Myth of Money: Is it Game Over for Bitcoin?

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

Crypto markets have been incredibly volatile this week, with Bitcoin moving several times within the $35,000 to $40,000 range. I have received a lot of questions about whether we are going to see a crash and how to protect yourself, so I have decided to address these below.

Before we begin, I am a true believer in Bitcoin’s potential.

Bitcoin’s positive impact and long-term value, however, do not always correlate to current price.

What is Bitcoin volatility being caused by?

(1) Potential Tether Scandal

For those who are new to the crypto markets, Tether is a stablecoin with a market cap of $24 billion. It is also the most common form of digital dollar used today, frequently utilized by traders to exit positions into dollar-equivalents without leaving the digital world.

The premise behind Tether, is that there is an equivalent number of dollars sitting in a bank, backing its value. Except, this fact has not been verified. (A great essay on this here.)

The regulators have been asking questions for years, and investors are currently awaiting on clarification from the New York Attorney General. If Tether is in fact not fully backed, that means the supply of Tether was artificially inflated, and in turn, so was Bitcoin. If this were to be the case, we could see a collapse of epic proportions.

(2) Market Manipulation

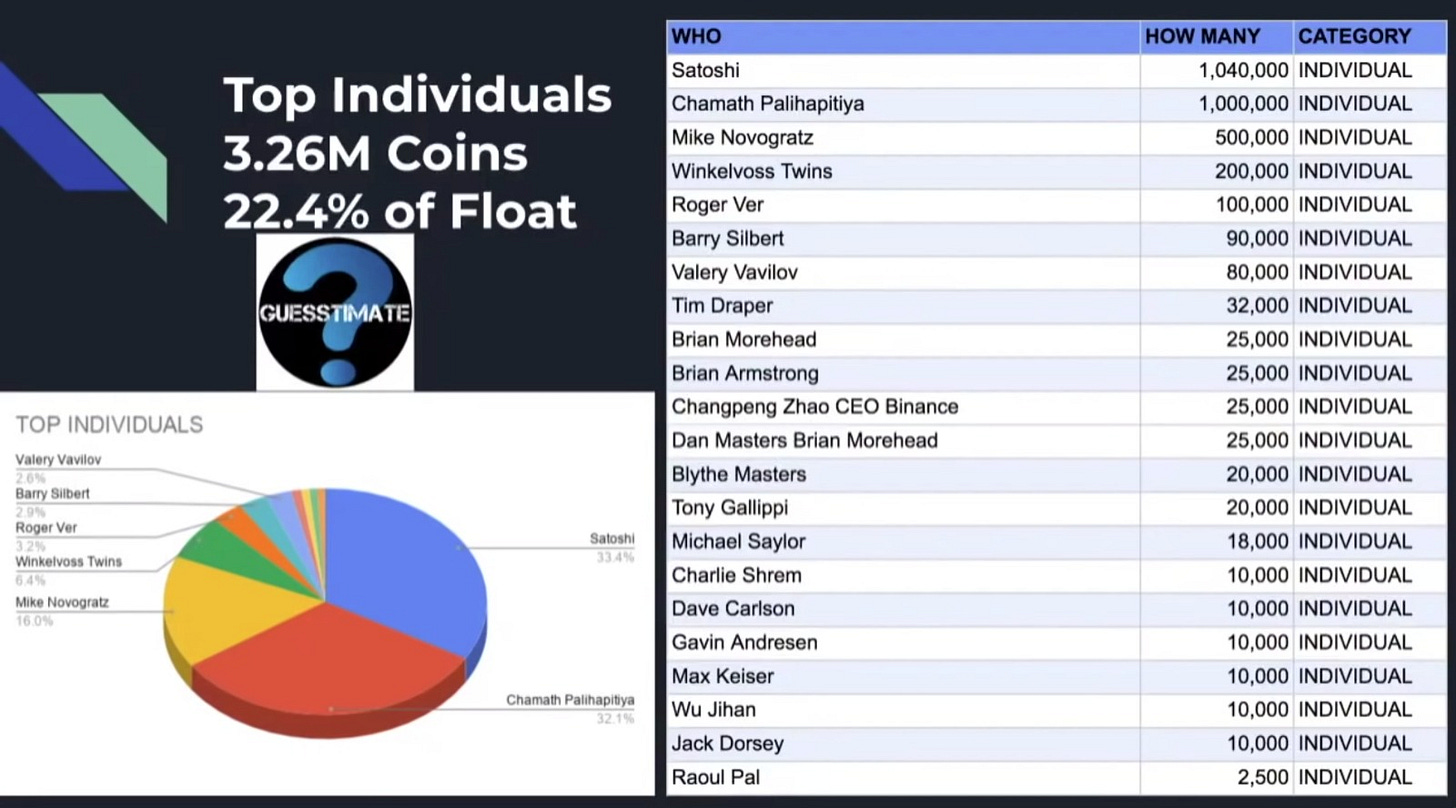

The current market cap of Bitcoin is $654 billion. Even as the asset continues to grow, it is still surprisingly centralized. Let’s look at who are some of the largest holders of Bitcoin that are known to us. (Many more continue to be anonymous.)

