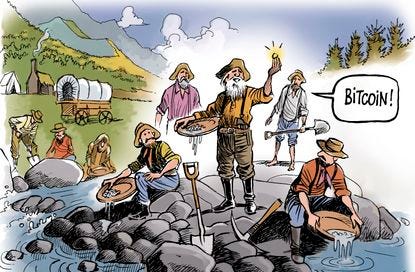

"Build on Bitcoin" Era is Here

Dear Investors,

Welcome to this week’s edition of the Myth of Money. If you would like to keep in closer touch, please reach out on X (formerly Twitter) below.

This week has been remarkable in every respect. The financial markets delivered exceptionally positive results across all sectors, signaling a prosperous period. Additionally, it's Super Bowl weekend, capturing the nation's attention as viewers eagerly watch an intensely competitive game between the Kansas City Chiefs and the San Francisco 49ers. The spotlight also shines brightly on Taylor Swift and Travis Kelce, drawing extra interest from fans.

Moreover, this week signifies the official launch of our firm, Moonwalker Capital. We specialize in trading Bitcoin and investing in the "Build on Bitcoin" ecosystem, focusing on liquid assets. This marks a significant milestone in our journey towards innovating and leading in the cryptocurrency space.

The “Build on Bitcoin” Thesis

Moonwalker Capital has strategically embraced the "Build on Bitcoin" philosophy as a cornerstone of its investment approach. This perspective suggests that the developments and infrastructure established on leading blockchain networks like Ethereum, Solana, and Polygon in recent cycles were preliminary steps paving the way for a more significant venture. The firm believes it's time to transition the foundations of DeFi (Decentralized Finance) and NFT (Non-Fungible Token) ecosystems onto Bitcoin's original, institutional-grade, decentralized framework.

This shift is fostering the creation of new ecosystems and a diverse range of products, introducing Bitcoin-based alternatives to well-known platforms such as Uniswap, MakerDAO, and OpenSea. As we acquaint ourselves with these innovations, Moonwalker Capital views the forthcoming bull market as being propelled by this fresh narrative, setting the stage for a transformative era in blockchain and cryptocurrency.

Since its inception in 2009, Bitcoin has proven to be a resilient foundational Layer 1 (L1) network, maintaining uninterrupted operation amidst the downtime and disruptions faced by other networks. Despite its robustness and the accumulation of over $500 billion in idle capital, Bitcoin lacked the programmability found in networks like Ethereum, restricting its utility for developers and users alike.

Enter Stacks, a groundbreaking solution that introduces programmability to Bitcoin through smart contracts on a Layer 2 (L2) platform. This innovation enables transactions to be permanently settled on the Bitcoin blockchain, effectively unlocking over $500 billion of previously untapped Bitcoin capital for development and application use.

The forthcoming Natamoto network upgrade is set to revolutionize the network further by decreasing block times to just 5 seconds and introducing sBTC, a mechanism facilitating Bitcoin deposits and withdrawals from L1, thereby enhancing BTC liquidity.

However, Bitcoin's L1 protocol faces scalability challenges due to its decentralized consensus mechanism, which, while ensuring security, limits transaction throughput. This becomes a significant issue during periods of high network activity, leading to delays and increased transaction costs. Moreover, Bitcoin's basic scripting capabilities limit the range of possible applications, making the development of complex applications challenging.

Layer 2 solutions, therefore, are essential in addressing these constraints. Operating on top of the L1 Bitcoin blockchain, they alleviate congestion and enable the creation of advanced applications without compromising on security or decentralization. Layer 2 solutions are pivotal for fostering innovation and expanding the capabilities of the blockchain without undermining its core security and economic principles.

Layer 2 Highlights:

Enhances the blockchain architecture by adding new functionalities on top of L1 networks.

Offers scalability solutions, potentially requiring consensus for implementation via significant software upgrades or hard forks.

Utilizes off-chain services like rollups and sidechains to improve scalability and efficiency.

Maintains a proven security record, with users depending on L2 networks for transaction processing and efficiency, often leveraging the underlying security of L1.

At Moonwalker Capital, we believe this evolution signifies a new era for Bitcoin, promising both expanded utility and continued innovation within the crypto ecosystem. It also presents ample new opportunities to invest in as at least 5 new Layer-2s are set to emerge this cycle with new liquid projects built on top of each one.

Tucker Carlson Interviews Putin in a Historic Interview

Tucker Carlson positioned his interview with Russian President Vladimir Putin as an unprecedented journalistic venture, venturing where no other Western journalist had presumably dared. The Kremlin praised Carlson, distinguishing him as the sole Western journalist allowed an audience with Putin in the past two years, attributing this privilege to his views being starkly different from the prevailing narratives in traditional Anglo-Saxon media.

Notable, Vladimir Putin pointed out that the US Government is killing the dollar with their own hands, many countries including major oil producers, are accepting payments for oil in Chinese yuan.

Key Takeaways:

Putin's Unfiltered Views:

Offered extensive thoughts on Russia-Ukraine relations, claiming Russia's right over Ukrainian territory.

Praised by Carlson for his detailed knowledge, with little challenge to his narratives on the conflict.

Media and Propaganda:

Putin criticized U.S. support for Ukraine and justified his suppression of independent media.

Critics highlighted unchecked falsehoods and misleading statements in the interview.

Carlson's Role and New Platform:

The interview highlighted Carlson's move to X (formerly Twitter) and his attempt to grab headlines post-Fox News departure.

Carlson introduced Putin as sincere, regardless of viewer agreement.

Negotiations and Anti-US Sentiment:

Putin expressed openness to negotiations with the U.S., critiqued U.S. leadership, and suggested intelligence agencies undermine Biden.

