Myth of Money: Key Financial Events of 2020

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

Most Notable Financial Events of 2020

I’d like to kick off this edition of the #MythOfMoney by wishing everyone a Happy Holiday season.🎄 No matter which events you and your family celebrate, I think we can universally celebrate 2020 coming to an end 💫 🎊

This year brought much hardship, and with it unparalleled opportunity. In what was popularly dubbed as a “K-shaped” recovery, we witnessed the wealth gap become greater than ever. It is estimated that billionaires added $931 billion to their fortunes as a result of COVID-19.

Here are some of the most noteworthy financial events that happened in 2020:

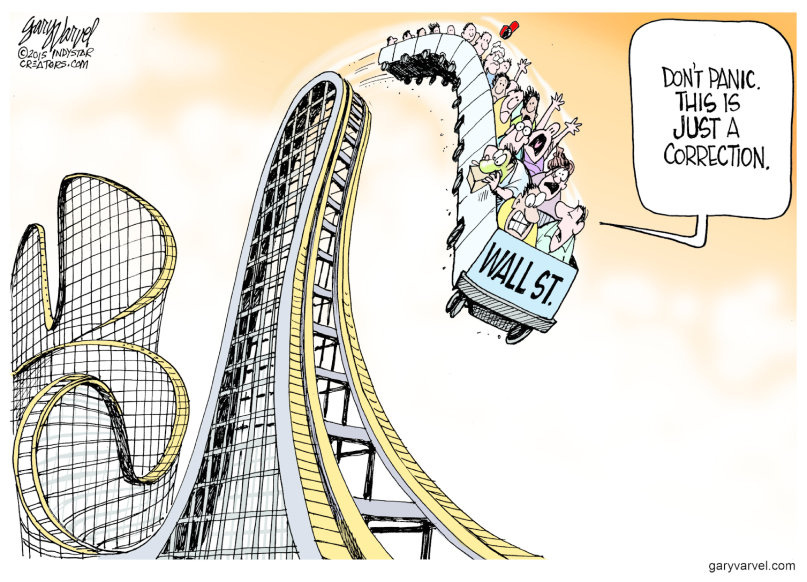

Liquidity Crisis - In March, stocks were down 25%, gold down 15% and Bitcoin down 50% in a single day.

Negative Oil Prices - On April 20, 2020, the price of US oil has turned negative for the first time in history. Oil producers were paying buyers to take the commodity off their hands over fears that storage capacity could run out.

0% Interest Rates - Two emergency interest rate cuts to 0% for the second time in history. The first was to boost the economy after the 2008 Financial Crisis.

Record Quantitative Easing - The Fed propped up the stock markets with multiple QE packages totaling $3.5 trillion.

NASDAQ All-Time-High - The tech index recovers, gaining 88% since March lows, finishing the year at the ATH of 12,804 points.

Tesla Gains 820% - In a meteoric rise, Tesla rewards its investors with 820% gains this year, a 7-1 split and inclusion in the S&P 500.

Real Estate - median listing prices grew 13.3%.

Bitcoin - BTC recovers from March lows, gaining 460% return.

Notable IPO’s - The biggest IPO’s of the year included AirBnB ($3.51 billion), DoorDash ($3.37 billion), Snowflake ($3.36 billion), Palantir ($2.5714 billion) and Warner Music Group ($1.93 billion).

SPAC’s - 2020 was dubbed as the year of the SPAC, or “blank check” companies. Some notable SPAC’s included Virgin Galactica, Fisker Inc. and DraftKings.

What were some of your most notable financial events of 2020?

This Week By the Numbers

Markets continue to deliver mixed results. U.S. consumer spending fell in November and December, despite the holiday season, while jobless claims remain high at 803,000, indicating the economic recovery has hit a plateau. Oil prices continued to decline amid news of fresh global lockdowns. The one investment that continues to outperform is Bitcoin, appreciating 21%+ in just one week.

Top Stories

SEC Sues Ripple Over 7-Year, $1.3B ‘Ongoing’ XRP Sale

The U.S. Securities and Exchange Commission believes Ripple Labs violated federal securities laws in selling the XRP cryptocurrency to retail consumers. According to a lawsuit filed Tuesday, Ripple raised $1.3 billion over a seven-year period to retail investors through its sale of XRP (-5.21%) on an ongoing basis. The San Francisco-based fintech firm has long maintained that XRP the cryptocurrency is separate from Ripple the company. Read Full Story.

Scaramucci’s Skybridge Invested $25M in New Bitcoin Fund

Skybridge has moved $25 million into the fund already and new investors can participate starting Jan. 4 2021. Fidelity Digital Assets is the bitcoin "back office" and "storage mechanism.” Scaramucci said his fund's structure will give investors exposure to bitcoin's net asset value while avoiding the premiums extracted by the Grayscale Bitcoin Trust (GBTC). Scaramucci said he and Michael Saylor have developed a "very close relationship over the past few months," and credited the MicroStrategy CEO, whose firm now holds over $1 billion in bitcoin, as an inspiration for starting the new fund. Read Full Story.

Jay Clayton steps down as SEC chairman

In a letter to President Donald Trump, Clayton wrote: “It has been the honor and privilege of my professional life to serve the American people as Chairman of the U.S. Securities and Exchange Commission. ” Clayton praised the SEC for its work helping keep financial markets functioning through the COVID-19 pandemic, its efforts to modernize regulations and its record of returning $3.5 billion to harmed investors during the past four years. Read Full Story.

Congress agrees to $900 billion Covid stimulus deal after months of failed negotiations

Congress reached a deal Sunday on a $900 billion coronavirus relief package, a long-delayed effort to boost an American health-care system and economy buckling under the weight of the pandemic. The relief plan includes direct payments of $600 to most adults and $600 per child. The Democrats said it would put $284 billion into Paycheck Protection Program small business loans, and include funds for loans from small and minority-owned lenders. It would direct another $20 billion to small business grants and $15 billion to live event venues. It would also add a $300 federal unemployment supplement and temporarily keep in place pandemic-era programs that expanded unemployment insurance eligibility. Read Full Story.

Product of the Week - Lolli.com

Buying last minute Christmas presents? Lolli.com lets you earn Bitcoin while you shop. You can earn Free Bitcoin by shopping at your favorite online retailers like Bloomingdales and Nike, and even while booking flights and hotels for the holidays on Expedia.

Check it out here and start accumulating Bitcoin today :) [Available only in the U.S.]

Interested in joining the Myth Of Money as a sponsor? Reply to this email to learn more :)

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Tips: BTC @ 1MgfRn8NHnc8ZE5kBvNgYbgpTFShJh5mKK

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.