These individual holdings are astounding, with investor Chamath Palihapitya holding $35B USD equivalent of the circulating supply.

What would happen to the price of Bitcoin if just two of these individuals got together to flash sell?

(3) Natural Bull Cycle

The final factor to consider is the natural bull cycle in markets. Bitcoin price went up too fast, tripling within 30 days. This type of price action is enough to make any investor a little manic. I personally went through a phase of losing sleep, and checking my accounts every five minutes.

But all euphoria eventually comes to an end, and predictably so.

The following is a graph of the typical bull cycle. I can’t tell you where we are in it with any amount of certainty, but it sure feels like a “bull trap” to me.

The Remedy

Before you panic sell everything you own, consider that most profits are made by staying in the market when times seem tough.

My recommendation is to take some profits. For me, it was 25% of my holdings. I can sleep at night knowing I took some profits from this run and will have dry powder to get back in if there is a massive dip.

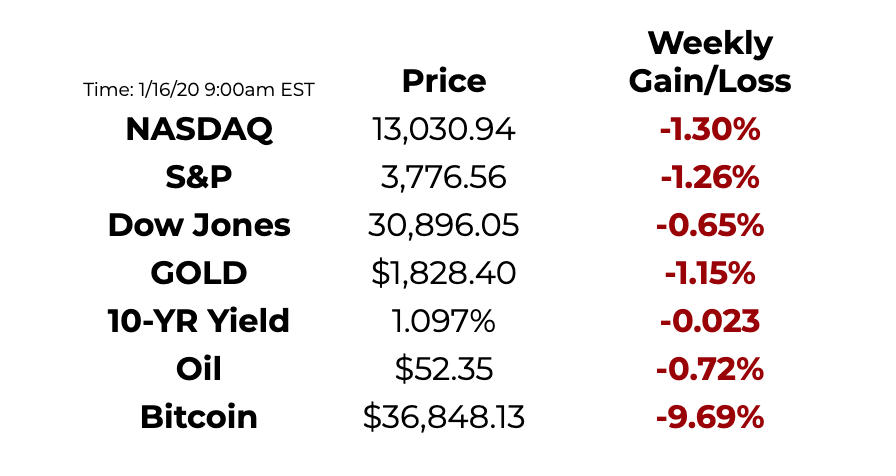

This Week By the Numbers

Markets fell across the board amid a growing divide in America and continued COVID-related restrictions. Investors should have rejoiced at Biden’s speech laying out a $1.9 trillion stimulus plan, but economic data including retail sales and slowing energy sector continue to pull down the economy.

