Myth of Money: Coinbase reports $1.8B revenue for Q1

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

Dear Investors,

Coinbase’s first earnings call beat all expectations.

In its highly anticipated direct listing on the NASDAQ on April 14, the crypto unicorn published estimated financial results for the first quarter of 2021 on Tuesday, reporting $1.8 billion in total revenue for the first quarter of 2021.

Key figures:

$335 billion in trading volume, as compared to the $89 billion in Q4 2020

Net income of "approximately $730 million to $800 million" for the period

56 million verified customers and 6.1 million monthly transacting customers

$322.3 million in 2020 profits versus a roughly $30 million loss in 2019

Coinbase's current implied valuation is $121.7 billion

Coinbase indicated that it may spend upwards of $1 billion over the course of 2021:

"Looking to full year 2021, in order to scale our operations and to continue to drive product innovation, we expect our technology and development expenses and our general and administrative expenses to be between $1.3 billion to $1.6 billion, excluding stock-based compensation, in 2021."

Coinbase also indicated that it will boost its marketing spend this year. Full transcript here.

Overall, this is an incredibly bullish signal for us ‘bitcoiners.’

Crypto entrepreneurs are no longer asking the traditional financial system for acceptance. We are simply eclipsing it.

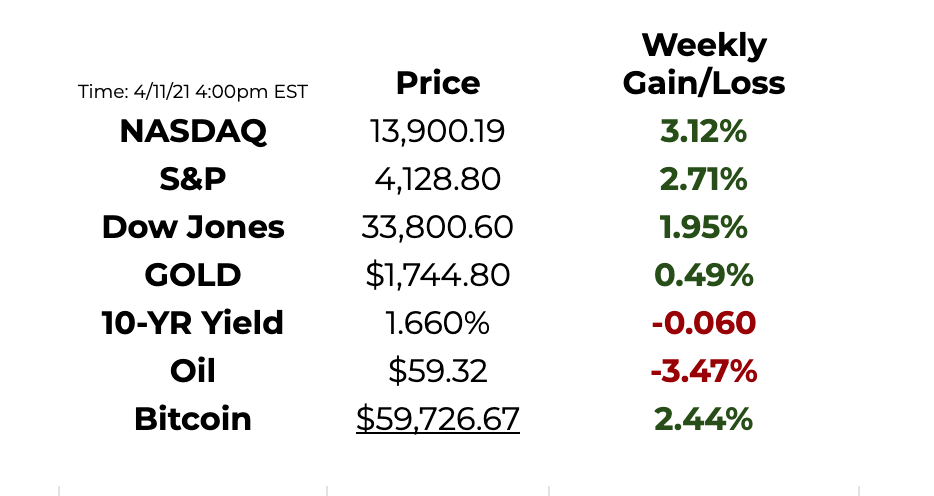

This Week By the Numbers 📈

Stocks continue to be on fire, with the Dow and S&P closing at records. Bitcoin hovered back up over $60,000.

Top Stories 🗞

Sotheby’s Plans Its First NFT Auction With Artist Pak and Nifty Gateway

Top auction house Sotheby’s, established in 1744 in London, has announced its first auction of non-fungible token (NFT) based digital artworks created by anonymous artist Pak, that “scrutinizes our understanding of value.” “The Fungible” Collection by Pak will be taking place April 12-14 on Nifty Gateway, an NFT marketplace owned by Gemini, the cryptocurrency exchange founded by the Winklevoss brothers. The creator of Archillect, an AI built to discover and share stimulating visual media, Pak has been active in digital art for over two decades. In December 2020, they were the first to earn $1 million for their NFT art. Read Full Story.

Sacramento Kings to Offer Bitcoin Salary Option to All Players

The Sacramento Kings are set to become the first major sports franchise to offer a bitcoin payment option to all players and staff, team owner Vivek Ranadivé said on Clubhouse on Monday. The move would strengthen the Kings’ longstanding claim to being one of the most crypto-forward teams in professional sports. The California National Basketball Association team began selling everything from tickets to hot dogs for bitcoin in 2014, and in 2019 launched rewards token for fans. Read Full Story.

DA Davidson Raises Coinbase Price Target to $440 From $195 After Q1 Earnings

Crypto exchange Coinbase’s blowout Q1 earnings results led investment bank DA Davidson to up its price target for the company’s soon-to-be-direct-listed shares by 125%. Rating COIN a “buy,” Davidson raised the exchange’s share price target from $195 to $440, which is a 20x multiple of its expected 2021 revenue. The analysts said the company’s Q1 performance was proof the crypto exchange giant could generate “healthy margins” despite the uncertainty of the bitcoin markets. Davidson estimates Coinbase will have 205.6 million shares outstanding. While that share count may change, it “does imply a $90 billion market cap,” said Gil Luria, head of institutional research at Davidson. Read Full Story.

VIP Investor List 💰

I will start sending out occasional investment opportunities to those on my VIP investor list. Some of these will be fund investments, start-up investments, pre-IPO deals, crypto and digital assets opportunities, exclusive allocations… you get it. If you are an accredited investor and want to be on this list, send me a note.

Product of the Week: GDA Lending

This week I’m giving a shout out to my friends at GDA Lending. Having recently worked on a loan with them, I can say that they offer the best rates for collateralized crypto loans at 4.5%, with the lowest counter-party risk. If you are looking to borrow against your BTC or ETH, ping me for an intro here.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.