China's Stimulus Package Leads New Rally

Dear Investors,

Welcome to this week’s edition of the Myth of Money. If you would like to keep in closer touch, please reach out on X below.

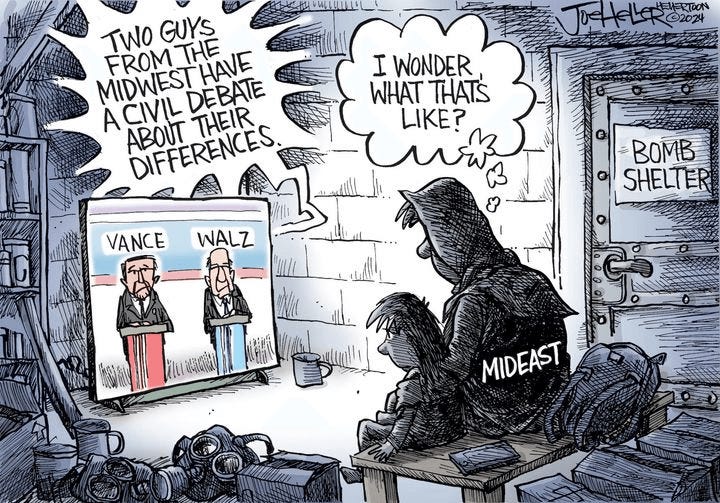

We've had another tumultuous week in the markets. Iran launched over 200 missiles into Israel, and the world watches anxiously, anticipating a potential response.

Meanwhile, Hurricane Helene has claimed at least 232 lives in North Carolina, leaving devastation in its wake.

In U.S. politics, Trump has pulled ahead of Harris by 3% on Polymarket and saw a significant 13% bump in Pennsylvania after his appearance with Elon Musk in Butler this week.

Meanwhile, the Vice-Presidential debate was as poorly timed as it was as uneventful, with Walz emphasising, and I quote, that Kamala represents “the political of JOY.”

