First Republic Bank: A Ticking Time Bomb in the Ongoing Banking Crisis

Dear Investors,

Over the weekend, federal regulators worked to seize and sell the struggling First Republic Bank before the opening of financial markets on Monday. This was done in an effort to address the banking crisis that began the previous month with the collapse of Silicon Valley Bank.

A prompt solution must be reached to avoid further erosion of confidence in the American banking system. Depositing money in a U.S. bank should not be deemed a high-risk activity.

The Significance of First Republic Bank

Since the beginning of the banking crisis in March, First Republic Bank, located in San Francisco and catering mainly to affluent customers in the technology and finance sectors on the coasts, has been identified as the most at-risk regional bank. This bank is popular with small to mid-sized businesses with fewer than 100 employees. The crisis started following the collapse of Silicon Valley Bank.

On Monday, the bank disclosed that it had lost $102 billion in customer deposits, with the majority of the outflow taking place in just three weeks in March, not including the $30 billion recent “bailout” from the 11 big banks. Like Silicon Valley Bank, First Republic has also faced losses on its loans and investments as the Federal Reserve raised interest rates to combat inflation.

The Federal Deposit Insurance Corporation is leading the effort to address the crisis, as First Republic's shares plummeted 75% since the announcement of customer withdrawals. It was revealed that larger banks were hesitant to acquire the bank, as they were concerned that the purchase would result in billions of dollars in losses.

Inside First Republic Bank's Recovery Efforts

The Federal Deposit Insurance Corporation (FDIC) has been in talks with banks such as JPMorgan Chase, PNC Financial Services, and Bank of America regarding a possible acquisition of First Republic Bank. If a deal is reached, the buyer would most likely assume the deposits of First Republic, which would eliminate the need for a government guarantee of deposits exceeding $250,000 - the limit for deposit insurance.

However, if an agreement is not reached, the FDIC would need to decide whether or not to seize First Republic and take ownership itself. Federal officials could invoke a systemic risk exception to safeguard the larger deposits, similar to what was done after the failures of Silicon Valley Bank and Signature Bank in March.

Former Treasury Secretary Lawrence Summers emphasized that the government needs to take action to ensure that uninsured depositors get their money back in full, either through a takeover or government guarantee. If not, it runs the risk of setting off a wave of further withdrawals from all but the largest of institutions.

JPMorgan Chase and Bank of America are prevented by regulations from acquiring another deposit-taking bank because of their size. Regulators would have to grant an exemption if either of those banks were to acquire First Republic. PNC, one of the country's largest regional banks based in Pittsburgh, had previously considered buying First Republic but was unable to make a deal work due to the large losses it would incur from First Republic's relatively low-rate home mortgages and other loans.

