Dear Investors,

Welcome to this week’s edition of the Myth of Money. If you would like to keep in closer touch, please reach out on X (formerly Twitter) below.

Moonwalker Capital, our new firm focused on Bitcoin ecosystem assets, is now 95% subscribed.

SEC: Gary Gensler Requests $2.6B to Take On Crypto Industry

In a bold move to strengthen regulatory oversight within the rapidly evolving crypto market, SEC Chairman Gary Gensler has proposed a significant increase in resources for the U.S. Securities and Exchange Commission (SEC). Gensler's ambitious plan involves a request for $2.6 billion to enhance the SEC's capacity to regulate the digital asset industry. This financial infusion aims to add more than 5,000 positions to the agency's workforce, highlighting a proactive approach to addressing the complexities and challenges of the crypto space.

By requesting an additional $2.6 billion in the SEC's 2025 fiscal budget, Gensler underscores the urgency of equipping the agency with the necessary tools to navigate and police the dynamic and often tumultuous crypto market. "Investors have put hard-earned assets at risk in a highly speculative asset class," Gensler commented, emphasizing the need for robust regulatory mechanisms to protect investors and maintain market integrity.

Regulatory Hurdles for Ether ETFs

The outlook for the approval of spot ether ETFs in May appears increasingly bleak, with Bloomberg Intelligence ETF analyst James Seyffart expressing skepticism due to the U.S. Securities and Exchange Commission's (SEC) perceived disengagement with potential issuers. This stands in stark contrast to the active dialogues that preceded the approval of spot bitcoin ETFs. Seyffart, along with his colleague Eric Balchunas, adjusted their expectations, foreseeing a likely denial for ether ETF applications on May 23—the final decision deadline for one of the seven issuers, including industry giants like BlackRock, Fidelity, and Invesco, alongside partners like Galaxy and Grayscale.

This pessimistic view is further exacerbated by the SEC’s reported investigation into the Ethereum Foundation, part of a broader effort to potentially classify ETH as a security. Such a move could profoundly impact the regulatory landscape for Ethereum and its associated products. Notably, Coinbase’s Chief Legal Officer, Paul Grewal, and others have critiqued the SEC’s approach, emphasizing the lack of justification for denying the ETF applications given Ethereum's established regulatory status.

Ethereum’s Technological Progress

Amidst these regulatory challenges, Ethereum Co-founder Vitalik Buterin highlighted the ongoing concerns regarding centralization within Ethereum's proof-of-stake mechanism, proposing "rainbow staking" as a potential solution. The emphasis is on diversifying staking practices to avoid concentration risks, particularly in the face of dominant entities like Lido, which controls a substantial portion of staked ether.

Simultaneously, Ethereum developers are pushing for a significant network update by proposing to increase the gas limit from 30 million to 40 million. This adjustment aims to reduce transaction fees by 15% to 33%, addressing a critical pain point for users and developers on the network. The initiative has garnered support from various quarters of the Ethereum community, signaling a collective effort to enhance the blockchain’s efficiency and scalability.

BlackRock Says Ethereum ETF Faces “Little Demand”

During a recent engagement at the Bitcoin Investor Day conference in New York, BlackRock’s Head of Digital Assets, Robert Mitchnick, shed light on the firm's digital asset strategy, particularly highlighting the investor sentiment surrounding Ethereum ETFs. Despite the burgeoning diversity in the cryptocurrency market, BlackRock's analysis reveals a distinct investor preference for Bitcoin over Ethereum, suggesting a lukewarm reception at best for the prospect of an Ethereum exchange-traded fund (ETF).

Mitchnick’s insights suggest a stark contrast between the enthusiasm for Bitcoin and the relatively subdued interest in Ethereum among BlackRock's clients. "I can say that for our client base, Bitcoin is overwhelmingly the number one focus and a little bit Ethereum," Mitchnick articulated, emphasizing the predominant inclination towards Bitcoin. This trend is further exemplified by the notable success of BlackRock’s iShares Bitcoin ETF (IBIT), which swiftly climbed the ranks to become one of the top five ETFs in the market, boasting an impressive $15 billion in assets.

