Myth Of Money: Biden's New Deal and What It Means for Crypto

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

Dear Investors,

Congress passed a $1.2 trillion infrastructure package Friday.

This was a predictable step as measure for post-Covid economic relief, and is generally expected to increase employment and economic output to catch up with the potential threat of inflation.

How is inflation and economic output related?

Simply put, the money circulating represents the value of our economy. And if the economy does not grow, but the money supply does, the dollar becomes worth less. One way to solve for this is to take some dollars out of circulation. The other is to increase economic output. And if increasing economic output is the goal, what better way than to upgrade the country’s infrastructure.

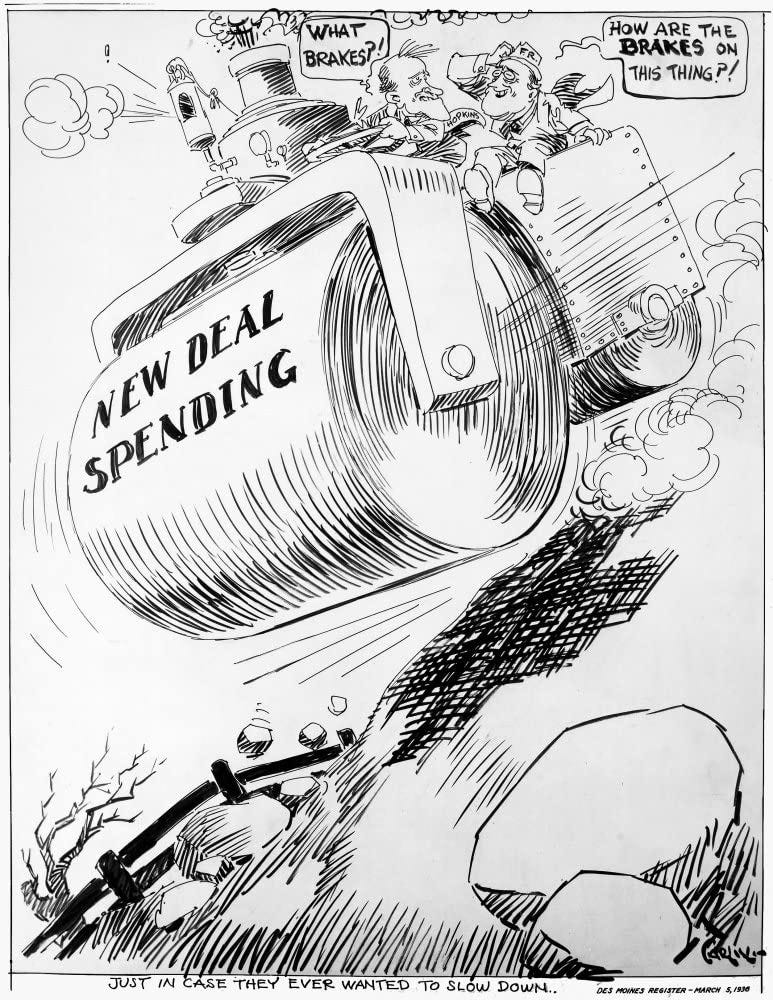

Biden’s Infrastructure Bill can be compared to FDR’s New Deal.

According to Wikipedia:

The New Deal was a series of programs, public work projects, financial reforms, and regulations enacted by President Franklin D. Roosevelt in the United States between 1933 and 1939. Major federal programs and agencies included the Civilian Conservation Corps (CCC), the Civil Works Administration (CWA), the Farm Security Administration (FSA), the National Industrial Recovery Act of 1933 (NIRA) and the Social Security Administration (SSA). They provided support for farmers, the unemployed, youth and the elderly. …The programs focused on what historians refer to as the "3 R's": relief for the unemployed and poor, recovery of the economy back to normal levels, and reform of the financial system to prevent a repeat depression.[1] The New Deal produced a political realignment, making the Democratic Party the majority (as well as the party that held the White House for seven out of the nine presidential terms from 1933 to 1969) with its base in liberal ideas, the South, big city machines and the newly empowered labor unions, and various ethnic groups. The Republicans were split, with conservatives opposing the entire New Deal as hostile to business and economic growth and liberals in support. The realignment crystallized into the New Deal coalition that dominated presidential elections into the 1960s while the opposing conservative coalition largely controlled Congress in domestic affairs from 1937 to 1964.[2]

Sound familiar?

What is included in the infrastructure bill?

$110 billion for roads, bridges and major infrastructure projects, incl. $40 billion for bridge repair, replacement and rehabilitation, and $11 billion for transportation safety

$39 billion to modernize public transit - funds would repair and upgrade existing infrastructure, make stations accessible to all users, bring transit service to new communities and modernize rail and bus fleets, including replacing thousands of vehicles with zero-emission models

$66 billion in passenger and freight rail, included in the package is $12 billion in partnership grants for intercity rail service, including high-speed rail

$65 billion investment in improving the nation's broadband infrastructure

$17 billion in port infrastructure and $25 billion in airports to address repair and maintenance backlogs, reduce congestion and emissions near ports and airports and promote electrification and other low-carbon technologies

$7.5 billion for zero- and low-emission buses and ferries, aiming to deliver thousands of electric school buses to districts across the country

Another $7.5 billion would go to building a nationwide network of plug-in electric vehicle chargers

$65 billion to rebuild the electric grid

$55 billion to upgrade water infrastructure

Another $50 billion would go toward making the system more resilient -- protecting it from drought, floods and cyberattacks

$21 billion to clean up Superfund and brownfield sites

What Does the Infrastructure Bill Mean for Crypto?

