Welcome to this week’s edition of Myth of Money, a weekly newsletter on the digital asset markets read by 12,000+ investors.

Disclaimer: The following is not intended as investment advice. Do your research.

Dear Investors,

As the American CPI numbers came in at a record 9.1% since November, 1981, the Federal Reserve has continued to stress the importance of raising interest rates.

Whilst economists were expecting an 8.8% increase in June, a shocking record pace inflation was recorded at a 0.3% more than predicted.

The largest monthly increase since 2005 occurred with the broadest inflation rate at a pace of 1.3%, inching up from 1% in may and climbing at a faster tempo than the 1.1% economist predicted.

U.S. stocks were slammed early Wednesday following the hotter-than-expected print. The S&P 500 dropped 1.3% at the open, while the Nasdaq shed 1.7%, and the Dow fell 1.1%. “Core” CPI, which excludes the more volatile food and energy components, rose 5.9% in June, compared to 6.0% in May. Economists expected a 5.7% increase in this measure.

The report's energy index soared 7.5% in June and 41.6% over the last year, marking the largest 12-month increase since the period ending April 1980. Meanwhile, the component of the report tracking food prices increased 1% over the month and 10.4% annually, the biggest 12-month increase since the period ending February 1981.

Notably, the current CPI numbers specifically exclude the rising costs of energy and food, which are the two largest expenditures for everyday American consumers.

But what does this actually mean for the rest of the world?

As American bonds, mortgages and T-Bill rates go up across the board, investors are incentivized to invest in American debt and forego riskier investing in emerging markets. Consequently, developing countries are having a harder time raising funding for basic needs and development by selling their own debt during recessionary conditions. This leads to a shortage of fuel, food and water in these markets, creating a potential death spiral and unrest.

