcoin transaction fees has lit a fire under one of the largest crypto exchanges to upgrade to the Bitcoin Lightning Network. Following a second halt in withdrawals, Binance announced it would work on “enabling BTC Lightning Network withdrawals, which will help in such situations.” The Lightning Network (LN) is a federated system for cheap, near-instant payments built atop Bitcoin. When the Bitcoin mempool (where transactions waiting to be confirmed gather) is full or busy, the Lightning Network is unaffected. Several large crypto exchanges have integrated the Lightning Network, including Bitfinex, River Financial, OKX, Kraken and CoinCorner. If implemented correctly, the Lightning Network would allow users to withdraw and send Bitcoin immediately from wallets, sidestepping the congested Bitcoin blockchain.

Do Kwon Set to Be Released on Bail in Montenegro Travel Document Forgery Case

Terraform Labs founder Do Kwon is set to be released from Montenegro jail on supervised bail as his trial on document forgery charges continues, a court notice from Friday shows. The Basic Court of Podgorica said in its statement that it has accepted a proposal made by Kwon's lawyers on Thursday to pay 400,000 euros ($435,000) to release him from custody. Under the conditions of bail, the defendants in the case – Kwon and Terra executive Han Chang-joon – will be under surveillance and be prohibited from leaving their apartment. The two were arrested by Montenegrin authorities in March for attempting to travel with falsified documents. Both the U.S. and South Korea have requested his extradition from Montenegrin authorities to face criminal charges over the collapse of Kwon's crypto enterprise Terraform Labs in May last year.

House Republicans release probe into Biden family finances

House Republicans have unveiled what they say are records of $10m in payments to members of the Biden family from foreign entities. Oversight Committee Chair James Comer said Joe Biden's relatives had used the family name to enrich themselves, and the president was "involved". The report itself does not substantiate these claims or implicate Mr Biden. It does not allege illegal conduct. The roughly 30-page report detailed what lawmakers say are various companies and financial records tied to family members of Mr Biden, including his son, Hunter Biden, and daughter-in-law, Hallie Biden. It contains records of bank transactions, obtained through subpoena, that Republican lawmakers say are linked to Romania and China.

Microsoft, Goldman Sachs, others partner in new blockchain network

A new blockchain network aimed at financial institutions is in the works from a conglomerate of participants in the finance and tech space, including the likes of Microsoft and Goldman Sachs. According to the announcement on May 9, the Canton Network will be a privacy-enabled interoperable blockchain network aimed at those working with institutional assets. It will allow the synchronization of financial markets that were “previously siloed.” The network will begin testing its capabilities in July, which include extensive privacy controls and the ability to achieve the scale and performance needed by major financial institutions. Participants in the network currently include BNP Paribas, Cboe Global Markets, Digital Asset, Paxos, Microsoft, Goldman Sachs, Deloitte and others. Cathy Clay, executive vice president of Cboe Global Markets — one of the partners in the project — said that, when leveraged, blockchain technology can potentially “unlock” new opportunities in the market.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).

While I probably entirely disagree with Brad Sherman's entire political outlook and policies (do not know anything about him), it is an interesting point about Bitcoin redirecting capital investment away from productive industries. It is very true that a lot of resources and energy from very smart people are consumed by this asset. Attention that could be spent on other areas of an economy or production.

I'm also going to say the thing you're not supposed to say if you're in any way "cool" in this financial space--but I'm just not seeing Bitcoin or crypto suddenly replacing any currency anywhere. It's just administratively too difficult for the average person to utilize as a medium of exchange.