Welcome to this week’s edition of Myth of Money, a weekly newsletter on the digital asset markets read by 12,000+ investors.

Disclaimer: The following is not intended as investment advice. Do your research.

Dear Investors,

I arrived in Miami last night and look forward to seeing many of your at Art Basel this week.

The last few weeks have not been positive for the space, with concerns surfacing that the Luna, FTX, Genesis, and other failures in the crypto industry will halt if not kill the development of the sector as a whole.

The Economist magazine chimed in a classic “Crypto Dead” article.

Firstly, let me assure all of you that crypto is not dead. Yes, many projects are highly speculative. Yes, many should and will die. But the entire industry? Not a chance. The metaverse trend is only getting started. Gaming deals are at an all-time high. And the financial innovations being created through DeFi are becoming more and more interesting to institutional players.

What About Bitcoin?

At a time like this, Bitcoiners are becoming increasingly offended by their association with the crypto space. Bitcoin, after all, is meant to be a simple, mathematically backed store of value that transcends borders, not a speculative scheme. It is the first mainstream innovation in the blockchain and crypto space, and the only one that continues to hold water through bull and bear cycles. If you understand the true value proposition of Bitcoin as a separation of money and state, you understand that the name of the game is to end each cycle holding more Bitcoin than you did before.

Top investment managers including Ark Invest’s Cathy Wood continue to predict Bitcoin price to reach $1M by 2030.

What is the lightning network?

One recent innovation that has increased Bitcoin’s value proposition as a payment system is the Lightning Network.

Lightning Network is a layer 2 decentralized network, originally designed to make bitcoin transactions faster, using smart contract functionality in the blockchain to enable instant payments across a network of participants. The network allows for instant payments without waiting for block confirmations. To augment the security purpose of block confirmation, a blockchain smart contract is deployed which prevents the creation of on-blockchain transactions for individual payments. This process cuts down the transaction time into milliseconds.

Depending on the underlying blockchain technology and its native smart-contract scripting language, it is possible to create a secure network of participants who are able to transact at high volume and high speed.

For this to work, there must be:

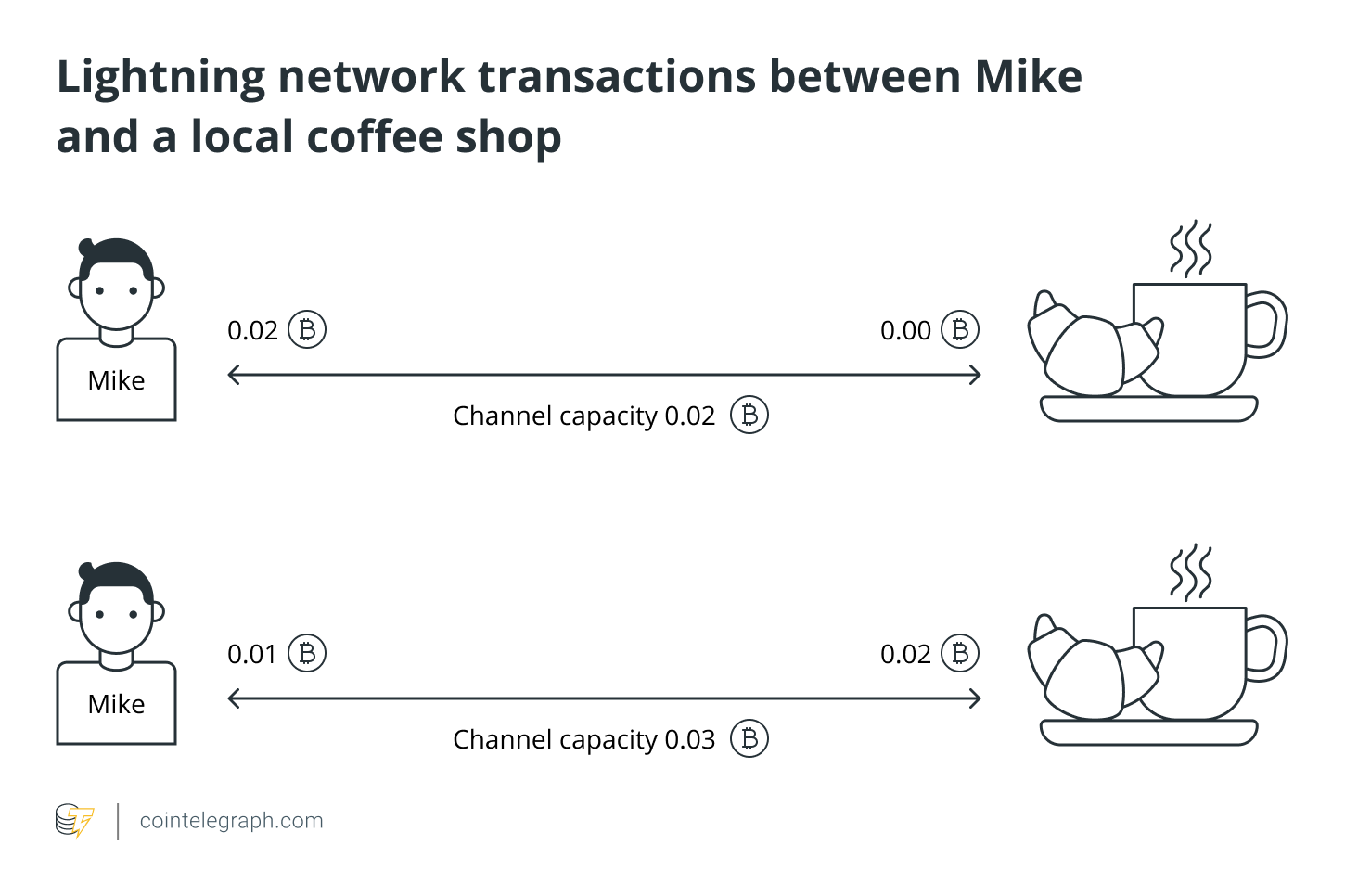

The Bidirectional Payment Channel: Two participants create a ledger entry on the blockchain which requires both participants to sign off on any spending of funds. Both parties make transactions that refund the ledger entry to their individual allocation, but do not broadcast them to the blockchain. They can update their individual allocations for the ledger entry by creating many transactions spending from the current ledger entry output. Only the most recent version is valid, which is enforced by blockchain-parsable smart-contract scripting. This entry can be closed out at any time by either party without any trust or custodianship by broadcasting the most recent version to the blockchain.

Lightning Network: By creating a network of these two-party ledger entries, it is possible to find a path across the network similar to routing packets on the internet. The nodes along the path are not trusted, as the payment is enforced using a script that enforces the atomicity (either the entire payment succeeds or fails) via decrementing time locks.

Blockchain as Arbiter: As a result, it is possible to conduct transactions off-blockchain without limitations. Transactions can be made off-chain with confidence in on-blockchain enforceability. This is similar to how one makes many legal contracts with others but does not go to court every time a contract is made. By making the transactions and scripts parsable, the smart contract can be enforced on blockchain. Only in the event of non-cooperation is the court involved – but with the blockchain, the result is deterministic.

The network does not need to create pairs between all users. For instance, if User A has a channel with User B, and User C has a channel with User B but not User A, funds can still be freely transferred between all networked parties. Lightning addresses look like Bitcoin addresses, and the payment process is very similar for users.

The Lightning Network first received attention for its use in El Salvador at Bitcoin Beach. The town of El Zonte was able to create a closed economy for 3,000 participants using Strike App on the Lightning Network during the onset of Covid. (I covered this in Forbes here.)

The network has since picked up in popularity. DappRadar reports $67 million worth of BTC (3,479 BTC) locked up in the network.

Where Can You Use the Lightning Network?