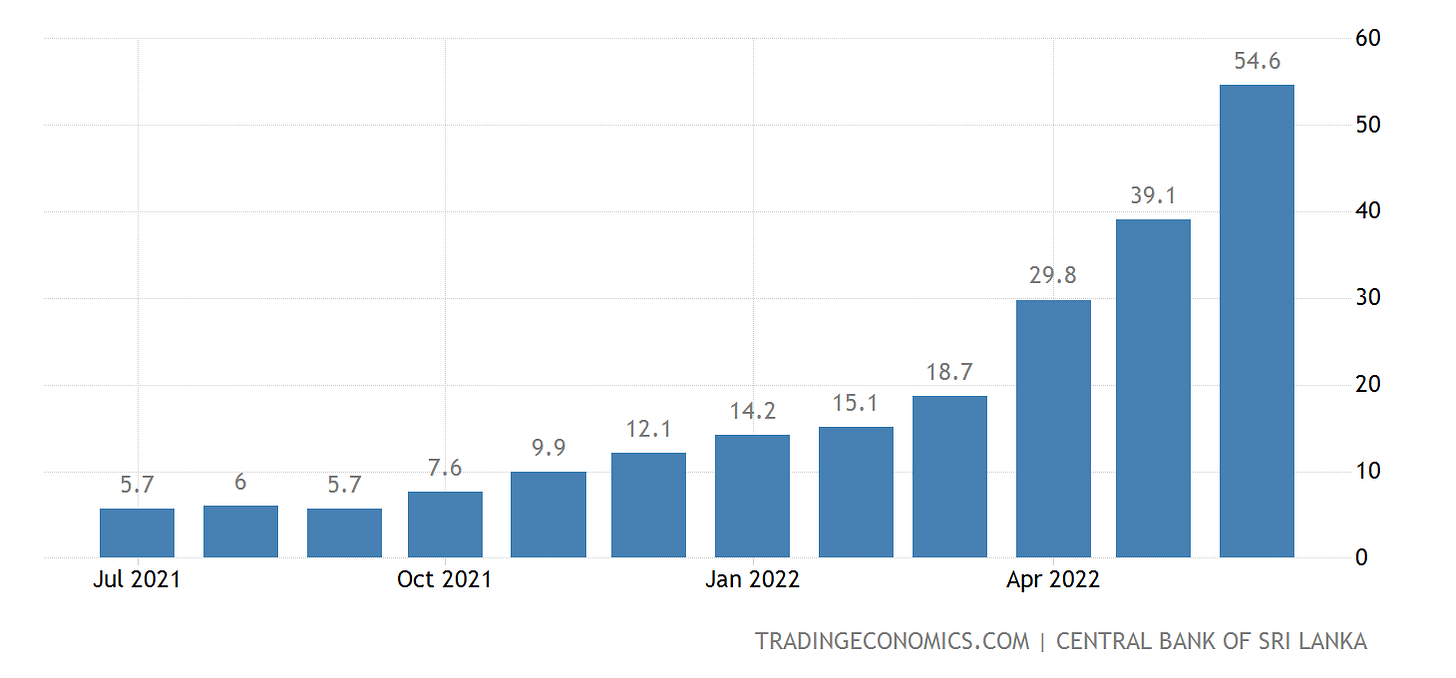

Sri Lankans Rose up as Inflation Soared

Videos of Sri Lankans taking over the President’s house and scaling the walls of the Prime Minister’s office have gone viral. The President has fled to the Maldives. The government has declared a state of emergency. (More in WashingtonPost.)

In one year, Sri Lanka’s inflation rate grew by more than 50%. It rose by 15% just between May and June.

Since March, protests have sprouted in the south asian nation, whose 23 million people are contending with an economic crisis that has led to severe shortages in medicine, fuel and food.

A brief timeline:

March: Protests leading to a state of emergency

April: Clashes between the security forces and citizens leading 10 injuries and 1 fatality

May: Resignation of the Prime minister as further clashes between the police and protesting citizens continues

Last week: the World Food Programme reported a rising figure of 6 million Sri Lankan residents’ inaccessibility to food

Following the resignation of several key government personnel, the protesters appeared victorious but uncertainty looms as it is unsure who would fill the vacuum of power and how they will tackle the inflation rate.

The Nigerian Inflation Crisis

Meanwhile, in Africa’s largest economy, Nigeria, the Annual inflation rate has accelerated for a fifth straight month to an annualized rate of 18.6% in June of 2022, the highest rate since January of 2017, and compared to 17.7% in May. Food inflation surged to 20.6% from 19.5%, mainly due to rising costs of bread, cereals, potatoes, yam, meat, fish, oil and fat, and wine. The Food and Non-Alcoholic Beverages subindex is by far the most important, accounting for nearly 50% of the total weight in the index. Compared to the previous month, consumer prices increased 1.82%, after a 1.78% rise in May.

3 warning signs from the 9.1% red-hot inflation report—and 3 signs of real hope

High headline and services inflation

Headline inflation, which unlike core inflation includes volatile food and energy prices, came in well above economists’ expectations in June. The headline inflation data also revealed a disturbing trend for services inflation.

Broad-based inflation and the soaring cost of rent

Inflation in June was also very broad-based, with core CPI, which excludes volatile food and energy prices, rising 5.9% compared to a year ago. Economists on Wall Street were expecting a 5.7% jump.

Persistent food inflation and a big risk for stock investors

Food inflation also continued to be an issue in June, with the food index rising 10.4% year over year. Food-at-home costs have now jumped by at least 1% monthly for six straight months.

Curt Covington, the senior director of partner relations at AgAmerica, America’s largest nonbank agricultural lending firm, told Fortune that unless energy and commodity prices fall substantially, food inflation will continue to be an issue.

“The biggest impact affecting the agriculture sector, apart from rising interest rates, is inflation in the energy sector and the rising prices of input costs. Increased input costs cut into the already thin revenue margins for the farmer and the additional costs are then passed along to the consumer,” he said. “While the Fed is doing what they can, I anticipate that inflationary pressure won’t ease until sometime next year.”

A few positives

Gas prices are driving inflation—and they’ve been coming down.

First, gas prices were a major contributor to CPI last month, but prices at the pump have come down from highs of over $5 per gallon in June to $4.63.

The lag in the CPI data could be as much as 3 months.

