Myth of Money: Bitcoin, What the F*@#?

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

Happy New Year Everyone!

Thank you to everyone who continues to read this newsletter week after week. When I first started writing these weekly notes, it was March 2020 and we were in the middle of a global market collapse. As I started to dig deeper and figure out what was happening across equities, commodities and crypto, I wrote down my weekly thoughts. One by one, many of you signed up and continue to send me feedback. Thank you.

New VIP Investor List.

I will start sending out occasional investment opportunities to those on my VIP investor list. Some of these will be fund investments, start-up investments, pre-IPO deals, exclusive allocations… you get it. If you are an accredited investor and want to be on this list, send me a note.

Bitcoin, What the F*@#?

For a second week in a row, we have seen weekly gains of 20%+. Bitcoin appears to be an unstoppable rocketship and so many of you have emailed me asking if it’s too late to get in…

Here are a few factors to consider:

Bitcoin is now an institutional grade asset coveted by hedge funds, banks, publicly traded companies and insurance companies. That means it is no longer a purely speculative asset which could one day go to $0 and disappear. So if you still have these concerns, please rest easy.

The trading game is very different than the investment game. Traders make money during increased volatility and often contribute to factors that cause volatility through algo-trading, futures and derivatives, margin trading, etc. Given the relatively small market cap of Bitcoin, a 5% move in the market can avalanche into a 30% correction within days if not hours. Just because you made 25% this week, it does not mean all weeks will be the same. Celebrate. Take some profits. Live to see another day.

Is it too late to buy now? Yes and no. This depends on your investment horizon. There is a good chance we will see Bitcoin at 100k by the end of 2021. There is also a good chance we will see one or two corrections before this happens. Do not invest what will make you lose sleep at night. Figure out the amount you are comfortable with and dollar-cost average in (as in buy periodically, in intervals, so that you catch some highs and some lows and it evens out in the end.)

What about those AltCoins? Ethereum is making some moves this week… 43% to be exact. Smaller coins are following suit. Please remember that if you don’t understand what you are investing in or what actually drives its value, you are gambling. Do not gamble. If you want to take advantage of “Alt Season”, consider giving your money to a professional to manage instead - I can recommend a few.

Still trying figure out how to make your first purchase? Consider some recommendations I made here.

Another interesting tidbit of information that came across my desk this week - Bitcoin is now the largest financial services company by market cap 🤯

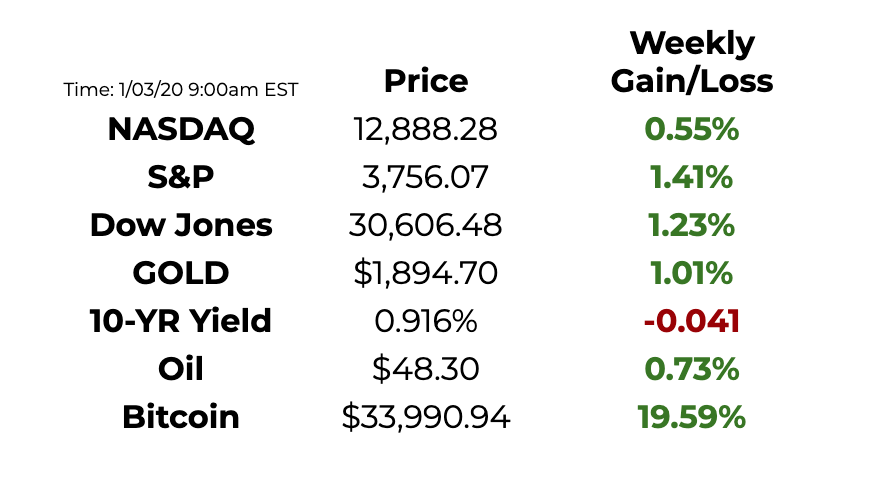

This Week By the Numbers

This was a slow week for non-crypto markets due to the holidays. Traditional markets continue to bear uncertainty with Biden taking office imminently. Wall Street investors are hearing whispers of an upcoming equities crash, yet the newly passed stimulus bill will likely prolong the inevitable and continue to provide price support in Q1 and Q2.

Top Stories

The $900 billion package provides more relief beyond the $600 checks that have become the focus in Washington.

The $900 billion stimulus bill that President Trump finally signed into law on Sunday evening goes well beyond providing the $600 checks that became a huge sticking point in getting the legislation across the finish line. The relief package casts a wide net with a variety of measures aimed at addressing the needs of millions of Americans, including those who have lost their jobs, as well as small businesses, nursing homes, colleges, universities and K-12 schools. The full text of the bill ran almost 5,600 pages. Read Full Story.

Beijing says it will take ‘necessary measures’ in response to NYSE delisting of 3 Chinese companies

China vowed on Saturday to respond to the delisting of three telecommunications giants by the New York Stock Exchange under an executive order signed by President Donald Trump in November. The NYSE said on Thursday that it will delist China Telecom Corp. Limited, China Mobile Limited, and China Unicom Hong Kong Limited. Trump signed an order in November that barred Americans from investing in companies it alleged were connected to the Chinese military. The investment ban will take effect on Jan. 11, just days before President-elect Joe Biden is due to be inaugurated. According to NYSE, trading in the three companies will be suspended possibly as soon as Jan. 7 or as late as Jan. 11. Read Full Story.

Microstrategy's BTC Holdings More Than Double in Value to $2.4 Billion Four Months Later

The company has seen the value of its initial haul of 38,250 coins grow to over $1.3 billion from the $425 million spent. The value of this Nasdaq listed company’s stock has surged from just under $135 recorded on August 11 to $388.55 by close of trading on December 31. This has seen Microstrategy’s market capitalization rising from $1.3 billion to $3.6 billion, representing a growth of approximately 187% in less than 6 months. Read Full Story.

Coinbase to Suspend XRP Trading Following SEC Suit Against Ripple

The cryptocurrency at the heart of a U.S. Securities and Exchange Commission lawsuit against Ripple Labs claiming the token is really a security. Exchanges that continue to list XRP without registering as a securities exchange with the SEC face potential consequences down the line, including possible enforcement actions. For Coinbase, the reason for dropping XRP as a traded asset was simple: As the company seeks to go public, being a platform for something that’s potentially a security would mean adding more paperwork simply so it could be legally allowed to let retail customers buy and sell a single cryptocurrency. However, should Ripple prevail in its defense, Coinbase can re-list XRP easily. Read Full Story.

Featured Products

SafePal offers a crypto cold-wallet wallet solution with software level convenience, backed and invested by Binance. The SafePal S1 offers access to built in Binance Spot Trading, DeFi DApp support for UniSwap, 1inch Exchange, Compound, Aave & Curve. Currently priced at $39.99, it is also one of the most affordable hardware wallets on the market as well as the 1st tokenized crypto hardware wallet solution.

Lolli.com lets you earn Bitcoin while you shop at your favorite online retailers like Bloomingdales, Nike, Expedia and thousands more. Check it out here and start accumulating Bitcoin today. [Available only in the U.S.]

Interested in joining the Myth Of Money as a sponsor? Reply to this email to learn more :)

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Tips: BTC @ 1MgfRn8NHnc8ZE5kBvNgYbgpTFShJh5mKK

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.