Myth Of Money: China is Coming

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

Dear Investors,

Brian Armstrong, CEO of Coinbase, the largest cryptocurrency exchange in the United States, has been reaching out to powerful American officials, warning that “the U.S. will need to be a major player in crypto to stay relevant long term.”

It was revealed that a few days before the US Federal Reserve chair Jerome Powell announced that they were considering a CBDC, he met with Brian Armstrong. While the contents of the meeting are not available, Armstrong has also met lawmakers including US House of Representatives Speaker Nancy Pelosi.

Armstrong published a summary of the meetings in a thread on Twitter:

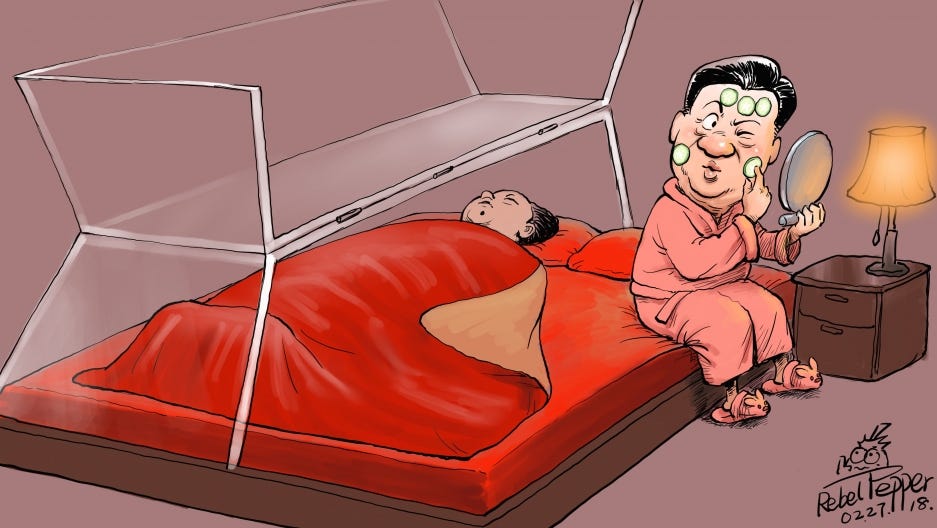

About 1.5 years ago I did a deep dive into the digital yuan initiative for Forbes. Below are some highlights to catch you up on the initiative.

FORBES: How China Will Take Over The World

Post-War Economics

The single most transformational economic event over the last century was World War II (1939-1945). As governments overprinted and overspent money on defense, many European nations were faced with financial bankruptcy and saw their currencies significantly devalued. And when the war was finally over, their balance sheets were far too weak to rebuild infrastructure or meaningfully participate in international trade.

In 1944, in an effort to stabilize the global economy, many of the world's leaders came together at a gathering in Bretton Woods, New Hampshire to introduce the Gold Standard. It was decided that most of the world’s currencies would become tied to the US Dollar at a fixed exchange rate, which in turn would be backed by gold held in vaults. A new entity, the International Monetary Fund (IMF) was created to police these exchange rates, while all participating countries would ship their gold to the U.S.

The IMF then created the Special Drawing Right (SDR) which, rather than representing a currency per se, was designed to represent a unit of account or exchange. For example, at the time of writing, 1 SDR = 1.38 USD. Today, the SDR is based on a basket of currencies which includes the US Dollar, the Euro, Japanese Yen, the Pound Sterling, and most recently, the Chinese Yuan.

After the Gold Standard was introduced, the post-war period between 1945 and 1970 was perhaps the greatest period of economic stability and prosperity of the last century. Countries were investing heavily in infrastructure and manufacturing, which provided well-paying jobs, giving rise to the middle class popularized by suburban America. It was during this time that the U.S. assumed its world dominance in the political sphere, largely due to the lingering weakness of recovering European economies and their lack of infrastructure and manufacturing capacity.

In 1971, Nixon abolished the Gold Standard to continue funding war efforts in Vietnam, and the world has not been the same since. The US Dollar remained widely regarded as the global reserve currency. But beginning in 1995, many European countries started using the Euro instead, which was meant to unify the European region through trade.

China started working on its own currency ascension plan to stimulate its trade and economic growth between 1994 and 2005, when it pegged the Yuan to the US Dollar. Widely regarded as an economic miracle, China embraced widespread centralized economic reforms, averaging a GDP growth of 10% annually and lifting half of its 1.3 billion people out of poverty. China is projected to surpass the United States as the world’s largest economy in the next decade. In 2016, the Chinese Yuan was the first emerging market currency to be allowed into the IMF SDR basket and by 2019 became the 8th most traded currency in the world.

The New Cold War

The growing might of China has put Western powers on high alert. But, the next cold war will not be fought by exerting dominance in the physical world, but rather in the digital one. Data has become more valuable than oil. Modern societies are now powered using oceans of data, with Facebook and Google at the forefront, and companies like Palantir in the background. These companies have more knowledge and power than governments have ever had, but lack the same level of responsibility to its ‘citizens’. They are our new multinational multilaterals.

In the physical world, the U.S. is known for weaponizing its currency, using sanctions (12 countries today and counting) to alter global behavior. But in the digital world, it simultaneously wages war on its own tech companies with regulations, effectively and unwittingly disabling the very tools that could help it achieve lasting global dominance. One such effort is the proposed Democrat house bill “Keep Big Tech out of Finance Act.” This bill directly targets companies such as Facebook, Amazon, and Google to prevent them from creating their own ‘corpo-currencies’. A similar effort to fight U.S. big tech was undertaken in Europe with the GDPR.

