Myth of Money: Is the U.S. Dollar at risk?

On this week's edition of the Myth of Money, we discuss interest rates, government debt, decline of the stock market, and of course, Bitcoin.

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ subscribers.

Disclaimer: The following is not intended as investment advice. Do your own research.

Now let’s dig in…

The Fed:

What a week. On Wednesday, Federal Reserve Chairman Jerome Powell took the stage yet again with a solemn tone.

Key Takeaways:

Fed will keep rates low until inflation holds above 2%, so expect near-zero to negative interest rates well into 2023.

Expect more fiscal stimulus from congress, as there are 11 million people still out of work that will require financial support.

Remember, inflation is correlated to full employment. So long as millions of Americans continue to be unemployed, the USD is not at risk of high inflation or hyper-inflation.

Housing Market:

Pay close attention to the housing market. With 0% rates for the next 3 years, many folks will take advantage to finally get into the market, but it may not be in the geographies you expect. Small towns and suburbs offering a better quality of life and ‘work-from-home’ set-ups will continue to boom, while cities may see slower growth. (Check out homebuilder indices such as $NAIL to invest in the upcoming construction and housing boom.)

Ray Dalio on the U.S. Dollar:

On Tuesday, Ray Dalio gave an interview to Bloomberg on $USD and alternative currencies.

Dalio emphasized that at a time of currency uncertainty, the best stores of wealth are equities, gold and other asset classes that rise in value. [Real estate is another good option.]

U.S. continues to rely on government debt to fund much of its recovery by selling government treasuries. Dalio contends that if too many people buy safety assets such as gold and equities, and choose to sell their bonds as interest rates remain low, the government would be forced to go on the defensive to continue to borrow. This means artificially raising interest rates and stifling an already struggling economy.

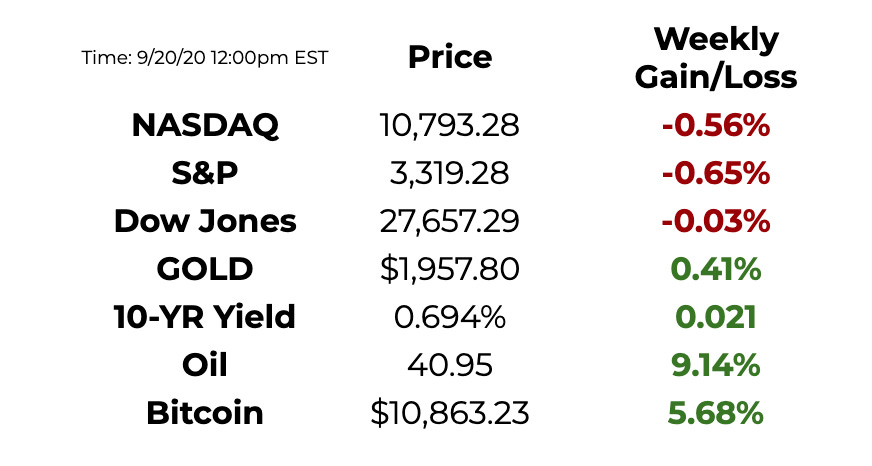

This Week By the Numbers

American stocks hit a six-week low as technology shares continued to decline. The S&P fell for a third day. The dollar strengthened and treasuries yields remained stable. The tension between FOMO and uncertainty is real. Could the markets continue pushing higher or will they retreat to represent the current state of the economy?

Consumer sentiment rose to its highest level since March, but data shows we still have a long way to go before consumers are convinced that we are in a real recovery. A true recovery is unlikely until we have a vaccine or the virus ‘disappears’. Consider still heavily depressed sectors such as oil and airlines as you set up your trades for 2021.

Bitcoin is recovering after a major sell-off, hovering around the $11,000 mark all week, while #DeFi traders continue to collect yield on transactions that make little sense, such as the UniSwap airdrop.

Top Stories

Trump Blesses Oracle’s TikTok Deal, Delays App Store Ban

Donald Trump gave his blessing to Oracle Corp.’s bid for the American operations of TikTok, putting the popular video-sharing app on course to escape a U.S. ban imposed as part of his pressure campaign against China. The new company, which will be called TikTok Global, has agreed to funnel $5 billion in new tax dollars to the U.S. and set up a new education fund, which Trump said would satisfy his demand that the government receive a payment from the deal. Oracle plans to take a 12.5% stake in the new TikTok Global, while Walmart Inc. said it has tentatively agreed to buy 7.5% of the entity. TikTok’s Chinese owner ByteDance Ltd. is seeking a valuation of $60 billion. Read Full Story.

Business Analytics Firm MicroStrategy To Rely On Bitcoin As Primary Treasury Reserve Asset

MicroStrategy Incorporated (NASDAQ: MSTR), in a filing with the United States Securities and Exchange Commission, disclosed that it would adopt a new Treasury Reserve Policy with renewed treasury management and capital allocation strategy. The policy indicates that the company is bullish on Bitcoin and that the open-sourced digital asset would be treated as an important component of the treasury reserve assets. The company expressed its belief that the virtual currency powered by a public blockchain is superior to cash over the long term. Its current Bitcoin balance is $425 million. Read Full Story.

Justice Ruth Bader Ginsburg, Champion Of Gender Equality, Dies At 87

Justice Ruth Bader Ginsburg, the demure firebrand who in her 80s became a legal, cultural and feminist icon, died Friday. The Supreme Court announced her death, saying the cause was complications from metastatic cancer of the pancreas. The court, in a statement, said Ginsburg died at her home in Washington, D.C., surrounded by family. Architect of the legal fight for women's rights in the 1970s, Ginsburg subsequently served 27 years on the nation's highest court, becoming its most prominent member. Her death will inevitably set in motion what promises to be a nasty and tumultuous political battle over who will succeed her, and it thrusts the Supreme Court vacancy into the spotlight of the presidential campaign. Read Full Story.

Kraken Becomes First Crypto Exchange to Charter a US Bank

On Wednesday, the Wyoming Banking Board voted to approve the San Francisco-based crypto exchange’s application for a special purpose depository institution (SPDI) charter. Kraken is now the first SPDI bank in Wyoming. According to the Wyoming Division of Banking’s general counsel, Chris Land, Kraken will also be the first newly chartered (de novo) bank in the state since 2006. In addition to more products, Kraken Financial will give Kraken the ability to operate in more jurisdictions. As a state-chartered bank, Kraken now has a regulatory passport into other states without having to deal with a patchwork state-by-state compliance plan. Read Full Story.

This Week in Forbes: Your Mom’s Guide to Bitcoin

It’s finally here - the #Bitcoin for Beginners Guide you’ve been waiting for. This super easy to follow FAQ answers the most commonly asked questions about the digital currency.

Interested in AI and Healthcare?

The STEMM MIT CSAIL AI in Healthcare Summit is taking place virtually on October 1-2. Scientists, AI researchers, healthcare experts and business leaders will come together to discuss critical healthcare challenges, collaborate to minimize the damages, and find preventive measures. Co-hosted by MIT’s Computer Science & Artificial Intelligence Laboratory and STEMM Global Scientific Community.

To learn more about the event, please visit: https://stemm.ai/

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Tips: BTC @ 1MgfRn8NHnc8ZE5kBvNgYbgpTFShJh5mKK

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.