Myth of Money: Instagram NFTs, U.S. Recession, Germany's Relief Plan and more.

Welcome to this week’s edition of Myth of Money, a weekly newsletter on the digital asset markets read by 12,000+ investors.

Disclaimer: The following is not intended as investment advice. Do your research.

Dear Investors,

After 2 years of an experimental hype-bubble, it seems that NFTs are finally hitting the mainstream.

Meta Opens NFT Sharing on Instagram and Facebook to All US Users

Facebook’s parent company META has announced that American users, will now be able to connect their crypto wallets, such as Metamask, to their Instagram as part of the app’s new digital collectibles. NFT functionality on Instagram has been in beta-testing since May and became available to all users in the U.S. on Thursday.

The announcement comes on the heels of the company’s CEO, Mark Zuckerberg, selling an NFT of his childhood baseball card for $105,000.

Meta Platforms pauses hiring, warns of restructuring

Meanwhile, the company also announced that it is cutting down on its expansion and hiring process as a result of the current macroeconomic situation in the country.

"I had hoped the economy would have more clearly stabilized by now, but from what we're seeing it doesn't yet seem like it has, so we want to plan somewhat conservatively," Zuckerberg told employees during a weekly Q&A session, Bloomberg News reported.

Apple Plans to Charge 30% on in-app NFT Sales

As non-fungible tokens have evolved into assets with a range of utilities, a rising number of applications with in-app NFT purchases have been created, including NFT market places and gaming applications where NFTs can represent gaming characters and can be moved between multiple gaming platforms/applications.

Apple is currently allowing NFTs to be bought and sold through apps listed on its marketplace, but at a 30% on all sales. Most developers and consumers believe it is grotesquely overpriced as the standard commission on marketplaces by developers and owners is 2.5%.

Tariffs, such as this, have caused a significant decline in business between Apple and other companies. Reports noted that popular Solana NFT market Magic Eden withdrew its service from the App Store after learning of the policy, even after Apple offered to lower its commission to 15%, though the app continues to be listed on the app store at the time of writing. Meanwhile, other NFT marketplaces on the App Store have reportedly limited functionality due to the hefty commissions.

This Week By the Numbers 📈

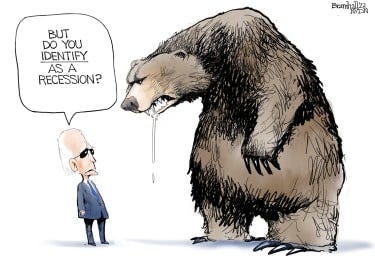

The U.S. Economy shrank by 0.6% last quarter, the second quarter in a row, a third and final estimate from the Bureau of Economic Analysis confirms. The latest report shows that the economy is in a technical recession, despite economists predicting a slowdown.

The current average rate on a 30-year fixed mortgage is 6.85%, compared to 6.39% a week earlier. For borrowers who want a shorter mortgage, the average rate on a 15-year fixed mortgage is 5.95%, up 0.25% from the previous week.

Lumber prices have fallen to their lowest level in more than two years, bringing two-by-fours back to what they cost before the pandemic building boom and pointing to a sharp slowdown in construction. Lumber futures closed at $429.30, down about one-third from a year ago and more than 70% down from their peak in March, when the Federal Reserve began raising interest rates to fight inflation.

Sales of newly constructed homes jumped 28.8% in August from July. This comes after two consecutive months of declines. Some 685,000 new homes were sold last month, at a seasonally adjusted annualized rate, up from a revised 532,000 in July. A year ago, 686,000 newly constructed homes were sold. Meanwhile, the median price for a new home is now $436,800, down from $439,400 the previous month.

Top Stories 🗞️

Telefónica, Spain's Largest Telco, Allows Purchases With Crypto, Invests in Local Exchange Bit2Me

Telefónica, Spain’s largest telecommunications company, is enabling the purchase of products on its technology marketplace with cryptocurrencies. The company activated purchases with crypto on Tu.com after adding a payment feature provided by Spain's largest crypto exchange, Bit2Me. Telefónica has also invested in Bit2Me, the exchange confirmed, adding that more details on the investment will be released in the coming weeks.

Germany Announces a €200 Billion Relief Plan To Cope With Inflation

Germany is announcing a plan to aid its citizens to help combat soaring inflation, according to AP. Nations throughout the world are raising interest rates in an effort to counteract growing inflation. It is believed that several countries, including the UK, are already in a recession. The fund’s announcement came after the news of German inflation hitting double-digit levels for the first time in 70 years. The inflation rate in Germany hit 10.9% in September. According to a preliminary estimate released on Thursday by the federal statistics office, consumer prices in Germany increased by 10.9% in the year to September, picking up speed from an increase of 8.8% in August. The 200 billion euro fund will help consumers and businesses combat the rise in energy prices. This is especially due to the rise in the price of natural gas lured by the Ukraine war.

Federal Judge Orders SEC to Turn Over Hinman Documents in Ripple Case

A Judge of the Federal Court has ordered the SEC to turn over Hinman Documents in the ongoing Ripple case. The SEC previously objected to the order back in July, but must now comply with court orders to hand over the documents. According to the official court order, The objection was overruled today in court by Judge Analisa Torres. The overruling is a big win for Ripple in the case, helping provide additional evidence to support that its native XRP token is a security. The documents in question pertain to a 2018 speech by former director William Hinman. In the speech, he argues that Ether was not a security. The SEC previously argued that the comments from Hinman in the documents didn’t reflect the agency’s policy position. On the other hand, Ripple argues that the internal speech documents are relevant because they “may be used to obtain potential impeachment evidence or to impeach witnesses at trial,” including Hinman, should he testify. Now, these documents mark a potential turning point in the case in Ripple’s favor.

Robinhood Web3 wallet enters beta, taps Polygon as the first blockchain

Crypto and stock trading platform Robinhood announced the launch of Robinhood Wallet, a self-custody, Web3 wallet, with Polygon (MATIC) as its first supported blockchain. Robinhood launched the beta version of its Web3 wallet on iOS. It is being made available to the first 10,000 users who joined the waitlist in May 2022. Hosted first over the Polygon blockchain, Robinhood Wallet allows users to trade and swap cryptocurrencies with no network fees. For Robinhood, Polygon, as a blockchain network of choice, additionally offers scalability, speed, low network fees, and a robust developer ecosystem. Robinhood’s symbiotic relationship with Polygon dates back to August 2022, when the platform added support for MATIC withdrawals and deposits on the Polygon proof-of-stake (PoS) chain.

Do Kwon Is Wanted in 195 Countries, What Happens Next?

The cat-and-mouse chase between South Korean authorities and Do Kwon just stepped up a gear. Prosecutors in Seoul confirmed Monday that the Terraform Labs co-founder had been added to Interpol’s red notice list, effectively making him a wanted fugitive in 195 countries. Bloomberg first reported on the update and the prosecutors have since confirmed the news with multiple publications. Crypto Briefing reached out to the prosecutors, Kwon, and Terraform Labs representatives for comment but had not received a response at press time. The Seoul Southern District Prosecutors’ Office said on September 19 that it had initiated the process of adding Kwon to the international police organization’s wanted list, escalating the manhunt for the central figure behind the failed Terra blockchain.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

Tatiana Koffman

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I believe in empowerment closing the financial education gap and creating equal opportunity for the next generation. I have invested in 20+ companies and funds. Check out my portfolio here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.