Dear Investors,

In the past two decades, a profound shift has taken place in the global economic and geopolitical scene, as the rise of BRICS nations provides an increasingly substantial counterweight to the enduring dominance of the G7.

What Happened at the Annual BRICS Summit?

After the 15th annual BRICS summit held in Johannesburg, South Africa last Thursday, the bloc of major emerging economies welcomed six new members: Iran, Saudi Arabia, Egypt, Ethiopia, Argentina, and the United Arab Emirates. This expansion, effective from January 1, 2024, is aimed at strengthening the group's presence in the Global South, enhancing its global economic and political influence, and will be the first BRICS expansion since 2010.

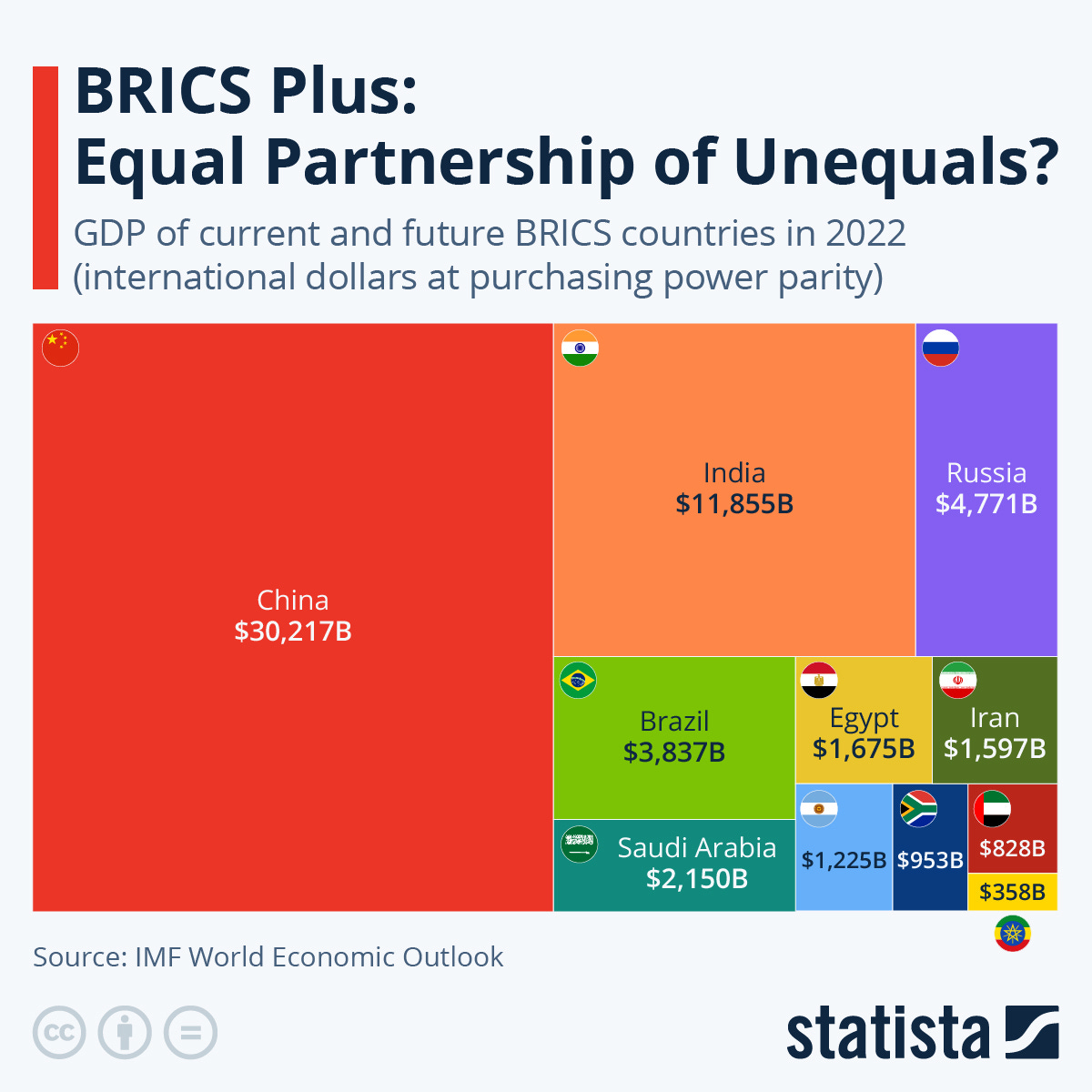

The collective population of the new bloc will represent approximately 46% of the world's population, contributing to 29% of the global GDP in nominal terms and 37% in terms of global GDP at purchasing power parity. It's worth noting that while these new additions bring diversity, the dominance in terms of both population and economy will continue to be led by China and India within the expanded BRICS framework. The combined GDP contribution of the six new members will constitute about 10% of the overall group GDP, with Saudi Arabia's trillion-dollar economy being the most substantial among the newcomers.

