GameStop's Roaring Kitty Shakes the Market

Dear Investors,

Welcome to this week’s edition of the Myth of Money. If you would like to keep in closer touch, please reach out on X (formerly Twitter) below.

GameStop's Roaring Kitty, the legendary trader behind the GameStop (GME) meme stock frenzy, has made headlines again with his first YouTube livestream in three years. On June 7, Keith Gill, known as Roaring Kitty, revealed his financial situation and future plans, sparking dramatic market reactions.

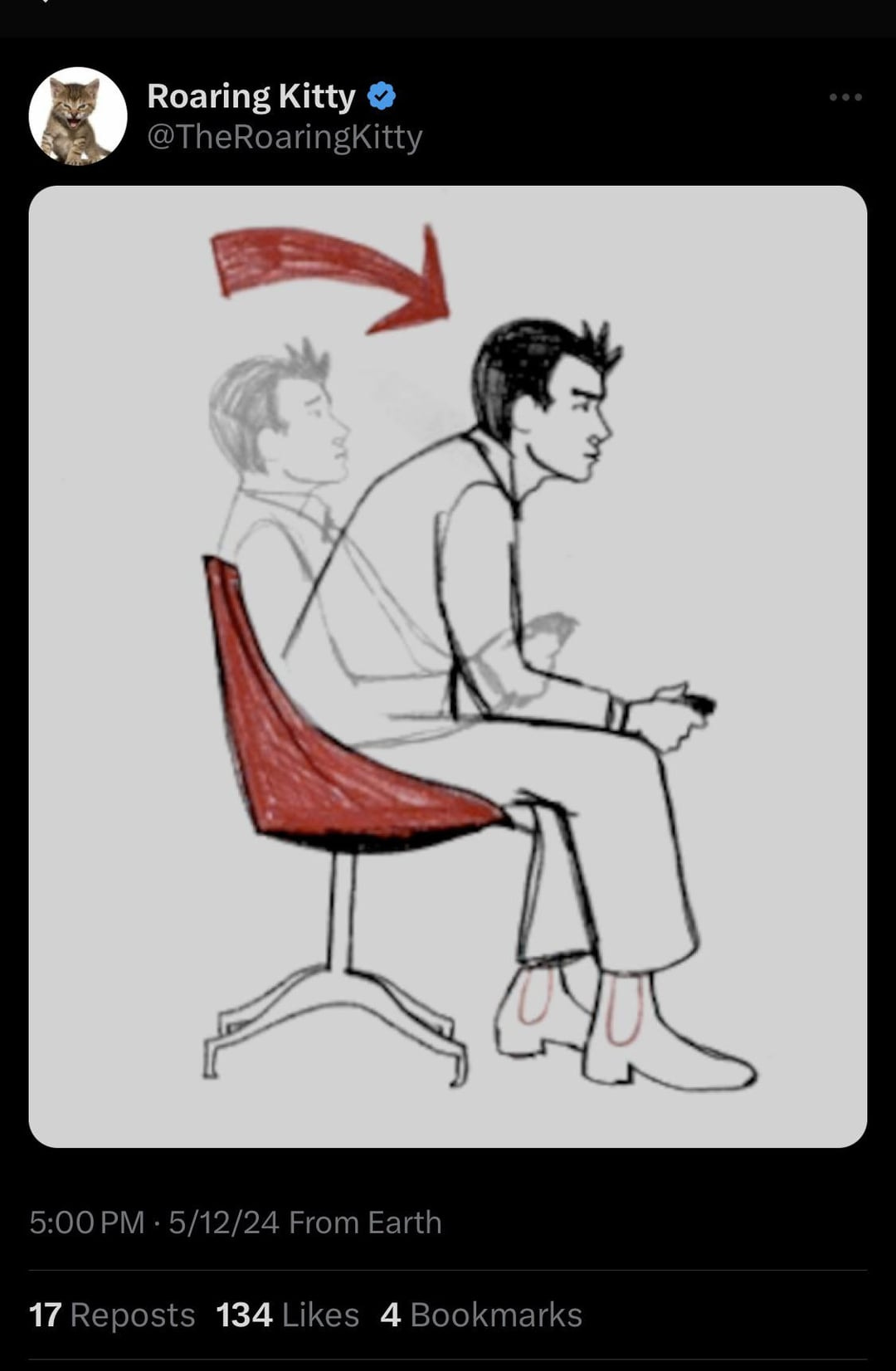

In 2021, Gill's advocacy for GameStop sent its shares soaring by as much as 1,600% before they came crashing back to earth. He became an internet hero to some and an annoyance for others on Wall Street. The stock received renewed attention when Gill posted the following meme on his X, indicating that it was time to buckle up.

