Myth of Money: Africa, The Final Frontier of Crypto

Welcome to this week’s edition of Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

Dear Investors,

Even with crypto facing downward pressure and tech investors turning bearish amid financial tightening, my optimism for the future of crypto is undeterred as I remain focused on the long-term. Crypto adoption is a seismic technological and cultural shift. It will take time. Looking to this future, I want to highlight today what I see as the final frontier for crypto - Africa.

The world’s second-most populous continent is far from a monolith, home to a staggering diversity of cultures, languages, and histories, but the evidence is mounting that Africa as a whole is well-positioned to become a key player in the cryptosphere.

Several crypto giants are already establishing an African foothold. Binance runs a Binance Africa operation and has made a big push to drive crypto adoption across the continent, such as its recently announced sponsorship of Africa’s largest soccer tournament. FTX made its first African investment late last year, and Coinbase and Blockchain.com have also joined in on the action. Nigeria is the only government outside the Caribbean to launch a CBDC.

Furthermore, expanding Chinese influence in the region cannot be ignored.

Here are the top four reasons why I’m bullish on crypto in Africa.

Growth Trajectory: The U.N. has estimated that over half of the world’s population growth from now through 2050 will occur in Africa. Although Africa’s absolute share of the crypto market is still small, it is the fastest-growing cryptocurrency economy among developing regions and the third-fastest overall.

Technological Familiarity: Peer-to-peer financial platforms and digital wallets are popular among African consumers. This is due in part to limited access to traditional financial infrastructure, such as banks. Africans’ relative familiarity with the same technology that underpins blockchain should help drive crypto adoption. Five African nations rank in the top 20 of Chainalysis’ latest crypto adoption index, and three are in the top 10 (Togo, Kenya, Nigeria), driven largely by a high volume of P2P activity.

Unstable Status Quo: Many African countries have long faced government instability with corruption and conflict, alongside volatile currencies that encumber international trade and domestic progress. These unfortunate realities provide a bleak contrast against which the value of decentralized, low-transaction-cost cryptocurrencies can shine.

Leapfrog Potential: Africa’s struggle to build sustainable infrastructure for finance, production, and governance provides it a unique opportunity. It can create a new, blockchain-based system that will face relatively little resistance from status quo stakeholders. Africa already has a history of this kind of quantum-leap technology adoption. Many African countries saw vast mobile phone and mobile payment adoption despite having largely skipped their logical predecessors of landlines and credit/debit cards, respectively. “We see a similar opportunity for crypto; it can enable Africa to leapfrog an entire generation of financial services technology,” James Fitzgerald of Valar Ventures has said.

There are a handful of leaders emerging in the African landscape:

Yellow Card: A crypto exchange, founded in 2016 and launched in Nigeria in 2019, that allows Africans to buy and sell crypto using their local currencies via bank transfer, cash, and mobile payments. In September Yellow Card raised a $15 million Series A led by Valar Ventures, Third Prime, and Castle Island Ventures, with participation from Square, Coinbase Ventures, and Blockchain.com Ventures.

Chipper Cash: As one would expect with developing economies, African countries tend to rely more heavily on remittances. But transfer fees can make these costly. Chipper launched in 2018 aiming to provide “no-fee, peer-to-per cross-border payment services for Africans.” This is a strong use case for crypto as well, drawing in FTX as an investor in Chipper’s recent $150 million Series C.

Binance Africa: Binance has made inroads into the region with large charity projects and lavish sponsorships, such as the Africa Cup of Nations. Although Binance seems to operate with an unlimited budget, regulators and users are pushing back against the foreign behemoth.

Luno: Based in South Africa, Luno was recently bought by Digital Currency Group as a strategic investment in the region. Luno wants to make investing in crypto easy for anyone in the world.

CoinMARA: Based in Kenya, CoinMARA is the new kid on the block, building an all-in-one financial infrastructure for Africa - including a crypto-to-fiat centralized exchange, collateralized lending platform, and NFT marketplace. The startup’s roadmap starts with leveraging its relationships with telecoms, key government leaders, and financial firms across sub-Saharan Africa, and ultimately establishing itself as Africa’s go-to crypto hub.

