Myth Of Money: Bitcoin is Becoming Less Volatile

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

Dear Investors,

One of the biggest deterrents for traditional investors to allocate capital to Bitcoin is its inherent volatility. Most investors are not used to seeing their assets move 20-50% on a monthly basis.

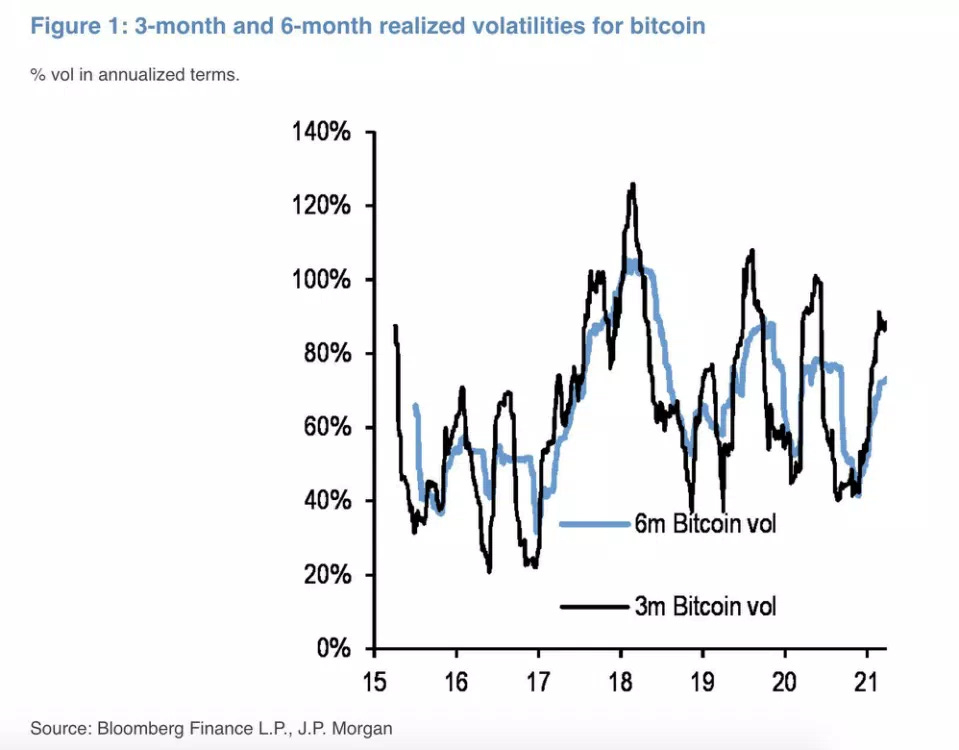

According to a recent report by JPMorgan Chase & Co., Bitcoin’s decrease in volatility is setting the stage for a trend that could encourage institutions to dive in. Bitcoin’s 3-month realized volatility has fallen to 86% after rising above 90% in February, and six-month measure appears to be stabilizing at around 73%.

Volatility is a key consideration for risk management for seasoned investors -- the higher the volatility of an asset, the higher the risk capital consumed by it. The biggest U.S. banks right now provide direct access to Bitcoin and its counterparts.

And yet, most institutions are taking an interest in the asset class as we saw a 300% appreciation in price in 2020 alone.

Goldman Sachs Group Inc. said this week it’s close to offering investment vehicles for Bitcoin and other digital assets to private wealth clients. Morgan Stanley plans to give rich clients access to three funds that will enable ownership of crypto and Bank of New York Mellon Corp. is developing a platform for traditional and digital assets.

JPMorgan further states that Bitcoin’s long term price could reach $130,000 if its volatility continues to decline. This target is based on the notion that bitcoin’s volatility will meet gold’s, which for the time being is still some way off. Bitcoin’s realized volatility in the last three months stood at 86% compared to 16% for gold.

This Week By the Numbers 📈

Ethereum, the second-largest cryptocurrency behind bitcoin, jumped to an all-time this week to $2,091.

The economy added 916,000 jobs in March, the biggest gain since last August and way up from the 468,000 added in February. The unemployment rate also ticked down from 6.2% to 6%, its lowest level since before the pandemic.

Top Stories 🗞

NBA Top Shot’s Dapper Labs Raises $305 Million in Latest Round

Dapper Labs, the company behind the popular NBA Top Shot digital collectibles platform, said it closed a $305 million funding round with backing from a roster of professional athletes and media personalities. The latest financing injection -- with endorsements from Michael Jordan, Will Smith, Kevin Durant and Stefon Diggs, among others -- brings the company’s total capital raised since February 2018 to $357 million. Financial firm Coatue also invested. Read Full Story.

BlackRock Has Begun Trading Bitcoin Futures

Investments giant BlackRock has indeed “started to dabble” in the bitcoin market. BlackRock held $6.5 million in CME bitcoin futures earlier this year with an appreciation of $360,000, new SEC filings show. The holdings represented 0.03% of BlackRock’s massive Global Allocation Fund on reporting day Jan. 31 – “very small,” the source said. (The gains represent just 0.0014%.) BlackRock’s original 37 contracts expired on March 26. Read Full Story.

MicroStrategy Rated ‘Buy’ at BTIG Partly on View Bitcoin Will Hit $95K by End of 2022

BTIG began coverage of MicroStrategy, the business intelligence firm/bitcoin storehouse, with a “buy” rating Wednesday, saying the company’s adoption of the cryptocurrency as its primary treasury reserve asset represents a “rational action” to protect the firm’s value in the long run. BTIG, which also praised the company's core business, said it views bitcoin as a form of digital gold and that buying Microstrategy (Nasdaq: MSTR) provides investors a way to gain exposure to it. MicroStrategy's strategy lets it benefit from the rise of bitcoin driven by its adoption by institutional investors worried about inflation. BTIG said its valuation is partly based on an assumption that the price of bitcoin will rise to $95,000 by the end of 2022. Read Full Story.

Coinbase’s COIN Stock to Go Live on Nasdaq April 14

The crypto exchange will also hold a first-quarter earnings call on April 6, providing a financial outlook for 2021. There’s been much anticipation about the Nasdaq listing. Prices for the shares are predicted to fall between $300 and $350, valuing the trading platform at about $100 billion. The listing would put Coinbase atop an emerging class of publicly traded firms dealing in bitcoin. Further, a $100 billion debut would make Coinbase more valuable than traditional tech stocks such as Uber. CEO Brian Armstrong’s 39.6 million shares will be worth $13.6 billion, catapulting him into the “decabillionaire” rankings alongside the likes of Jeff Bezos, Elon Musk and Bill Gates. Read Full Story.

VIP Investor List 💰

I will start sending out occasional investment opportunities to those on my VIP investor list. Some of these will be fund investments, start-up investments, pre-IPO deals, crypto and digital assets opportunities, exclusive allocations… you get it. If you are an accredited investor and want to be on this list, send me a note.

Favorite Products 👀

Lolli.com - Earn Bitcoin while you shop at thousands of online retailers. [U.S. only]

Coinbase - Looking to make your first Bitcoin purchase in the U.S.? Use this code for a $10 sign-up bonus.

Binance - Looking to make your first Bitcoin purchase outside the U.S.? Use this code to get a 10% discount on trading fees.

Aspiration Bank - Join this climate-friendly bank, pay what you want in fees, and get a $50 bonus when you spend $250 by using this link.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.