During his highly anticipated livestream, Gill disclosed that he was down $235 million. This revelation came as GameStop shares plummeted from the previous day's close of around $46 to a low of around $26. At the time of writing, GameStop shares are trading around $28.

Gill also shared that he held call options on 12 million GameStop shares. His announcement on June 6, which scheduled the livestream for the following day, caused GameStop shares to jump from $32 to $46.55, with aftermarket trades hitting a high of $61.27. Based on this aftermarket price, Roaring Kitty was projected to become a billionaire, provided the market held those levels during regular trading on June 7.

The livestream caused significant volatility, with GameStop trading halted six times on June 7 due to extreme price swings. GameStop's stock price dropped sharply, finishing at $28.22. Investors exchanged $10 billion worth of GameStop shares, making it one of the most traded stocks on Wall Street that day, surpassed only by Nvidia and Apple.

Gill's massive position in GameStop faces several challenges. Exercising his call options would require $240 million in cash, which he currently lacks. Selling shares to raise this cash would likely depress the stock price further. Additionally, outside financing could attract scrutiny, adding to the pressure on Gill, who has already faced congressional testimony regarding his market influence.

The reaction from institutional players and trading platforms was swift. E*Trade announced it might remove Roaring Kitty from its platform due to concerns over market manipulation. The GameStop company itself issued a letter clarifying that the sharp rise in its stock was not due to its underlying performance.

Despite the turmoil, Gill maintained his confidence in GameStop's CEO, Ryan Cohen. He urged his nearly 600,000 livestream viewers to trust in Cohen's leadership, though he warned that his aggressive investment style might not be suitable for everyone.

"This is what he does. He discusses the fundamentals, he likes the stock, he memes, he drinks, he rambles," commented Reddit user SteveRogers7 after the livestream. "You want him to tell you to go and pump GME? That is not gonna happen, stay disappointed."

GameStop's recent financial report revealed net sales of $881.8 million and a net loss of $32.3 million for the first quarter. While the sales represented a year-over-year decline of 28.7%, the net loss was an improvement. The company reported $1.083 billion in cash, cash equivalents, and marketable securities. GameStop also announced plans to sell up to 75 million shares to raise capital, though it did not specify the timing.

The GME stock was halted a total of 7 times over the last week.

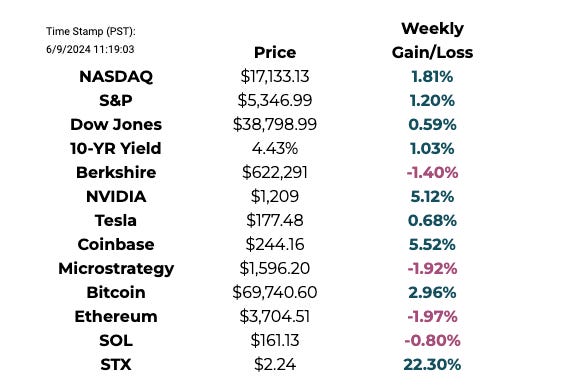

This Week By the Numbers 📈

Quick Facts:

- Big Tech starts the week with Nvidia's (NVDA) 10-for-1 stock split and Apple's (AAPL) Worldwide Developer's Conference on Monday

- A vote on Tesla (TSLA) CEO Elon Musk's $56 billion pay package is expected on Thursday

- The next update on inflation with the release of the May Consumer Price Index (CPI) is expected on Wednesday morning

- On a "core" basis, excluding food and energy prices, inflation is expected to have risen 3.5% year over year, down from the 3.6% increase in April

- Fed expected to keep rates unchanged

- JPMorgan chief US economist Michael Feroli predicts the Fed will project a median of two interest rate cuts this year in its dot plot, down from three in March

- IMF warns on US fiscal burden

- Binance surpasses 200 million users

- Franklin Templeton explores broader crypto fund

- Kraken considers $100 million funding round

- BTC remains just below ATH after $218 million ETF inflows

- Trump calls himself the ‘crypto President’

- Punks dip below 30ETH

Top Stories 🗞️

BlackRock, Citadel Securities-backed TXSE Group to launch Texas Stock Exchange

TXSE Group, backed by BlackRock (BLK.N), opens new tab and Citadel Securities, plans to launch the Texas Stock Exchange in Dallas, going up against established New York-centric exchanges in a bid to attract global companies. The exchange, which has raised about $120 million, plans to file registration documents with the U.S. Securities and Exchange Commission to start operating as a national securities exchange later this year, TXSE said on Wednesday. A rebound in capital markets has sent a plethora of companies from within and outside the United States scrambling to list their stocks, creating more opportunity for indexes. But carving a space could be difficult for a new exchange in the lucrative U.S. listings market, where the New York Stock Exchange and the Nasdaq have dominated in a virtual duopoly since the 2000s.

