Myth of Money: Biden Chooses Yellen

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

The biggest news in the markets this week is Biden choosing former Federal Reserve chair Janet Yellen as the next Treasury Secretary, to succeed Steven Mnuchin in January. Yellen was the first woman to serve as Federal Reserve’s chair, and if confirmed by the Senate, Yellen would be the first woman to lead the Treasury.

“Yellen, 74, is widely seen as a politically “safe” pick for the role, likely to garner support from Senate Republicans as someone capable of pursing bipartisan compromise during an otherwise fragile time for the economy.”

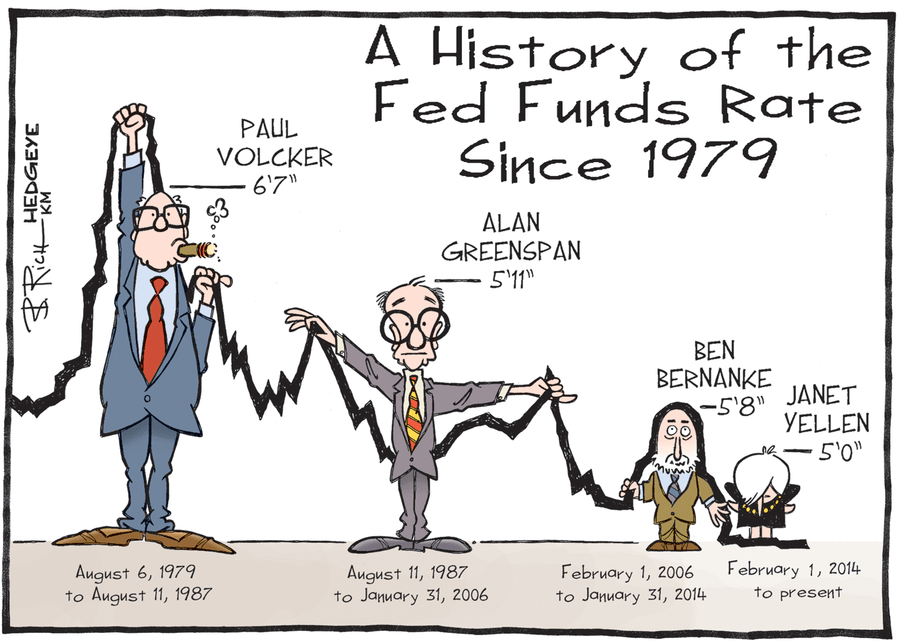

Yellen’s future leadership was a bullish move for the stock market this week, particularly because of her track record of keeping interest rates historically low.

Yellen has her work cut out for her. As the Secretary of the Treasury, she will work closely with the Fed to stabilize an economy badly bruised and still reeling from coronavirus.

“The Treasury Department runs tax policy and issues government debt, two issues that could be flash points in Biden’s first years in office. The budget deficit eclipsed $3.1 trillion in 2020, and Republicans have recently signaled they want to dramatically cut back on spending at a time when Biden says large levels of government support are needed to bring the economy back to life.”

“In her time in the Clinton administration, Yellen was supportive of efforts to balance the federal budget, but she has become an advocate of spending more money now that interest rates are at historic lows, making it cheap for the U.S. government to borrow money.”

Yellen is also known for her inflationary bias and has historically supported stimulus efforts and MMT (modern monetary theory), which encourages governments with sovereign currencies to add more money into the system during periods of high unemployment.

All of this seems like good news for Bitcoin-ers, who believe that USD inflation and instability will lead to a boom in BTC price. Even though I’m a die-hard Bitcoiner myself, before jumping onto the “crypto-bandwagon,” I urge my readers to pick up a copy of Stephanie Kelton’s book “Deficit Myth.”

Sure, inflation is generally ‘bad’. But there is a time and a place for sovereign monetary systems to use the tools given to them to stabilize an economy during a financial crisis, which we are still in the middle of. (Don’t let that stock market bubble fool you.)

Simply put, the ability to print money is actually a feature of our system, not a bug. Our concerns shouldn’t be about monetary stimulus itself, but rather the quantity and distribution of those funds. At over $8 trillion of stimulus this year (or one-third of the American GDP), many Americans are still struggling for basics and healthcare. Most Western countries have been able give MORE support to their citizens with much LESS.

America does not have a funding problem, but rather a politicized distribution problem.

Hopefully Yellen’s leadership will be able to create more targeted support where it is needed most.

