Myth of Money: A Buying Opportunity of a Lifetime

Welcome to this week’s edition of Myth of Money, a weekly newsletter on the digital asset markets read by 12,000+ investors.

Disclaimer: The following is not intended as investment advice. Do your own research.

Dear Investors,

As Bitcoin volatility continues, the fear and greed index remains at an all-time low.

It is unclear when and if we will hit market bottom any time soon, but leading industry analysts are telling us that we are getting pretty damn close.

It is nearly impossible to catch the exact market bottom. Many talented traders in my inner circle are calling for a sub-$10k Bitcoin.

I can only share with you what I am currently doing. #NotFinancialAdvice

I have started systematically deploying capital to increase my Bitcoin position (so have many institutions, sovereign wealth funds, etc.) I am saving 50% of my dry powder for the $10k scenario.

I am NOT engaging with any alts at this time. As I said many times before, all alts look overvalued to me. That means we don’t know where the bottom is on them. Their price movement tends to be an exponential increase or decrease to the motion of Bitcoin. So until I am clear that we have bottomed on BTC, playing alts is too risky.

An Opportunity of a Lifetime

Since the start of 2022, cryptocurrencies have lost as much as 90% of their value. This can be attributed to the Fed raising interest rates, China's restrictions on digital assets, the Russian-Ukraine war, and the fall of LUNA and UST.

Fear is the biggest factor that drives a bearish sentiment in the crypto market. The most recent fear narrative has been around crypto lenders such as Celcius, Babel and others unable to meet their obligations

But with great fear comes great opportunity. Let’s take a look at Bitcoin and Ethereum over the years.

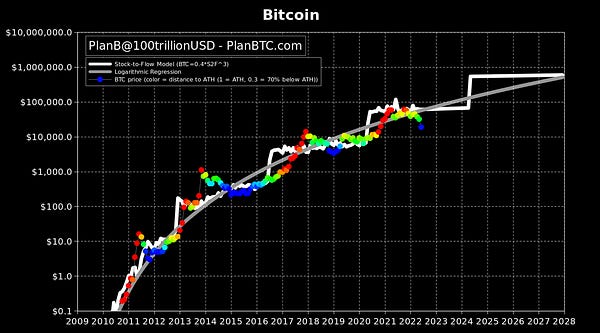

Bitcoin

BTC is the largest of all cryptocurrencies with the largest market cap. It has been declared “dead” countless times since its birth in 2009. In 2011, BTC price broke $1, then $8 in May, and $30 in June. It then went as low as $2 and closed at the year at $4.7. From 2012 to 2014, Bitcoin started gaining global momentum, hitting $1000 in early 2014. Due to the Mt.GOX hack, BTC fell again and closed the year at $318.

In 2016 and 2017, we saw another market boom and retail traders’ awareness drove volume and prices up. Bitcoin had a new ATH of $19,000. From 2018 to 2020, Bitcoin was in a downtrend in the early months bouncing between $6000 and $8000 before closing the year at $3,709. Bitcoin picked back in 2019, increasing gradually from $4000, $5000, $8000, and $13000, ending the year at $7200.

In 2021, Bitcoin peaked above $64,000 by mid-April. Subsequently, the fall of BTC started with some news about China's restrictions on crypto (again), followed by the fall of Luna and UST, and additional pressure on crypto lenders BTC stands at a current price of $20,000.

Ethereum

ETH is the second-largest cryptocurrency behind BTC. Launched in 2015 and valued under $1, it remained at that price until gaining recognition in 2016 and closing the year at $8. In 2017, there were a few jumps on the charts, and with an all-time high of $826.

Dipping as low as $80 during the market-wide collapse of March 2020, Ethereum started to fulfill its promise through smart contract capabilities during the Defi and NFT boom. High NFT volume drove the price to its latest all-time high of $4800, before dipping to below $1000 this week.

While it is challenging to predict price movements, zooming out makes it easier to predict overall trends. And the trends show us, that an ‘apocalypse set-up’ always recovers. While a peak always turns around. Today, we are in an apocalypse setup. Fears of a global recession are palpable. But if you ask me, I don’t think inflation is going anywhere. The Fed will not push rates higher than 5-6%. At which point inflation will come back, largely because demand for dollars globally is subsiding (shifting trade from Russia, China, etc). Then Bitcoin will finally become the inflation hedge we need, making today, the buying opportunity of a lifetime.

