Myth of Money: British Prime Minister Resigns as Economy Stumbles

Welcome to this week’s edition of Myth of Money, a weekly newsletter on the digital asset markets read by 12,000+ investors.

Disclaimer: The following is not intended as investment advice. Do your research.

Dear Investors,

This week, all eyes are on British politics.

Prime Minister Liz Truss of Britain announced her resignation on Thursday, bringing a swift end to a six-week stint in office that began with a radical experiment in trickle-down economics and descended into financial and political chaos, as most of those policies were reversed.

With her tax-cutting agenda in tatters, her Conservative Party’s lawmakers in revolt and her government in the hands of people who did not support either her or her policies, Ms. Truss, 47, concluded that she could no longer govern. (Source: New York Times.)

Truss departs as the shortest-serving occupant of Downing Street in 300 years of British history.

Her resignation speech was as swift as her tenure:

I came into office at a time of great economic and international instability.

Families and businesses were worried about how to pay their bills.

Putin’s illegal war in Ukraine threatens the security of our whole continent.

And our country had been held back for too long by low economic growth.

I was elected by the Conservative party with a mandate to change this.

We delivered on energy bills and on cutting national insurance.

And we set out a vision for a low-tax, high-growth economy that would take advantage of the freedoms of Brexit.

I recognise, though, given the situation, I cannot deliver the mandate on which I was elected by the Conservative party.

I have therefore spoken to His Majesty the King to notify him that I am resigning as leader of the Conservative party.

This morning I met the chair of the 1922 Committee, Sir Graham Brady.

We have agreed there will be a leadership election to be completed in the next week.

This will ensure we remain on a path to deliver our fiscal plans and maintain our country’s economic stability and national security.

I will remain as prime minister until a successor has been chosen.

Thank you.

Despite being in office for merely 44 days, Truss will claim a yearly £115,000 allowance reserved for former Prime Ministers. Truss is also entitled to receive a pension allowance of up to 10% of the £115,000 allowance. Notably, Truss is only the sixth Prime Minister to receive this allowance, which was ratified in 1991 by John Major post-Margaret Thatcher’s resignation.

Events leading to the resignation

In an attempt by the Conservative Party leader to radically reorient the government’s economic agenda, Truss announced that she would be slashing taxes. Truss scrapped the pledge to reverse predecessor Boris Johnson's hike of corporation tax from 19% to 25%, a decision estimated to restore around £18 billion ($20.1 billion) to the U.K. Treasury's coffers by 2026.

In an already heightened inflationary climate, there was no subsequent plan to balance the economy. The announcement sent the markets into a tailspin, and Truss never recovered. By the end, Truss had grown so unpopular that her fellow party lawmakers were publicly contemplating plans to replace her.

The resignation comes only a week after Truss fired Finance Minister Kwasi Kwarteng after less than six weeks on the job, amid market chaos.

Kwarteng was the architect of Truss’s vision for economic growth and a longtime political ally. Truss fired him Friday and replaced him with Jeremy Hunt, Britain’s fourth finance minister. Kwarteng had unveiled a significant shift in the country’s economic strategy, promising to slash taxes for the highest earners and biggest corporations — with no plans to balance the budget.

The British pound’s valuation tanked, and the United Kingdom’s central bank was forced to hike interest rates. Inflation — already at record highs — raised the cost of living further, shredding the Conservative Party’s reputation for fiscal responsibility. Working-class voters were turned off by a renewed sense that the Conservative party represented only the interests of financial elites.

Musical Chairs of the British Government

Truss was not the only politician to depart this week. Home Secretary Suella Braverman also stepped down Wednesday. In her resignation letter, Braverman made it clear she was unhappy with the direction of Truss’s government. Truss’s top aide, Jason Stein, had been suspended after “anonymously” criticizing fellow Conservative lawmakers to reporters. Truss also appointed Edward Argar as Treasury chief secretary to replace Chris Philp in the Treasury’s second most important job which includes management of public spending.

Truss’ resignation sent the pound into a tailspin that left it briefly near parity with the dollar and forced the Bank of England to intervene in bond markets to stave off the collapse of pension funds and sent mortgage interest rates soaring.

