Myth of Money: GameStop or GameOver?

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

As I sat down to write this letter, it was difficult to figure out where to start.

Over centuries, we have seen a push-pull dynamic between the “haves” and the “have-nots.” The harsh truth, that no one wants to speak out loud, is that absolutely every centralized system out there is designed to serve those with money, power and status.

Every structure out there is built around some type of story that the elite can tell the masses, and make them believe it is for their benefit.

Dictatorships often push the narrative of the protectorate. Communists preach the myth of equality. Democracies claim that each one of us has a say.

These are all fictions for the benefit of the few, albeit to varying degrees.

The biggest fiction of them all is the story of the free markets.

The “free market” is a very American concept. It embodies the American dream of going from rags to reaches within a short period of time. And as long as a handful of such success stories are occasionally get circulated, the majority will continue to hope and believe in that possibility.

The reality is, the stock market is NOT a free market. It has been rigged for decades - from high frequency trading, to synthetic derivatives to excessive money printing, the stock market has existed for a handful of insiders to make money off of retail investors.

Last week, a couple million redditor’s decided to change the game on a group called #WallStreetBets. They didn’t care about losing money. Most of them just wanted to expose the system for it was.

After realizing that hedge funds shorted the $GME stock 149% of its entire public stock, this group of 2.5 million (now 7 million) realized that pumping the stock price would make the hedge funds who shorted Gamestop bleed. And bleed they did. It is estimated that just Friday alone, the loss was $12.6 billion.

This user’s post summarizes their motivations.

Instead of protesting on the streets like they did in 2008, people decided to hurt the hedge funds where it hurts the most.

