Myth Of Money: Macroeconomic Outlook for 2022

Welcome to this week’s edition of Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

Dear Investors,

You might have noticed I’ve been on a bit of a hiatus. I know that many of you rely on this newsletter to stay informed. But as with all good things, sometimes it is important to take a step back from a process to make improvements.

As the new year begins, we are bringing back a new and improved version of the Myth of Money newsletter, starting with a Macroeconomic Outlook for the next year.

What can we expect in 2022?

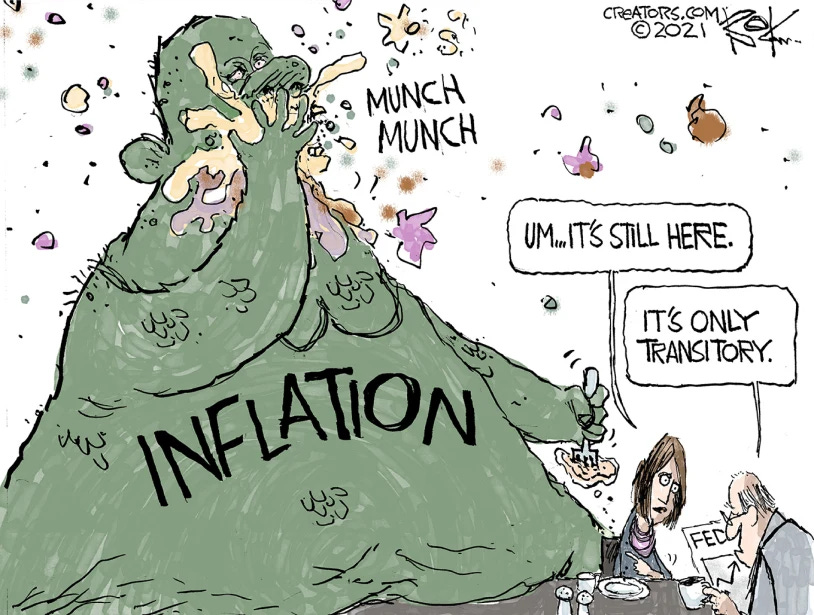

Inflation remains high on both sides of the Atlantic.

This week in the U.S. the updated CPI, which tracks the prices of a basket of commonly purchased goods, pegged annual inflation at 7%, the highest rate since June 1982. Core CPI, a narrower basket that excludes food and energy, rose 5.5%, the highest since February 1991. In the Euro Zone inflation hit a historic high of 5%.

Central Bankers from the U.S. Federal Reserve Preparing to Respond

Comments from several Fed bankers this week reemphasized the likelihood of oncoming interest rate hikes, as soon as March. The consensus is at least three increases will occur in 2022, each with at least a 0.25% bump, if not higher. By increasing the cost of borrowing money, the Fed’s aim is to keep the economy from overheating. The Fed also appears ready to taper asset purchases, effectively slowing the flow of its monetary firehose.

Powell and Lagarde Concur on Tightening

At his reconfirmation hearing before the Senate on Tuesday, Federal Reserve Chairman Jerome Powell endorsed a tighter monetary policy, and added that he thinks the U.S. economy is strong enough to withstand it.

Head of the European Central Bank Christine Lagarde sought to calm worries over rising prices in the Euro Zone on Tuesday, touting the ECB’s commitment and ability to stabilize inflation. On Friday, Lagarde pledged to bring inflation down to 2% by “any measures” necessary.

What Does This Mean for Crypto?

Crypto is going through a maturation cycle, evident in its growing integration with regulatory frameworks, governmental treasuries, and smart-money investment portfolios.

With maturation often comes a reckoning, and I think we will soon see separation between the wheat and the chaff, where only the strongest crypto businesses will survive.

Price action is likely to be bearish across the board over the next few months as the Fed starts tightening.

Logic Chain: The Fed’s policy, coupled with fiscal stimulus winding down, will tighten capital markets, and therefore tighten crypto as well.

How Does This Shape My Investment Thesis?

Even in this market, my investment thesis remains unchanged. Over the last two years I have allocated and will continue to allocate capital with the following mindset:

Theme #1: Bitcoin

I still believe Bitcoin is one of the most undervalued assets in the world and is on track to be a $1M asset (per coin) within five years. That’s over a 20x climb from today. I’m not saying Bitcoin will never fall below its current price. But there is more capital to flow into this asset - from corporate treasuries to institutional funds to retail retirement accounts and even governments.

