Myth of Money: Adam Neumann's Redemption

Welcome to this week’s edition of Myth of Money, a weekly newsletter on the digital asset markets read by 12,000+ investors.

Disclaimer: The following is not intended as investment advice. Do your own research.

Dear Investors,

In a classic “pivot-to-crypto to reinvent yourself” moment, controversial WeWork founder Adam Neumann recently completed a Series B raise for Flowcarbon, to sell tokenized carbon credits on the blockchain.

According to TechCrunch:

Venture capitalists just can’t seem to get enough of Neumann and his spouse/co-founder, Rebekah, who started the company alongside its CEO Dana Gibber and two others, Caroline Klatt and Ilan Stern. Now, Flowcarbon says it has raised $70 million in funding led by Andreessen Horowitz’s crypto division (a16z crypto) through a combination of traditional VC equity and a token sale.

Who is Adam Neumann?

Adam Neumann is an Israeli-American businessman and investor. He previously co-founded WeWork with Miguel McKelvey. He resigned as CEO of WeWork and gave up his majority voting control as a result of mounting pressure from investors (Softbank being the biggest) based on findings made during the pre-IPO S-1 filing on September 26, 2019.

Adam became a cultural icon after the popular show WeCrashed depicted him as an erratic CEO, with big ideas and questionable execution.

Photo Credit: Financial Times

What is Flowcarbon?

Now, Adam Neumann has a new idea - tokenized carbon credits on the blockchain. Except the idea is not new, with several blockchain companies attempting to solve the same problem since as far back as 2018.

According to Investopedia;

Carbon trade is the buying and selling of credits that permit a company or other entity to emit a certain amount of carbon dioxide or other greenhouse gases. The carbon credits and the carbon trade are authorized by governments with the goal of gradually reducing overall carbon emissions and mitigating their contribution to climate change.

The company describes itself as a pioneering climate technology company working to build market infrastructure in the voluntary carbon market (VCM). Through the tokenization of carbon credits on the Celo blockchain, Flowcarbon intends to make the purchase, selling, and trading of carbon more accessible and efficient than the current carbon markets.

Flowcarbon’s $70M raises included investors General Catalyst, Samsung Next, 166 2nd, Sam and Ashley Levinson, RSE Ventures and Allegory Labs. It is said that $38M of the raise was into Flowcarbon’s Goddess Nature Token (GNT), while the raise was into equity.

Should we support Adam Neumann’s resurrection as a founder?

There is an interesting fascination occurring with CEOs that have shown themselves to be eccentric and even fraudulent. Several popular TV shows came out this year depicting the stories of Ana Sorokin, Elizabeth Holmes, Adam Neumann, and Travis Kalanick. But where do we draw the line between eccentricity and fraud? How far is faking it till you make it, versus completely crossing the line? And which category should we put Adam Neumann into?

This Week By the Numbers 📈

Top Stories 🗞️

Stepn to block mainland China users to comply with regulatory policies

The non-fungible token (NFT) game Stepn will ban users in mainland China in an attempt to follow Chinese regulatory requirements. The company's uncertainty has been fueled by rumors that it will be forced to leave mainland China. STEPN is a popular "move-to-earn" game based on Solana (SOL) and BNB Chain (BNB) that was created by two Chinese emigrants now living in Australia. The news sent shockwaves throughout the market, with investors dumping assets. When Pandaily launched Stepn in April, the floor price of a "sneaker" on the platform was around 13 SOL, but it has since dropped to just 8 SOL. Also, the price of STEPN's utility token, GMT, has plummeted by more than 30% in the past 24 hours, with most of it occurring after the announcement.

Billionaire Bill Miller calls Bitcoin ‘insurance’ against financial catastrophe

Bill Miller the billionaire founder and chief investment officer of investment firm Miller Value Partners, has said he considers Bitcoin (BTC) an “insurance policy against financial catastrophe.” Appearing on an episode of the “Richer, Wiser, Happier” podcast on May 24, Miller backed the cryptocurrency as a means for those caught in conflict to still access financial products. He used the collapse of financial infrastructure in Afghanistan after the United States withdrawal in August 2021 as an example. Miller also rebuked Warren Buffett’s recent criticism of Bitcoin, where the billionaire investor famously remarked that “it doesn’t produce anything” and he “wouldn’t take” all the Bitcoin in the world for even $25.

Near Protocol picks up slack, onboards Tracer following Terra’s downfall

For many layer 1 crypto projects, returning to normalcy from Terra’s death spiral meant a complete migration to a different ecosystem. But, how does one make the right move, especially after knowing the unfortunate fate of their initial platform of choice? In the case of Tracer, a Web3 fitness and lifestyle app, moving away from the Terra ecosystem for survival was just one piece of the puzzle. Choosing a new host to build on requires more than checking the technical compatibility with the blockchain ecosystems. As explained by Near Foundation’s Nicky Chalabi, projects like Tracer seek alignment with the ecosystem’s core values that can support the company’s roadmap in time to come. Tracer’s decision to completely migrate over to Near Protocol complements the various other crypto projects that have recently shifted over to Binance’s BNB Chain and Polygon Studios.