South African President Cyril Ramaphosa, during a press briefing outlining summit outcomes, articulated BRICS' vision as a champion for the Global South's needs and concerns. He highlighted priorities such as beneficial economic growth, sustainable development, and multilateral system reform. Ramaphosa emphasized that this initial expansion is just the start, with a comprehensive framework and further expansion phases yet to unfold.

How does BRICS compare to the G7?

The G7, established in 1975, initially comprised Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States, with the European Union joining later. This forum enabled advanced economies to discuss economic policies, global matters, and international cooperation.

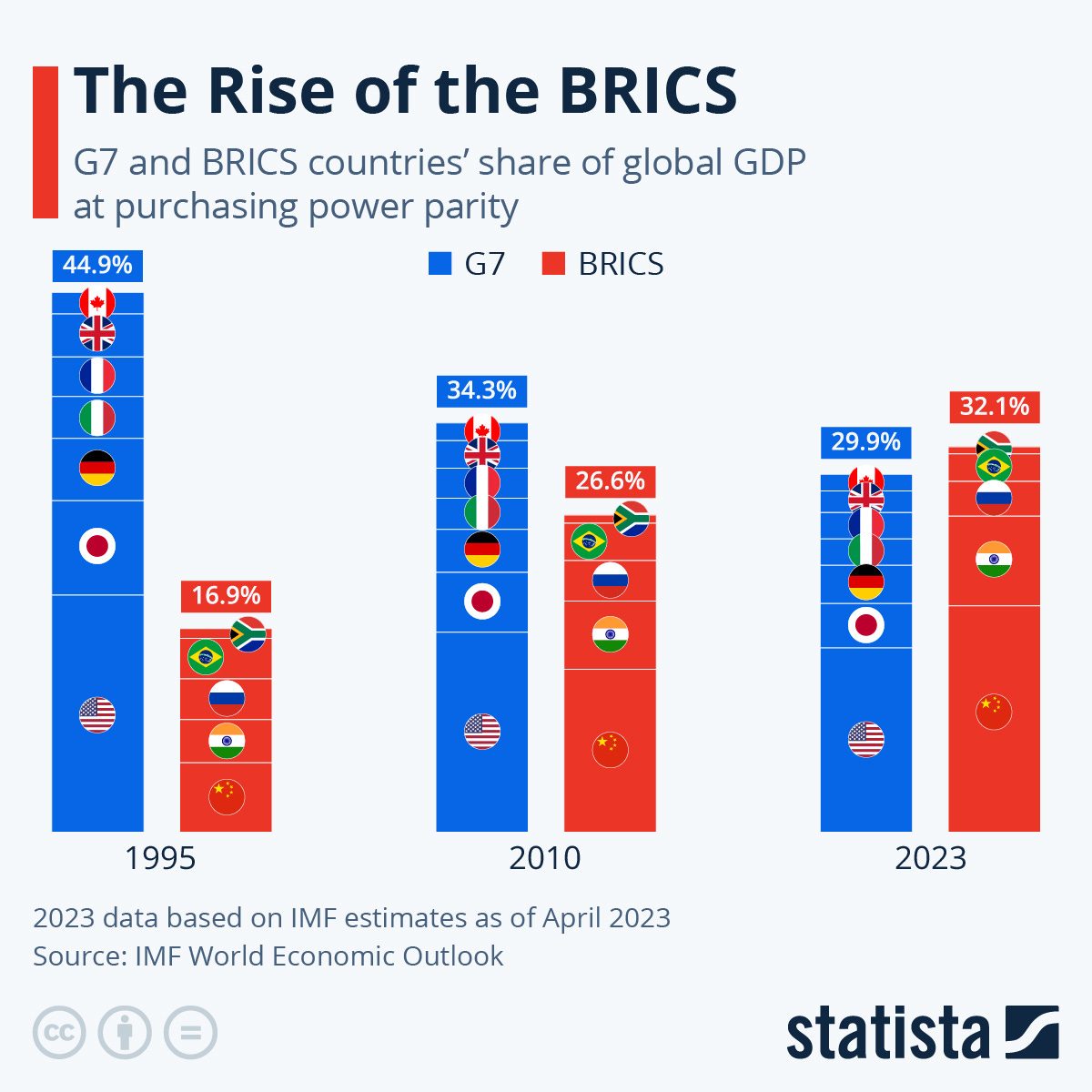

The original BRICS countries—China, India, Brazil, Russia, and South Africa—achieved rapid growth over the last two decades. China's remarkable economic surge reshaped trade, investment, and innovation, positioning it as a global frontrunner. India's vast population and thriving tech sector positioned it as a potential second economic powerhouse. While Russia, Brazil, and South Africa faced challenges, together, the BRICS bloc outperformed the G7's GDP in 2020 when measured by purchasing power parity. Projected to account for 32.1% of global GDP this year, up from 16.9% in 1995, BRICS surpasses G7's 29.9%. The rise of BRICS underscores calls for more inclusive global governance and divergence from G7 policies, evident in differing responses to Russia's Ukraine actions—G7 imposed sanctions, while BRICS did not condemn or impose sanctions.

How Influential is the New BRICS?

The newly formed BRICS holds:

54% of global oil production

5 of the world’s 6 biggest food producers

36% of global landmass

46% of the world’s population

The new BRICS also has significant influence over key trade routes including the Artic Sea Route, Persian Gulf, Red Sea, Suez Canal, and others.

Can BRICS compete with the G7?

Critics question BRICS' ability to rival the West on the global stage due to varying national priorities, citing a lack of trust, alignment, and strategic priorities among its member countries.

Looking at 2022 GDP in international dollars at purchasing power parity, China’s economy is two and a half times the size of India’s, the second-largest economy within the bloc. The GDP of the remaining nine (future) BRICS members combined adds up to just over half of China’s economic output, making it hard to imagine China’s voice having an equal weight in future negotiations within the group. A recent survey revealed China’s role on the world stage is viewed with a lot of skepticism even among its partners, with the majority of respondents in India, Brazil, and Argentina thinking that China would barely take their own country’s interests into account when making international policy decisions.

