Myth of Money: Metaverse or Universe?

Welcome to this week’s edition of Myth of Money, a weekly newsletter on all things crypto read by 10,000+ investors.

Disclaimer: The following is not intended as investment advice. Do your own research.

Dear Investors,

Silicon Valley’s origins are closely tied to William Shockley’s decision in 1956 to move from New Jersey to Mountain View, California to take care of his ailing mother in Palo Alto. Shockley’s pioneering work in semiconductors steadily attracted more inventors, entrepreneurs and investors to the region, and ultimately catalyzed what would become its longstanding economic engine of high-tech. Wouldn’t it have been nice to know where things were headed in those early days, and buy some affordable real estate prior to the Valley’s boom?

We’re seeing signs of this sort of opportunistic land grab happening in the Metaverse. In December, a crypto investor spent $450,000 on a virtual plot in The Sandbox next to a digital property owned by Snoop Dogg. The month prior, crypto firm Tokens.com purchased a virtual plot in Decentraland for $2.4 million. Digital real estate sales across the four biggest pure-play metaverse platforms – Decentraland, Sandbox, Cryptovoxels, and Somnium – surpassed $500 million in 2021, and some analysts expect that to double this year.

These are bets that the Metaverse will follow in the footsteps of the internet and the mobile revolution to become the next big thing in tech: a layer of networks that sits between our physical and digital lives, wherein we socialize, play, work and transact. To reach its economic potential, which has been forecast by Goldman Sachs to be $8 trillion, the Metaverse will need verifiable, digital scarcity. The assets and currencies used in and adjacent to it are therefore an excellent use case for crypto.

To an extent, the Metaverse is already here: people socialize in video games like Fornite and on chat servers like Discord, they trade virtual currencies and tokens, shop in digital stores, and join work meetings with video software. These are early iterations, lacking the full-on immersion that many envision for the Metaverse. But a far more important piece of the Metaverse that’s far from realized is interoperability. Without it, users won't be able to transport their virtual avatars, credentials, and assets across the various networks that will comprise the Metaverse. This will limit its utility, and make it difficult for assets like digital land plots to accumulate value.

Bringing about this interoperable future must happen incrementally, and several players are already well into this work. Decentraland launched in 2017 to provide users a decentralized virtual playground. Its native token, MANA, can be used on-platform to purchase one of its 90,000 land plots, buy and trade various items to adorn virtual assets and avatars, and engage in numerous activities including entertainment and shopping. MANA can also be traded off-platform, as can the NFTs used in Decentraland. As of writing, MANA’s market cap is $5.26 billion. Sandbox, another big player, with its own native token SAND, sports a market cap of $3.78 billion. Whereas Decentraland has been a decentralized organization from conception, Sandbox began as a centralized entity that is effectively a blockchain-enabled version of Roblox, offering low- and no-code game-development tools alongside a marketplace and currency that can be traded off-platform.

There are also a handful of big business incumbents working to bring about the Metaverse versions of their respective next chapters, including Meta (formerly Facebook), Microsoft, and JPMorgan.

On one hand, these efforts are simply the old guard trying to shield themselves from disruption. Many crypto diehards won’t welcome these players, given their established roles as centralized gatekeepers, the antithesis of the open, democratized, transparent system that crypto enables. But I think this view is a mistake.

The Metaverse must overcome its cold start problem - its potential relies on having a big user base, but it must be able to attract those users in the first place. The last several years have seen spurts of content development meant to bring on early adopters, and they’re beginning to trickle in. But for the Metaverse to become a place the masses use, old brands that many consumers already trust can spur broader adoption. It’s great to be able to start a new layer of society from scratch, but that also comes with the fact that the builders and operators have limited track records and therefore questionable credibility. The established brands of Web2 can be the bridge to a fully realized, Web3 version of the Metaverse.

Having established brands’ help to galvanize adoption is all the more important given the inevitable issues that will deter user adoption. These are already emerging: there’s growing concern about misinformation, sexual harassment and virtual assault in the Metaverse. We will likely see many more digital manifestations of the plagues of our physical world, including war, human trafficking, crime, fraud and beyond.

So where does this leave those of us considering buying virtual land before it becomes the Metaverse’s version of Silicon Valley, Hollywood, or Singapore? I’m skeptical that the economics of land ownership will mirror those in the real world. Although networks like The Sandbox and Decentraland have limited numbers of plots, there’s nothing stopping other networks from popping up and endlessly growing the aggregate supply of digital land. This is a key difference from the physical world’s fixed supply of land, not to mention the lack of physical dynamics that incentivize proximity, like the burdens of traveling to work or desire to live near loved ones.

Instead, my bet would be on the Metaverse’s interoperability infrastructure, which is in its infancy. Would you rather own a plot of land in a Silicon Valley that can leak residents and businesses like a sieve, or the airspace that people must travel through, no matter where their journeys may lead?