A global, not local, phenomenon

Secondly, inflation remains a global issue. Countries around the world are experiencing rising consumer prices due to the ongoing war in Ukraine, effecrs post COVID-19 lockdowns, and de-globalization.

Other countries are also affected, even more so. Inflation in Argentina topped 60% in May, according to the country's INDEC statistics agency. And economists surveyed by the country’s central bank forecast a nearly 73% annual inflation rate by the end of the year, Bloomberg reported in June.

Some positive expert predictions

Not every economist or Wall Street analyst is predicting doom and gloom when it comes to inflation.

Amberwave Partners’ Stephen Miran said that he expects “core goods inflation to come down to earth” in the months ahead. He pointed to rising inventories at retailers, which will lead to stockpiles of electrical components and other goods, as a key to the incoming reduction of price pressures. And Mark Haefele, the chief investment officer at UBS Global Wealth Management, said in a Wednesday note that he believes inflation will begin to fall in the coming months. Finally, Jay Hatfield, chief executive officer at Infrastructure Capital Management, told Fortune that he expects the strong U.S. dollar will help to push commodity prices lower in the second half of the year, leading inflation to fall.

The Doom Loop

An article aptly titled “The Doom Loop” by Arthur Hayes, yes THAT Arthur Hayes, went viral this week.

To summarize is here, would take me 10 pages. You can read the full article here.

TL:DR;

Arthur lays out a series of geopolitical factors that will lead Bitcoin’s price to go to $1 million per coin.

The shock of cancelling the world’s largest energy producer from the dominant Western financial system cannot be undone. No policy maker globally can ignore the precarious nature of any funds held in Western fiat currencies and their respective assets. Therefore, the Doom Loop’s occurrence is assured. Even if the sanctions were removed today and Russia had free use of its funds once more, the mere fact that such sanctions could (and did) happen serves as a warning to never allow oneself to be put in such a situation again.

At the f(x): maxima and minima, flags will pursue a savings policy mix that includes storing commodities and purchasing gold / Bitcoin. The fact that USD and EUR assets are not part of this mix, combined with entrenched real goods / energy inflation puts the Doom Loop into motion.

The Doom Loop will usher in $1 million Bitcoin and $10,000 — $20,000 gold by the end of the decade…

Bear no malice towards those recalcitrant flags that refuse to learn even after hearing the good word.

As Lord Satoshi said, “Forgive them, for they do not know what they do.”

My Thoughts?

Short term:

Stockpile on dollars, food, and gas. I don’t mean to sound apocalyptic, but some bags of rice and extra cans of chickpeas never hurt anybody. We are heading into a recession and numerous middle-class American families lived on canned food during the 2008 crisis. If you are reading this from a less fortunate part of the world, you know this advice is important.

Additionally, the housing market will correct. It’s already happening. Deals are getting canceled. Mortgages declined. Rents don’t cover carrying costs, etc. So if you have cash, you will be one of the lucky ones to buy a house at a discount.

Long term:

Is it just me or is the pendulum between boom and bust starting to swing a little quicker than before?

I don’t think the current system is sustainable, particularly as entire economies are starting to opt out of the dollar. Bitcoin is likely to take a dip. Not this month. Things are feeling bullish. But sometime during the fall. Be ready to stockpile it then. Because Bitcoin and a self-sustaining farm will be your only insurance against a global collapse.

This Week By the Numbers 📈

Top Stories 🗞️

Ex-OpenSea exec faces up to 20 years in prison over NFT insider trading

A former executive of OpenSea, Nate Chastain, faces up to 20 years in jail after being charged with wire fraud, money laundering and his alleged use of privileged insider information to enrich himself during his time at the leading NFT marketplace. Details of the case published by the US Department of Justice revealed that he was arrested in New York and would be presented in court on June 1, 2022. The authorities indicated that Chastain exploited insider information about NFT listings on the OpenSea platform before it was featured on its homepage. Based on this information, he purchased dozens of NFTs and was able to sell them for two-five times the price of his initial purchase. It was revealed that he was able to hide his actions by making these purchases using anonymous digital currency wallets and anonymous accounts on OpenSea.