Legislators snuck in a highly contention provision into the bill which will require all developers of blockchain products to report transactions over $10,000. That means if you build a wallet or some other product, even if it is decentralized, you are now on the hook for reporting transactions. The law is predicted to have a particularly negative effect on DeFi products.

This Week By the Numbers 📈

This Week in Forbes

FTX Backs CoinMENA In $9.5M Seed Round To Build A Crypto Exchange For The Middle East

Headquartered in Bahrain, fiat-to-crypto exchange CoinMENA has secured $9.5M in seed funding from BECO Capital, Kenetic Capital, Arab Bank Switzerland, Bunat Ventures, FTX investment arm Alameda Research and Girnas Capital.

Launched in early 2021 by Dina Saman, Talal Tabbaa, and Yazan Barghuthi, CoinMENA was built to facilitate easy and safe access to crypto investing in the gulf region with a focus on countries such as Bahrain, United Arab Emirates, Saudi Arabia and other regions in the MENA (Middle East and North Africa) market. The company operates as a fully regulated, onshore crypto exchange licensed by the Central Bank of Bahrain, and holds only one of two such licenses issued.

CoinMENA offers fiat-to-crypto on ramp and off ramp, the ability to purchase and trade 20+ leading crypto currencies, personalized customer service, and an easy-to-use mobile app for both beginners and professional traders. The exchange’s services are currently available to residents of Bahrain, United Arab Emirates, Saudi Arabia, Kuwait, and Oman, with a view to expanding to other countries in the MENA region.

Link: Full Story on Forbes.

Link: CoinMENA WEBSITE.

Top Stories 🗞

FTX, Solana Ventures and Lightspeed Create $100M Web3 Gaming Investment

FTX, Lightspeed Venture Partners and Solana Ventures have joined forces to create a $100 million Web3 gaming investment initiative. The investment will focus on gaming studios, technology and projects that focus on the overlap between blockchains and gaming. Lightspeed has invested over $300 million in a range of early to late-stage gaming and crypto companies, including Epic Games, 1047 Games, TripleDot Studios, Faraway Games, FTX, Offchain Labs, Alchemy, Wintermute and others. The initiative will help advance and develop new decentralized models for gaming as well as the tools developers need to build. The first investment has already been deployed to Faraway Games, a Web3 gaming studio focused on “social games with player-driven and decentralized economies.”

Crypto Investors Buy 40 Acres of Land in Wyoming to Build Blockchain City

Back in July, Wyoming passed a law legally recognizing Decentralized Autonomous Organizations (DAOs)—blockchain-based entities in which members vote on the group’s direction with tokens—so long as they are registered as companies in the state. Now, one DAO that has aspirations of founding a blockchain-based city says it has actually purchased land in the state. “Today, CityDAO is officially the first DAO to own land, using the new Wyoming DAO LLC law. This is just the beginning,” CityDAO tweeted, along with a video of a CityDAO flag being raised on a barren hill. “This parcel is a proof of concept parcel - it’s not in the most convenient location nor does it have an abundance of natural resources. It does have a well for water, a flat area for building, and is 45 minutes from an airport.”

JPMorgan renews prediction that bitcoin could hit $146,000 - and says it's acting more like digital gold than ever

JPMorgan recently published a deep dive into digital assets and it makes for happy reading for crypto fans - albeit with a few caveats.The US's biggest bank has renewed its prediction that bitcoin could surge to $146,000 in the long term, if volatility subsides and institutions start preferring it to gold in their portfolios. That's roughly 130% above Wednesday's price of $63,160.And JPMorgan thinks bitcoin, which is also a scarce product, is increasingly competing with gold for investors' attention as a hedge against inflation.

Fed to start winding back $120bn-a-month stimulus programme

The Federal Reserve said it would begin scaling back its massive $120bn monthly bond-buying programme this month, a critical milestone for a US economy that is recovering from the pandemic and contending with surging inflation. The decision is the culmination of months of debate among Fed officials about the level of support the world’s largest economy needs as price pressures begin to extend beyond the sectors most sensitive to the post-pandemic reopening. The move corresponded with abrupt actions by a number of central banks around the world to tighten monetary policy, including the Reserve Bank of Australia and the Bank of Canada. Markets expect the Bank of England, which meets on Thursday, to raise interest rates for the first time since 2018.

Join Our Syndicate 💰

Following the success of our last 3 deals, have spawn off a new venture - a hub for all future SPV’s under the brand of Moonwalker Capital on Angellist. To participate in future deals, SIGN UP HERE (LINK).

We are launching our first deal shortly, so don’t miss out.

If you are a founder looking for additional exposure and funding, please reach out. SPVs are a great way to open your deal to the investment community while keeping you cap-table squeaky clean ;)

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.