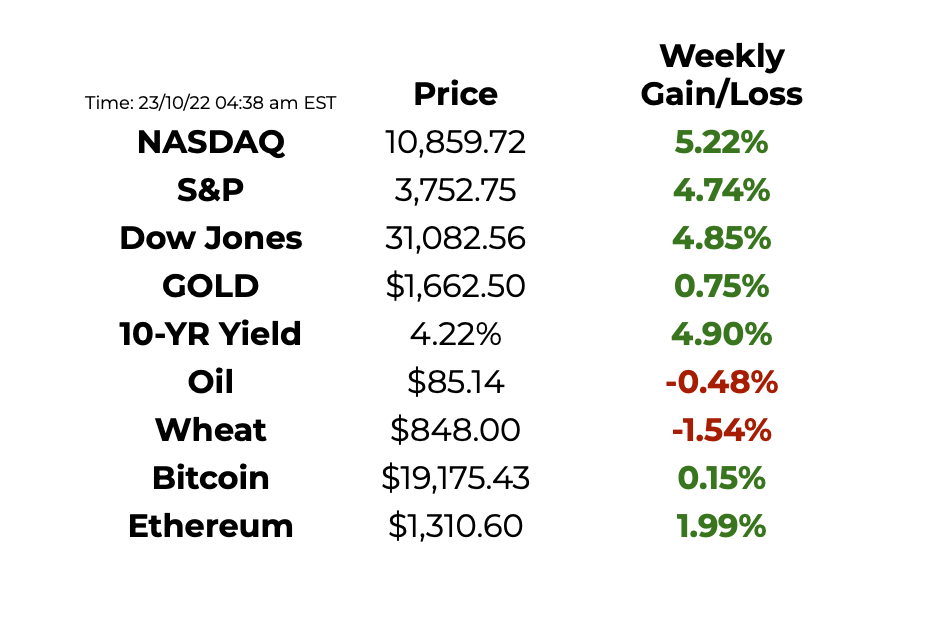

This Week By the Numbers 📈

Top Stories 🗞️

Kanye West bids to buy ‘free speech platform’ Parler

Kanye West, the musician now legally known as Ye, is buying Parler, a social media platform that styles itself as a “free speech” alternative to Twitter. The acquisition was announced by Parler in a press release, which said that it has entered into an agreement in principle with Ye that’s expected to close later this year. “In a world where conservative opinions are considered to be controversial we have to make sure we have the right to freely express ourselves,” said Ye in a press statement.

Stablecoin Issuer Tether to Make USDT Available at 24,000 ATMs in Brazil

Stablecoin issuer Tether will make tether (USDT) available at 24,000 ATMs in Brazil starting Nov. 3, the firm said Thursday. Tether will enable the conversion of USDT to Brazilian reals through an agreement with Brazilian crypto services provider SmartPay, which is integrated with TecBan, a local company that owns 24,000 ATMs under the brand name of Banco24Horas. Users will be able to send USDT from any wallet – including exchanges – to an ATM, SmartPay CEO Rocelo Lopes told CoinDesk. Beginning in February, the company will allow users to deposit Brazilian reals at ATMs and receive USDT in their wallets.

Crypto Exchange Coinbase Waives Fees for Converting Between USDC and Fiat, Eyeing Global Audience

Publicly traded crypto exchange Coinbase (COIN) will waive commission fees for USD coin (USDC) sales and purchases made in any fiat currency in a push to promote the wider global adoption of its stablecoin, it said in a blog post-Thursday. The company's policy change is effective immediately. “Users usually have to pay fees in the process of converting their local currency into USDC, and this is a barrier to broader international adoption,” the post read. “The way to correct this, and accelerate the adoption of USDC internationally, is by establishing global parity for all users.”

Mobile bank N26 launches cryptocurrency trading with Bitpanda partnership

German fintech N26, valued at $9B, launched crypto trading on its mobile app. Starting from Austria and rolling out to other countries in the upcoming months, N26 Crypto will let its customers buy and sell 200 cryptocurrencies, including Bitcoin and Ether. The Berlin-based fintech announced on Oct. 20 that the launch in Austria addresses “strong local demand,” with 40% of N26 users actively trading or expressing interest in investing in cryptocurrencies. N26 plans to roll out its crypto trading service to other key markets in the next six months.

Polkadot co-founder Gavin Wood steps down as CEO of Parity

Gavin Wood, the co-founder of Polkadot, is stepping down as the CEO of blockchain infrastructure company Parity Technologies. Parity is the development company behind the Polkadot ecosystem. In a statement released on Oct 21, Wood shared that he never desired the CEO role. Although he could act as one for an interim period, it was not a position where he saw himself finding “eternal happiness.” In his statement, Wood announced that the co-founder of Parity, Björn Wagner, will replace him as the new CEO. Wood also shared that he will remain the company’s majority shareholder and will take on the title of chief architect.

Further Reading 🤓

This week, I’m reading a primer developed by Amy Luo, Partner at DIGITAL, on the regulatory considerations of gaming, metaverse, and NFTs.

As the global gaming industry balloons to $336B in 2021, Web3 gaming explodes as the fastest-growing category (growing 2000% this year). Web3 gaming, however, faces its own legal and regulatory challenges. Very little has been written on the topic, despite regulatory uncertainty being the largest pain point for our industry.

You can check out the primer here - AmyMadison.xyz

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

Tatiana Koffman

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I believe in empowerment closing the financial education gap and creating equal opportunity for the next generation. I have invested in 20+ companies and funds. Check out my portfolio here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.