Polygon Crypto Jumps on Disney Selection for Accelerator Program

Polygon’s MATIC token jumped after Walt Disney Co. chose it for a business-development accelerator program. MATIC was 1.3% higher Friday morning in Asia after surging 21% on Thursday in the wake of Disney’s announcement that Polygon was one of six companies selected. “The implications for Polygon are significant, given that it was the only blockchain provider chosen,” Walter Teng, digital-asset strategy associate at Fundstrat, wrote in a note Thursday. Since Disney “hasn’t invested or built an in-house crypto solution, the accelerator marks its foray into the digital-asset space.”

USDC Issuer Circle Discloses Its Reserves, Proving Their Liquidity And Availability

On July 14, Circle Internet Financial released its first monthly report on the USDC reserve assets it held in storage as of June 30, 2022. The company revealed that the USDC reserve is held solely in cash and 3-month U.S. Treasuries. This is important because it proves that it has enough liquidity to return all assets in a short period of time in case of a major panic attack or a negative event of any kind. According to Circle’s report, its total reserves are $55.7 billion, divided into two parts; one of $42.122 billion in Treasury bonds and the second in $13.5 billion in cash invested in financial institutions regulated by the United States.

Cardano DEX Sees 54,000% Rise in TVL as Cardano Records Modest DeFi Inflows

Cardano's TVL has been facing a slight increase of 3.12% since Wednesday to stand at 137.21 million (with the inclusion of staking) by Thursday. However, without staking, the TVL only recorded 111.69 million. The overall value of crypto assets placed in a decentralized finance (DeFi) system—or DeFi protocols in general—is referred to as total value locked (TVL). WingRiders is the largest of the Cardano decentralized exchanges tracked by DefiLlama. With approximately $48.99 million in TVL, WingRiders retains 35.71% market dominance.

Celsius bankruptcy filings show a company in deep trouble

Celsius’ bankruptcy filing has revealed some unpleasant surprises about the state of the crypto lending platform, including a $1.2 billion deficit formed largely as a result of user deposits. A chapter 11 bankruptcy document signed off by Celsius CEO Alex Mashinsky on July 14 has revealed that the company holds around $4.3 billion in assets against $5.5 billion in liabilities, representing a $1.2 billion deficit. User deposits made up the majority of liabilities at $4.72 billion, while Celsius' assets include CEL tokens as assets valued at $600 million, mining assets worth $720 million, and $1.75 billion in crypto assets. The value of the CEL tokens has drawn suspicion from some in the crypto community however, as the entire market cap for CEL tokes is only $321 million, according to CoinGecko data. Under Chapter 11 bankruptcy proceedings, the company filing for protection claims ownership of all assets. Under SIPA, a failed firm must either transfer its accounts to another firm or be liquidated and send funds to investors.

Further Reading

This week, OK Cool published an article on how the Metaverse is gaining ground, forming the next big Web3 trend. The report emphasized that hospitality and retail brands should get ready for this change and it into their service offerings. [Download full report HERE.]

Deal of the Week 💰 * Ape Water *

Recently featured in NFT NOW, Ape Water is capitalizing on the recent popularity of the Bored Ape Yacht Club NFTs, Ape Water allows owners of Apes to license their characters and monetize their NFTs by selling…. yup, water. Canned water has taken off as a category, with companies like Liquid Death gaining a valuation north of $500M. Ape Water is an all-American-made sustainable brand sourced from Mt. Shasta, regarded as one of the best water sources on earth.

Ape Water already has support from several key players in the space, including their lead investor, “Pink Dot” a Los Angeles iconic landmark convenience store chain, which also has hundreds of ghost stores distributed through Postmates.

I like this team for its experience in consumer beverages with former executives of some of the biggest beverage brands in the world. I like the concept as it addressed both the NFT trend, as well as sustainability. I like this valuation (seed-stage) and am comfortable with the potential return profile.

If you would like to learn more or participate in my SPV for the deal, please reach out.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

Tatiana Koffman

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I believe in empowerment closing the financial education gap and creating equal opportunity for the next generation. I have invested in 20+ companies and funds. Check out my portfolio here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.

Op doesn't know anything about Sri Lanka but cites in this waffle?