Quick summary of President Elect Joe Biden’s new $1.9 trillion stimulus package:

$25 billion for rental assistance

$5 billion for overdue water and energy bills

Extension of the nationwide eviction moratorium

$350 billion for local, state and tribal governments

$2,000 stimulus check for taxpayers and their dependents

Enhanced unemployment benefits of $400 per week

$160 billion provision for the nationwide vaccination effort

Emergency paid leave for 106 million people

$15-per-hour national minimum wage

Top Stories

Cathie Wood’s ARK Invest plans ‘ARKX’ space exploration ETF to tap the growing industry

Ark Invest plans to add a “Space Exploration ETF” under the ticker ARKX, according to a securities filing on Wednesday. While the ETF’s constituents have yet to be announced, shares of space companies Virgin Galactic and Maxar Technologies each jumped in after-hours trading. The Space Exploration ETF would focus on companies that are “leading, enabling, or benefitting from technologically enabled products and/or services that occur beyond the surface of the Earth,” the filing said. Read Full Story.

Andrew Yang kicks off NYC mayoral campaign with $2,000 basic income proposal for poorest

Former Democratic presidential candidate Andrew Yang made his first appearance as a New York City mayoral candidate on Thursday, proposing a basic income program for the city’s poorest. “We will launch the largest basic income program in the history of the country,” Yang stated. “We will lift hundreds of thousands of New Yorkers out of extreme poverty, putting cash relief directly into the hands of the families who desperately need help right now.”Yang’s plan, a modified version of his national universal basic income (UBI) proposal, would involve providing roughly 500,000 New Yorkers “who are living in extreme poverty with an average of $2,000 per year.” Read Full Story.

Anchorage Becomes First OCC-Approved National Crypto Bank

Crypto custodian Anchorage has secured conditional approval for a national trust charter from the U.S. Office of the Comptroller of the Currency (OCC), making it the first national “digital asset bank” in the U.S. The safekeeping, management and trading of digital assets have been regulatory stumbling blocks for large financial institutions – but those obstacles are gradually being removed. The OCC, a part of the Treasury Department charged with keeping banks safe but also competitive, has now issued three interpretative letters that lay the groundwork for banks to custody crypto, participate in blockchain networks and become payment providers using the tech. Read Full Story.

Crypto Platform Bakkt to Go Public Through Blank-Check Merger

Bakkt Holdings LLC, the cryptocurrency platform majority-owned by Intercontinental Exchange Inc., plans to go public through a merger with blank-check firm VPC Impact Acquisition Holdings. The deal values Bakkt at approximately $2.1 billion. Gavin Michael, the former head of technology for Citigroup Inc.’s global consumer bank, will join Bakkt as its chief executive officer. Bakkt, founded in 2018, is planning a widespread rollout of a mobile app in March that would allow consumers to use the $1.2 trillion held in cryptocurrencies, loyalty points and gift cards at more stores. In exchange, merchants are promised a lower cost for payment acceptance. Read Full Story.

VIP Investor List

I will start sending out occasional investment opportunities to those on my VIP investor list. Some of these will be fund investments, start-up investments, pre-IPO deals, crypto and digital assets opportunities, exclusive allocations… you get it. If you are an accredited investor and want to be on this list, send me a note.

Featured Products

SafePal offers a crypto cold-wallet wallet solution with software level convenience, backed and invested by Binance. The SafePal S1 offers access to built in Binance Spot Trading, DeFi DApp support for UniSwap, 1inch Exchange, Compound, Aave & Curve. Currently priced at $39.99, it is also one of the most affordable hardware wallets on the market as well as the 1st tokenized crypto hardware wallet solution.

Lolli.com lets you earn Bitcoin while you shop at your favorite online retailers like Bloomingdales, Nike, Expedia and thousands more. Check it out here and start accumulating Bitcoin today. [Available only in the U.S.]

Interested in joining the Myth Of Money as a sponsor? Reply to this email to learn more :)

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Tips: BTC @ 1MgfRn8NHnc8ZE5kBvNgYbgpTFShJh5mKK

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.