Theme #2: Financial Infrastructure

I actively seek out early-stage deals in companies building financial infrastructure that is likely to withstand business-cycle changes. This includes crypto exchanges for making trades, lending platforms, bridges for transferring funds across blockchains, wallets for storing crypto assets, and L1/L2 protocols. Infrastructure is the rails that crypto runs on, which will continue to exist cycle after cycle.

Theme #3: Everything Else Is a Shitcoin

Pardon my french, but 98% of the publicly traded crypto market is overvalued, even in a dip. Liquid prices DO NOT represent any active users or underlying business for these coins. Prices move based mostly on hype and narratives surrounding the potential of projects. Understanding this doesn’t mean you can’t make a lot of money in crypto; it’s that you have to take short-term positions on strong-narrative tokens during the dips, and remember to get out on time. Don’t buy into the religion of crypto. This market is still speculative and major corrections are coming.

This Week By the Numbers 📈

Although it felt like a down week across the board, commodities and cryptocurrencies significantly outperformed the stock market.

Top Stories 🗞

U.S. Representative Tom Emmer Introduces Bill Prohibiting Fed from Issuing CBDC Directly to Individuals

Emmer, a Congressman from Minnesota since 2015, introduced a bill this week that would prohibit the Fed from issuing a central bank digital currency (CBDC) directly to individuals. A CBDC effectively is a government issuing its own cryptocurrency, complementing and potentially replacing alternative coins. Emmer’s bill, however, seeks to limit the U.S. government’s ability to do so. His reasons include protecting citizens’ financial privacy, maintaining the dollar’s global dominance, and cultivating innovation.

Rio de Janeiro Mayor Plans to Invest 1% of the City’s Treasury in Crypto

Amid Brazil’s own inflation issues and political instability, Rio de Janeiro Mayor Eduardo Paes announced plans to invest 1% of his city’s treasury in cryptocurrency. The mega city, home to almost 7 million residents, is also exploring the possibility of giving citizens tax discounts if they pay in bitcoin. Paes spoke of Rio’s plans at a panel this week where he sat alongside Miami Mayor Francis Suarez, who recently announced similar plans for his city. These moves follow El Salvador becoming the first nation to have Bitcoin on its balance sheet last year.

FTX Launches $2 Billion Venture Capital Fund Focused on Bolstering Blockchain, Web3 Adoption

In its announcement of the new $2 billion investment fund, cryptocurrency firm FTX said, “FTX Ventures’ core mission is to advance global blockchain and web3 adoption, with a broad investment mandate across social, gaming, fintech, software, and healthcare. The fund will invest in multi-stage companies and projects, providing flexible funding and strategic support from FTX and its network of global partners.” FTX, reportedly valued at some $32 billion, also announced it was bringing on former Lightspeed Ventures partner Amy Wu to lead the new fund. “Our investors at FTX have made a deep impact in supporting our growth and development,” said FTX CEO Sam Bankman-Fried. “We strive to do the same at FTX Ventures and are excited to find the brightest minds and disruptive innovation in tech.”

Tonga to Copy El Salvador’s Bill Making Bitcoin Legal Tender, Says Former MP

Former member of Tonga’s parliament Lord Fusitu’a outlined a plan in a series of tweets for the Pacific Island country to adopt Bitcoin as legal tender. Fusitu’a said the approach is “modeled on and almost identical to the El Salvador bill,” which legalized using Bitcoin for any financial transaction in the Central American country. Part of the appeal to Tonga of doing so would be to improve the process by which its relatively vast diaspora population sends finances from abroad back home.

Coinbase Buys Crypto Futures Exchange, Plans to Sell Derivatives in U.S.

The cryptocurrency exchange announced it is buying crypto futures exchange FairX in order to bring more derivatives trading to the U.S. crypto market. Common derivatives include call and put options, which give investors the future right to buy or sell an asset, respectively, at an agreed-upon price. “The development of a transparent derivatives market is a critical inflection point for any asset class and we believe it will unlock further participation in the crypto economy for retail and institutional investors alike,” the company said in a statement.

Deal of the Week - CoinMARA💰

CoinMARA is building a centralized exchange, lending platform and NFT market place for the African region, the next outsized opportunity to create sustainable financial infrastructure over the next decade. Based in Kenya, the founder and the project have a strategic alliance with SafariCom (M-Pesa), as well as several high profile individuals in the region.

CoinMara has confirmed investment from Distributed Global, FTX, Coinbase Ventures, DIGITAL (Steve Cohen), TQ Ventures (Scooter Braun), Mechanism Capital, Woodstock, Day One Ventures, GDA Capital and others.

The company is opening its private token sale this week. Please contact me directly at tatiana@tatianakoffman.com for more information.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.