Miami Mayor Bids for 2024 Presidency; Blackrock Files for Bitcoin ETF

Dear Investors,

In light of the regulatory challenges faced by the digital assets industry, our attention is keenly focused on the presidential candidates who hold pro-crypto stances. It is evident that we have a vested interest in their positions and policies.

During the Bitcoin 2023 conference, Robert F. Kennedy Jr. expressed his belief that crypto technologies serve as a significant catalyst for innovation. He went on to describe Bitcoin as a symbol of democracy and freedom. Notably, Kennedy is pioneering the acceptance of Bitcoin for campaign donations, becoming the first presidential candidate to do so.

On the other hand, Governor Ron DeSantis has made a commitment to safeguard the freedom to engage in activities such as Bitcoin. He vows to stand against the influence of "central planners" in Capitol Hill, advocating for a favorable environment for crypto-related endeavors.

Suarez Bids for 2024 Presidency

A new pro-crypto candidate has emerged over the last week, and it's none other than Miami’s Mayor Francis Suarez. Considered a long shot, Suarez pioneered Miami as a hub for all things Bitcoin and Crypto.

“My dad taught me that you get to choose your battles, and I am choosing the biggest one of my life. I’m going to run for president, I’m going to run for your children and mine. Let’s give them the future they deserve. It’s time to take things into our own hands. It’s time to get things started,” Suarez said in a video released Thursday morning.

Later that evening, during a speech at the Ronald Reagan Presidential Library, Suarez tactfully proposed an alternative to former President Donald Trump and Florida Gov. Ron DeSantis, without explicitly mentioning them. He called upon Republicans to unify and adopt Reagan's inclusive "big tent" political philosophy as a means to connect with demographic groups historically lost by the party, such as young and urban voters, while also making gains with Hispanics and suburban women.

“It’s time for a leader who can connect with segments of our country that Republicans have historically lost, like young voters and urban voters, and segments we can make gains with, like Hispanics and suburban women,” said Suarez.

Suarez, a Cuban American, currently serves his second term as the mayor of Miami, which is Florida's second-most populous city. Until recently, he held the position of president in the bipartisan US Conference of Mayors, highlighting his ability to work across party lines.

As the first major Hispanic candidate to join the Republican race, Suarez begins as a clear underdog in the primary. Trump, residing in nearby Palm Beach, and DeSantis overshadow the field in polling. Other contenders in the primary include former Vice President Mike Pence, former United Nations Ambassador Nikki Haley, South Carolina Sen. Tim Scott, North Dakota Gov. Doug Burgum, former Arkansas Gov. Asa Hutchinson, and former New Jersey Gov. Chris Christie.

Having met Suarez Personally, I have to say that I’m a big fan. He has the well-spoken but down-to-earth charm we have recently seen in Obama and is sure to engage the under-represented Hispanic population.

Many attribute Miami's growth and prosperity to Mayor Suarez's leadership and policies. Under Mayor Suarez's watch, Miami has seen a reduction in crime, decreased taxes, and a bolstered business economy. His handling of the COVID-19 pandemic, including a willingness to reopen quicker than other areas, has contributed to Miami's success. Additionally, his efforts to welcome businesses, entrepreneurs, and investors to the city have seen a large influx of new-comers from New York, LA, and San Francisco. In 2022 alone, Miami’s housing marketing has appreciated 24.03%.

If any of this speaks to you, you can learn more and donate on their official donation page.

$9 Trillion Asset Manager Files For Bitcoin Spot ETF

The discussion surrounding a Bitcoin Spot ETF has been ongoing for approximately the last two cryptocurrency cycles, spanning around seven years. This potential development is considered significant for driving Bitcoin adoption as it would enable individuals to include Bitcoin in their retirement portfolios and allow pension funds to have widespread exposure to the cryptocurrency.

At present, Bitcoin ETFs are limited to holding Bitcoin futures contracts or stocks of companies and other ETFs that have exposure to cryptocurrencies.

Owning a futures contract on an asset differs from owning the asset itself, and therefore does not indicate an increase in demand for the asset class. However, BlackRock, a prominent financial firm, has a higher likelihood of obtaining regulatory approval compared to its competitors.

BlackRock's iShares Bitcoin Trust has disclosed in a filing with the U.S. Securities and Exchange Commission (SEC) that it will utilize Coinbase Custody as its custodian. The recent application made by BlackRock's iShares Bitcoin Trust to the SEC may have a better chance of approval compared to previous attempts by other fund managers, attributed to the inclusion of a "surveillance-sharing agreement" between exchanges.

Within the 19b-4 filing on page 36 of the Nasdaq, where the proposed ETF will be listed, it is mentioned that Nasdaq will engage in a surveillance-sharing agreement with a spot trading platform operator for Bitcoin (BTC). This agreement aims to mitigate market manipulation by facilitating the sharing of information on trading activity, clearing activity, and customer identification.

If this agreement comes into effect, it would symbolize Bitcoin's integration into the Wall Street realm as a fully regulated and accepted asset class.

