End of Bear Market: Fed Shifts Monetary Policy

Dear Investors,

Welcome to this week’s edition of the Myth of Money. If you would like to keep in closer touch, please reach out on X.

The past couple of weeks have been exceptionally busy. On a personal note, I've been traveling to Art Basel in Miami and Barbados. Professionally, it's been a crucial time as well, with my team and I finalizing the launch of Moonwalker Capital, our new investment management firm, set to debut in the new year.

Meanwhile, the financial markets have been active, maintaining a bullish trend. The Federal Reserve has made several statements indicating a likely decrease in interest rates, signaling an end to the bear market.

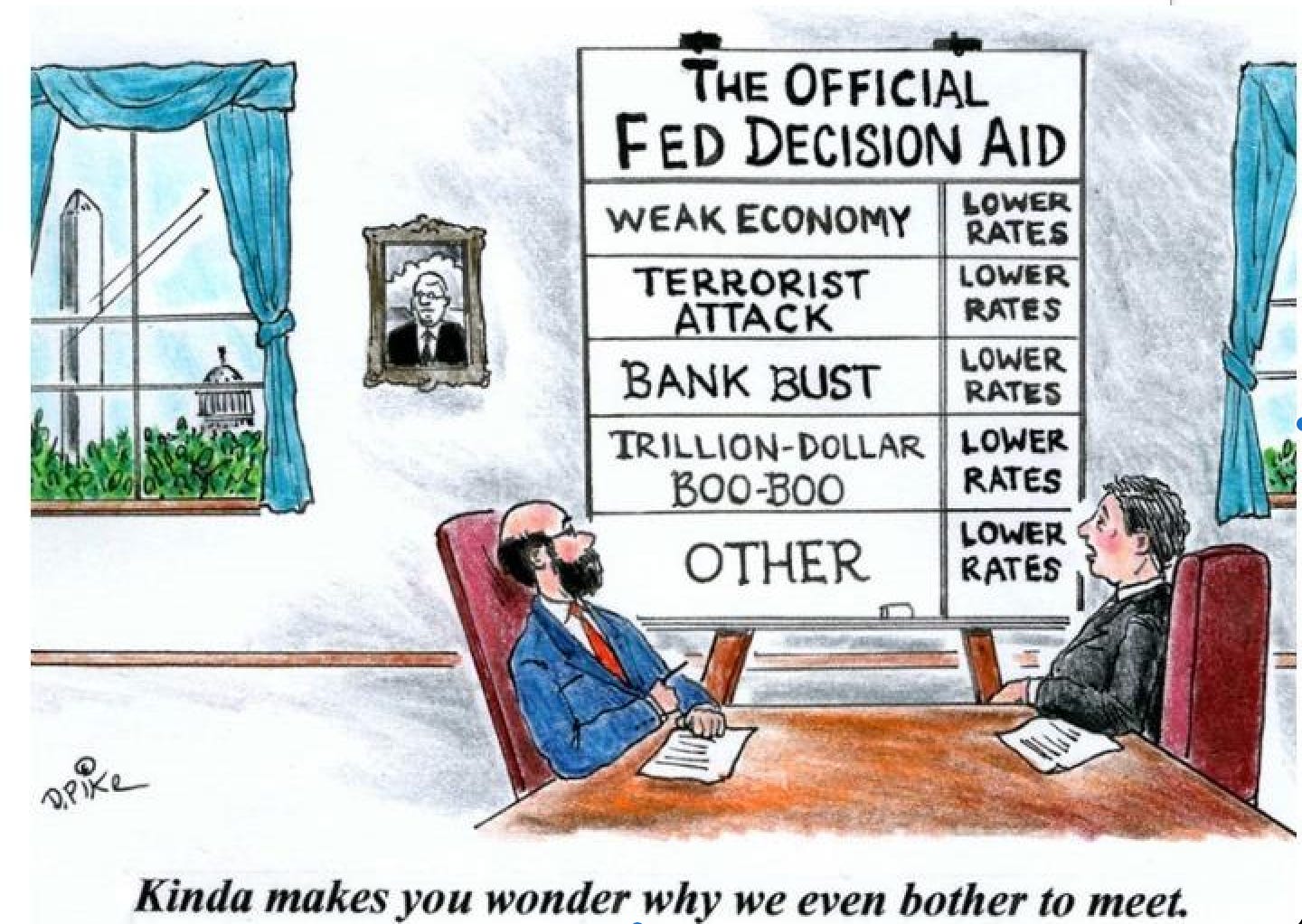

Fed Signals End to Rate Hikes

In a significant shift, the Federal Reserve has indicated that the cycle of aggressive interest rate hikes is likely coming to an end. This change follows the Fed's latest meeting, where the central bank kept interest rates steady, maintaining the target range at 5.25% to 5.5%. Fed Chair Jerome Powell emphasized that the historic tightening of monetary policy might be over, citing a faster-than-expected fall in inflation and a balanced approach to the dual mandate of stable prices and maximum employment.

A Soft Landing in Sight

Powell's comments suggest that the Fed is close to achieving a "soft landing" for the economy. Inflation is moving back towards the Fed's 2% target, and the labor market is showing signs of returning to balance, with unemployment rates remaining low. Powell remarked, "We are seeing strong growth that... appears to be moderating. We're seeing inflation making real progress. These are the things we've been wanting to see." He cautioned that declaring victory would be premature, but the question of dialing back policy restraint is now clearly in sight.

Market's Bullish Response

The markets reacted positively to these developments. U.S. stocks, including the S&P 500 and the Dow Jones Industrial Average, jumped sharply following the Fed's announcement and Powell's press conference. This surge reflects investor optimism about a potential shift towards a less restrictive monetary policy. The bond market also responded, with the yield on Treasury notes falling, effectively delivering a rate cut to the open market.

Rate Cuts on the Horizon

The possibility of rate cuts has now entered the conversation, with 17 of 19 Fed policymakers foreseeing lower rates by the end of 2024. The updated projections indicate that headline personal consumption expenditures inflation is expected to fall close to the Fed's target in the next two years. This optimistic outlook comes with minimal impact on unemployment, which is expected to rise only slightly.

Implications for the Economy

