Welcome to this week’s edition of Myth of Money, a weekly newsletter on the digital asset markets read by 12,000+ investors.

Disclaimer: The following is not intended as investment advice. Do your research.

Dear Investors,

‘Crypto Twitter’ is a scary place this week with talks of a crypto contagion. The primary fear among investors is that the entire centralized cryptosystem was built on a house of cards, or better yet, a house of unsustainable leverage. Not too dissimilar from the traditional financial system many of us hold in a slightly ‘higher’ regard. But as I always said, crypto is just a caricature of real life. It doesn’t create new problems, it just sheds light on problems that have long existed within human psychology, inefficient government, and corrupt financial institutions across ALL asset classes.

So, what happened at FTX?

On Wednesday, November 2nd, news of a leaked balance sheet from Alameda Research, the investment arm of FTX was shared by CoinDesk.

Just a few days after, the founder and CEO of Binance, Changpeng Zhao, popularly known as CZ, announced his intentions to liquidate $500M worth of FTT gotten from their investment exit from FTX equity last year. (TL;DR: FTT is an exchange token that gives users discounts on trading fees at FTX. The value of this token is purely speculative.)

Crypto Twitter did exactly as CZ planned and perpetuated the panic, thus delivering a bank run and final blow to the platform.

In a now deleted tweet, Sam Bankman-Fried tried to restore calm to the situation by saying all users’ assets were safe in FTX. To curb the panic, the CEO of Alameda Research, Caroline Ellison, declared her intentions to purchase all FTT from CZ at a flat rate of $22 per unit.

CZ declined the offer, further fuelling the panic.

Early hours on Wednesday, a tweet surfaced, to further fuel speculations, on how 173 million FTT tokens worth over 4 billion USD became active on-chain in September.

Later on Wednesday, there seemed to a potential resolution to the situation when Binance submitted a non-binding letter to acquire the FTX exchange.

A significant bullish jump in price was created.

However, a complete U-turn came when Binance announced that they would not go forward with the acquisition.

FTT plummeted.

Not more than a few days after, FTX CEO Sam Bankman-Fried, reportedly losses 94% of his net-worth. SBF was once regarded as one of the youngest self-made billionaires, with an estimated net worth of $26 billion at his peak. SBF was grew FTX from humble beginnings of 7 employees to an enterprise worth $32B with Tom Brady as its spokesperson and FTX having its brand proudly displayed over the Miami Heat area.

Source: Forbes. Pictured Lauren Remington Platt, Sam Bankman-Fried and Gisele Bündchen at the SALT Crypto Bahamas Conference.

So what happened? Did Sam simply fly too close to the sun?

An internal slack memo was leaked and shared on twitter. This memo contained SBF’s thought and message of praise, commendation and a plan to turn things around.

The hope was short-lived, as on Friday, November 11, FTX announced that they will be filing for bankruptcy across FTX International, FTX US and Alameda.

Some investors found a way to get their locked up balances from platform.

Leaked communications reveal that SBF was aware there was trouble behind the scenes and continued to put investor’s capital at risk, either negligently or maliciously.

But SBF was great at creating a compelling story by reputation laundering with politicians and celebrities. SBF even reach out to Elon in a bid to invest in Twitter.

And is if all this wasn’t bad enough, just a few hours after the Chapter 11 filing, FTX gets hacked to the tune of $600M. It is unclear if insider were behind the attack.

Rumor has it that both SBF and Caroline are trying to make their way to Dubai to avoid sanctions.

On Saturday, the SEC opened an official investigation into SBF, FTX and Alameda. How this ends? Only time will tell. But if history is any indicator, the 2008 financial cirisis that left many families destitute through “regulated” means, did not result in any bankers serving time. Bankman-Fried and Ellison both have strong political connections and may avoid any real punishment.

Subsequent trouble for BlockFi

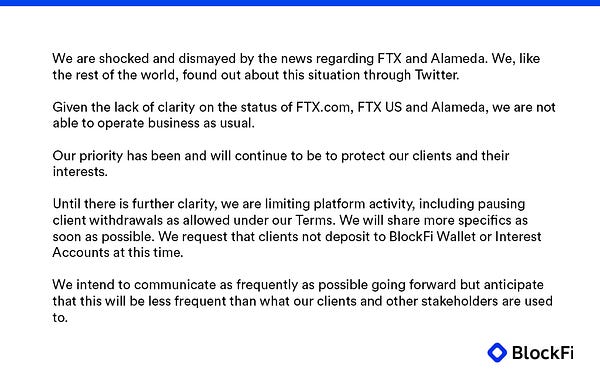

BlockFi, the crypto lender bailed out by FTX earlier this year, has suspended withdrawals only two days after assuring users that it was fully operational.