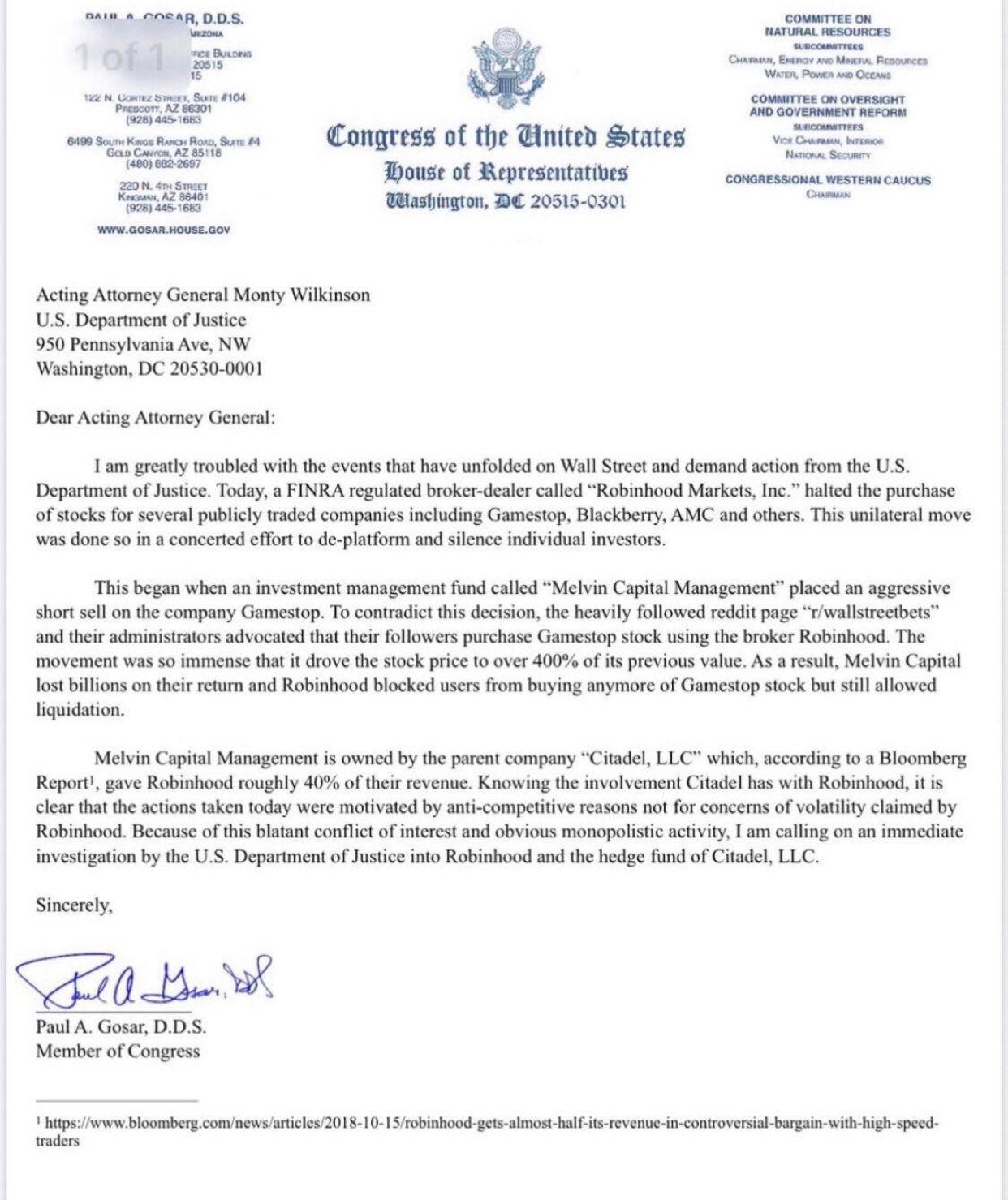

And then, just when we thought it couldn’t get any worse, Robinhood did the unthinkable. They restricted the buying for $GME, which resulted in an outcry and this letter by Congressman Paul Gosar.

Public figures and celebrities took to Twitter to condemn Robinhood and support the #WallStreetBets community. Rapper Ja Rule and former porn start Mia Khalifa called the actions criminal.

And then there was my favorite tweet by, Andreas Antonopolous, a popular Bitcoin educator.

This is class warfare on the elite’s turf. And there is nowhere to go but to fight.

Although the next steps are unpredictable, here are two potential outcomes:

GameStop could get permission from the SEC to issue new stock, and devalue the stock by diluting its supporters. This is the circuit breaker hedge funds are hoping for.

The tug of war continues, increasing market volatility and eventually leading to a market-wide correction. Until now, it was unclear what could drive a correction with such intensive monetary policy in place. But a shaken belief in the stock market, could lead to massive self-off among retailers as well as significant losses by financial institutions.

Here’s another theory. It borders on conspiracy but is supported by some facts nonetheless. One redditor outlines a possibility of counterfeit shares present in the market. This theory was supported on Twitter by Michael J. Burry, the man behind the ‘Big Short’. If true, this would lead to a collapse of the stock market, which will only be brought back to life with new and sweeping regulation. Read full post here.