A growing number of vendors are increasingly willing to accept Bitcoin payments via the Lightning Network including Subway and South African grocery chain Pick n Pay.

Twitter allows users to send and receive Bitcoin “tips” via the Lightning Network. Via a Lightning Network-compatible payments app called Strike, many of Twitter’s 360 million monthly active users can send Bitcoin payments to other Twitter accounts instantly and for free. (Twitter isn’t actually the first creator-driven social platform to incorporate the Lightning Network — Substack has allowed BTC payments since late August.)

El Salvador became the first nation to make Bitcoin legal tender — in part because of the desire to save Salvadorans some $400 million annually in money transfer fees. The government-created wallet, Chivo, is Lightning-compatible and designed to enable seamless cross-border payments. As of October, Chivo had consistently been one of El Salvador's most downloaded apps.

Finally, a peer-to-peer Bitcoin exchange called Paxful, which processes millions of dollars worth of Bitcoin transactions in emerging markets and claims to have 1.5 million users in Africa alone, also recently announced it will enable Lightning payments. This integration could allow fast and cheap Bitcoin payments for millions of users.

To learn more about the Lightning Network, check out Lyn Alden’s research paper here.

This Week By the Numbers 📈

Top Stories 🗞️

UAE regulator revokes FTX license amid the exchange’s collapse

As the FTX debacle still creates waves in the crypto industry and beyond, the Dubai Virtual Assets Regulatory Authority (VARA) has suspended the license that allows FTX to make preparations to service the local market. In an announcement posted on its official website, VARA mentioned revoking the approval of FTX MENA’s Minimum Viable Product (MVP) license. Citing the bankruptcy filing of FTX-related entities, including FTX exchange and Alameda Research, VARA confirmed that FTX MENA’s license had been suspended before any clients were exposed.

Curve releases whitepaper and official code for its stablecoin

The developers of the decentralized exchange Curve Finance have released code and official documents for Curve's soon-to-be-launched decentralized stablecoin called crvUSD. While an official announcement from Curve is still pending, the repository published on the project's official GitHub account shows the project is all set to finish work on its crypto-backed stablecoin that's soft-pegged to the US dollar. Per the whitepaper, authored by Curve Finance founder Michael Egorov, crvUSD will have similar functionality to MakerDAO’s stablecoin called DAI. Matching DAI, it will be overcollateralized with crypto assets. The whitepaper states that users will be able to mint the stablecoin by depositing excess collateral in the form of a cryptocurrency loan in a reserve, a mechanism called a collateralized debt position (CDP). The stablecoin will also rely on a novel algorithm dubbed Lending-Liquidating AMM (LLAMMA), which will work to continuously liquidate and sell the deposited collateral to better manage potential collateralization risks.

Genesis has $2.8 billion in outstanding loans on the balance sheet: report

Troubled crypto lender Genesis Global has outstanding loans of $2.8 billion on its balance sheet, with around 30% of lending made to related parties, including parent company Digital Currency Group, Bloomberg reported Tuesday, citing people familiar with the matter. The Block reported that in a note to shareholders, Digital Currency Group founder and CEO Barry Silbert said that in the "ordinary course of business, DCG has borrowed money from Genesis Global Capital in the same vein as hundreds of crypto investment firms. These loans were always structured on an arm's length basis and priced at prevailing market interest rates." Silbert said DGC currently has a liability to Genesis of around $575 million, due in May 2023 and that the loans were used to "fund investment opportunities and to repurchase DGC stock from non-employee shareholders in secondary transactions previously highlighted in quarterly shareholder updates."