This Week By the Numbers 📈

Top Stories 🗞️

Crypto exchange Coinbase slashes staff by 18% amid bear market

Coinbase CEO Brian Armstrong officially announced on Tuesday that he made a "difficult decision" to reduce the size of the Coinbase team by about 18% due to a starting economic recession. “We appear to be entering a recession after a 10+ year economic boom. A recession could lead to another crypto winter, and could last for an extended period,” Armstrong wrote. He added that the trading revenue significantly declined during past crypto winters, noting that Coinbase has survived through four major crypto winters since its foundation in 2012. According to the announcement, all departing employees will receive support in finding a new role, including a minimum of 14 weeks of severance as well as an additional two weeks for every year of employment beyond one year. Additional support includes four months of health insurance in the United States and four months of mental health support globally.

Elon Musk gets hit with ‘ridiculous’ $258B Dogecoin lawsuit

Billionaire Elon Musk, along with his companies SpaceX and Tesla Inc, are all being sued for an astonishing $258 billion in damages for being “engaged in a crypto pyramid scheme” involving Dogecoin (DOGE). The damages sought are more than 34 times Dogecoin’s current market cap of $7.5 billion and nearly three times its all-time high (ATH) market cap of $88.68 billion in mid-2021. Filed in the New York District Court by an attorney at Evan Spencer Law on Thursday, the class-action lawsuit alleges that Musk “used his pedestal as World’s Richest man to operate and manipulate the Dogecoin Pyramid Scheme for profit, exposure, and amusement.”

Crypto lender Babel Finance halts withdrawals due to liquidity pressures

Hong Kong-based asset manager Babel Finance is the latest cryptocurrency lending firm experiencing some serious issues amid the ongoing market downturn. Babel Finance officially announced Friday a temporary suspension of redemptions and withdrawals from its products, citing “unusual liquidity pressures.” “Recently, the crypto market has seen major fluctuations, and some institutions in the industry have experienced conductive risk events,” the statement on Babel Finance's website reads. The firm said that it’s in close communication with “all related parties” on the matter and is doing its best to best protect its customers. “Babel Finance is taking action to best protect the interests of our clients. We are in close communication with all related parties and will share updates in a timely manner," a spokesperson for the firm said in a statement.

Lummis-Gillibrand bill is finally here

One can hardly name a document more long-hoped-for as the crypto bill, co-sponsored by United States Senators Cynthia Lummis of Wyoming and Kirsten Gillibrand of New York, was for the crypto community. And, it’s finally here. Last week, Lummis and Gillibrand introduced a 69-page bill in the U.S. Senate. What’s inside? The projects of study on the environmental impact of digital assets and advisory committee on innovation, a tax structure, a mandate for analysis of the use of digital assets in retirement savings and much more. Should it become law, the bill would undoubtedly implement major changes to the current regulatory landscape. Kirsten Gillibrand and Cynthia Lummis have confirmed that Bitcoin (BTC) and Ether (ETH) will be classified as commodities and regulated by the Commodity Futures Trading Commission (CFTC). At the same time, bill authors consider most altcoins securities subject to U.S. Securities and Exchange Commission (SEC) regulations.

Consensus 2022: Web3, unpacking regulations, and optimism for crypto’s future

“Everything is bigger in Texas” proved to be true during Consensus 2022. The crypto conference took place June 9–12 in Austin, Texas, this year, attracting over 20,000 people from across the globe, despite the 100-degree plus weather. According to the event sponsors, Consensus 2018, which was held at the Hilton Hotel in New York, had previously drawn in almost 9,000 attendees. Caitlin Long, CEO of Custodia — the Wyoming-based digital asset bank — told Cointelegraph that the event this year speaks volumes. “New York has sent a lot of this industry fleeing to places like Austin, Wyoming and Miami. It will be interesting to see if New York makes a comeback.” Aside from its new location, current market conditions were another defining factor of the event. However, attendees remained optimistic about the crypto ecosystem as a whole. In general, new projects and the rise of Web3 were the main discussion points rather than cryptocurrency prices. Ray Youssef, founder and CEO of Paxful — a peer-to-peer cryptocurrency marketplace — told Cointelegraph that crypto winters allow for building phases to start, which he fully supports. “We are now seeing projects build platforms that are real and empowering.”

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

Tatiana Koffman

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. I have invested in 20+ companies and funds. Check out my portfolio here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.