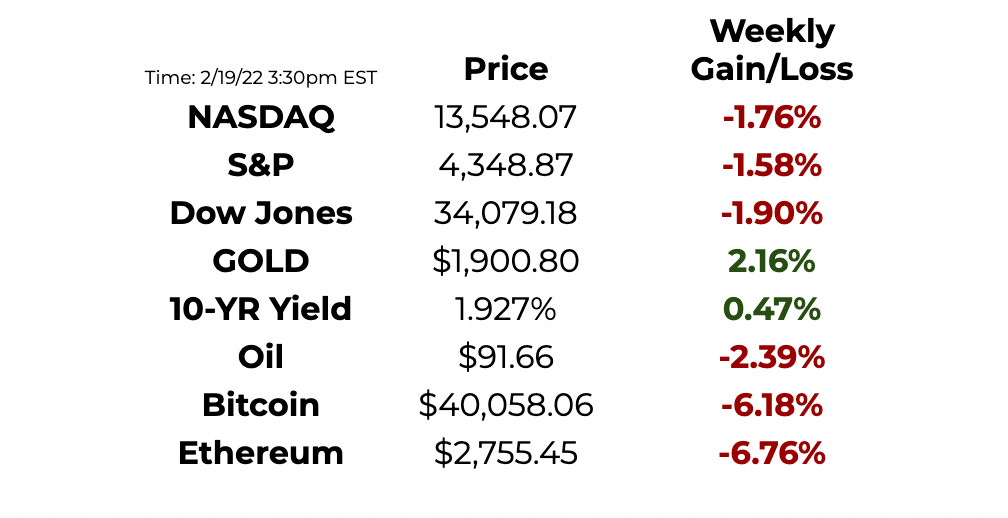

This Week By the Numbers 📈

A combination of impending interest rate hikes, potential war surrounding the Russia-Ukraine conflict, and ongoing supply chain challenges has investors spooked and scrambled for answers.

Top Stories 🗞

NYSE Wants to Be Marketplace for NFTs Just Like With Stocks

“The NYSE said in a regulatory filing with the U.S. Patent and Trademark Office that it wants to be a financial exchange for cryptocurrencies and NFTs that would compete with the likes of OpenSea and Rarible Inc. The filing, dated Feb. 10, indicated plans for a NYSE-branded cryptocurrency and a marketplace to buy, sell and trade NFTs.”

Mastercard Is Going on a Hiring Spree in Crypto and Services Push

“Mastercard Inc. said it will hire more than 500 young professionals this year as it expands its data and services unit, an effort that will include launching consulting practices focused on cryptocurrencies and open banking…With its crypto consulting practice, Mastercard said it is aiming to help banks navigate the adoption of digital currencies. It can also assist in designing crypto loyalty programs, developing crypto cards or performing risk assessments.”

Ukraine Passes Vote on Bill to Legalize Bitcoin

As Ukraine edges closer to an invasion from Russia, its parliament granted legal status to cryptocurrencies and virtual assets. The bill, which establishes a regulatory framework and confirms citizens’ rights to hold and use crypto, was previously vetoed by Ukraine’s president Volodymyr Zelensky, but was since amended.

JPMorgan Bets Metaverse Is a $1 Trillion Yearly Opportunity as it BecomesFirst Bank to Open in Virtual World

“The bank’s metaverse launch coincided with the release of a paper by Onyx, JPMorgan’s blockchain arm launched in 2020, which explores the opportunities offered by the metaverse. And JPMorgan is bullish: The bank predicts that the metaverse will become a $1 trillion market opportunity in yearly revenues, given that its virtual worlds will ‘infiltrate every sector in some way in the coming years.’”

Warren Buffet Invests $1B in Bitcoin-friendly Neobank, Dumps Visa and Mastercard Stocks

The Oracle of Omaha increased his investment into Nubank, Brazil’s largest fintech bank that has grown popular among Bitcoin investors. “In a securities filing late Feb. 14, the industrial conglomerate disclosed that it had purchased $1 billion worth of Nubank Class A stock in Q4/2021. On the other hand, it sold $1.8 billion and $1.3 billion worth of Visa and Mastercard stock, respectively, signaling a shift away from credit companies to gain exposure in their fintech rivals.”

Deal of the Week - CoinMARA💰

***This deal is now 90% subscribed and is closing March 1.***

CoinMARA is building a centralized exchange, lending platform and NFT marketplace for the African region, the next outsized opportunity to create sustainable financial infrastructure over the next decade. Based in Kenya, the founder and the project have a strategic alliance with Safaricom (M-Pesa), as well as several high-profile individuals in the region.

CoinMara has confirmed investment from Distributed Global, FTX, Coinbase Ventures, DIGITAL (Steve Cohen), TQ Ventures (Scooter Braun), Mechanism Capital, Woodstock, Day One Ventures, GDA Capital, Nexo, DAO Jones (Disclosure, Mike Shinoda, Steve Aoki) and others.

Direct participation - email for more info tatiana@tatianakoffman.com.

Syndicate - MyAsiaVC is running a syndicate with low minimums on Angellist [CLICK HERE TO PARTICIPATE IN THE SYNDICATE].

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.