Renminbi vs. the Dollar

While the creation of a common BRICS currency remains improbable, the group is actively reducing reliance on the dollar. In a recent article outlining BRICS summit objectives, the bloc pledged to diminish the dollar's role and promote national currencies in global trade.

Russian President Vladimir Putin emphasized the irreversible de-dollarization process during the event. South Africa's finance minister acknowledged discussions among central bankers about using local currencies for cross-border payments.

China aims to boost the renminbi's international trade role through the BRICS bloc, yet differing geopolitical priorities among member states could hinder such aspirations. Despite China’s efforts, the U.S. dollar accounted for around 90% of global forex transactions in 2022 and 59% of foreign exchange reserves in Q1 2023, surpassing the renminbi's 2.5% share. As a result, the renminbi's challenge to the dollar's global dominance and the notion of a BRICS currency remain distant prospects, according to Shearing of Capital Economics.

This Week By the Numbers 📈

Markets continue to experience downward pressure as investors expect additional rate hikes in mid-September.

Quick Facts:

S&P 500 slumped due to higher crude oil prices, starting holiday-shortened week

Dow Jones Industrial Average dropped 0.4% (130 points)

S&P 500 dipped 0.3%, Nasdaq Composite edged down 0.1%

Major indexes exceeded respective 50-day moving averages

Berkshire Hathaway Class B shares reached all-time high despite broader market struggles

Saudi Arabia extended 1-million-barrel/day oil production cuts, causing oil prices to rise

West Texas Intermediate futures increased 2% to over $87/barrel, highest since November

10-year Treasury yield surged over 8 basis points to 4.258%, affecting risk assets

Goldman Sachs lowered recession odds to 15%, anticipates Fed skipping rate hike

UBS predicts "softish" landing for U.S. economy, sees inflation nearing Fed's target without recession

Q2 GDP growth revised down to 2.1%, consumer spending revised up, business investment pared

Corporate profits rebounded in Q2 but remained down year-on-year

Private payrolls grew by 177,000 in August

Chip designer Arm filed updated regulatory filing for U.S. IPO at $47-$51/share

SoftBank plans to sell 95.5 million Arm shares, implying valuation up to $54.5 billion