As the May deadline for the ETF decision approaches, the crypto community remains keenly focused on the SEC's actions, which could set precedent-setting implications for the industry. Meanwhile, Ethereum's proactive measures to address its internal challenges showcase the inherent dynamism and resilience of the blockchain industry, even in the face of regulatory headwinds. The outcome of these concurrent narratives will likely have lasting impacts on the trajectory of cryptocurrency adoption and the regulatory landscape in the years to come.

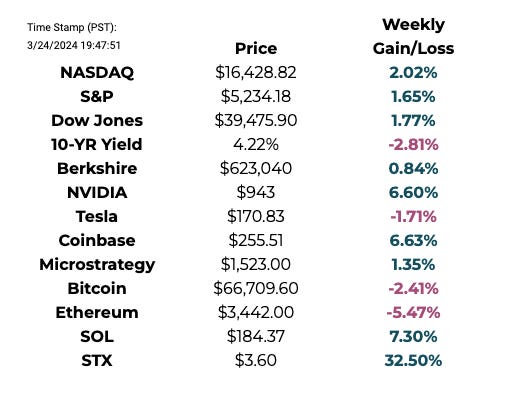

This Week By the Numbers 📈

Quick Facts:

Federal Reserve leaves interest rates unchanged, remains at 5.25% - 5.50%

MicroStrategy bolsters its Bitcoin holdings by an additional $623m

Cathie Wood predicts Bitcoin's potential surge to $3.8m

Standard Chartered Bank raises its Bitcoin price target to $150,000 this year and $250,000 by end of 2025

Ark offloads Coinbase shares amidst market rally

World's largest $1.43 trillion pension fund in Japan looks into adding Bitcoin to its portfolio

Memecoin activity drives a 51% increase in Base volume

FTM emerges as top-performing Layer 1, Coinbase adds futures listing

SOL's monthly DEX volume hits $50bn, with revenues soaring 30-fold

European Union bans anonymous crypto transactions over €3,000 using self-custody wallets

Significant decrease in Futures Funding rates across altcoins

Robinhood launches crypto wallet on Google Play for Android users

FTX considers selling its Anthropic stake for $1bn

Do Kwon poised for bail release

Stocks end lower, yet mark the best-performing week in months

Reddit shares end trading up 48% in IPO market debut

The dollar is on the brink of a significant breakout

European Central Bank hints at a rate cut in June

Senate approves a $1.2 trillion government funding bill

Neuralink user makes history by posting on X using thought

X has now received a money transmitter license for payment services in 22 US states

Princess Catherine undergoes treatment for cancer

US drops out of the top 20 happiest countries list

Top Stories 🗞️

Saudi Arabia reportedly in talks with VC firms like Andreessen Horowitz to create mammoth $40 billion AI fund

Saudi Arabia’s sovereign wealth fund is in talks with American venture capital firm Andreessen Horowitz and potentially others to create a $40 billion fund to invest in artificial intelligence. The move, which two people with knowledge of the matter told CNBC has been under discussion for months, would see a partnership formed between Saudi Arabia’s $925 billion Public Investment Fund and Andreessen Horowitz, one of Silicon Valley’s largest venture capital firms. Saudi Arabia’s PIF has been on a buying spree as it seeks to diversify the kingdom’s revenues away from oil, a key pillar of Saudi Crown Prince Mohammed bin Salman’s Vision 2030 initiative. It has poured billions of dollars of investment into stake purchases and joint funds with major international companies like Uber, Bank of America, Citi, SoftBank and Blackstone. Andreessen Horowitz, with $35 billion in assets under management, has backed successful companies including Airbnb, Coinbase, Facebook and Slack, and has nearly 100 AI-related startups in its portfolio.

