Has Anyone Seen The Economy? 🤷🏻♀️

Welcome to this week’s edition of Myth of Money, a weekly newsletter on thing crypto, macro, and tech, read by 13,000+ investors.

Disclaimer: The following is not intended as investment advice. Do your research.

Dear Investors,

We have started a new Myth of Money Twitter! If you enjoy this newsletter, please follow us for a daily dose of up-to-date market news here 👇

This past Wednesday, the FOMC increased the federal fund’s target rate by 25 basis points to a range of 4.50% to 4.75%. This move was expected and signals a slowdown in the Federal Reserve's tightening monetary policy efforts. Although the Fed is continuing its anti-inflationary efforts, there are signs that inflation is easing, as Powell prepares for a soft landing.

Economists predict there will be a further 0.25% hike in March, but this may be the last or the second last hike this year. The Federal Reserve continues to balance the need to curb inflation with the risk of causing a recession, while the cost of borrowing for corporates and consumers continues to rise.

CPI is trending downward, at 6.5% in December, down from 7.1%, with a further expected decrease to be reported for January. Meanwhile, the Fed's preferred measure of inflation, the Core Personal Consumption Expenditures Price Index, rose by 4.4% in December, lower than the 4.7% increase in November.

Powell continues to warn consumers that there is still a long way to go before inflation can be brought down to its long-term target of 2%, and the tight labor market makes it challenging for the Fed to achieve this goal.

What's Next for the U.S. Economy?

Federal funds rate is expected to reach 5.1% and will stay elevated until 2024

The unemployment rate is expected to rise to 4.6.%

Inflation is likely to decrease to 3.5% by the end of the year

Stocks are likely to trend downwards as earnings come in lower than expected for the first two quarters of 2023

CME Group's FedWatch predicts there is an 82% chance the Fed will raise rates again in March

What does this economic climate mean for start-ups?

The end of the 13-year low-interest-rate policy in the US has caused concerns for many technology companies as they face inflation, rising interest rates, a focus on immediate cash flow, and the possibility of a recession. This has resulted in a significant decrease in risk appetite among US venture capital funds, with investments dropping over 60% between Q4 2021 and Q4 2022.