Grayscale identified as second-largest holder of ETH

Chinas takes measures to boost property market, including cutting downpayment ratio and mortgage rates

Top Stories 🗞️

U.S. Court Calls ETH a Commodity While Tossing Investor Suit Against Uniswap

The lawsuit – filed in April 2022 by a group of investors against Uniswap and its creator Hayden Adams – alleged the DeFi platform violated U.S. securities laws by failing to register as an exchange or broker-dealer, offering and soliciting securities on an unregistered exchange. The suit sought to hold Uniswap accountable for investors losing money to “scam tokens” that were issued and traded on the protocol. The tokens cited in the suit include Ethereum (ERC-20) tokens EthereumMax (EMAX), Bezoge (BEZOGE) and Alphawolf Finance (AWF). But Wednesday's ruling to scrap the suit before it goes to trial stated the true defendants of the case were the issuers of the "scam tokens" in question and not Uniswap. While Securities and Exchange Commission (SEC) Chief Gary Gensler has so far shied away from calling ETH a security, Judge Katherine Polk Failla of the Southern District of New York directly called it a commodity and declined to "stretch the federal securities laws to cover the conduct alleged," in the case against Uniswap.

SEC Delays Spot Bitcoin ETF Decision for All Applicants Including BlackRock, Fidelity

The U.S. Securities and Exchange Commission (SEC) has delayed until October making a decision on all of the spot bitcoin exchange-traded fund (ETF) applications filed by applicants including BlackRock, WisdomTree, Invesco Galaxy, Wise Origin, VanEck, Bitwise and Valkyrie Digital Assets earlier this year, according to agency filings on Thursday. Already down sharply on the day, bitcoin (BTC) fell further on the news, now off 4.1% over the past 24 hours to $26,100. The SEC began reviewing the latest slate of applications, from both crypto-heavy and traditional finance firms like Wise Origin (Fidelity), BlackRock and Invesco Galaxy, last month. The applicants hope to launch the first spot bitcoin ETF, which advocates have argued would allow for greater retail investment in the bitcoin space while saving investors from the troubles of setting up a wallet or having to buy bitcoin directly.

China court says virtual assets legally protected as properties

Virtual assets remain legal property protected by law in China, according to a Friday report from People’s Court Daily, a daily newspaper managed and issued by the Supreme People’s Court of China. The report, authored by a People’s Court in the southeastern Fujian province, said that virtual assets have economic attributes and should be classified as property. The People’s Courts of the People’s Republic of China serve as the state’s judicial bodies that independently exercise judicial power, free from interference by administrative entities, according to the Chinese constitution. Virtual assets held by individuals should be considered legal and protected by law, the People’s Court Daily report said.

Former SEC chair says spot Bitcoin ETF approval is ‘inevitable’ despite delays

Following the United States Securities and Exchange Commission (SEC) delaying decisions on several spot Bitcoin exchange-traded funds, former commission chair Jay Clayton said he believed approval was still going to happen at some point. The commission has another 45 days upon publication of the notice in the Federal Register to approve, deny or again delay the ETF applications from these seven major firms. Clayton said he expects to see “progress on this going forward.” The SEC can continue to push the deadlines on the applications until March 2024. “An approval is inevitable,” said Clayton. “The dichotomy between a futures product and cash product can’t go on forever.”

Crypto gambling site Stake sees $41M withdrawn in confirmed hack

Crypto gambling site Stake experienced $41 million in withdrawals on Sept. 4 in what blockchain security analysts have called “suspicious outflows.” The withdrawing account has been labeled “Stake.com Hacker” by Etherscan, implying that the drained funds may be the result of a stolen private key. Blockchain data shows very large withdrawals from Stake.com contracts into the alleged attacker’s account. After draining the funds, the alleged attacker distributed them to multiple accounts. Stake confirmed the hack via social media.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).

The BRICS initiative is interesting for undermining American domination over the world. However, do you really think that a BRICS currency could really prevail, when India and China totally hate each other?

Personally, I doubt it. I rather think that China will try to impose its yuan on other countries and in particular throughout the BRI in order to obtain the same exorbitant privileges in the future as those which America benefits from by issuing the world reserve currency.

In all this, India will refuse to follow China and continue to keep a foothold in both worlds.

Generally speaking, I doubt that the BRICS initiative will really work, because apart from a certain distrust or even hatred of the West, each country preaches above all for its parish and common points are non-existent.