Myth of Money: Bitcoin Bulls Are Here to Stay

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

Join Us On Clubhouse 🎤

Starting this Sunday, I will be hosting a weekly Clubhouse discussion on all things money, stocks, crypto, macro and more.

Each week will feature special guests.

Today's clubhouse will feature friend and investor Gary Sheynkman. We’ll be discussing capital allocation strategies, Bitcoin, meme stocks and so much more :)

Join us @ 11am EST, 2pm PST, 7pm GMT, 11pm UAE - CLUBHOUSE LINK

Happy Super Bowl Sunday from the Middle East :)

Tampa Bay Buccaneers will become the first NFL team to play the Super Bowl at their home stadium. As Americans continue to be cooped up during the pandemic, Super Bowl bets are expected to increase 63% this year.

In fact, as we spend more time at home, we have seen erratic behavior not only in the online betting world, but also in stocks and cryptocurrencies.

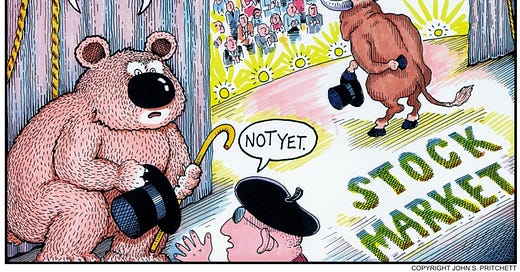

Bull Market is Here

Small and mid-cap crypto’s rallied this week, producing outrageous returns of 100% to 1000%. Bitcoin also made significant gains, briefly reaching $41,000.

Many investors are still nervous about making long-term allocations in Bitcoin. One of the most convincing arguments pro-allocation was presented by Cathie Wood, CIO of Ark Invest and Bloomberg’s greatest stock picker of the year, in a paper titled Big Ideas 2021.

TL:DR:

Bitcoin price is an all-time high

As of November 2020, roughly 60% of bitcoin’s supply had not moved in more than a year, a testament to the market’s longer-term focus and a holder base with stronger conviction.

Bitcoin’s Realized Capitalization, a measure of a holder’s cost basis, has hit an all-time high.1 A growing cost basis suggests that early investors are taking profits, while newer investors are establishing positions and creating higher price support levels.

Bitcoin’s search interest is low relative to the increase in its price. As its price neared all-time highs, bitcoin’s Google search interest was at 15% of its all-time high.

Decentralized finance (“DeFi”) has been a positive catalyst for the increased adoption of Ethereum’s network. By leveraging ether as “trust-minimized” collateral, market participants can disintermediate traditional financial companies and access financial services like credit & lending, market making, trading, custody, investing, and access to synthetic US dollar exposure.

Bitcoin Could Play A Pivotal Role As Corporate Cash. Square and Microstrategy, both with balance sheet investments in bitcoin, are showing the way for public companies to deploy bitcoin as a legitimate alternative to cash. If all S&P 500 companies were to allocate 1% of their cash to bitcoin, its price could increase by approximately $40,000.

Bitcoin offers one of the most compelling risk-reward profiles among assets. It could scale from roughly $500 billion to $1-5 trillion in network capitalization during the next five to ten years.

Based on daily returns across asset classes during the past 10 years, analysis suggests that allocations to bitcoin should range from 2.55% when minimizing volatility to 6.55% when maximizing returns.

Capital allocators should consider the opportunity cost of ignoring bitcoin as part of a new asset class.

Michael Saylor Teaches a Class

Michael Saylor, the MicroStrategy CEO-turned-king of bitcoin treasuries, called upon fellow business executives Wednesday to avoid the path of financial “serfdom” at his virtual WORLD.NOW bitcoin-themed conference. In his solo address, Saylor detailed the cryptocurrency playbook that propelled his three-decade-old data firm to newfound relevance in less than a year. Watch full presentation here.

How to Become A Great Capital Allocator?

Preserving capital is often more difficult than accumulating it. One of my favorite podcasts this month was with billionaire Chamath, where he discusses how he developed his investment thesis between various themes and sectors. Full episode here.

This Week By the Numbers 📈

The Nasdaq and S&P had their best week since November, as Democrats moved forward with stimulus plans and the Wall Street Bets momentum started to die down. Oil prices have been on an upswing, hitting their highest level in a year yesterday.

Top Stories 🗞

Palihapitiya-backed Clover Health shares fall on critical report by short seller Hindenburg Research

Shares of Clover Health fell Thursday following a critical report from short seller Hindenburg Research claiming the company is under an active investigation by the Department of Justice that it has not disclosed to investors. Hindenburg accused billionaire investor Chamath Palihapitiya of misleading investors when he took the company public through a special purpose acquisition company (SPAC) last month. The DOJ investigation involves at least 12 different issues relating to Clover’s business model and Clover Assistant software, according Hindenburg, which said it obtained a Civil Investigative Demand outlining this. The claims have not been independently verified at this time. Read Full Story.

Dan Tapiero Launches $200M Fund to Invest in Crypto Companies

Investor and entrepreneur Dan Tapiero is launching a $200 million fund called 10T Holdings to invest in cryptocurrency startups. The long-time bitcoin advocate filed to launch the new fund Tuesday, per documents from the U.S. Securities and Exchange Commission. Tapiero's filing comes amid a stampede of other institutional interest in investing and building in the cryptocurrency industry as bitcoin has returned gains near 300% in the past year. In addition to Tapiero, the filing lists as investors longtime investor Michael Dubilier and Stan Miroshnik, former CEO of crypto-focused advisory firm Argon Group. Read Full Story.

‘A Good Thing’: Elon Musk Says He’s a Supporter of Bitcoin

Tesla and SpaceX CEO Elon Musk has clarified that he is a bitcoin supporter, if a bit “late to the party.” Talking on invitation-only audio-chat app Clubhouse on Monday, Musk said, “I should have bought [bitcoin] eight years ago … I do at this point think bitcoin is a good thing. I am a supporter.” The Tesla CEO further said bitcoin, the top cryptocurrency by market cap, is “on the verge of getting broad acceptance by conventional finance people.” He added that he did not have a “strong opinion on other cryptocurrencies.” Read Full Story.

VISA Expands Digital Currency Roadmap with First Boulevard

VISA announced a partnership with First Boulevard, a digitally native neobank focused on building generational wealth for the Black community. First Boulevard will be first to pilot Visa’s new suite of crypto APIs, which will enable their customers to purchase, custody and trade digital assets held by Anchorage, a federally chartered digital asset bank. The pilot will serve as a key first step in supporting API capabilities that help additional Visa clients access and integrate crypto features into their product offering, and is anticipated to launch later this year. Read Full Story.

VIP Investor List

I will start sending out occasional investment opportunities to those on my VIP investor list. Some of these will be fund investments, start-up investments, pre-IPO deals, crypto and digital assets opportunities, exclusive allocations… you get it. If you are an accredited investor and want to be on this list, send me a note.

Product of the Week 👀

Lolli.com lets you earn Bitcoin while you shop at your favorite online retailers like Bloomingdales, Nike, Expedia and thousands more. Check it out here and start accumulating Bitcoin today. [Available only in the U.S.]

Interested in joining the Myth Of Money as a sponsor? Reply to this email to learn more :)

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Tips: BTC @ 1MgfRn8NHnc8ZE5kBvNgYbgpTFShJh5mKK

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.