Powell's stance indicates that the Fed is prepared to cut rates even if the U.S. economy does not enter a recession in 2024. This willingness to adjust policy in response to changing economic conditions suggests a proactive approach to supporting economic growth while keeping inflation in check. The bond market's response, a significant decrease in Treasury yields, underscores the market's anticipation of a more accommodative monetary policy.

Wall Street's Optimism

Wall Street banks, including Goldman Sachs, predict bullish quarters ahead, fueled by expectations of cooling interest rates and increased activity in the cryptocurrency market, among other factors. The financial sector is poised for a period of growth, anticipating a conducive environment for investments and trading activities.

What I’m Reading This Week 📚

A16Z publishes their list of bullish crypto plays for 2024.

This Week By the Numbers 📈

Quick Facts:

Bloomberg reports that a Bitcoin ETF launched in January, with an Ethereum ETF likely to follow in May.

Van Eck's CEO says Bitcoin will reach a new all-time high in the next 12 months.

Coinbase has initiated legal action against the SEC for refusing its regulation request.

The Bank of Korea emphasizes the urgent need for the introduction of Central Bank Digital Currencies (CBDCs).

Polygon announces a strategic shift to focus on Chain Development Kit (CDK) for scaling purposes.

Worldcoin Price Surges 65% Following Strategic Move by OpenAI’s Sam Altman in pursuit of an additional $50 million in funding.

The stock market marks its seventh consecutive week of gains.

A rebound in U.S. home sales is observed as mortgage rates begin to ease.

Homelessness in the United States reaches an unprecedented level.

Costco reported selling $100 million worth of gold bars in the last quarter.

Key economic data releases this week include U.S. GDP on Thursday and PCE Inflation on Friday.

Top Stories 🗞️

MSC, the world’s largest shipping carrier, joins shipping giants Hapag-Lloyd and Maersk in Red Sea travel pause amid attacks

MSC, the world’s largest shipping carrier, said it is no longer traveling through the Suez Canal after its container ship, the MSC PALATIUM III, was attacked Friday while transiting the Red Sea under a subcharter to Messina Line. “Due to this incident and to protect the lives and safety of our seafarers, until the Red Sea passage is safe, MSC ships will not transit the Suez Canal Eastbound and Westbound. Already now, some services will be rerouted to go via the Cape of Good Hope instead.” MSC explained the new routing will impact the sailing schedules by several days for vessels booked for Suez transit. This announcement follows the announcement in the pause of Red Sea and Bab al-Mandeb Straight travel by shipping giants, Hapag-Lloyd and Maersk, following a series of attacks on their vessels by Iranian-backed Houthi militants from Yemen.