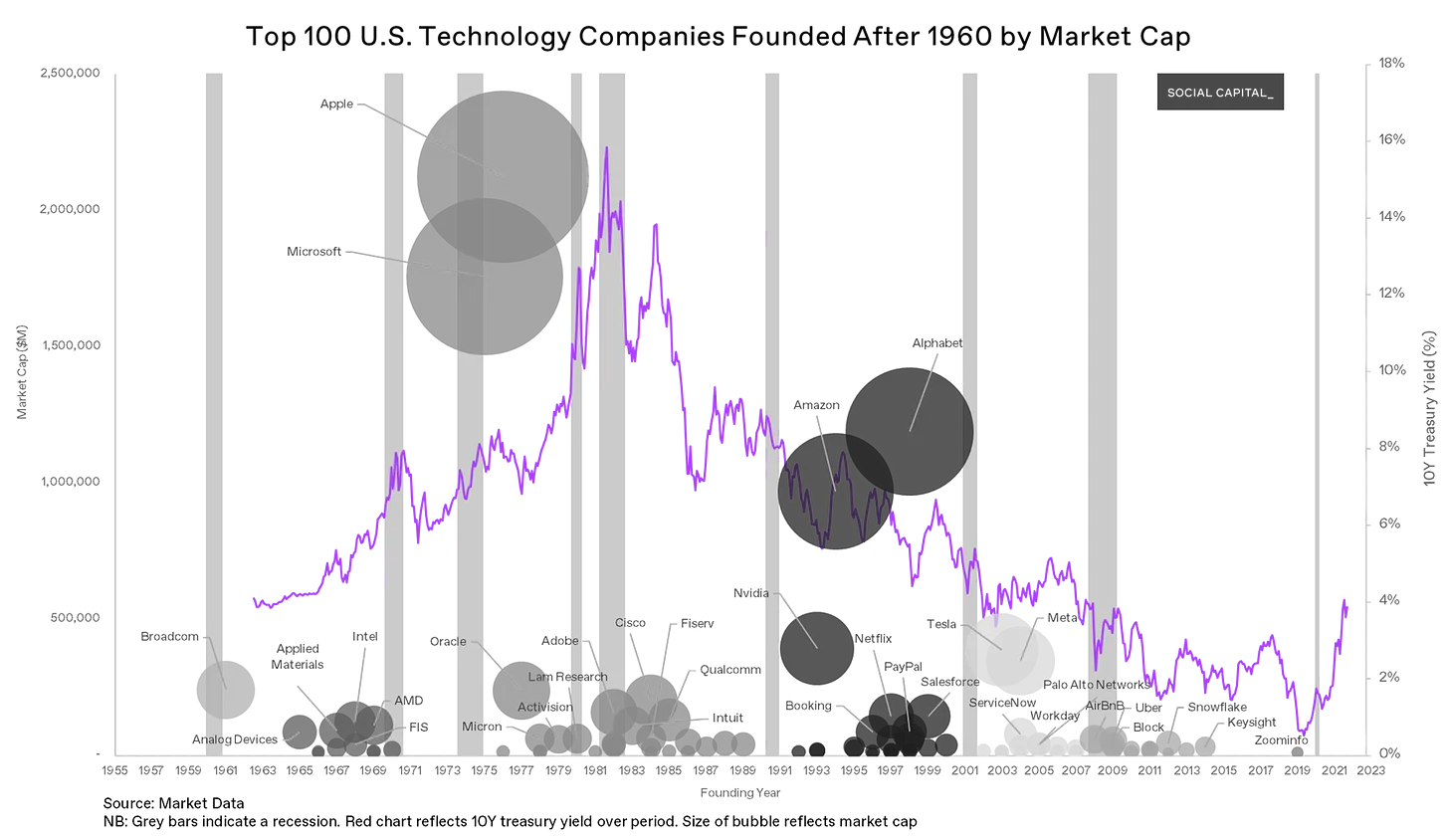

Despite these challenges, history has shown that successful startups can still be established during economic turbulence. The following is a chat of top American tech companies. The four major technology platforms of the last 60 years (Apple, Microsoft, Alphabet, and Amazon) defined "Silicon Valley," and were responsible for the invention of the personal computer, the creation of the internet economy, and mobile computing.

Each platform was built on a new technological breakthrough and was established during a time of economic turmoil, including interest rate fluctuations and recessions. The key to success for these companies was their ability to pivot to profitability and capitalize on a shake-out in competition.

According to tech investor Chamath Palihapitiya:

Interest rates cut both ways. While startup creation is directly proportional to the availability of risk capital, free money can actually be a headwind for sustained success. Instead of concentrating financial resources in a few promising ventures, it can have the tendency to spread capital and talent too thinly over a broader set of companies.

As a result, during low-rate environments we find that competition thrives, talent gets diluted, and input costs like labor and advertising go up while the individual probability of any company succeeding goes down.

At the same time, the market becomes too quick to reward a dollar of revenue growth with several more dollars of incremental enterprise value. In turn, companies are mistakenly given a clear incentive: grow at any cost.

The unfortunate outcome is that this promotes unsustainable growth models, which as we are experiencing now, are extremely difficult to snap out of, particularly when regimes (like interest rates) change.

It is clear that a new tidal change is coming in tech innovation, and most of us are likely going to be wrong about where the tide will go. If I had to bet, I would continue to double down on Bitcoin and other decentralized technologies, AI, and fintech in emerging markets.

What I’m Reading This Week 🤓

Going Through Levels of Wealth - a comical but honest essay on the American philosophy of money and how people get stuck.

