Dear Investors,

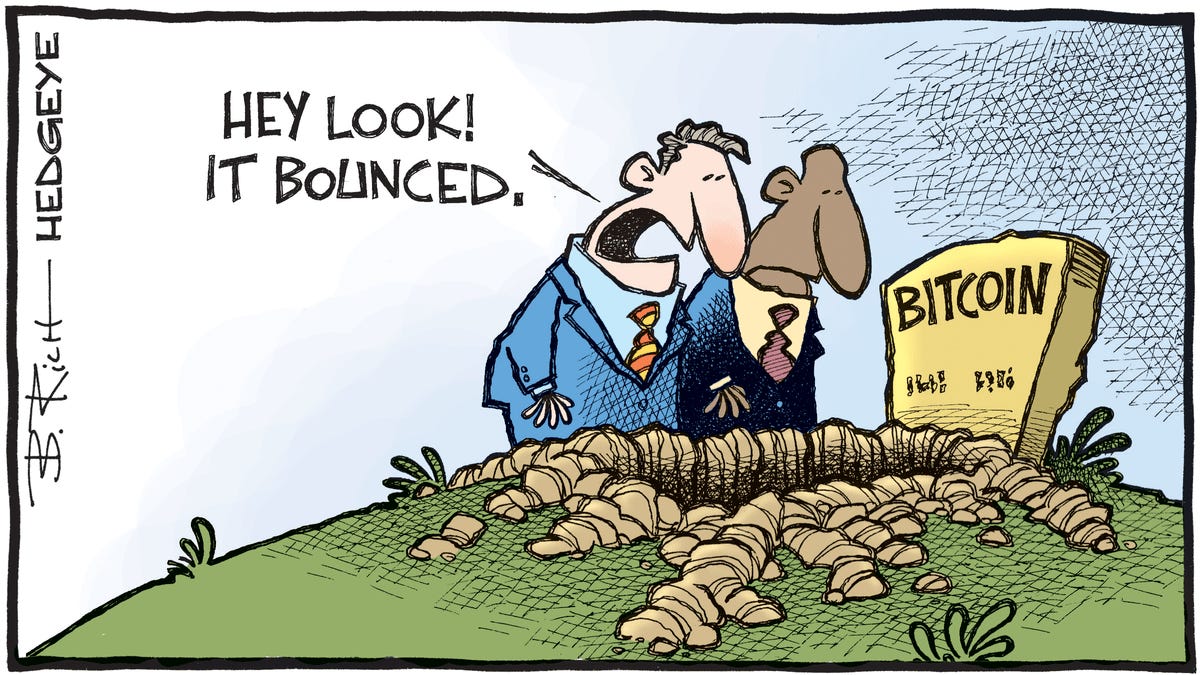

U.S. Court Orders SEC to Review Grayscale's Bitcoin ETF Rejection, Fueling Bitcoin Surge

In a pivotal move, the U.S. Court of Appeals has directed the Securities and Exchange Commission (SEC) to reassess its denial of the Grayscale Bitcoin Trust's (GBTC) application for a Bitcoin Exchange-Traded Fund (ETF).

Bitcoin witnessed a notable 5% valuation surge, driven by traders and investors speculating on the potential broadening acceptance of Bitcoin-backed ETFs. Coinbase, a significant player in various spot Bitcoin ETF proposals, saw its stock price surge by over 14%.

Grayscale Bitcoin Trust, with assets worth $14 billion applied to transition its GBTC application from over-the-counter to a listed Bitcoin ETF. Concerns about litigation and uncertainties linked to its parent company, Digital Currency Group (DCG), had previously led to a 50% markdown in GBTC shares.

On August 29, Judge Neomi Rao of the U.S. Court of Appeals Circuit issued an emphatic ruling in favor of Grayscale. The court has instructed the SEC to review its decision to reject the GBTC listing application and revoke the denial order. This verdict has taken both Grayscale and the industry by surprise, as Judge Rao criticized the SEC for failing to present a coherent rationale for its denial.

This ruling DOES NOT guarantee an immediate listing of a Grayscale spot Bitcoin ETF.

Michael Sonnenshein, CEO of Grayscale Investments, communicated on Twitter that their legal team is actively examining the court's viewpoint. A triumph for Grayscale might establish a path for other companies like BlackRock and Fidelity, which are eager to introduce Bitcoin ETFs, by offering insights into the regulatory environment.

Notable asset management firms such as BlackRock, Fidelity, WisdomTree, and Bitwise have submitted applications and are awaiting the SEC's verdict. The court's scrutiny of the inconsistent treatment between futures-linked and spot-based ETFs has introduced complexity into the ongoing regulatory discussion.

DCG Reaches Crucial In-Principle Deal With Genesis Creditors, Recoveries Could Be Up to 90%

Notably, Grayscale operates under the ownership of Digital Currency Group (DCG), a parent company that also holds the media platform Coindesk and the distressed lender Genesis.

In October 2022, Grayscale terminated agreements with its partner Genesis Global, leading to Genesis halting withdrawals on November 16 due to market turmoil caused by FTX's collapse and the failure of Three Arrows Capital, leaving $1.2 billion debt unpaid. In January 2023, Genesis Global revealed debts exceeding $3 billion, considering a $500 million venture capital portfolio sale. Notably, Genesis owes $900 million to users of Gemini's Earn program.