Tether launches stablecoin pegged to pesos on Ethereum, Tron and Polygon

Amid market issues surrounding stablecoins, Tether (USDT) launched a new digital asset that will be pegged to the Mexican peso on Ethereum (ETH), Tron (TRX) and Polygon (MATIC) networks. In an announcement sent to Cointelegraph on Thursday, Tether mentioned that the token will have the MXNT ticker and will join Tether's roster of fiat-pegged stablecoins that includes dollar-pegged USDT, euro-pegged EURT and Chinese yuan-pegged CNHT. According to Tether's chief technology officer, Paolo Ardoino, the rise in crypto usage in Latin America pushed their decision to "expand." He explained that the introduction of a stablecoin pegged to the peso will give those in Mexico a way to store value.

Huobi Global Acquires Latin American Crypto Exchange Bitex

Huobi Global, a crypto exchange registered in Republic of Seychelles, acquired Latin American crypto exchange Bitex to expand its presence in the region, Huobi said Thursday. Huobi Global plans to integrate Bitex’s exchange platform with its global platform, the company said in a statement. Bitex will continue operating under its current name and management team in Latin America, Bitex CEO Francisco Buero told CoinDesk.

Deal of the Week - Alpha Impact💰

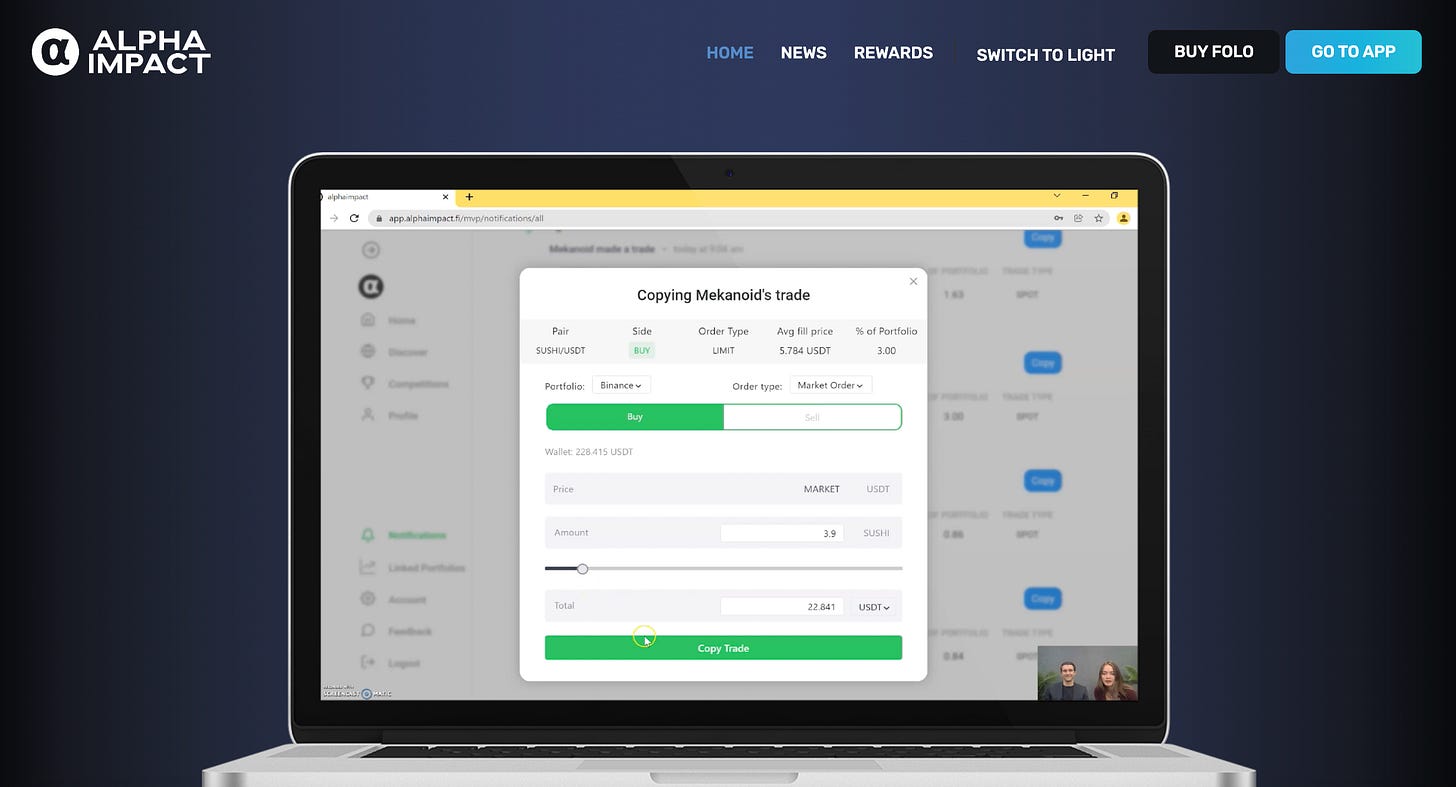

Alpha Impact is a non-custodial crypto robo-advisory platform that is crowdsourcing alpha from expert crypto traders. One of the company’s unique features is copy-trading, where you can plug in your exchange account and have it mimic trades of seasoned traders. The platform also has a selection of plug-and-play products, some of which have shown monthly returns of over 300%.

Based in Singapore, the platform recently raised funds from brand names including Genesis Block, LuneX, Antler, Krypital, Axia8, Solidity Ventures, LCV Capital, and more.

The company is conducting opening an additional fundraise in both equity + tokens. For more details, please contact Hayden Hughes, CEO at Hhughes@alphaimpact.fi.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

Tatiana Koffman

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. I have invested in 20+ companies and funds. Check out my portfolio here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.