Moonwalker Insights // May 8, 2025

Dear Investors,

As Bitcoin approaches back to $100,000, we continue another eventful weeks in the markets.

Legacy Risk > Market Risk: Why the Fed Refuses to Blink

The Federal Reserve kept rates steady today at 4.25–4.50%, exactly as the market expected. But behind the curtain, this looks more like a nervous pause than a confident one.

Remember back in late 2023 and early 2024, when Powell all but promised that 2025 would be the year of cuts? The dot plots showed a gentle glide path down. The market cheered. Rate-sensitive assets rallied like it was QE4Ever.

But something’s changed. And it’s not the data…it’s the narrative risk.

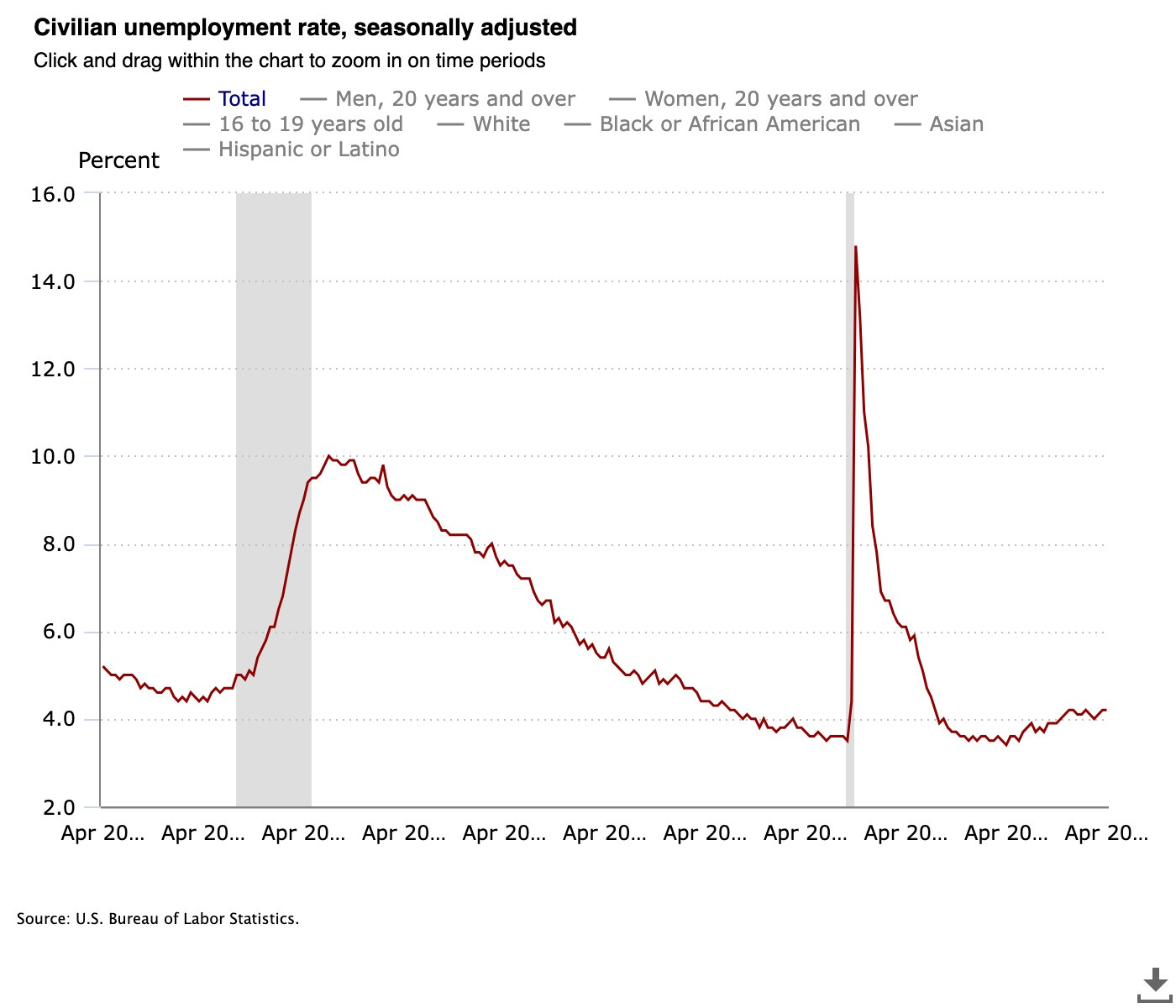

Powell is now playing defense against a ghost: the fear of cutting too early and being remembered as the central banker who unshackled inflation 2.0. The Fed could reasonably start to ease without triggering a spike in inflation. Consumer sentiment is rolling over. Small business optimism is collapsing. Global trade uncertainty is hanging over everything like a lead balloon and the COVID era monetary supply expansion seems to have been fully absorbed. But the unemployment rate is still low, and inflation, while close to target, still appears sticky. So they wait.