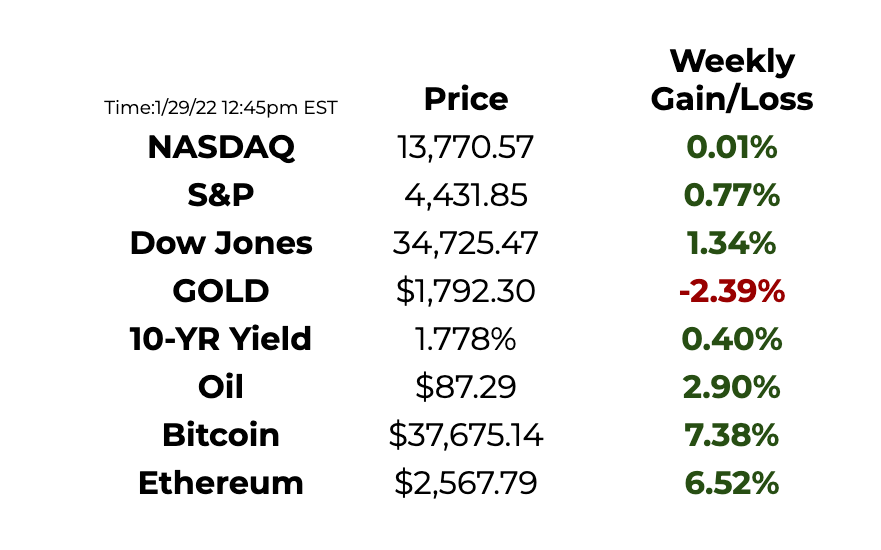

This Week By the Numbers 📈

This week saw a slight rally across the board, save for gold. Prices are still down from last year’s exuberant run. Crypto is starting to show signs of correlation with stocks, but it remains to be seen how long that will last and what that implies for its investment profile.

Top Stories 🗞

SEC Rejects Application for Fidelity's Wise Origin Bitcoin Trust Spot ETF

On Thursday the SEC rejected Fidelity’s application to offer a Bitcoin ETF that would effectively provide investors an easier onramp to BTC exposure. An ETF that tracks the present “spot” price of the asset thus remains unavailable, although there are a handful of ETFs tied to BTC’s future price. Supporters of the spot ETF say the product would increase access to BTC, but the SEC cited concerns surrounding insufficient investor protections against fraud and manipulation.

Russian Finance Ministry Calls for Crypto Regulation, Not Restriction

Contrary to a report from Russia’s Central Bank last week calling for a blanket ban on crypto trading and mining, a director within Russia’s Ministry of Finance called Tuesday for a more measured approach. “We need to give these technologies the opportunity to develop,” said Ivan Chebeskov, adding that the Finance ministry has prepared a proposal for crypto regulation, and is awaiting the government’s response.

SEC Reportedly Probing Crypto Lending Products by Gemini and Celsius

At issue is whether the products offered by Celsius, Gemini and others should be considered securities. These firms pay users to lend out their cryptocurrencies, and tend to offer significantly higher interest rates than traditional banks. The SEC has reportedly not accused the companies of wrongdoing, but is probing whether their products expose lenders to undue risk and/or insufficient disclosure.

Crypto Secrecy Makes DeFi a Financial Felon’s Wonderland

DeFi platform Wonderland faced a new headache this week as an anonymous Twitter user revealed the identity of its pseudonymous Treasurer, who had been presiding over the ongoing plummet of Wonderland’s token, TIME. The exposure revealed that Wonderland’s Treasurer, known as Sifu, is actually Michael Patryn, a convicted felon who’s served prison time for fraud and conspiracy, legally changed his name multiple times, and was an early member of the disgraced Canadian crypto exchange Quadriga, which defrauded investors of over $130 million in 2018 (Patryn was not convicted in the Quadriga scandal). Wonderland co-founder Daniele Sestagalli reportedly knew of Patryn’s ignominious past but on Thursday tweeted that he’d asked Patryn to step down.

Uniswap Founder’s Bank Account Shut Down by JP Morgan Chase, Shadow-Debanking Allegations Surface

Hayden Adams, founder of decentralized exchange Uniswap, tweeted this week that his bank account had been closed by JPMorgan Chase “with no notice or explanation.” Adams called the attack “personal” and said he knows many people and companies in crypto who’ve “been similarly targeted.” It was not immediately clear why his account was closed, but the SEC has reportedly been investigating Uniswap since at least last year. One theory that made the rounds on Twitter was that Adams may have been flagged by a federal examiner.

Deal of the Week - CoinMARA💰

CoinMARA is building a centralized exchange, lending platform and NFT marketplace for the African region, the next outsized opportunity to create sustainable financial infrastructure over the next decade. Based in Kenya, the founder and the project have a strategic alliance with SafariCom (M-Pesa), as well as several high profile individuals in the region.

CoinMara has confirmed investment from Distributed Global, FTX, Coinbase Ventures, DIGITAL (Steve Cohen), TQ Ventures (Scooter Braun), Mechanism Capital, Woodstock, Day One Ventures, GDA Capital, DAO Jones and others.

The company’s private token sale is now open.

Direct participation - email for more info tatiana@tatianakoffman.com.

Syndicate - MyAsiaVC is running a syndicate with low minimums on Angellist [CLICK HERE TO PARTICIPATE IN THE SYNDICATE].

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.