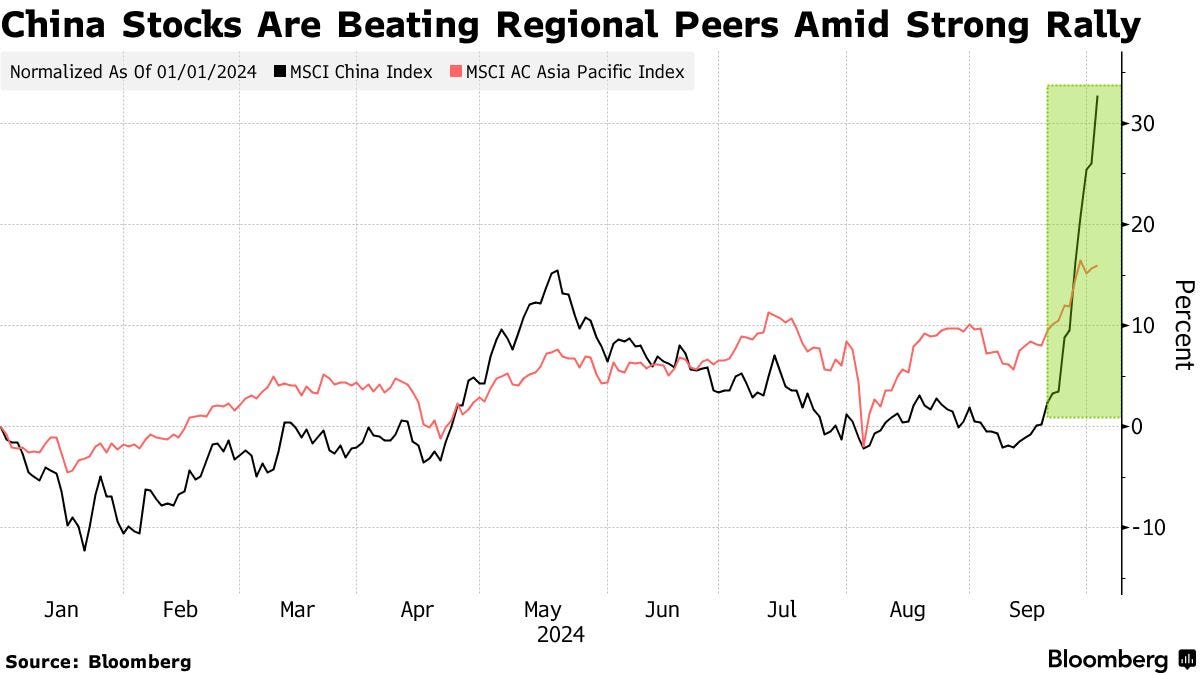

Perhaps the biggest story as I head to bed this Sunday night: the Chinese stock market has surged with a dramatic rally, sparking the much-anticipated "god candle" in the Bitcoin markets. Chinese stocks have soared an impressive 35% over the past month.

China's announced stimulus package has caught the attention of investors worldwide. With an estimated value of 7.5 trillion yuan (US$1.07 trillion), this intervention is not just a domestic affair but a global liquidity injection. However, China's track record with large-scale stimulus efforts is mixed at best.

At the heart of the stimulus lies a series of monetary policy measures designed to inject liquidity into the Chinese economy. The People's Bank of China (PBOC) has slashed the reserve requirement ratio by 50 basis points, freeing up an estimated $142 billion for loans. Additionally, the central bank has lowered a key policy interest rate by 0.2 percentage points and reduced mortgage rates by an average of 50 basis points.

The immediate market reaction was striking. The CSI 300 index surged 4.3%, marking its most significant single-day gain since July 2020. This rally extended beyond China's borders, with U.S. stock prices climbing and commodities experiencing a notable boost. Silver futures soared over 4.5%, reaching decade-high levels, while copper futures hit a two-month peak.

To put this stimulus into perspective, we need to look back at similar macroeconomic events in history. The most obvious parallel is China's own 4 trillion yuan stimulus package in 2008, which helped the country weather the global financial crisis and provided a significant boost to worldwide demand. However, the current economic landscape is markedly different. Unlike in 2008, China is now grappling with a prolonged property crisis and significant deflationary pressures, making the stakes even higher this time around.

Another historical parallel worth considering is Japan's experience since the 1990s. Japan's "Lost Decades" serve as a cautionary tale, showing that monetary easing alone may not be sufficient to trigger sustained economic growth. This suggests that while China's stimulus may provide immediate relief, long-term success may hinge on structural reforms and addressing underlying economic issues.

For the Chinese economy, the stimulus package aims to tackle several key challenges. It's designed to help achieve the target of about 5% economic growth for 2024, revive the struggling real estate sector, boost consumer spending, and stabilize the stock market. While these measures are substantial, some analysts warn they may not be enough to fully reverse deflationary pressures or kickstart a new credit cycle in the private sector.

The implications for the U.S. economy are likely to be more nuanced compared to previous Chinese stimulus efforts. The numerous trade restrictions and technology export bans imposed by the U.S. on China in recent years may limit direct benefits to the American economy. However, if the stimulus successfully boosts global economic growth, the U.S. could indirectly benefit from increased global demand, potentially providing a tailwind for multinational corporations and export-oriented industries.

On a global scale, the ripple effects of China's stimulus could be significant. Commodity markets might see increased demand, benefiting countries like Australia. Asian economies integrated into China's supply chains could experience higher demand for industrial exports. European luxury goods manufacturers and tourism-dependent economies might see a boost from increased Chinese consumer spending. Developing economies, particularly in Southeast Asia and commodity-producing nations, could also benefit from increased Chinese economic activity.

For American investors, this stimulus package presents both opportunities and challenges. It may be worth considering increasing exposure to sectors and regions likely to benefit from Chinese economic growth. Emerging markets, particularly in Asia and commodity-producing countries, could offer attractive opportunities. U.S. companies with significant exposure to the Chinese market or its supply chains might also see positive impacts.

However, it's important to approach these opportunities with caution. The effectiveness of the stimulus will depend on its implementation and the broader economic context. Investors should also be aware of potential impacts on currency markets, particularly the yuan-dollar exchange rate, which could affect returns on international investments.

For now, China's 2024 stimulus package represents a significant economic event with global implications. While it draws parallels to past interventions, its ultimate impact remains to be seen.