Because waiting is safe.

If the Fed cuts too early and inflation re-accelerates? That’s a legacy-defining mistake. If they cut too late and the market tanks? Well, then they were just “following the data.”

This is the new third mandate: don’t be the Fed that lost the plot.

The data dependency trap:

Inflation is a lagging indicator. So is unemployment, albeit to a slightly lesser extent.

By the time the data confirm a slowdown, the damage is already done.

But acting preemptively requires conviction, not cover—and conviction is in short supply.

QT continues. Global liquidity remains expansionary. But behind the mechanics is an institution terrified of getting it wrong in the wrong direction. The Powell Fed would rather err on the side of pain than risk its inflation-fighting credibility. And as we’ve shared in previous letters, while liquidity is strong, we believe that markets are not fully pricing in risks of economic slowdown.

Why it matters:

Markets may be pricing in rate cuts for later this year, but the bar is higher than it looks.

If Powell blinks, he’ll need bulletproof data—faltering growth, rising unemployment, and disinflation all at once.

Until then, the path of least resistance is standing still and blaming the spreadsheets.

Bottom line:

This wasn’t a pivot. It wasn’t even a soft nod. It was an institution saying: we’re not going to blink unless the numbers make us. The Fed’s credibility is now tied not to foresight—but to deference.

The data may be lagging. But the Fed would rather lag with it than lead without it.

Capital Is Still Running Scared—and It’s Running to Japan

In uncertain times, you can always count on capital to go where it feels safest. Not necessarily where the fundamentals are best, or where the growth story is hottest, but rather where the risk of getting caught in the blast radius feels lowest. And right now, for large pools of international capital, that place is Japan.

Global liquidity is surging. CrossBorder Capital reports that the Shadow Monetary Base has ballooned to $177.2 trillion, up 12% on a 3-month annualized basis. That’s a lot of dry powder sloshing around the system. But here’s the twist: the money isn’t going where the central banks probably hoped. It’s not piling into U.S. equities or European growth stocks. It’s hiding out.

Specifically, it’s hiding in:

Japanese assets, where yield curve control makes the world feel predictable again

Gold, which refuses to correct meaningfully even with rate volatility

Bitcoin, which despite its baggage, is increasingly treated like an off-grid ledger of last resort

Meanwhile, investor positioning in the U.S. is still net negative. According to the latest CrossBorder data, U.S. investors are “risk off” with an index of -11. In Europe, investors are hesitant but not retreating (UK: +4, Eurozone: -4). France is being ghosted altogether (-18). But Japan? +39. That’s not just bullish, it’s borderline euphoric.

Why Japan? Because it’s the rare place in the developed world where the central bank hasn’t veered off its course of loose monetary policy. The Bank of Japan is still pumping liquidity. Inflation remains minimal. The political landscape is boring (in the best way). And there are no upcoming elections threatening to turn the monetary base into a campaign toy.

Even China, with its infamous opacity, is back in the liquidity game. The PBoC has subtly shifted its stance toward economic support, allowing the yuan to weaken in favor of internal stimulus. That has helped offset some of the liquidity drain from the Fed, which is still letting its balance sheet run off. But the market knows where the risks are: China’s got transparency issues, Europe’s got structural malaise, and the U.S. has political fireworks on a fuse.

This is not about chasing growth. This is about hiding in plain sight.

And if you look at how crypto and gold are behaving, the pattern repeats. Bitcoin’s Q1 correction neatly mirrored the Q4 liquidity slump. Liquidity rebounded in Q1, and sure enough, BTC caught a bid. Gold hit a new high in Q2, and while momentum has slowed, the pullbacks have been shallow because every time volatility rises, gold gets new fans.