Bitcoin fees hit 20-month high as miner revenues match $69K BTC price

Bitcoin miners are the main beneficiaries of current sky-high transaction fees, data shows, but many longtime market participants have little time for complaints. Bitcoin on-chain transaction fees are dividing opinion as the cost of sending BTC skyrockets. Data from the statistics resource BitInfoCharts puts the average transaction fee at nearly $40 as of Dec. 17. The latest wave of Bitcoin Ordinals inscriptions has resulted in elevated transaction fees for all network users — but some believe that they are here to stay. As casual on-chain spending becomes unviable for many smaller investors, a heated debate among Bitcoin proponents continues. While many are angry at the impact of Ordinals on fees, popular Bitcoin figures argue that double-digit transaction costs are merely a taste of things to come. Those wanting to shield themselves need to embrace so-called layer-2 solutions such as the Lightning Network, which is specifically designed to cater to mass adoption.

Solana phone sells out in US as traders spot arbitrage with bonk's skyrocketing price

The Solana Saga phone has sold out in the US after traders saw upside in buying the phones, currently trading for $2k+ on Ebay. Each Saga comes with 30 million bonk tokens — worth more than the phone at its current price. Over the last 24 hours, the price of bonk increased from $0.000014 to a peak of $0.000033, up 135%, according to The Block's Bonk Price Page. The token has gone parabolic recently, up 600% from the start of December to its current price. Each Solana phone comes with 30 million bonk tokens. While that was only a few dollars when the phone first came out, that amount of tokens was worth $990 at its recent all-time high. That's compared to just $599 for the phone.

Tether has frozen $435M USDT for U.S. DOJ, FBI, and Secret Service

The world’s largest stablecoin issuer has frozen 326 wallets containing $435 million worth of Tether (USDT) for the U.S. authorities, the company highlighted in a letter on Dec. 15. The assets were frozen to assist law enforcement authorities, including the U.S. Department of Justice (DOJ), the Federal Bureau of Investigation (FBI), and the Secret Service. The letter, addressed to Senator Cynthia M. Lummis and Congressman J. French Hill, followed another letter to the politicians on Nov. 16. Both letters were sent in response to Lummis and Hill’s letter to Attorney General Merrick Garland on Oct. 26, which outlined their concerns about the use of stablecoins for illicit activities, such as money laundering and terrorist financing. Making both letters public, Tether CEO Paolo Ardoino noted that the company aims to become a “world class partner” to the U.S. to “expand dollar hegemony globally.”

FTX's revised reorganization plan values crypto claims at time of bankruptcy

The FTX Debtors estate, led by CEO John Ray III and the lawyers of Sullivan & Cromwell, has filed its amended Chapter 11 plan of reorganization today, laying out precisely how bankruptcy claims will be treated in the case. Notably, the plan contains a provision that would value claimants' digital assets in cash at the time of the date of the bankruptcy filing, Nov. 11, 2022. The collapse of FTX caused a notable dip in the market that has since healthily recovered, with the global crypto market cap increasing from about $856 billion to 1.6 trillion today. Even FTX's own token has nearly doubled in that time. That means creditors could stand to lose out on millions in potential gains should the plan be approved. The price of most cryptocurrencies have recovered since the bankruptcy; the price of Bitcoin was around $17,000 at the time, and now trades above $42,000.

Deal of the Week 💰

Last month, I invested in Radicle Science, which invented "Proof-as-a-Service," making it easy for natural products to clinically prove their health effects and become affordable trusted alternatives to pharmaceuticals.

This week, TED published Dr. Jeff Chen’s TED talk, one of the founders of Radicle Science.

What if it was easy to prove the effects of natural products? Maybe we'd have affordable non-pharma medicines for all.

Thank you for reading this week’s edition of the Myth of Money.🚀

Were you forwarded this email? Subscribe below.

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).