Five things to know about Nikki Haley as she prepares for the 2024 race - a two-term South Carolina governor, a Republican, a female, and a child of Indian-Punjabi immigrants, prepares to make her bid for the 2024 presidential seat, as she gains rapid support from the business and tech world.

The Big Leap, By Gay Hendricks - a book on shaking your fear and unlocking your true zone of genius.

This Week By the Numbers 📈

Top Stories 🗞️

ChatGPT sets record for fastest-growing user base

ChatGPT, OpenAI's popular chatbot, reached 100 million monthly active users in January just two months after its launch, making it the fastest-growing consumer application in history according to a UBS study. Analytics firm Similarweb reported that an average of 13 million unique visitors used ChatGPT daily in January, double the level of December. UBS analysts noted that in 20 years of observing the internet, they have not seen a faster ramp-up for a consumer internet app. It took TikTok 9 months and Instagram 2 and a half years to reach 100 million users, according to Sensor Tower data.

Russia's Sberbank Will Introduce DeFi Platform by May

Sberbank, Russia's largest bank, is set to launch a decentralized finance (DeFi) platform by May, based on the Ethereum network, according to a report by Interfax. Users can access the platform through the MetaMask wallet extension. The bank's DeFi network is currently in closed beta and will transition to open testing on March 1. The product director of Sberbank's blockchain lab, Konstantin Klimenko, stated that DeFi has the potential to replace traditional banking services in the future. Sberbank has previously received a license from Russia's central bank to issue and exchange digital assets and launched Russia's first blockchain ETF. The bank has over 110 million customers and one million corporate clients.

Federal judge bars SBF from contacting FTX and Alameda employees via Signal

A federal judge in the criminal case against former FTX CEO Sam Bankman-Fried, also known as SBF, has prohibited him from having any communication with current or former employees of the exchange or Alameda Research as part of his bail conditions. Judge Lewis Kaplan of the Southern District of New York ruled that Bankman-Fried must have a lawyer present for any communication with these individuals and is not allowed to use encrypted messaging apps like Signal. The ruling was made due to the perceived risk of inappropriate contact with prospective witnesses, as prosecutors claimed that the former CEO had used the app to reach out to the FTX US general counsel. The judge deemed the risk to be sufficient to warrant the imposition of additional conditions until the full argument of the cross-applications is heard.

Filecoin Creator Protocol Labs Cuts 21% of Staff

Protocol Labs, the creator of the decentralized file storage network Filecoin, is undergoing a 21% workforce reduction due to the challenging economic environment, particularly in the crypto industry, according to a blog post by CEO Juan Benet. Benet cited high inflation, low investment, and tough markets as reasons for the cuts, which are aimed at reducing costs during these trying times. The company will eliminate 89 positions across various teams, including corporate, member services, network goods, and others. The blog post did not mention if the team working on Filecoin was impacted.

Chinese Communist Party officials issue KPIs for e-CNY transactions in Suzhou

Senior Communist Party officials in Suzhou, China have reportedly set a goal for the adoption of the digital yuan or e-CNY. According to JS China, the officials have set a tentative target of 2 trillion CNY ($300 billion) in e-CNY CBDC transactions in the city by the end of 2023, which will be promoted by municipal administrators. They have also set a target of processing $30 billion in e-CNY loans for small and mid-sized businesses in the city by the end of the year. In 2022, e-CNY transactions in Suzhou surpassed 340 billion CNY ($50.5 billion) with over 30.54 million digital wallet downloads and financial incentives related to e-CNY reached 40 billion CNY ($5.9 billion) with 18.7 billion ($2.78 billion) in e-CNY loans issued.

Deal of the Week 💰

This week I angel-invested in an A+ founder solving the data gap in Africa using AI, IoT, and NanoSatellites. If this sounds like something that fits your investment thesis, DM me for an intro.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (my portfolio).

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.