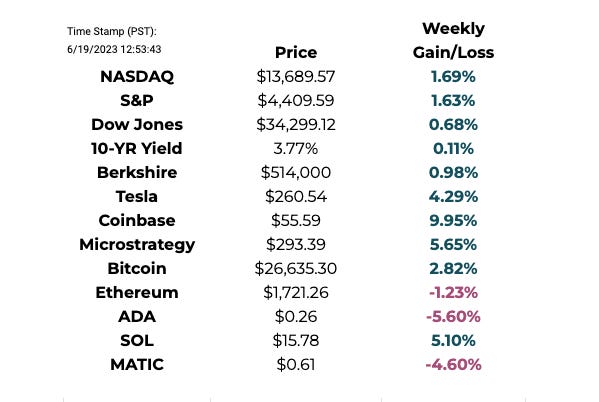

This Week By the Numbers 📈

The Federal Reserve announced on Wednesday that it would pause rate hikes, keeping the federal funds rate at 5-5.25%, the first pause in over a year. Expressing concern about ongoing inflation, the Fed's Open Market Committee stated in a release, "Inflation remains elevated." Additionally, they asserted their readiness to adjust rates "if risks emerge that could impede the attainment of the Committee's goal" of achieving a 2% inflation rate. It is likely, the Fed felt a pause was necessary to assess the interest rate effects on the banking system and the credit markets.

Simultaneously, the Fed revised its unemployment projections from 4.5% to 4.1%, while the current rate stands at 3.7%. This indicates the Fed's belief that it can continue to raise rates without triggering substantial job losses. Meanwhile, US national debt reached an all-time high of $32 trillion.

The stock market experienced a slight rally, while Bitcoin and Ethereum stabilized. The alt-coin sell-off continues amid regulatory concerns.

Top Stories 🗞️

Treasury Secretary Janet Yellen says to expect a gradual decline in the dollar's share of global reserves

The US should expect the dollar's share of global reserves to slowly decline, but no alternatives exist that could completely displace the greenback, Treasury Secretary Janet Yellen said on Tuesday. Her comments came during a Housing Financial Services Committee in response questions about the risk of de-dollarization. Asked by Rep. Warren Davidson, R-Ohio, on whether US sanctions could impact dollar transactions, Yellen acknowledged that their use has motivated some countries to look for currency alternatives. "But the dollar plays the role it does in the world financial system for very good reasons that no other country is able to replicate, including China," she said. "And that is we have deep liquid open financial markets, strong rule of law and an absence of capital controls that no country is able to replicate. It will not be easy for any country to devise a way to get around the dollar."

Hong Kong reiterates banks should support licensed crypto exchanges

Hong Kong's banking regulator said on Thursday it had, in April, asked lenders operating in the region to try and meet the business needs of licensed crypto exchanges, responding to a report saying banks were under pressure to take such exchanges on as clients. The Hong Kong Monetary Authority's (HKMA) comments were in response to a Financial Times report which said lenders including HSBC (HSBA.L) and Standard Chartered (STAN.L) were facing pressure from Hong Kong's central bank to take on crypto exchanges as clients. In its bid to emerge as a global crypto hub, Hong Kong has been pulling out all stops, from courting mainland China crypto firms to floating plans of testing a digital dollar in its mortgage market. The UK-based lenders, and the Bank of China were questioned by the Hong Kong Monetary Authority last month on why crypto exchanges were not being accepted as clients, the report added.

Jack Dorsey-Backed Bitcoin Wallet Bitkey To Integrate With Coinbase and Cash App

Jack Dorsey’s FinTech company Block (SQ) will integrate its new self-custody bitcoin wallet, Bitkey, with its financial services platform Cashapp and the cryptocurrency exchange Coinbase. Public beta testing for the wallet will commence in a few weeks with a global launch expected later this year, according to a blog post on Wednesday by the company. Coinbase is the largest cryptocurrency exchange in the U.S. by trading volume and Cashapp is Block’s own financial services platform that offers payments, stocks and bitcoin in a single app. With the new integrations, Bitkey users will be able to buy and sell bitcoin (BTC) via Cashapp and Coinbase directly from within the wallet’s app. Bitkey is a multi-signature hardware wallet device that comes with a set of recovery tools and a mobile app. The full Bitkey product suite is expected to launch later this year in the U.S., Canada, the U.K., Brazil, Australia and other global markets.

Binance Under Investigation in France for 'Aggravated' Money Laundering

Binance's French unit is under investigation by local authorities for the "illegal" provision of digital asset services and "acts of aggravated money laundering.” The investigation relates to illegally operating as a digital asset service provider before it received regulatory approval in May 2022 and "aggravated money laundering by taking part in investment operations, concealment and conversion, the latter being carried out by perpetrators of offenses having generated profits,” the public prosecution office told CoinDesk. Binance is registered as a PSAN, or digital asset service provider, with the French financial regulator, the AMF (Autorité des Marchés Financiers). The French unit is suspected of having canvassed French customers through its local arm outside the legal framework until 2022.

Calpers ups VC allocation after 'lost decade'

America's largest public pension scheme, Calpers, which manages some $444 billion in capital on behalf of California's 1.5 million state, school, and public agency employees, is leaning into venture—even as many LPs lean away. After years of bringing down its VC exposure to a 1% target, the institutional investor is now looking to increase its allocation by more than sixfold, from $800 million to $5 billion, the Financial Times reported. The strategy shift comes on the heels of steep losses in Calpers' venture strategy as well as losses related to Silicon Valley Bank's failure. The pension manager suffered a "lost decade" coinciding with the venture boom, according to a new review of the program by managing investment director Anton Orlich.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

Tatiana Koffman

About the Author: Tatiana Koffman

Hi there and thanks for reading! If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I write to make financial topics more accessible and create equal opportunity for the next generation of investors. I have personally invested in 20+ companies and funds (👉 my portfolio).