Here’s the punchline:

Global liquidity is rising, but capital isn’t feeling brave. It’s not chasing yield. It’s parking itself in assets and regions that feel insulated from the madness.

Because capital, like everyone else in 2025, is just trying not to get burned.

The Dollar’s Not Dead, Just Hungover

If you’ve checked financial Twitter lately, or accidentally wandered into a Peter Schiff podcast, you might be under the impression that the U.S. dollar has just been wheeled into hospice care. The “end of the dollar” chorus is back, louder than ever, and armed with charts, gold bug manifestos, and BRICS conspiracy memes.

But here’s the thing: the dollar isn’t dying. It’s just taking a breather after an absolutely filthy 15-year bender.

The real trade-weighted dollar index, Wall Street’s equivalent of a morning-after heart rate monitor, shows we’re in a cyclical pullback. Think hangover, not hospice. Since 2009, the dollar has ridden structural capital inflows, China’s corruption purge, and U.S. economic outperformance like a spoiled trust fund kid on daddy’s jet stream. A little retracement here isn’t doom. It’s digestion.

So why the panic?

Partly because liquidity is easing (for now), fiscal policy remains tight (moderately), and we’re in a political moment where every hiccup looks like an exorcism. But if you dig into the weeds the picture looks different. Term premia haven’t blown out, demand for Treasuries is still obnoxiously strong, and, despite all the TikTok de-dollarization hot takes, there is still no real alternative.

Let’s look at the term premium spread between 10-year U.S. Treasuries and foreign bonds. Not only has the spread remained resilient, it's actually become more negative since 2022. Translation? Foreign investors are still willing to sacrifice yield to hold Treasuries because they’re liquid, safe, and convenient. If the dollar were really losing its safe haven status, this would be going the other way. It’s not.

And then there’s the “convenience yield”—the nerd term for how much investors are willing to give up just to hold U.S. debt versus AAA corporates. It’s rising too. In other words, people still trust Uncle Sam more than pretty much all other debt assets.

So yes, we’re watching a dollar correction. But we’re also watching a setup. Fed liquidity will likely tighten again in the second half of 2025. That should give the dollar a little more runway. Meanwhile, the BRICS currency project is still more science fiction than science, and no other economy has the combination of deep capital markets, credible rule of law, and military insurance that the U.S. does.

Final take:

If you're looking for a new global reserve currency, good luck. The euro’s a mess, the yuan’s a black box, and Bitcoin doesn’t yet have a yield curve. For now, the dollar’s still king but just so happens to be recovering poolside, sipping Pedialyte and avoiding sunlight under the shade of a Vegas hotel style cabana.

Trade Drama Continues

This weekend, Bessent and U.S. Trade Representative Jamieson Greer are set to meet with China's Vice Premier He Lifeng in Switzerland. The agenda? Not a comprehensive trade deal, but rather a preliminary discussion aimed at de-escalation and scoping out the formal negotiation procedure. Both sides have been quick to assert that they didn't initiate these talks, each suggesting the other made the first move.

If you were hoping for a détente, you might want to lower those expectations. The U.S.-China trade war isn't cooling off; it's merely entering a new phase, one that's less about resolution and more about strategic posturing. The tension is still real. And the opening act looks more like performative brinkmanship than serious diplomacy.

Enter Scott Bessent, the Treasury Secretary who has largely been the face of trade negotiations, stood firm before Congress this week, defending the administration's tariff strategy while remaining tight-lipped on negotiation status. His message was clear: the tariffs are here to stay, at least for now.

President Trump, for his part, earlier this week had a colorful Oval Office sitdown with Canada’s new Prime Minister, Mark Carney, where he toed the line between a loving older sibling wanting to maintain a warm relationship and a tormenting big brother insisting that Canada might one day be for sale.

In statements earlier today, he also made it abundantly clear that he won't be reducing the 145% tariffs on Chinese goods to kickstart negotiations. His stance: the tariffs are working, and there's no incentive to change course.

Meanwhile, the markets are cautiously optimistic. The mere fact that talks are happening has been enough to buoy investor sentiment. But let's not get ahead of ourselves. The initial meetings are likely to be heavy on rhetoric and light on substance. Think of it as the opening act of a play; setting the stage, introducing the characters, but not advancing the plot.