Criticized U.S. financial aid to Ukraine, aligning with certain U.S. political narratives.

Push for Journalist's Release:

Carlson requested the release of detained Wall Street Journal reporter Evan Gershkovich, which Putin did not commit to.

Russian Media and Propaganda Effort:

Russian state media and propaganda outlets heavily promoted the interview, with Kremlin officials noting high interest and "professional jealousy" among U.S. media.

This Week By the Numbers 📈

Quick Facts:

BTC surpasses $48K amid expectations of increased ETF inflows

$6bn in BTC accumulated by whales over the past 3 weeks

BTC rally attributed to reduced selling by miners

Barack Obama describes Bitcoin as a secure financial system without government access

10,000 blocks remain until Bitcoin halving

BlackRock says Bitcoin "creates global internet value that allows assets to move at low cost and in near real-time across borders”

BlackRock & Fidelity now hold 151,950 $BTC worth over $7.16 billion for their spot Bitcoin ETFs

MicroStrategy buys an additional 850 Bitcoin ($37.2 million)

Twitter Founder Jack Dorsey wearing Bitcoin Satoshi shirt at the Super Bowl

US national debt reaches new all-time high of $34.2 trillion

ETH upgrade anticipated next month

SOL recovers from outage, total value locked reaches 2-year peak

Potential for stablecoin legislation in the US

Traders suggest altcoin accumulation phase nearing end

Thailand removes tax on crypto trading

Asset managers hold their highest equity futures positions in 15 years

Trump secures victory in Nevada caucus, Haley continues campaign

Supreme Court expected to reconsider Trump's eligibility

Pro Bitcoin candidate Nayib Bukele re-elected as President of El Salvador

Top Stories 🗞️

OpenAI reportedly seeking trillions for AI chip development

Sam Altman, the CEO of the artificial intelligence (AI) developer OpenAI, is reportedly in talks with investors worldwide to raise trillions of dollars for developing semiconductor chips. According to a report by The Wall Street Journal on Feb. 8, Altman’s project would require fundraising of around $5–7 trillion. Sources close to OpenAI say the funds would solve the scaling constraints of the company and the scarcity and cost of chips needed to develop high-level AI systems. Altman has been reportedly pitching partnerships between OpenAI and “various investors,” chip makers and energy providers, saying OpenAI would agree to be a “significant customer” of the new factories.

Terraform Labs Co-Founder Do Kwon Has Extradition Verdict Reversed Again

The Appeals Court of Montenegro has reversed the decision of the High Court for the extradition of Do Kwon, co-founder of Terraform Labs, to the United States in response to an appeal from his legal defense team. The Appeals Court stated that the Higher Court failed to adhere to proper procedures, thereby breaching standards by approving Kwon’s extradition to the US. Furthermore, the appeals court alleged that the High Court did not “conclusively determine the sequence of the arrival of extradition requests” from the Republic of South Korea and the US. In December 2023, BeInCrypto reported that Kwon was facing an extension of his detention in a Montenegro jail for an additional two months.

New York Expands Fraud Case Against Digital Currency Group to $3 Billion

New York Attorney General Letitia James has amplified its civil fraud case against Digital Currency Group (DCG), now saying the company is responsible for $3 billion in investor losses tied to the Gemini Earn product and to direct investments with Genesis, according to a new court filing. As stated in an initial $1 billion fraud lawsuit against DCG, its defunct lending platform Genesis and Gemini Trust Co. in October, the companies are accused of misleading investors and assuring them of the safety of their money even as the companies' managements were aware that doom fast approached them. The fraud case focused at first on the Gemini Earn investment program that Genesis and Gemini ran together, but after the lawsuit, James' office said many more investors raised complaints of being swindled by Genesis more directly. As many as 230,000 people lost as much as $3 billion, according to the attorney general, spurring Friday's expansion of the lawsuit in the New York Supreme Court.

What Is ERC-404? The Experimental Standard Whose First Token Has Rocketed 12,000% in One Week

The first token based on a new, unofficial, and experimental type of Ethereum standard has given rise to a new multi-million sub-asset class in the crypto market. Pandora, the first of the so-called “ERC-404” tokens, traded as high as $32,000 on Friday morning from a low of $250 in just under a week. It has a supply of only 8,000 tokens and traded some $76 million in volumes in the past 24 hours. Several projects have already latched on to the hype and issued their own versions of ERC-404 tokens. Some of these have airdropped a small part of their token supply to Pandora holders, boosting demand for the token while also creating hype for their own projects. While, some have launched on other blockchains, such as Arbitrum and Solana, in a bid to be the first mover in an entirely different ecosystem.

Hamas had command tunnel under UN Gaza HQ

Israeli forces have discovered a tunnel network hundreds of metres (yards) long and running partly under UNRWA's Gaza headquarters, the military says, calling it new evidence of Hamas exploitation of the main relief agency for Palestinians. Army engineers took reporters for foreign news outlets through the passages at a time of crisis for UNRWA, which has launched an internal probe and seen a string of donor countries freeze funding over allegations last month by Israel that some of its staff doubled as Hamas operatives. UNRWA Headquarters is in Gaza City, among northern areas that Israeli troops and tanks overran early in the four-month-old war against the governing Islamist faction Hamas, sending hundreds of thousands of civilians fleeing southward.

My Top 10 Investment Ideas for 2024 🐸

This week, we are offering an additional free knowledge source - My Top 10 Investment Ideas for 2024, including picks across stocks and crypto, and my reasoning behind making those investments personally.

To receive this product, simply refer 3 friends using your unique shareable link 👇

Thank you for reading this week’s edition of the Myth of Money.🚀

Were you forwarded this email? Subscribe below.

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).