The Banking Crisis is Not Over

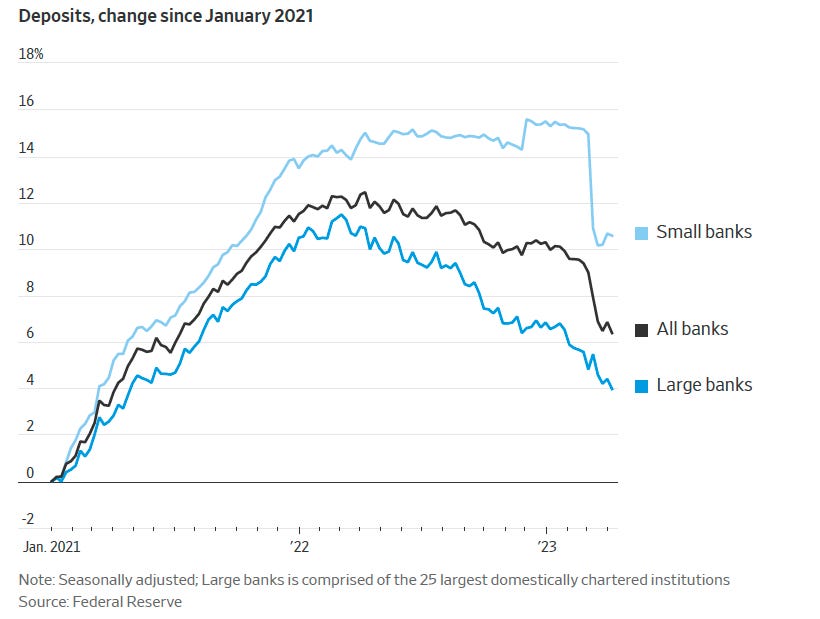

Last month's banking crisis caused significant disruptions in the industry. Many banks had failed to raise deposit rates in response to the Federal Reserve's aggressive short-term interest rate hikes aimed at curbing high inflation. However, last week's earnings reports from banks showed that regional lenders have managed to stem the most severe outflows in the panic phase of the banking crisis, thanks to a quick government response that implicitly backed all uninsured deposits.

Depositor runs on both Silicon Valley Bank and Signature Bank caused customers, including corporate treasurers with large payroll accounts, to question whether they should move uninsured deposits to larger, more tightly regulated banks. This left many small or regional banks vulnerable to deposit outflows. The lingering question now is how much of an impact any lending pullback will have on the economy.

Despite the government's efforts to ease concerns by guaranteeing deposits at banks with less than $10 billion in assets, depositors remain anxious and may continue to withdraw their funds from smaller banks. This steady erosion of deposits could continue as consumers seek higher returns through money-market mutual funds, leading to increased funding costs for banks and squeezed profits.

According to Goldman Sachs economists, a 10% decline in bank profitability could reduce lending by 2%. If deposit betas reach 2007 levels, it could cause a 3% to 6% decline in lending in the US.

Depositor anxiety could resurface if and when banks face worries over losses due to loan defaults. Businesses with fewer than 100 employees receive nearly 70% of their commercial and industrial loans from banks with less than $250 billion in assets, and 30% of such lending from banks with less than $10 billion. Economists estimate that link is tighter outside of large cities: In most U.S. counties, small and midsize banks account for 90% of loans to small businesses.

To add pressure to an already sensitive situation, the Fed is poised to raise interest rates again in May, which could exacerbate the lending crunch. Officials have hinted that they will increase the fed funds rate to just over 5% at their May 2-3 meeting before potentially taking a break.

With loan-to-deposit ratios sitting near 80% for many small banks compared with 60% for large banks, the likely solution for smaller banks will be to reduce lending, further slowing down the economy.

What I’m Reading This Week 📚

Our previous newsletter provided a brief overview of SpaceX's Starship launch and its importance. Below is a much more detailed resource exploring this launch's scientific significance.

Starship Will Change Humanity Soon by Tomas Pueyo.

TL;DR: SpaceX has drastically reduced the cost of carrying weight to space, from over $75,000 per kilogram in the 1980s to $1,500 per kilogram with the Falcon Heavy rocket. The Starship rocket is set to carry over 100 tons of payload, 50% more than the Falcon Heavy, with thousands of launches planned yearly. Elon Musk predicts that within 2-3 years, the cost per kilogram will drop from $1,500 to $100.

This Week By the Numbers 📈

The US economy slowed considerably in the first quarter of this year due to rising interest rates and inflation, with GDP increasing at an annualized rate of 1.1% compared to the expected 2% growth. The PCE price index increased 4.2%, exceeding the estimated 3.7%, and core PCE (which strips food and energy costs) rose 4.9%. Stocks rose significantly while Treasury yields increased following the report.

The US House of Representatives narrowly passed a bill to increase the debt ceiling by $1.5 trillion, along with sweeping spending cuts over the next decade. The bill's passage by a mostly partisan 217-215 vote is a victory for Republican House Speaker Kevin McCarthy, but the bill is unlikely to pass the Senate or receive approval from President Joe Biden. If enacted, the legislation would limit spending growth to 1% annually, eliminate some tax incentives for renewable energy, and impose stricter work requirements for certain anti-poverty programs.

The trend of de-dollarization continues with various new developments:

Argentina plans to pay for Chinese imports in yuan instead of dollars.

China, a BRICS nation, aims to build a rail link to Pakistan and decrease dependence on the West for international trade.

The yuan has surpassed the US dollar as the most widely used currency for cross-border transactions with China.

Brazilian President Luiz Inacio Lula da Silva supports creating a currency for trade within the BRICS group, comprising Brazil, Russia, India, China, and South Africa.