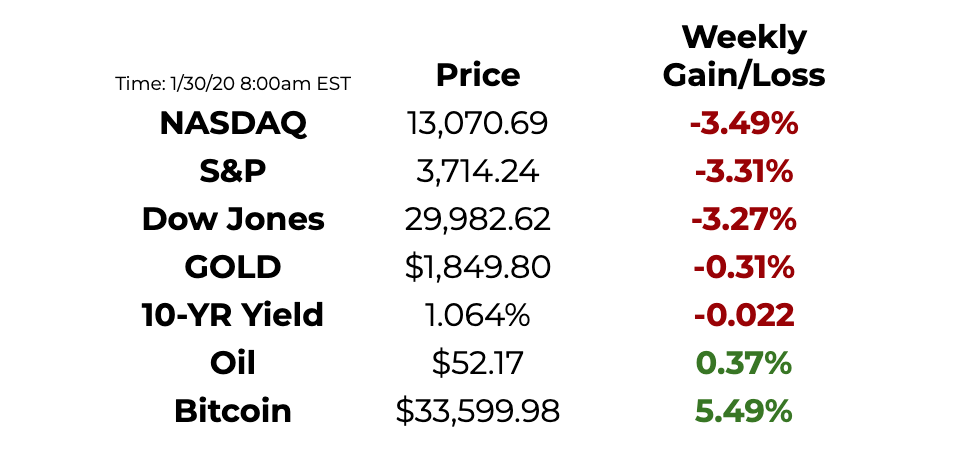

This Week By the Numbers

The markets turned red across the board, amid increased volatility.

Bitcoin made a modest recovery due widespread social media support among figures like Elon Musk, as a remedy to the current broken financial system .

Ray Dalio published a pro-Bitcoin report this week here.

Top Stories

Bill Gross Releases Investment Outlook, "Little Bit Softer Now"

Legendary bond and fixed income investor, William H. (Bill) Gross today released a new Investment Outlook, "Little Bit Softer Now." In his first Investment Outlook of 2021, Mr. Gross writes his favorite current market sector is the natural gas pipeline group, with yields between 9% and 12% for investment grade stocks with certain tax advantages. Conversely, he believes 2020's growth stocks and SPACs "may struggle" while Tesla is "definitely overvalued." Read Full Story.

Ray Dalio's Bridgewater lost $12.1 billion in 2020 - but he's still the best-performing hedge fund manager of all time

Ray Dalio lost $12.1 billion for investors in his firm Bridgewater Associates in 2020, a year when the world's top 20 hedge funds reaped their best returns in a decade thanks to the rapid rebound in stocks in the spring. Nonetheless, Dalio is still the best-performing hedge fund manager of all time, with net gains of $46.5 billion since inception, according to the latest rankings from LCH Investments, which is part of the Edmond de Rothschild group. The top 20 managers of all time made $63.5 billion for investors in 2020, LCH said, the best returns for the group in 10 years. That was half of the $127 billion the industry as a whole made for investors, which was down from $178 billion in 2019. Read Full Story.

India plans to introduce law to ban Bitcoin

India plans to introduce a law to ban private cryptocurrencies such as bitcoin in the country and provide a framework for the creation of an official digital currency during the current budget session of parliament. In the agenda (PDF) published on the lower house website, the legislation seeks to “prohibit all private cryptocurrencies in India,” but allow “for certain exceptions to promote the underlying technology [blockchain] of cryptocurrency and its uses.” The law also seeks to “create a facilitative framework for creation of the official digital currency” that will be issued by the nation’s central bank, Reserve Bank of India. In 2018, an Indian government panel recommended banning all private cryptocurrencies and proposed up to 10 years of jail time for offenders. Read Full Story.

VIP Investor List

I will start sending out occasional investment opportunities to those on my VIP investor list. Some of these will be fund investments, start-up investments, pre-IPO deals, crypto and digital assets opportunities, exclusive allocations… you get it. If you are an accredited investor and want to be on this list, send me a note.

Featured Products

SafePal offers a crypto cold-wallet wallet solution with software level convenience, backed and invested by Binance. The SafePal S1 offers access to built in Binance Spot Trading, DeFi DApp support for UniSwap, 1inch Exchange, Compound, Aave & Curve. Currently priced at $39.99, it is also one of the most affordable hardware wallets on the market as well as the 1st tokenized crypto hardware wallet solution.

Lolli.com lets you earn Bitcoin while you shop at your favorite online retailers like Bloomingdales, Nike, Expedia and thousands more. Check it out here and start accumulating Bitcoin today. [Available only in the U.S.]

Interested in joining the Myth Of Money as a sponsor? Reply to this email to learn more :)

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Tips: BTC @ 1MgfRn8NHnc8ZE5kBvNgYbgpTFShJh5mKK

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.