**Hot Tip:** Chinese buyers are believed to make up a significant portion of Bitcoin holders—some estimates suggest as much as 50%. As a result, any economic stimulus in China can have a direct impact on Bitcoin's price movement. If geopolitical tensions remain stable, analysts predict Bitcoin could experience a surge of up to 30% leading into the U.S. elections.

MicroStrategy offers a roughly 1.7x leveraged exposure to Bitcoin, and the newly launched 2x MicroStrategy ETF (MSTU) amplifies that leverage even further. While the potential downside is substantial, MSTU could be a powerful tool for those seeking an aggressive, short-term bet on Bitcoin.

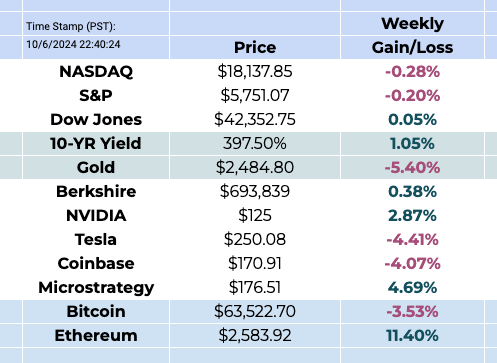

This Week By the Numbers 📈

📈 Market Moves

🏦 Monetary Policy & Economy

⚖️ Regulation & Legal

💼 Corporate News

World Liberty Financial, Trump-backed crypto platform, welcomes accredited investors

Samsung plans to cut thousands of jobs amid struggles in AI market

Spirit shares plummet as WSJ reports airline exploring bankruptcy filing

🌍 Geopolitics

President Biden discusses Israel striking Iran's oil facilities

Shigeru Ishiba, a monetary policy hawk, becomes Japan's prime minister

🎥 Calls for Speculation

Polymarket: 84% odds Satoshi’s identity won't be proven in 2024

JP Morgan: Geopolitical risks may push investors to gold and bitcoin

OG Bitcoin whale moves $3.58M of BTC mined in 2009 to Kraken

This Week’s Additional Resources:

It’s Show Time by Crypto Currently: What lies ahead for Bitcoin?

Adding a quick video for you guys this week on the price action of Bitcoin.

TL;DR: Bitcoin’s Q4 is historically volatile, making it an exciting period for traders. October often sees positive performance, setting the stage for potential upward momentum into November, which is crucial for determining the year-end trend. November is particularly significant as it can either continue the bullish trend or signal a reversal. Election years tend to enhance this bullish trend, with political events positively influencing market sentiment. Global liquidity fluctuations and the Federal Reserve’s monetary policy, especially decisions on interest rates and quantitative easing, play critical roles in shaping Bitcoin’s market conditions. Having a well-prepared plan for various market scenarios helps mitigate risks and enables informed decision-making, avoiding impulsive reactions to market changes.

Top Stories 🗞️

Iran's leader defends strikes on Israel in rare public speech

Iran's missile strikes on Israel were "correct, logical, and lawful", Ayatollah Ali Khamenei told a vast crowd which had gathered to hear him speak in Tehran on Friday. The country's supreme leader described the attack as the "minimum punishment" for what he called Israel's "astonishing crimes" while leading Friday prayers in the capital, something he has not done since 2020. Khamenei's speech came three days after Iran fired nearly 200 missiles at Israel, in what it said was retaliation for the assassination of Hezbollah’s leader, Hassan Nasrallah. Iran is the main backer of Hezbollah and Hamas, as well as other armed groups around the Middle East which have attacked Israel. They often dub themselves the "Axis of Resistance". On Thursday, US President Joe Biden suggested a possible Israeli strike on Iran's oil infrastructure had been discussed, as Israel continued to weigh up how to strike back at Tehran.

Powell Says Fed Not in a Hurry, Will Lower Rates ‘Over Time’

Powell also reiterated his confidence that inflation will continue moving toward the Fed’s 2% target, adding that economic conditions “set the table” for a further easing of price pressures. “Looking forward, if the economy evolves broadly as expected, policy will move over time toward a more neutral stance,” Powell said in a speech in Nashville at the annual meeting of the National Association for Business Economics. “But we are not on any preset course,” he said, noting that policymakers will continue to make decisions meeting by meeting based on incoming economic data. A neutral policy is one that neither stimulates nor holds back the economy. The Fed’s current benchmark rate, which officials lowered to a range of 4.75%-5% earlier this month, is widely regarded as still restricting economic activity. The remarks left open the question of how policymakers will approach the size and pace of interest-rate cuts in coming months, a crucial matter for investors. In a Q&A session following his speech, the Fed chair acknowledged that projections issued by officials alongside their September rate decision point toward quarter-point rate cuts at the next two meetings, in November and December. But he cautioned that the Federal Open Market Committee will make its decisions based, in part, on information they haven’t yet received.