FTX recovery may include recent prices

As crypto prices have risen, much more pressure has been placed on the FTX bankruptcy process. The core tension is whether customers are paid out in the crypto they supposedly had at the exchange or in an equivalent dollar value. So far, FTX’s bankruptcy lawyers have steamrolled ahead with dollarized claims. Yet with bitcoin breaking new highs, ether retesting old ones and solana rallying hard, customers are unsurprisingly asking the question: Why shouldn’t they be paid out in crypto? It’s certainly been done in other bankruptcy proceedings. While Mt Gox’s process has taken a decade, the plan is to repay creditors in a combination of bitcoin and fiat currency. More recently, BlockFi has repaid creditors in crypto and Celsius is set to follow. While the FTX estate might argue that it only had a fraction of some cryptocurrencies, it certainly has plenty of others.

BlackRock Teams Up With Coinbase For Its Tokenized Investment Fund

BlackRock’s revelation of BUIDL on Wednesday offers qualified investors a unique avenue to earn US dollar yields via blockchain. Through Securitize Markets, LLC, investors gain access to this novel fund, heralding a shift in investment dynamics. Observers were quick to note a significant transaction of $100 million in USDC stablecoin on the Ethereum network, likely laying the financial groundwork for BUIDL. Consequently, this event has been interpreted as a robust endorsement of the fund’s potential to revolutionize blockchain investment practices. Tokenization, a central theme in BlackRock’s digital asset endeavors, promises to offer substantial benefits. These include broader investor access, instantaneous settlements, and seamless transfers across platforms. Moreover, BNY Mellon’s involvement ensures a bridge between digital and traditional financial realms, enhancing the fund’s operational fluidity.

Moscow Terrorist Attack Kills 40, US Intelligence Says It Knew ISIS-K Was Planning Attack

The initial reports that ISIS has claimed responsibility for the terror attack in Moscow appeared rumor at first, and has still been subject of widespread scrutiny and debate, however, US media and government officials are saying that the Islamic State (or ISIS-K) statement is authentic. "A branch of the Islamic State claimed responsibility on Friday for the attack in Moscow that killed at least 40 people and injured about 100 others, and U.S. officials confirmed the claim shortly afterward," The New York Times writes late in the day. What's more is that US intelligence knew there was to be an imminent attack on Moscow: "The United States collected intelligence in March that Islamic State-Khorasan, known as ISIS-K, the branch of the group based in Afghanistan, had been planning an attack on Moscow, according to officials. ISIS members have been active in Russia, one U.S. official said," according to more from NYT.

OpenAI Goes Hunting in Hollywood

According to a new report, the influential AI company has spent the last few months courting Hollywood executives in the hopes of convincing them that its newest content-generator, Sora, will be useful when it comes to making movies. Bloomberg reports that the AI company plans to hold more meetings in Los Angeles next week with “Hollywood studios, media executives and talent agencies” in the hopes of convincing them to use Sora. These discussions are just the latest round of talks, according to sources familiar with them. The report also notes that Sam Altman, OpenAI’s CEO, attended multiple parties in L.A. during the same weekend that the Oscars took place. It doesn’t specify whether Sam’s partying had anything to do with the company’s Sora pitch.

My Top 10 Investment Ideas for 2024 🐸

This week, we are offering an additional free knowledge source - My Top 10 Investment Ideas for 2024, including picks across stocks and crypto, and my reasoning behind making those investments personally.

To receive this product, simply refer 3 friends using your unique shareable link 👇

Thank you for reading this week’s edition of the Myth of Money.🚀

Were you forwarded this email? Subscribe below.

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).

The SEC is the "law office" for Big Banks. They do the bidding of the Big Banks.

They were told years in advance about Maddof's ponzi operation and did zero, but show up to paint chalk lines around the bodies after the inevitable happened.

As for crypto, it's mostly Fear, Uncertainty and Doubt, to slow innovation so the Big Bank masters have time to catch up. And of course battlespace prep to clean out the competitors and leave everything wide open for these same "Masters of the Universe". Case in point is the BTC ETF's. I was involved in one of the early ones. Attys told us there is no reason not to approve it, it's completely legal, but must have SEC blessing to get listed. What happened? After four years, they approved all the Big Bank products and this one is left in the dust.

Another example is naked short selling. This is counterfeiting of securities and the SEC has been notified many times about this and chose to do nothing. It's a technique they use to destroy publicly traded companies with impossible shorting, due to unlimited supply of counterfeit securities.