Chinese yuan or Russian rubles are now used in 70% of trade deals between China and Russia.

19 new countries submit membership requests to join BRICS, challenging the US dollar's global dominance.

Top Stories 🗞️

Coinbase Files Lawsuit Against SEC Seeking Regulatory Clarity

Cryptocurrency exchange Coinbase has filed a legal action to ask the US Securities and Exchange Commission (SEC) to clarify regulations for the crypto industry. The filing follows a July 2022 petition from Coinbase asking the SEC to use formal rulemaking to provide guidance for the crypto sector. Coinbase claims that the SEC has not yet responded to its petition, so it has filed the legal challenge to compel the SEC to respond either positively or negatively to its request. The Administrative Procedure Act requires the SEC to respond to Coinbase’s rulemaking petition “within a reasonable time.” If the SEC decides not to respond, Coinbase will have the right to challenge that decision in court. Coinbase does not seek to dictate the SEC’s response, only to require that the agency responds at all, according to a statement released by the company. Coinbase and other crypto firms are facing potential regulatory enforcement actions from the SEC, even though the agency has not stated its position on the application of the law to the crypto sector. Coinbase asserts that regulatory clarity is long overdue for the industry, and that new rules would be “a critical step to giving the public notice about what activities they can and cannot engage in.”

Binance.US calls off $1.3 billion deal for Voyager's assets

inance.US has called off its $1.3 billion deal to buy assets of bankrupt crypto lender Voyager Digital, citing a "hostile and uncertain regulatory climate." In a court filing on Tuesday, lawyers for Voyager said the company reserves all rights with respect to a $10 million good-faith deposit paid by Binance.US to Voyager, as well as a reverse-termination fee owed by Binance.US. "The hostile and uncertain regulatory climate in the United States has introduced an unpredictable operating environment impacting the entire American business community," a spokesperson for Binance.US said in a statement. "We are focused on creating a safe platform where our customers can participate in the digital asset economy." The move adds another hurdle for Voyager, which has been looking to raise funds through an asset sale to repay creditors after it collapsed into bankruptcy last year.

MasterCard advances its Bitcoin and crypto card adoption with new partnerships, Polygon, Solana

MasterCard revealed a new partnership with Polygon (MATIC), Ava, and Aptos, among others, on a joint venture set to advance their innovative work in blockchain technology. The product, dubbed MasterCard Crypto Credential, will enhance “trust in the blockchain ecosystem,” according to an official announcement at Consensus 23 on April 28. The New York-based company is committed to expanding its Bitcoin and crypto card adoption. The crypto card program is designed to enable users’ digital asset use through MasterCard payment technology. Currently, the company boasts over three billion cards in circulation worldwide and is accepted at more than 90 million locations.

Fox Corporation sheds $962 million in market value after announcing Tucker Carlson is leaving the news network

Fox Corporation stock fell as much as 5% on Monday and erased $962 million in market value after it was announced that Fox News Media had parted ways with its host Tucker Carlson. The split between Carlson and Fox News comes just one week after the company settled a defamation lawsuit with Dominion Voting Systems for $787.5 million because of the network's spread of misinformation related to the 2020 US presidential election and unfounded claims of election fraud. Carlson has long been one of the most popular hosts at Fox News, with the conservative talk-show personality's 8 p.m. show consistently being the most watched news show on cable TV.

UK blocks Microsoft's $69 billion Activision deal over cloud gaming concerns

Britain will block Microsoft's (MSFT.O) $69 billion acquisition of "Call of Duty" maker Activision Blizzard (ATVI.O) over concerns it would hinder competition in cloud gaming, dealing an unexpected blow to the biggest-ever deal in gaming. The country's antitrust regulator said on Wednesday that Microsoft's commitment to offer access to Activision's multi-billion dollar "Call of Duty" franchise to leading cloud gaming platforms would not effectively remedy its concerns. Microsoft's president Brad Smith said in a statement the company remained fully committed to the acquisition and would appeal the decision, while Activision said it would "work aggressively" with Microsoft to reverse it. "We will reassess our growth plans for the UK," the company said in a separate statement. "Global innovators large and small will take note that - despite all its rhetoric - the UK is clearly closed for business."

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).