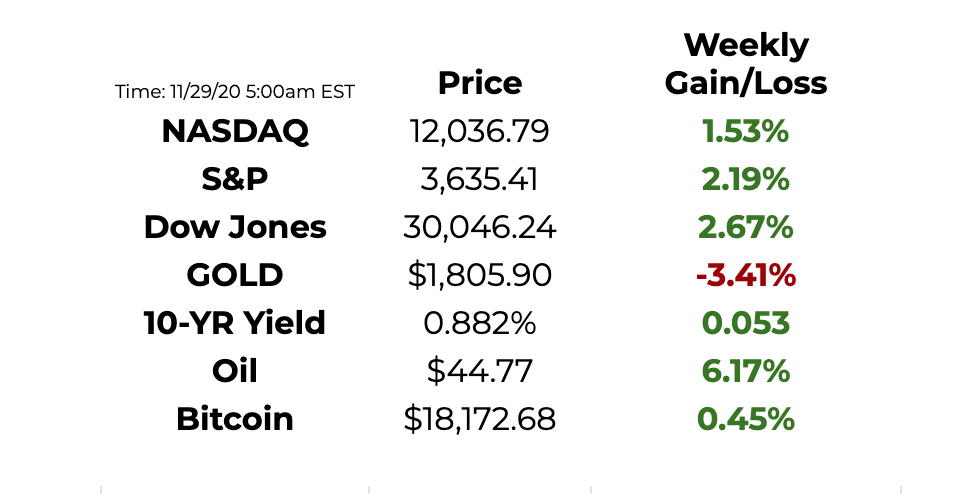

This Week By the Numbers

The American economy continues to diverge from reality. Consumer confidence fell more than expected this month, as COVID cases rise both in the U.S. and worldwide. Meanwhile, home prices posted their biggest gain in six years - the housing price index jumped 6.6% from a year ago in September after rising 5.3% in August. The Dow Jones also topped 30,000 points this week, a record high.

In a recent interview, prominent investor Dan Tapiero said something that really stuck with me:

“The Federal Reserve will sacrifice the dollar before the equity market and the asset market.”

If the Federal Reserve and the U.S. Treasury continue to prop up the markets, while pushing inflation of the U.S. Dollar, one has to ask the the following question - If the the yardstick by which you measure the performance of your portfolio is broken, how do you know if your investment strategy is working?

Top Stories

Guggenheim opens door to bitcoin exposure for $5 billion macro fund via Grayscale GBTC product

Guggenheim Partners, the $200 billion-plus asset-manager, could be the latest Wall Street firm to allocate capital to the cryptocurrency market, as per a filing. The firm, which invests across asset classes on behalf of companies, pension funds, and sovereign wealth funds, wrote in a filing on November 27 that it might "seek investment exposure to bitcoin indirectly" via Grayscale's Bitcoin Trust product (GBTC) through its Macro Opportunities Fund. Read Full Story.

Billionaire Hedge Fund Investor Druckenmiller Says He Owns Bitcoin in CNBC Interview

Druckenmiller said on CNBC Monday he owns bitcoin (BTC, +3.84%), becoming the latest high-profile, ultra high-net-worth investor to get in on the benchmark digital currency. Though he said his gold position is "many, many more times" larger than his bitcoin allocation, Druckenmiller predicted his bitcoin would outperform. "Frankly, if the gold bet works the bitcoin bet will probably work better because it's thinner, more illiquid and has a lot more beta to it…It has a lot of attraction as a store of value to both millennials and the new West Coast money and, as you know, they have a lot of it." Druckenmiller also said he's anticipating a three- to four-year decline in the dollar. Read Full Story.

Virgin Hyperloop completes first test with actual passengers

Virgin Hyperloop gave the first ride on its test track Sunday in Las Vegas, but it will be years before the public can potentially take a high-speed ride on a hyperloop. A hyperloop is an unproven transportation system in which people travel in a vehicle in a vacuum tube at speeds as high as 600 mph. Virgin's system includes magnetic levitation, much like used in advanced high speed rail projects in Japan and Germany. Magnetic levitation lifts a train car above a track, as the magnets' like poles push the train upward. Virgin Hyperloop's pod only reached 100 mph on the track, according to the company, rather than the 600 mph that hyperloop advocates have long promised. Virgin Hyperloop says its track is 500 meters long, limiting how fast the pods can go. Read Full Story.

Biden to Tap Former Fed Chair Janet Yellen as Treasury Secretary

The U.S. Director of National Intelligence has written to the Securities and Exchange Commission (SEC) over fears China’s dominance in the area of digital currencies could put the U.S. at a disadvantage. Ratcliffe is said to have raised the fact that over half of the global cryptocurrency mining power is based in China, and that the People's Bank of China is already developing its national digital currency. Read Full Story.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Tips: BTC @ 1MgfRn8NHnc8ZE5kBvNgYbgpTFShJh5mKK

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.