Myth of Money: Jay-Z and NFT's?

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

Join Us On Clubhouse 🎤

“Crypto in Africa” - featuring special guests Chi Nnadi (Sustainability International) and Ray Youssef (Paxful).

Sunday (TODAY): 11am PST, 2pm EST, 7pm GMT, 11pm UAE CLICK HERE TO ADD TO CALENDAR

This week’s big news was Square’s purchase of Tidal, a “for artists, by artists” music platform founded by Jay-Z.

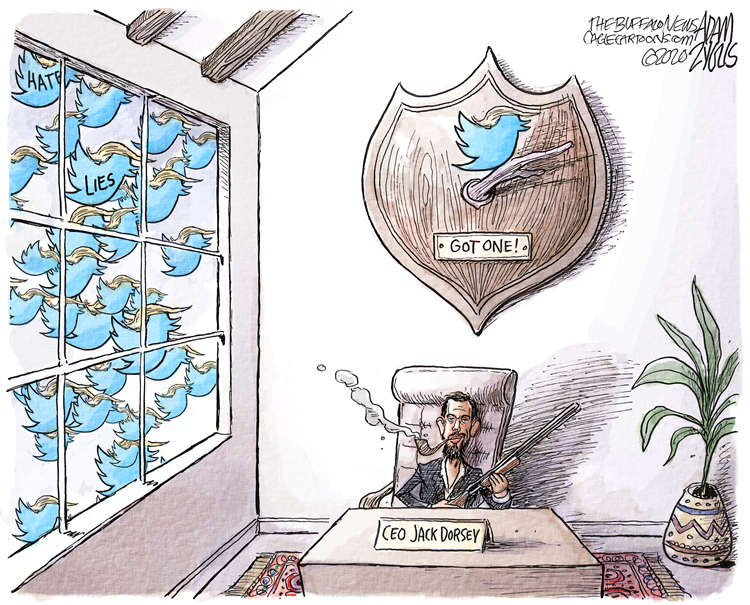

Spectators were confused by the move by Square, the financial services company run by Twitter co-founder and CEO Jack Dorsey. The company paid $297 million in cash and stock for a “significant majority” of Tidal. Dorsey announced that Square intends to create “entirely new listening experiences” and “new complementary revenue streams.” This was vague to say the least.

A quick recap of the Tidal story by Vox:

In 2015, Jay-Z bought an obscure Norwegian streaming service for $56 million, rebranded it, and launched it as an “artist-owned” streaming service. The idea was that Jay-Z had recruited other artists — like his wife Beyonce as well as Madonna, Rihanna, Daft Punk, and Kanye West — as partial Tidal owners, and Tidal would distinguish itself from competitors like Spotify by offering exclusive music on the service.

But in most cases, the artists involved in Tidal didn’t own their own music — big music labels did — so they couldn’t make their music exclusive on Tidal. And even the ones who did have that power, like Jay-Z, eventually relented and put their stuff on competitive services because that’s where all the listeners were.

Given Tidal’s original goal of providing artists with ultimate control, the most popular theory is that Dorsey will utilize the music brand to work on their own NFT platform.

And if you’ve been living under a rock…

NFTs (non-fungible tokens) are blockchain-enabled digital pieces of art, music, GIFs or any other collectable. The idea is that these digital items are unique or created in limited quantity, and cannot be replicated further. Think of NFTs as baseball trading cards on the blockchain.

We can imagine a world where Jay-Z and other artists are selling songs and digital merchandise through Square’s payment platform. As the NFT mania booms we can expect more of these deals. In fact, Kings of Leon just launched their new album as an NFT.

Blockchain offers a path for less established artists to raise for their craft from the public.

But don’t get too excited. The current NFT mania is smelling a lot like the ICO frenzy of 2017, and many consumers and investors will get burned. Square paying $300 million for a failed music service feels like we could be reaching the top.

This Week By the Numbers 📈

As the economy begins to recover on hopes of wide-spread vaccination, the stock market, particularly the tech sector is seeing a decline, third week in a row. On Friday, the NASDAQ closed negative over the 1 year time horizon.

