Myth Of Money: Back to the Moon

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

Dear Investors,

Today was an eventful day in the crypto universe as both Bitcoin and Ethereum saw 20%+ gains. As Twitter and other chat platforms are lighting up at the prospect of the return of a bull market, we still lack any clear reasoning as to the price movement.

Perhaps traders finally got the rest they needed on their yachts in Monaco and Mykonos. Perhaps prices were artificially depressed. Perhaps this is all some grand manipulation.

Nonetheless, here are a few Crypto events that are believed to have contributed to this gorgeous daily run.

Amazon is rumored to start accepting Bitcoin this year.

The B-Word conference this week featured an overwhelmingly pro-Bitcoin talk by Jack Dorsey, Elon Musk and Cathie Wood. Elon stated that he holds Bitcoin, Ethereum and Doge, and that Tesla is likely to start accepting Bitcoin soon (again) after completing its due diligence.

Several crypto whales are currently in Mexico at the Satoshi Roundtable event, apparently pumping the markets 🤔

Last but not least… Everyone’s favorite crypto astrologist has gone viral for calling both the Top and the Bottom on Twitter, because… you know… JUPITER.

Regulatory Pushback is Coming

Investors should be careful playing the crypto markets however, as further global crypto regulation is imminent.

Uniswap, the largest decentralized exchange by volume, has removed 129 tokens, including synthetic tokens SNX and UMA, from its interface due to pending regulation in the DeFi space.

It appears that the worlds’ wealthiest nations are aiming to regulate:

Peer-to-Peer Transactions;

Stablecoins;

Private wallets (cold storage, phone and desktop apps);

Privacy (privacy coins, mixers, Decentralized exchanges, use of TOR and I2P);

Former ICOs and Future Projects (DeFi, NFT, smart contacts, second layer solutions, etc).

In addition, these new regulations intend to:

Force those active in crypto to be licensed and regulated as banks (responsible for KYC and transaction tracking);

Create full transparency for ALL transactions;

Exclude and freeze assets of persons, activities, and countries labeled a “risk;”

Force the inclusion of user information with all transactions;

Revoke the license of those who don’t comply.

The regulation rolled out aims to create a system of complete transparency and control. At the same time, regulatory clarity could pave the way for the next stage of adoption.

There is a great Reddit post outlining all the details. I will include a few highlights below.

Why Now?

In 2018, the news that Facebook was creating a crypto currency shocked international regulators. Until then, they didn’t see cryptos as a risk to the stability of the global financial system. However, Libra, the coin Facebook proposed, was a so-called stablecoin; it maintains its value relative to the USD. They quickly realized what would happen when a company with a billion users creates an instant payment system that is cheaper, faster and more user-friendly than the current financial system.

This topic was discussed at the highest levels of government; the G20, an international forum for the governments and central bank governors from 19 countries and the European Union. They engaged an organization called the Financial Action Task Force (FATF).

This organization has passed similar legislation for banking and financial service providers around the world. They are responsible for the fact that all crypto-currency exchanges where fiat is exchanged for cryptos have the same KYC and anti-money laundering requirements as banks. Now, they are going to use this framework to focus on the elements of the industry currently outside their control, and declare what is, and isn’t acceptable.

Why do the FATF regulations have global reach?

Since FATF isn’t an official government agency of any country, they cannot create law. They issue what is known as “soft-laws”: recommendations and guidance. Only when this guidance is implemented in the laws of the countries, they become “hard-laws” with real power.

In theory, they are thus subjected to the formal law-making process of law-giving countries. However, countries that don’t participate are placed on a list of “non-cooperative jurisdictions.” They then face restricted access to the financial system and ostracism from the international community. For this reason, almost all nations implement these recommendations.

As of right now, we can expect the new regulations to start to take force in October 2021. This is particularly impactful to the DeFi space, which will be required to implement KYC across the board.

This Week By the Numbers 📈

Top Stories 🗞

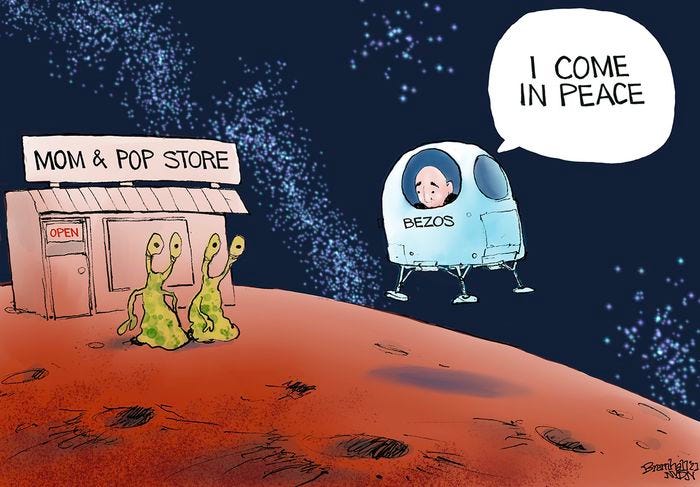

Jeff Bezos launches to space aboard New Shepard rocket ship

Billionaire Jeff Bezos has made a short journey to space, in the first crewed flight of his rocket ship, New Shepard. He was accompanied by Mark Bezos, his brother, Wally Funk, an 82-year-old pioneer of the space race, and an 18-year-old student. They travelled in a capsule with the biggest windows flown in space, offering stunning views of the Earth. New Shepard, built by Bezos' company Blue Origin, is designed to serve the burgeoning market for space tourism. Amazon founder Mr Bezos - and other participants in the "billionaire space race" - have been criticised for offering what some see as joy rides for the super-wealthy. Critics say the money could be spent on pay rises for employees or fighting climate change. Read Full Story.

Faster Inflation Takes Toll on U.S. Consumer Sentiment in July

U.S. consumer sentiment unexpectedly declined to a five-month low in early July as mounting concerns over rising prices led to a sharp deterioration in buying conditions for big-ticket items. The University of Michigan’s preliminary sentiment index decreased to 80.8 in July from 85.5 the prior month, data released Friday showed. The figure was lower than all estimates in a Bloomberg survey which had a median projection of 86.5. Consumers expect inflation to rise 4.8% over the next year, the highest since August 2008. Read Full Story.

US Senators Ask Team USA to Boycott China’s Digital Yuan at 2022 Olympics

Three senators are calling on the U.S. national team to effectively boycott China’s digital currency at the 2022 Winter Olympics in Beijing. Athletes should be forbidden from “receiving or using digital yuan during the Beijing Olympics,” Republicans Marsha Blackburn, Cynthia Lummis and Roger Wicker said in a Monday letter to the U.S. Olympic Committee leadership, citing privacy concerns. “We cannot allow America’s athletes to be used as a Trojan horse to increase the Chinese Communist Party’s ability to spy on the United States”. The boycott call amounts to an early salvo in the digital currency arms race. Read Full Story.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.