MetaMask will start collecting user IP addresses

According to a revised privacy policy agreement published by ConsenSys on Nov. 23, MetaMask will begin collecting users’ IP addresses and Ethereum wallet addresses during on-chain transactions. However, ConsenSys, the wallet’s creator, explains that the collection of users’ data will only apply if they use MetaMask’s default Remote Procedure Call (RPC) application, Infura. Individuals using their own Ethereum node or a third-party RPC provider with MetaMask are therefore not subject to the newly updated ConsenSys privacy policy. Instead, the terms of the other RPC provider apply. According to ConsenSys, information gathered in this manner may be disclosed to affiliates, during business deals, or to comply with Know Your Customer and Anti-Money Laundering requirements dictated by law enforcement. MetaMask is currently one of the most popular self-custody wallets on the market with more than 21 million monthly active users. The reaction within the crypto community has been mostly negative. For example, Adam Cochran, partner at Cinneamhain Ventures, stated: “There is nothing more important than consumer privacy, especially when it comes to your financial data —you have a right to be anonymous. Metamask has provided a great free service for a long time, but their decision to log IPs and tie it to transactions is unacceptable.”

IMF calls for tighter crypto regulation in Africa as the industry unfolds

The International Monetary Fund (IMF) is calling for increased regulation of Africa’s crypto markets, one of the fastest-growing markets in the world, the global institution blog reported on Nov. 22. Among the reasons why countries in the region should embrace regulation, the monetary fund cited the collapse of FTX and its ripple effect in cryptocurrency prices, which is “prompting renewed calls for greater consumer protection and regulation of the crypto industry.” Moreover, the authors argue that “risks from crypto assets are evident” and “it’s time to regulate” to find a balance between minimizing risk and maximizing innovation. Based on the October 2022 Regional Economic Outlook for sub-Saharan Africa, the piece states that “risks are much greater if crypto is adopted as legal tender,” posing a threat to public finances if governments accept crypto as means of payment.

Deal of the Week: Snack TBH 😋 😋 😋

I’m excited to announce that I have recently angel invested in Snack TBH, an alternative snack company led by Noah Schnapp (Stranger Things), Elena Guberman and my friend Bá Minuzzi.

Snack TBH is a guilt-free hazelnut cocoa spread that tastes too good to be true, vegan, and planet conscious.

Building on their extensive CPG experience, TBH reimagined the familiar taste of Nutella, without palm oil and other unhealthy additives.

What I like about this deal:

Valuation - $15M

Rockstar team with extensive CPG experience

The Nut Spread global TAM is a whopping $11.5B and the company plans to expand into other snacking groups in the future

Products have confirmed distribution with Erewhon and Ralphs, and are pending with Whole Foods

The company has opened up a public investment syndicate via Republic and is already oversubscribed. If this opportunity sounds interesting, you can learn more information here - CLICK HERE FOR REPUBLIC TBH CAMPAIGN

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

Tatiana Koffman

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I believe in empowerment closing the financial education gap and creating equal opportunity for the next generation. I have invested in 20+ companies and funds. Check out my portfolio here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.

Hi Tatiana,

Nice plug for the Lightning Network. I never believed that Bitcoin could become popular as a medium of exchange. What I find interesting in this substack article is that it conflates the idea of Bitcoin as an investment and Bitcoin as money (medium of exchange). Alas, nothing can be both an investment and at the same time be a medium of exchange. You either invest in something or you spend it. You can't do both. If you preach that Bitcoin is money, don't you think that you are doing a disservice to your readers by encouraging them to spend it? Every Satoshi one spends today could be a fortune tomorrow.

--Carlos

The collapse of FTX is the moment Web3 / Crypto started, not the moment it ended.

If you look to the Dot.com era (when most crypto folks weren't yet professionally engaged), you will find the exact same articles (global replace dot.com with crypto; https://finbold.com/guide/dot-com-bubble/).

Hype, exuberance, free money, new technology, lack of understanding by most, etc. leads to creation for creations sake as opposed to for solutions sake (Roof Roof Doge), an unsustainable market, followed by a deep deep crash that washes out the silly and "substantiates" the claims of the non-believers that it was all fake.

When it collapsed, the real builders, the real believers the real entrepreneurs and investors all stuck with it and built what is now commonplace in the world.

In 10 years no one will look back at this post, but today is that day.