It appears that good news for the economy is in fact bad news for the stock market.

This seems to make little sense, until you look at market mechanics a little more closely. As the economy begins to recover, long-term yields and the cost of borrowing begins to rise. With less cheap money to go around, investors have less to put back into the stock market.

Yields are expected to continue rising, particularly as the minimum 10% cash reserve requirement for banks is set to be re-instated on March 31st, requiring banks to borrow more.

We are also witnessing a “sector rotation”, where inflated tech and innovation stocks are correcting, while oil, real estate and consumer goods companies are recovering.

30-year mortgage rates have crossed 3% for the first time in the last year, indicating a potential softening in the housing market.

There are concerns that inflation is being underreported. Businesses are recording a 5-7% increase in price of goods, while Powell insists that we have yet to hit the 2% target, measuring at a current 1.4%.

Investors are waiting to see if the Fed will try to push long-term yields down by purchasing longer-term bonds and if the new $1.9 stimulus bill will have the desired positive effect on the markets.

Top Stories 🗞

Senate passes $1.9 trillion Covid relief bill, including $1,400 stimulus checks, with no Republican support

The Senate passed a $1.9 trillion coronavirus relief package Saturday, capping off a marathon overnight session after Democrats resolved internal clashes that threatened to derail President Joe Biden's top legislative priority. Legislation includes $1,400 stimulus checks, $300-per-week jobless benefits through the summer, a child allowance of up to $3,600 for one year, $350 billion for state aid, $34 billion to expand Affordable Care Act subsidies and $14 billion for vaccine distribution. The final vote was 50-49 along party lines, with every Republican voting "no." The legislation will have to be passed again by the House because the Senate made changes to its version. Read Full Story.

CBOE Kicks Off Bitcoin ETF Clock With VanEck Filing

The Chicago Board Options Exchange (CBOE) has officially filed to list shares of VanEck’s bitcoin exchange-traded fund (ETF). CBOE filed a Form 19b-4 Monday, formally announcing its intention to list and trade shares of the VanEck Bitcoin Trust. The form kicks off the legal review period that could lead to the first bitcoin ETF in the U.S. Within those 45 days, the SEC has to either approve or disapprove the application, or extend the review period. Read Full Story.

Aston Martin Formula One Team Adds Crypto.com to Partner Roster

Crypto.com has inked a deal with the Formula One team of British luxury car manufacturer Aston Martin. Both companies were mum on what the deal entails, but said in a press release the brands will “collaborate to bring exclusive experiences and opportunities to traders and fans of the sport.” For Aston Martin, 2021 marks the end of a 60-year hiatus from Formula One racing. Read Full Story.

Mark Cuban's Dallas Mavericks will accept dogecoin for tickets and merchandise

In another sign that dogecoin may be moving beyond its roots as a meme token, the Dallas Mavericks are set to begin accepting the cryptocurrency as payment for tickets and merchandise. The billionaire entrepreneur added: "Sometimes in business, you have to do things that are fun." This isn't the first time the team is accepting cryptocurrency as payment. In May 2019, the team began accepting bitcoin. Like bitcoin, dogecoin transactions will be done through BitPay, a cryptocurrency payment processor. Read Full Story.

VIP Investor List 💰

I will start sending out occasional investment opportunities to those on my VIP investor list. Some of these will be fund investments, start-up investments, pre-IPO deals, crypto and digital assets opportunities, exclusive allocations… you get it. If you are an accredited investor and want to be on this list, send me a note.

Favorite Products 👀

Lolli.com - Earn Bitcoin while you shop at thousands of online retailers. [U.S. only]

Coinbase - Looking to make your first Bitcoin purchase in the U.S.? Use this code for a $10 sign-up bonus.

Binance - Looking to make your first Bitcoin purchase outside the U.S.? Use this code to get a 10% discount on trading fees.

Aspiration Bank - Join this climate-friendly bank, pay what you want in fees, and get a $50 bonus when you spend $250 by using this link.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Tips: BTC @ 1MgfRn8NHnc8ZE5kBvNgYbgpTFShJh5mKK

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.