Genesis Global Holdco, LLC filed for bankruptcy in January 2023, owing over $3.5 billion to top creditors, including Gemini, Cumberland, Mirana, MoonAlpha Finance, and VanEck's New Finance Income Fund. Recent court filings revealed Digital Currency Group's (DCG) preliminary agreement with Genesis creditors to address bankruptcy claims.

To address DCG's obligations – $630 million in unsecured loans due by May 2023 and $1.1 billion in an unsecured promissory note due in 2032 – a new partial repayment structure was designed. It involves two tiers: about $328.8 million maturing in two years and $830 million in seven years. After implementing the partial repayment, DCG will make four $275 million installments for May 2023 obligations.

The proposed plan foresees 70%-90% potential recoveries for unsecured creditors in USD and 65%-90% recovery in-kind, depending on asset denomination, hinging on market pricing and formal documentation.

This Week By the Numbers 📈

Federal Reserve Chair Jerome Powell called for continued caution against inflation, hinting at possible interest rate increases. Speaking in Jackson Hole, he emphasized potential for further rate hikes and maintaining a restrictive stance until confident in sustainable progress on inflation reduction.

Top Stories 🗞️

The SEC brings its first NFT enforcement action

The Securities and Exchange Commission on Monday sued Los Angeles-based podcasting firm Impact Theory for allegedly offering securities in the form of non-fungible tokens (NFTs), raising more than $30 million through sales in late 2021. Impact Theory offered 20,000 NFTs at three levels of rarity in a 2021 offering. The tokens gave buyers "levels" of access to things the company would create, such as to discounts and events. Impact Theory is not really an NFT company, rather it appears to be a bare-bones entertainment shop centered around entrepreneur Tom Bilyeu. The SEC's action Monday comes in spite of the company's attempt to remedy the allegations, repurchasing the NFTs, called Founder's Keys, in the months following the sales, and returning roughly $7.7 million worth of ETH. Without admitting or denying the SEC's allegations, Impact agreed to destroy the NFTs in question and pay combined penalties of more than $6 million.

Tornado Cash Devs Charged With Helping Hackers Launder $1B, Including Infamous North Korean Attacks

Tornado Cash developers Roman Storm and Roman Semenov were charged with money laundering and sanctions violations tied to their work with the privacy mixer that "facilitated more than $1 billion in money laundering," including "hundreds of millions" for North Korea's Lazarus Group. The DOJ has already arrested Storm. The mixer, which obfuscates the origin of funds transacted through it, was sanctioned last year by the U.S. Treasury Department's Office of Foreign Asset Control after allegations that Lazarus had laundered the funds from multiple crypto hacks through it. OFAC sanctioned Semenov as well on Wednesday, alongside eight Ethereum addresses he allegedly controls. In a statement, U.S. Attorney Damien Williams said Tornado Cash and its operators "knowingly facilitated" money laundering.

X (Twitter) Acquires License to Add Crypto Payments

X (formerly Twitter) has acquired a license required to provide cryptocurrency payments and trading services in the US. Per data displayed on NMLS, the Rhode Island Currency Transmitter License was approved to X on August 28. This license is required to provide services related to digital assets on behalf of users. The acquisition of this license is a major step towards X's goal of becoming a "cryptocurrency-friendly" platform. In the past, X has taken several steps to integrate cryptocurrency, such as adding a Bitcoin tipping feature and allowing users to set non-fungible tokens (NFTs) as profile pictures.

Regional banks face another hit as regulators force them to raise debt levels

American banks with at least $100 billion in assets would be subject to the new requirements, which makes them hold a layer of long-term debt to absorb losses in the event of a government seizure, according to a joint notice from the Treasury Department, Office of the Comptroller of the Currency, Federal Reserve and Federal Deposit Insurance Corporation. In their latest proposal, impacted lenders will have to maintain long-term debt levels equal to 3.5% of average total assets or 6% of risk weighted assets, whichever is higher, according to a fact sheet released Tuesday by the FDIC. Banks will be discouraged from holding the debt of other lenders to reduce contagion risk, the regulator said.

All of Sam Bankman-Fried's Proposed Expert Witnesses Should Be Barred From Testifying says DOJ

All of FTX founder’s Sam Bankman-Fried’s proposed witnesses should be disqualified from testifying because their disclosure filings are insufficient, their experience may be misleading or their planned testimony may not be relevant, prosecutors said in a late Monday filing. Bankman-Fried’s team, for their part, wants to exclude a financial analysis expert proposed by the Department of Justice because his proposed testimony may not be allowed under the rules. The DOJ moved to discount all seven of the expert witnesses proposed by Bankman-Fried’s team, saying that some of the disclosures they filed did not detail their opinions, while others “are inappropriate subjects for expert testimony” or possibly confusing for a potential jury.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).

Once you get how our income-based labor force really works (that high profits depend on low wages), you will finally see and understand all the reasons why a global system that can match people to jobs, resources to communities, and everyday needs and demands to local production, consumption, and recycling operations is more sustainable and ethical than monetary methods practiced today, mainly because scientific-socialism, compared to scientific-capitalism, is actually more democratic; it values and views this very basic, very intuitive belief “universal protections for all” as both a human and environmental right.