JP Morgan Chase Bans Crypto Purchases for UK Customers

Dear Investors,

Chase UK, the British digital banking division of JP Morgan, has announced that it will prohibit customers from engaging in cryptocurrency transactions starting next month. This decision is attributed to a growing concern over the rise in cryptocurrency-related scams and fraud.

Effective from October 16th, Chase customers will no longer have the option to conduct cryptocurrency transactions via their debit cards or through outgoing bank transfers, as stated by the bank on Tuesday.

Chase said in an email to customers:

“If we think you’re making a payment related to crypto assets, we’ll decline it. If you’d still like to invest in crypto assets, you can try using a different bank or provider instead — but please be cautious, as you may not be able to get the money back if the payment ends up being related to fraud or a scam.”

Chase stated that its decision on Tuesday was driven by a commitment to safeguarding customers and their finances. Additionally, the bank cited recent reports of escalating losses due to cryptocurrency-related fraud as highlighted by UK regulators over the past year.

According to London-based law firm RPC, data from the UK's fraud reporting agency Action Fraud revealed that crypto fraud in the UK surged by 41% last year, hitting a record high of £306 million ($372.3 million). RPC shared these findings in May and attributed the sharp increase in fraud reports to the November collapse of the cryptocurrency exchange FTC. While the numbers have started to ease in the early months of 2023, RPC pointed out that crypto fraud is likely to remain elevated in the foreseeable future. They explained that even though investors are becoming more adept at identifying scams, fraudsters are adapting and becoming more sophisticated, especially those utilizing artificial intelligence. Additionally, when cryptocurrency values start to rise again, increased market activity often leads to more fraud.

JPMorgan Chase introduced its UK-based digital bank under the Chase brand in September 2021. As of May of this year, Chase had amassed over 1.6 million customers in the UK.

The crypto industry had a field day with the announcement, with Coinbase CEO Brian Armstrong leading the charge.

The announcement strengthened the case for the crypto industry aiming to allow the freedom to allocate your own capital as you wish. The movement to separate money and state is gaining momentum once again.

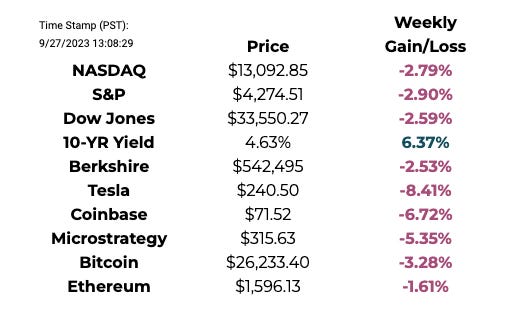

This Week By the Numbers 📈

Quick Facts:

Federal Reserve pauses interest rate hikes, remains at 5.25% - 5.50%

95% of the NFT market is now worthless

Federal Reserve says they don't see a recession until at least 2027

Dollar hits YTD high, bond yields at 16 year high

SEC delays Ark ETF due November until 2024

S&P down 7.5% since Fed removed recession forecast

BRICS sold $123m treasuries in 2023

Oil could go to $150: JP Morgan

OpenAI in talks for share sale at $90bn valuation

Microstrategy buys another $147m of Bitcoin

Top Stories 🗞️

U.S. House Lawmakers Push SEC’s Gensler to Approve Spot Bitcoin ETF ‘Immediately’

The U.S. Securities and Exchange Commission (SEC) should listen to the courts and give up efforts to block bitcoin exchange traded funds (ETFs) from regulatory approval, a bipartisan group of lawmakers argued Tuesday in a letter to SEC Chair Gary Gensler. On the eve of his scheduled appearance before the House Financial Services Committee, four members of that panel sent Gensler a letter contending that a spot bitcoin ETF is “indistinguishable” from the crypto futures ETFs for which the agency has already granted its blessing. Because of that, the agency should sign off on applicants requesting SEC approval, such as Fidelity, BlackRock’s iShares and Grayscale Investments, which shares CoinDesk’s parent company, Digital Currency Group.

Crypto exchange Kraken plans move into US stock trading

Cryptocurrency exchange Kraken reportedly plans to offer users trading services for stocks listed in the United States and exchange-traded funds, or ETFs. According to a Sept. 27 Bloomberg report, the U.S.-based exchange planned to launch its trading services in the U.S. and United Kingdom sometime in 2024 through a division called Kraken Securities. Kraken’s expansion of investment vehicles beyond cryptocurrencies would require licensing from the Financial Industry Regulatory Authority and financial regulators in the U.K., which the exchange reportedly already holds. The reported move by the crypto exchange came roughly a year after FTX US — now defunct — announced plans to launch a stock trading platform. Certain apps like Robinhood already offer both stock and crypto trading services, but largely U.S.-based digital asset exchanges stick with crypto and related offerings.

Florida US Rep. Matt Gaetz introduces resolution to end Ukraine aid

Florida US Representative Matt Gaetz introduced a resolution to end military and economic aid to Ukraine. That measure now has the backing of at least 10 Republicans in the House of Representatives. The measure is not likely to get much support from either party. The resolution wouldn't end the aid, just express a desire to do so. It would also urge both sides to find a peaceful resolution. The US has sent more than $110 billion worth of support to Ukraine.

Microsoft Crypto Wallets on Xbox: Leaked Documents Show Boom for Crypto-Gaming

Microsoft, a software behemoth, intends to incorporate crypto wallets into its Xbox gaming device, according to recently leaked papers. According to internal documents that were obtained and uploaded on the gaming forum ResetEra, the Xbox plan for May 2022 includes functionality for cryptocurrency wallets. However, the leaked documents did not display specific details about this anticipated integration. The leak was a result of legal action by the Federal Trade Commission against Microsoft, according to Phil Spencer, the CEO of Xbox. Microsoft mistakenly included leaked papers in its submissions as a result of the FTC’s resistance to the $69 million Activision Blizzard acquisition.

Ethereum Wallet Tied to Sinaloa Cartel Sanctioned by U.S. Government

The U.S. Treasury's Office of Foreign Assets Control (OFAC) has sanctioned an Ethereum wallet tied to Jimenez Castro, a Mexican male with ties to the Sinaloa cartel. Castro is one of 10 names listed on OFAC's sanctions list as a part of a counter narcotics operation, according to a published list on OFAC's website. The wallet in question was first active in January or this year and received around $740,000 in deposits to Binance in a two month period. A U.S. Treasury press release states that Jimenez Castro "operates money laundering organization that uses virtual currency and wire transfers, among other methods, to transfer proceeds from illicit fentanyl sales in the United States to Sinaloa Cartel leaders in Mexico."

Thank you for reading this week’s edition of the Myth of Money.🚀

Were you forwarded this email? Subscribe below.

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).