While our governments increasingly make attempts to regulate data, they haven’t quite figured out how to regulate money that isn’t tied to borders. Governments can forbid the usage of bitcoin and other cryptocurrencies, as Russia and China recently did, but since the transactions are designed to disintermediate central authority, the ban has only made its citizens more drawn to it.

China’s answer was not just to ban bitcoin, but to give its people an alternative - the DCEP (Digital Currency Electronic Payment). China becoming the first country to create a central bank backed digital currency shouldn’t come as a surprise. After all, this is a country that has a wider penetration of digital payments than any other region in the world.

WeChat, a popular Chinese chat and peer-to-peer payment app, has surpassed 1 billion users and accounts for 34% of total mobile traffic in China. The app appears to be popular among non-Chinese users as well, particularly in Asia and Africa. Consumers can pay for their every day expenses and make peer-to-peer payments with WeChat. As one of the 5 entities committed to using the DCEP, it is already accepted by most merchants, with paper bills rarely used. Even the homeless proudly display their QR codes in the streets.

China has already penetrated the global market by manufacturing the majority of the world’s consumer products. What happens when it creates the most efficient (and legal) payment system in the world and forces us to use it when buying its goods?

And just like that, the U.S. faces a real threat of no longer being the global reserve currency.

Digital Payments in Emerging Markets

Enter Facebook, a company with 2.4 billion users and a reputation for misusing user data. The giant also owns a popular messaging app, WhatsApp, with 1.5 billion users. The company has proposed its own solution to unite the world - a digital stablecoin which, upon closer inspection, seems to be modelled after the SDR. Libra’s basket is said to be based on 50% USD, and the rest in Euro, Japanese Yen, Pound Sterling, and the Singapore Dollar, as well as other stable non-currency assets. Facebook has made a point of excluding the Chinese Yuan, drawing a noticeable line in the sand.

Zuckerberg has acknowledged that Facebook may not have been the best candidate to bring forth a new international currency given its recent issues with privacy and the Cambridge Analytica scandal. But the necessity of such a currency still remains if we hope to slow down the Chinese global footprint.

As far as the U.S. is concerned, the DCEP will be a much greater threat to the ‘western hegemony’ than a Libra coin. A western-led digital currency like Libra would have kept the majority of the planet that lives outside of China’s firewall aligned. But Zuckerberg’s team made two crucial mistakes. First, it did not fully align with the U.S. government before launch, the way WeChat no doubt is aligned with the Communist Party of China, and second, perhaps more crucially, it did not take full advantage of Libra’s impact story in emerging markets.

Libra could have solved these issues and more. For example, many U.S. immigrants run businesses back in their home countries using WhatsApp. Libra would have allowed workers, suppliers, and managers to receive payments straight to their mobile phone and then spend it within their communities using the same app.

Will Coinbase be able to succeed where Facebook failed?

Full article available here.

This Week By the Numbers 📈

Top Stories 🗞

Supermarkets Are Stockpiling Inventory as Food Costs Rise

Supermarkets are stocking up on everything from sugar to frozen meat before they get more pricey, girding for what some executives anticipate will be some of the highest price increases in recent memory. Some supermarkets said they are buying and storing supplies to keep their shelves full amid stronger demand. Grocery sales in the U.S. for the week ended June 19 rose about 15% from two years earlier and increased 0.5% from a year earlier. Stockpiling by food retailers is driving shortages of some staples, grocery industry executives said, and is challenging a U.S. food supply chain already squeezed by transportation costs, labor pressure and ingredient constraints. Read Full Story.

UK Bank Barclays Blocks Payments to Binance

U.K. bank Barclays said Monday it is blocking customers from using their debit and credit cards to make payments to crypto exchange Binance. "With effect from today, Barclays intends to stop credit and debit card payments to Binance," Barclays said in an email to CoinDesk. "This action does not impact on the ability for customers to withdraw funds from Binance." The bank has been contacting customers who have used their cards on Binance this year, advising them it is stopping payments until further notice, according to tweets. The decision follows shortly after the U.K. Financial Conduct Authority (FCA) announced that Binance was not allowed to conduct any regulated activities in the country. Regulators in other markets including Japan and Canada have offered similar warnings in recent weeks, with one in Thailand even threatening criminal charges. Read Full Story.

Richard Branson reaches space on Virgin Galactic flight

Sir Richard Branson, after nearly 17 years of Virgin Galactic development, achieved his dream and reached space on Sunday. “I have dreamt of this moment since I was a kid, and honestly nothing could prepare you for the view of Earth from space,” Branson said after landing. The company’s spacecraft VSS Unity launched above the skies of New Mexico on Sunday, with two pilots guiding the vehicle carrying the billionaire founder and three Virgin Galactic employees. Branson is the first of the billionaire space company founders to ride his own spacecraft. Read Full Story.

Cryptocurrency Could Buy You a 101-Carat Diamond at Sotheby’s

International auction house Sotheby’s will accept payment in Bitcoin or Ether at the sale of a 101.38-carat diamond this Friday, marking another milestone in the adoption of cryptocurrencies. The pear-shaped flawless diamond could fetch as much as $15 million in the single-lot sale in Hong Kong, the most expensive physical object ever publicly offered for purchase with cryptocurrency, according to Sotheby’s. Auction houses are increasingly accepting cryptocurrencies for payment, with Phillips offering a piece from street artist Banksy last month for Ether or Bitcoin. Christie’s also allowed payment in Ether for a set of digital artworks in February. Read Full Story.

Product of the Week: GDA Lending

This week I’m giving a shout out to my friends at GDA Lending. Having recently worked on a loan with them, I can say that they offer the best rates for collateralized crypto loans at 4.5%, with the lowest counter-party risk. If you are looking to borrow against your BTC or ETH, ping me for an intro here.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.