Joe Biden Breaks Up With America

Dear Investors,

Welcome to this week’s edition of the Myth of Money. If you would like to keep in closer touch, please reach out on X below.

It has been another eventful week in the markets, and this week promises to be no different.

As the “Trump Trade” continues, Trump is scheduled to speak at Bitcoin Nashville this week. I will be in Nashville starting Wednesday, so feel free to DM me to meet up or forward any event invitations.

We also have another FOMC meeting on July 28-29. While a rate cut is unlikely on this date (more likely in September), traders are nonetheless taking on more risk, hoping the Fed will soften its stance.

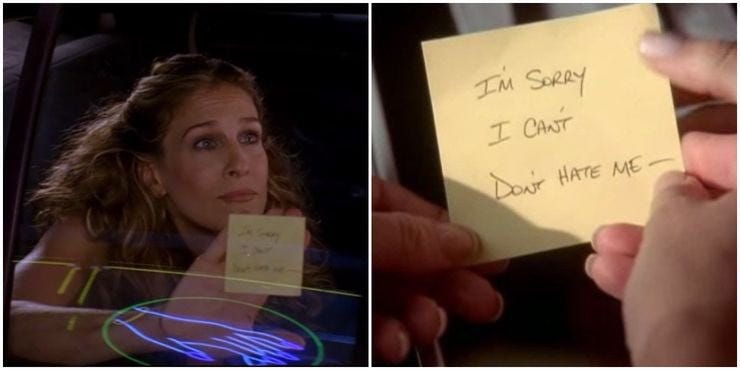

Over the weekend, Joe Biden officially dropped out of the 2024 presidential race and endorsed Kamala Harris as the Democratic nominee for the 2024 election. There was no speech or appearance, just an official newsletter shared via news outlets and on X. Many of us, like Carrie, wonder how Joe could just leave us like that.

And yet, it was not surprising at all. Just a few days prior, President Biden tested positive for Covid again.

Joe Biden’s resignation wiped out $67 million of crypto long positions in just 30 minutes. The US President’s withdrawal from the 2024 presidential race led to a sharp dip in the crypto market, followed by a near-immediate correction, causing massive liquidations. However, the dip was short-lived.

In an unprecedented show of support, over $60 million has been raised for Vice President Kamala Harris's presidential campaign. The fundraising efforts were spearheaded by the group Win With Black Women, which organized a call that saw participation from over 44,000 Black women and allies.

Yet, the country does not seem particularly excited. Many voters feel cheated that they were not able to choose an alternative candidate in the primaries. Biden was forced on them, and now so is Kamala.

Biden’s resignation news came right after a near-assassination attempt on Trump and the RNC-inspired momentum with appearances from Hulk Hogan and Amber Rose. With the addition of J.D. Vance to the ticket as VP, and his background as a former Marine turned venture capital investor, it seems the Republican Party is on its way to becoming the “populist party” the Democrats once were. There is something here for everyone, regardless of race, gender, or economic status.

Previously, to assist his ideological allies, specifically Barack Obama, Mark Zuckerberg provided the DNC with a $500 million ballot harvesting operation in 2020. This was one of the most blatant examples of election manipulation.

Fast forward to the next election cycle, and Joe Biden, the result of the 2020 election, is facing isolation, ridicule, and marginalization, partly from the same network of ideological allies (i.e., the Obama network).

When asked if he would fund the political apparatus in 2024, Zuckerberg announced his intention to stay out of the influence game, stating he would not endorse any political candidate.

He then went further saying what he witnessed in the assassination attempt of President Trump, “was one of the most badass things I ever witnessed in my life.”

“Seeing Donald Trump get up after getting shot in the face and pump his fist in the air with the American flag is one of the most badass things I’ve ever seen in my life,” Zuckerberg, 40, said Thursday during an interview with Bloomberg News.

“On some level as an American, it’s like hard to not get kind of emotional about that spirit and that fight, and I think that that’s why a lot of people like the guy.”

Meanwhile, Elon Musk has announced he will commit $45 million per month to a super PAC working to elect Donald Trump as President, according to the Wall Street Journal.

The crypto community is enthusiastic about the possibility of Trump becoming the next president, as his policies have traditionally been bullish for the markets. There are rumors that Trump is considering BlackRock CEO Larry Fink for the role of Treasury Secretary. Additionally, Trump has hinted at the possibility of including Bitcoin in the strategic reserve, stating he does not want "another country to take over" Bitcoin and crypto dominance.