Our take? Prepare for a lot of saber-rattling. The real progress, if it comes, will be in the subsequent acts. For now, the trade volcano is rumbling, and while an eruption isn't imminent, the pressure is building.

Sidebar: The Oracle’s Last Sermon

This week, Buffett formally announced that he’d be handing off control of Berkshire Hathaway at the end of this year, closing the curtain on a 60+ year run that turned a crumbling textile mill into one of the most iconic investment machines in history. Greg Abel now takes the helm. The world moves forward.

Warren Buffett didn’t just outperform the market. He outlasted it.

Buffett was never really about stocks. He was about temperament. About discipline in an age of distraction. About finding great businesses and holding them so long the IRS stopped checking in. He was the anti-flash, the anti-gimmick, the anti-algorithm.

And in a financial era shaped by passive flows, meme stocks, TikTok traders, and infinite liquidity, the idea of sitting still and compounding patiently over decades can feel like a relic. But Buffett proved that it still works.

The world may be noisier now, faster, more reactive. But Buffett’s playbook still offers something radical: a quiet kind of courage. A refusal to chase. A trust in fundamentals when everything else feels like chaos.

He didn’t just leave a track record. He left a blueprint for those willing to think in decades, not dopamine hits.

Moonwalker FUND II: Crypto Equities, Institutional Edge

FUND II focuses on crypto-themed equities—the picks and shovels of the digital gold rush. We invest in public companies that are enabling, adopting, or positioned to benefit from crypto and other frontier technologies.

This strategy gives institutional investors targeted exposure to the crypto economy—with the structure, liquidity, and risk controls of traditional public markets.

As we wrap up April, we posted a monthly return of 22%.

Over the past two years, this model has delivered exceptional returns using proprietary capital.

Top Hedge Funds for Comparison:

Renaissance Medallion Fund: ~40% annual (net of fees)

Citadel Wellington Fund: ~36% annual (gross)

Millennium Management: ~12–15% annual

For more info, reach out to investors@moonwalker.capital or reply directly to this note.

Market Highlights

Global Trade & Tariffs

US, China to Hold Ice-Breaker Trade Talks in Geneva on Saturday

Bessent Testifies Before Congress on Trade Policy and Tariffs

China Injects 'Tactical' Monetary Stimulus Ahead of US Trade Meeting

China's Wait-and-See Approach Exposes Policy Limit

Carney says Canada 'not for sale'

China Lowers Rates and Makes Bank Lending Easier in Response to Tariffs

China Holds Off on New Stimulus, Shows Composure in US Trade War

Opinion: Trump Still Has a Chance to Remake Rather Than Wreck Global Trade

Equities & Markets

Late Chip Rally Lifts Stocks After Fed Holds Rates Steady

Stock Market Today: Dow, Nasdaq Rise After Fed Holds Rates Steady

Rising Valuations, Cloudy Earnings View Confronts US Stocks After Tariff Rebound

S&P 500 Futures Rise on Trade Deal Optimism

World Stocks Lose Ground in Choppy Trade After Fed Keeps Rates Unchanged

India–Pakistan Tensions Escalate

India Launches Military Strikes Against Pakistan

Pakistan Vows Retaliation After Indian Strike Over Tourist Deaths

Airlines Re-route, Cancel Flights Due to India-Pakistan Fighting

India's Appeal for Investors Dimmed but Not Derailed by Conflict with Pakistan

Rupee Falls Most in a Month After Indian Strikes in Pakistan Raise Tension

Crypto & Digital Assets

Trump's Crypto Deal Sparks Congressional Backlash

Ethereum’s Pectra Upgrade Targets Faster, Cheaper Transactions

Bitcoin Climbs Above $97K as US-China Trade Talks Boost Risk Appetite

New Hampshire Becomes First State to Establish Crypto Reserve

MicroStrategy Increases Bitcoin Holdings Despite Quarterly Losses

Europe: Economy & Trade

Eurozone Economy Picks Up Pace Ahead of Tariff Disruption

Eurozone Economy Grows 0.4% in First Quarter Ahead of Donald Trump’s Tariffs

Euro Zone Core Inflation Jump Not Seen Preventing Rate Cut

European First-Quarter Corporate Profits Expected to Return to Growth

Unexpected Euro Surge Adds to Europe Inc's Tariff Misery

This concludes this week’s Moonwalker Capital letter.

Until next time,

Moonwalker Capital Team