In a tweet late Thursday, BlockFi said it cannot operate suitably due to uncertainty surrounding FTX.com, FTX US and Alameda Research. Co-founder Flori Marquez had earlier tweeted the firm remained an independent entity despite its bailout deal with FTX — implying that it was mostly unaffected by the exchange’s implosion.

In a recent tweet, information has it that the internal slack channel for the company, BlockFi, has gone mute.

Voyager’s survival was also dependent on FTX, and they are now back in the market looking for other buyers investors.

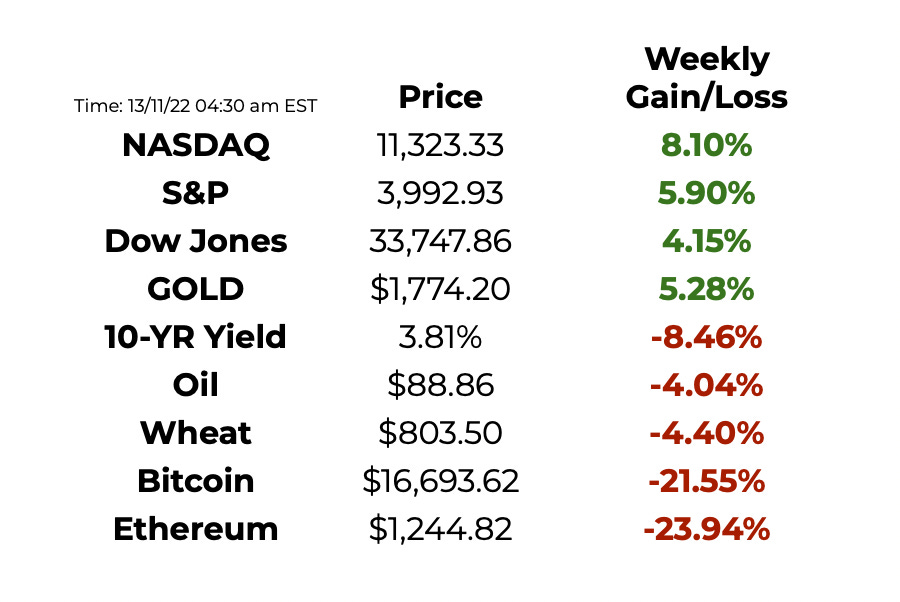

This Week By the Numbers 📈

The Consumer Price Index rose 7.7% for the year ending in October, a much slower pace of increase than the 8% economists had expected and the lowest annual inflation reading since January. The stock market skyrocketed on the news, with Dow futures surging by more than 800 points on hopes the Fed would dial back its aggressive rate hikes. While Fed Chair Jerome Powell said earlier this month that the central bank still has "some ways to go" in its battle to tame inflation, market sentiment is turning positive. Fed funds futures are now pricing in a nearly 80% chance of a half-point increase at the Fed's December policymaking meeting, smaller than the three-quarters of a percentage point increases the Fed announced at the previous four meetings. "The CPI report shows inflation is moving in the right direction," said Eric Merlis, managing director and co-head of global markets at Citizens. "The report provides ammunition for the Fed to begin pricing in sub-75-basis-point tightenings. This will be a welcome development for the Fed."

Year over year, shelter prices are up 6.9%, food prices are up 10.9%, and energy prices are up 17.6%, according to data from the Bureau of Labor Statistics. Costs for staples such as eggs (up 43%), bread (up 14.8%) and milk (up 14.%) remain elevated.

Top Stories 🗞️

Meta joins big tech layoffs, lets go of 11,000 employees

Facebook’s parent company Meta announced that about 13% of its current workforce has been cut in the first mass layoff in the company’s history. In a letter to his employees, Meta CEO Mark Zuckerberg announced the layoffs and also reiterated that the hiring freeze, which began earlier this year, will be extended into the first fiscal quarter of next year. According to the statement published through Meta’s newsroom, the layoffs terminated 11,000 jobs. Zuckerberg says he takes full responsibility for the layoffs, which were caused by soaring costs and a recent collapse of its share price