In response to Biden's news, stock futures have risen, and bond yields have fallen, while Bitcoin reached $68,000.

This Week By the Numbers 📈

Quick Facts:

Elon Musk adds laser eyes to his X profile picture

Elon Musk plans to move X (Twitter) headquarters to Texas

Rumored Elon Musk appearance at Bitcoin Nashville

SOL again leads, with DEX volume eclipsing ETH + BNB

Coinbase premium moves back to positive

Plan B points to a bullish setup in the S2F model

Market maker Wintermute plans to raise funds at a $2 billion valuation

Betting platform Polymarket hits a volume record of $20 million on election-related gambling

ETH spot ETFs to launch on Tuesday. Confirmed ETFs include VanEck, Invesco, Fidelity, 21Shares, Franklin Templeton.

Trump may consider BlackRock CEO Larry Fink as Treasury Secretary

Ukraine reaches a debt restructuring deal

Germany already lost $124 million profit selling

Stock futures rise and bond yields fall on Biden news

Delta cancels hundreds more flights in struggle to recover from Microsoft outage

Top Stories 🗞️

CrowdStrike’s faulty update crashed 8.5 million Windows devices

CrowdStrike’s faulty update caused a worldwide tech disaster that affected 8.5 million Windows devices on Friday, according to Microsoft. Microsoft says that’s “less than one percent of all Windows machines,” but it was enough to create problems for retailers, banks, airlines, and many other industries, as well as everyone who relies on them. CrowdStrike’s breakdown explains the configuration file that was at the heart of the issue: The configuration files mentioned above are referred to as “Channel Files” and are part of the behavioral protection mechanisms used by the Falcon sensor. Updates to Channel Files are a normal part of the sensor’s operation and occur several times a day in response to novel tactics, techniques, and procedures discovered by CrowdStrike. This is not a new process; the architecture has been in place since Falcon’s inception.

Asset manager says Trump admin may make Bitcoin strategic reserve asset

Speculation that Bitcoin may become a global reserve asset or a strategic US Treasury asset surged following former President Donald Trump’s announcement of support for the digital asset industry amid mounting worldwide debt and monetary inflation. Trump’s pick of JD Vance, a 39-year-old Bitcoin holder, as his running mate also fueled speculation that a future Trump administration could mean a new era for crypto, in which Bitcoin becomes fully integrated into the current financial system. Billionaire investor Mark Cuban has also imagined a scenario in which widespread inflation and geopolitical instability drive the global population to Bitcoin as a haven to protect their life savings and purchasing power, elevating Bitcoin to the status of a global reserve currency organically. Data from high-inflation countries like Argentina, Venezuela and Turkey indicates this is already happening, as populations shift to cryptocurrencies as a hedge against inflation.

Real World Asset Sector Outperforms on Growing TradFi Tokenization Effort

Real World Assets (RWA) tokens are leading the altcoin bounce during the recent crypto market’s rally. On July 10 Goldman Sachs’ head of digital assets, Matthew McDermott told Fortune that the multi-trillion dollar investment bank plans to launch three projects related to tokenization before the end of 2024, including one in the United States. Goldman Sachs’ potential move would mark the third major financial institution to get involved in RWAs following Blackrock and Franklin Templeton. $BUIDL, or the Blackrock USD Institutional Liquidity Fund, launched on March 20, and is Blackrock’s tokenized fund on Ethereum that is backed by traditional assets such as US Treasury Bills. Franklin Templeton launched a similar product in April 2021 called $FOBXX (Franklin OnChain US Government Fund), and became the first US registered fund run on blockchain. $FOBXX originally launched on Stellar, and expanded to Polygon in April 2023. Blackrock’s tokenized treasury fund, $BUIDL surpassed $500 million on July 8, and Franklin Templeton’s $FOBXX eclipsed $400 million on June 26. The market capitalization of tokenized treasuries has steadily been growing since the start of 2023. Its total value is up another 3.4% over the last 7 days, and has increased by 136% since the beginning of 2024.

Thank you for reading this week’s edition of the Myth of Money.🚀

Were you forwarded this email? Subscribe below.

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).