Coinbase rolls out smart wallet with no gas fees and easy onboarding

Cryptocurrency exchange Coinbase is launching a smart wallet. The new Coinbase Wallet will offer users greater convenience through onboarding, eliminating gas fees and making recovery phrases unnecessary. The smart wallet will allow users to create a new wallet and onboard onto a blockchain without downloading a new app or receiving a new recovery phrase. Instead, the smart wallet will integrate with major apps and use Face ID, users’ Google Chrome profile, fingerprint ID or Yubikey to onboard through a passkey that will be stored on users’ devices. The smart wallet will have self-custody and permit payments from the user’s Coinbase Wallet or Coinbase account. Developers will be able to choose to waive gas fees by sponsoring the transaction through a paymaster. A companion web app will be the user’s primary platform and will offer asset and identity management, buying, sending, swapping, nonfungible tokens and transaction history. Coinbase promises “a fluid and intuitive experience” throughout those transactions. At the start, the smart wallet will support the Base, Ethereum, Optimism, Arbitrum, Polygon, Avalanche, BNB Chain and Zora networks. The smart wallet will be free for both users and developers.

President Biden vetoes crypto custody bill

President Joe Biden has vetoed H.J.Res. 109, a congressional resolution that would have overturned the Securities and Exchange Commission's current approach to banks and crypto. Specifically, the resolution targeted the SEC’s Staff Accounting Bulletin 121, which presents guidance around how banks can handle customers’ crypto assets — in effect, they must treat those assets as liabilities. Banking groups have criticized this approach as making it prohibitively expensive for them to handle crypto, while regulators argue it's necessary to protect investors, particularly after the collapse of high-profile crypto companies like FTX. “SAB 121 reflects considered technical SEC staff views regarding the accounting obligations of certain firms that safeguard crypto-assets,” Biden said in a statement. “By virtue of invoking the Congressional Review Act, this Republican-led resolution would inappropriately constrain the SEC’s ability to set forth appropriate guardrails and address future issues.” Biden went on to say his administration “will not support measures that jeopardize the well-being of consumers and investors.”

Robinhood bets big on crypto with $200 million deal for Bitstamp

Trading platform Robinhood Markets, said on Thursday it has agreed to buy crypto exchange Bitstamp for about $200 million in cash, speeding up a broader push into digital assets with its biggest-ever deal. Robinhood, whose shares were up 3.4% before the bell, has been looking to expand its product offerings to become a full-fledged financial services provider. The acquisition of Bitstamp, which was founded in 2011 and holds 50 active licenses and registrations globally, puts Robinhood in direct competition with industry giants such as Binance and Coinbase (COIN.O), opens new tab. Bitstamp's core spot exchange, popular in Europe and Asia, has over 85 tradable assets, and the deal is expected to power the growth of Robinhood Crypto. The deal, expected to close in the first half of 2025, comes at a time when Robinhood's crypto business is seeing rapid growth but also facing regulatory hurdles in the United States.

US sets stage for antitrust probes into Microsoft, OpenAI and Nvidia

The U.S. Justice Department and the Federal Trade Commission have reached a deal that clears the way for potential antitrust investigations into the dominant roles that Microsoft, OpenAI and Nvidia, play in the artificial intelligence industry, according to a source familiar with the matter. The agreement between the two agencies shows regulatory scrutiny is gathering steam amid concerns over concentration in the industries that make up AI. Microsoft and Nvidia not only dominate their industries but are two of the world's biggest companies by market capitalization since Nvidia's market value recently surpassed $3 trillion. U.S. antitrust enforcers have publicly expressed a range of concerns around AI, from the advantage that Big Tech companies have in their access to data used to train AI models, to how generative AI affects the market for creative work, to partnerships between companies potentially being used to sidestep required merger review processes.

Thank you for reading this week’s edition of the Myth of Money.🚀

Were you forwarded this email? Subscribe below.

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).