Port Union Agrees to Suspend Strike

The International Longshoremen’s Association agreed on Thursday to suspend a strike that closed down major ports on the East and Gulf Coasts. The move followed an improved wage offer from port employers. The strike, which the dockworkers’ union began on Tuesday, threatened to weigh on the economy five weeks before national elections. Employers, represented by the United States Maritime Alliance, have offered to increase wages by 62 percent over the course of a new six-year contract, according to a person familiar with negotiations who did not want to be identified because the talks were continuing. That increase is lower than what the union had initially asked for, but much higher than the alliance’s earlier offer. Many businesses, expecting the strike, accelerated imports through the ports ahead of the walkout. But a long strike could have led to shortages and it was already beginning to cause congestion in supply chains. Perishable goods were particularly at risk from a strike. “I'm definitely relieved,” Daniel J. Barabino, chief operating officer at Top Banana, a fruit distributor based at the Hunts Point Produce Market in the Bronx, said after the announcement on Thursday. “I’m happy to have this behind us.”

Coinbase to Delist EU Non-Compliant Stablecoins in December

Coinbase Global Inc. will delist all unauthorized stablecoins from its crypto exchange in the European Economic Area by year-end, a potential blow for tokens like Tether Holdings Ltd.’s USDT. The European Union is set to fully implement new rules to oversee the crypto industry, known as MiCA, by the end of this year. Regulation of stablecoin issuers under MiCA took effect on June 30 and requires them to hold e-money authorization in at least one member state. Guidance for crypto exchanges and other companies operating in the bloc will kick in from Dec. 31. Companies from Robinhood Markets Inc. to Revolut Ltd. are considering launching stablecoins to challenge the dominance of Tether, the world’s largest stablecoin issuer, which has yet to gain permission to offer its $120 billion USDT in Europe.

Election betting is legal, federal appeals court says

A federal appeals court declined to block a lower court’s decision that allowed betting on 2024 federal elections Wednesday, a blow to the government agency that argued doing so could undermine election integrity. The Commodity Futures Trading Commission (CFTC) had asked the appeals court to block the prediction exchange platform Kalshi from offering “Congressional Control Contracts,” which allow buyers to bet on which political party will control the House and the Senate after the upcoming election. The U.S. District Court for the District of Columbia sided with Kalshi last month, ruling the government agency had exceeded its authority in trying to block the company from offering a market to bet on election outcomes. The CFTC warned such contracts “could potentially be used in ways that would have an adverse effect on the integrity of elections, or the perception of integrity of elections.” While the appeals court found the concerns “understandable,” it ultimately sided with Kalshi in the “close and difficult” case.

“Myth Of Money” Book - Shipping this week! 🤓

As many of you know, making financial education accessible has always been a passion of mine, and I’ve always offered it for free!

After a year of hard work, I'm excited to announce that my new book, published by Wiley Publishing, will be officially available on October 1st!

This book is a thrilling blend of personal stories from the financial world, coupled with clear explanations of how things really work—from investment banking and stocks to venture capital, macroeconomics, and cryptocurrencies.

How can you support?

For individuals the book is available for sale on Amazon!

If you pre-order and leave a review, I will add you to my personal Telegram group, where I share exclusive investment tips and tricks! Just email me a screenshot of both the pre-order and review, along with your Telegram ID.

For bulk orders, we offer discounts if you order 10 or more copies for your business or educational institution. Additionally, we are setting up a donation program for corporates interested in donating books to schools. If this interests you, please reach out to me directly!

Thank you for reading this week’s edition of the Myth of Money.🚀

Were you forwarded this email? Subscribe below.

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. Currently working as a proud General Partner at Moonwalker Capital.

(More about me 👉 here).