Tether blacklists $31.4M USDT following FTX's alleged hack

On the night of Nov. 11, several wallet addresses linked to FTX were found transferring millions of dollars worth of cryptocurrencies without an official notice — sparking speculations ranging from the commencement of FTX’s bankruptcy proceedings to the involvement of hackers. Within hours, FTX confirmed on Telegram that the fund transfers were part of an ongoing hack. Following FTX’s confirmation on Telegram about the hack, as shown above, Tether proactively blacklisted $31.4 million worth of USDT tokens linked to the transactions. As pointed out by blockchain investigator ZachXBT, the blacklisted USDT tokens were made up of $3.9 million USDT on Avalanche AVAX and $27.5 million USDT on Solana. Billionaire entrepreneur Elon Musk, who recently purchased Twitter in hopes of unleashing the platform’s full potential, acknowledged Twitter’s contribution in tracking down the FTX developments in real time. By blacklisting the alleged stolen USDT token, Tether disarmed hackers from siphoning the assets to another account or exchanging them for other cryptocurrencies. As part of the remediation, Tether can burn the blacklisted USDT and reissue equal amounts of the asset to the original owner.

Bankrupt Crypto Lender Voyager Reopens Bidding Process Following FTX’s Collapse

Bankrupt crypto lender Voyager Digital is ending the deal to sell itself to FTX US after the latter also declared bankruptcy on Friday. In September, FTX paid $1.4 billion to win a bidding war to acquire Voyager’s assets, beating out other crypto firms including rival exchange Binance and digital asset investment firm Wave Financial. FTX US, along with its international parent company, FTX, and quant trading firm Alameda Research, filed for Chapter 11 bankruptcy protection in the U.S. on Friday after news spread earlier in the week of the company’s massive liquidity crisis. The portfolio of companies is now fessing up to a massive hole of between $10 billion and $50 billion in their balance sheets. A part of that money apparently belongs to Voyager and its customers. In the press release issued Friday, Voyager admitted that it has approximately $3 million currently locked up in FTX, “substantially comprised of locked LUNA2 and locked SRM.” Following FTX’s collapse, Voyager Digital and the Voyager Official Committee of Unsecured Creditors announced on Friday they have reopened the bidding process and are “in active discussions with alternative bidders.”

Binance Proof-of-Reserve pledge gains support following FTX crisis

Following the liquidity crisis of cryptocurrency exchange FTX, Binance CEO Changpeng “CZ” Zhao said his exchange will soon start a Proof-of-Reserves audit system to allow verification of its digital asset holdings. In a Nov. 8 Twitter post, Zhao pledged to implement a Proof-of-Reserve mechanism at Binance to provide “full transparency” through the use of Merkle Trees — a data structure used to encode blockchain data more efficiently and securely. A Proof-of-Reserve audit is ordinarily conducted by an independent third party to ensure the custodian’s assets are owned as claimed.

Crypto.com's Preliminary Glimpse of Token Reserves Reveals 20% in Shiba Inu Coin

The swift collapse of the FTX crypto exchange has sparked an industry push among big rivals to publish proof of their reserves as a means to provide transparency into the assets on their platforms. With those efforts just getting underway, one firm, Crypto.com, has taken the proactive step of providing a preliminary set of disclosures – sharing wallet addresses with the blockchain analysis firm Nansen to create a dashboard of nearly $3 billion of reserves and other assets. What that shows is just how heavily the mix of assets is skewed toward a meme-y token called shiba inu (SHIB), a digital asset built atop the Ethereum blockchain that was largely inspired by the joke token dogecoin (DOGE). The holding ranks second only to the $872 million of bitcoin (BTC), the largest cryptocurrency by market value, which represents 31%. The amount exceeds the $487 million in ether (ETH), the second-biggest cryptocurrency, and dwarfs the $1.5 million in dogecoin, Nansen data suggests. A Crypto.com spokesperson said, "The reason our Proof of Reserves include Shiba is because we hold customers' balances 1:1. Thus, our Proof of Reserves are dictated by our customer holdings."

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

Tatiana Koffman

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I believe in empowerment closing the financial education gap and creating equal opportunity for the next generation. I have invested in 20+ companies and funds. Check out my portfolio here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.

I learned of you through a friend who shares a meditation interest with me. I'm enjoying your content. I'm a very early investor in the company behind unicoin.com. It may interest you for being asset backed by private equity investments it earns for featuring companies on their show, Unicorn Hunters. Also. I'd like to gift you 100 unicoins through their promotion now going on for the holidays.

Best. Todd@planetearth.com

So what do you think? Is this a good culling of the fat or bad?