Myth Of Money: Miami is Bitcoin

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

Dear Investors,

This past week was the #Bitcoin2021 conference in Miami, the largest crypto conference to date with over 20,000 attendees at the main and side events. This was a true testament to how far we have come as a community and where this movement will take us.

Top 5 Miami Moments:

Mayor Suarez made an inspiring speech about his journey to Bitcoin and his vision for Miami as a tech hub of the future.

Host Max Keiser and MicroStrategy CEO Michael Saylor made Bitcoin look like a cult for eccentrics.

Sam Bankman-Fried bought club Liv Miami, allegedly. The FTX founder got tired of waiting in line, so he used his new crypto riches to buy the entire club, and troll the rest of us on Twitter.

Someone dropped a dumpster full of Venezuelan Bolivars at the conference to show what inflation looks like.

A DOGE shiller jumped on stage and started to strip.

What is Happening with the Bitcoin Price?

In the meantime, the markets are no closer to recovering. Will Clemente, in his analysis of on-chain analytics pointed out some key takeaways:

BTC is still rangebound between 32K-40K

Exchange flows have plateaued, with no directional trend

Stablecoins are waiting on the sidelines to buy when trend emerges

Futures contracts are flat, waiting

Selling is still mostly being done by more short-term holders

Long term holders are still buying

Retail buying heavily

Bitcoin remains undervalued compared to the capital flows on-chain

This inconclusive set of data leads me to believe that we will be in this price range for the next while, until some positive news emerges to break the trend. For now, even the best traders cannot predict price action.

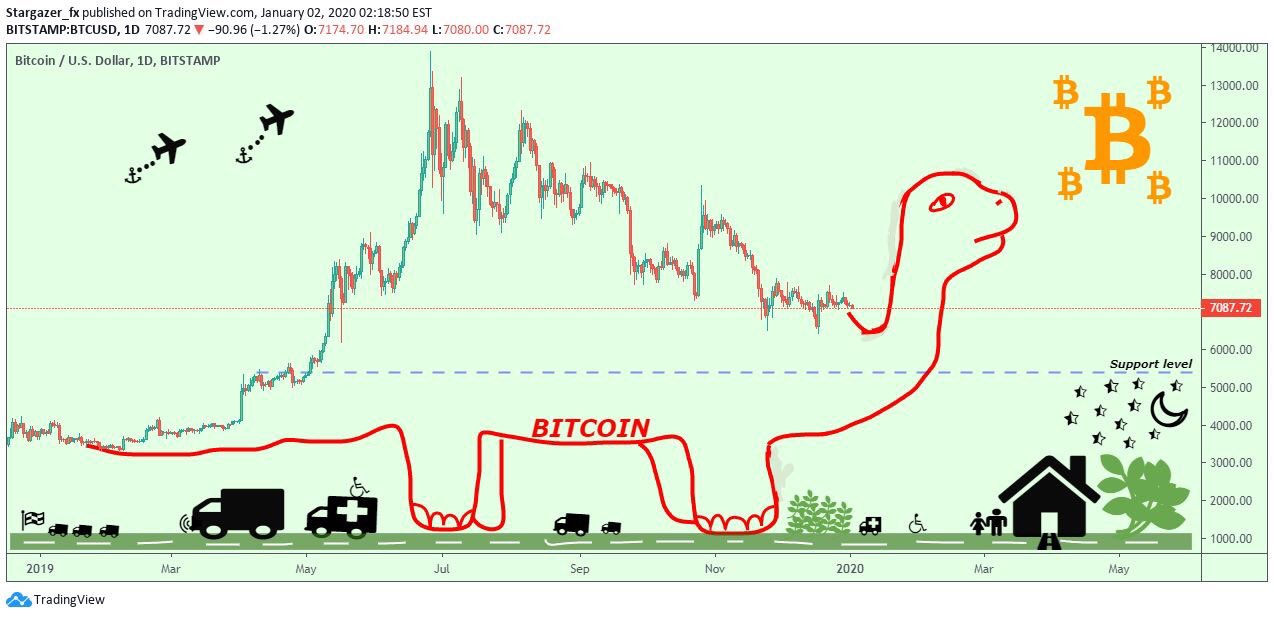

While we wait, please check out this “Cryptosaurus” chart as part of your analysis :)

This Week By the Numbers 📈

Crypto markets are still relatively flat, oil is up, while stocks continue to rise. Average housing prices jumped 7.3% over the last 12 months.

Top Stories 🗞

El Salvador looks to become the world’s first country to adopt bitcoin as legal tender

El Salvador President Nayib Bukele plans to introduce legislation that will make it the world’s first sovereign nation to adopt bitcoin as legal tender. Bukele broadcast his intentions on a video at the Bitcoin 2021 conference in Miami. Bukele said the country is partnering with digital wallet company, Strike, to build modern financial infrastructure using bitcoin technology. Read Full Story.

Russia to remove dollar assets from National Wealth Fund

Russia will completely remove U.S. dollar assets from its National Wealth Fund (NWF), while increasing the share of the euro, Chinese yuan and gold. Russia's NWF, which accumulates Russia's oil revenue and was initially designed to support the pension system, stood at $185.9 billion as of May 1. It forms part of Russia's gold and FX reserves that totalled $600.9 billion on May 27. After the changes, the share of the euro will stand at 40%, the yuan at 30% and gold at 20%. The Japanese yen and British pound will account for 5% each. Read Full Story.

Square CEO Jack Dorsey says the company is considering a new hardware bitcoin wallet

Square CEO Jack Dorsey said Friday the company is looking into building a hardware bitcoin wallet that would give consumers greater control over the cryptocurrency they own. Shares of Square rose about 2.7% on Dorsey’s comments, published on Twitter, where he is also CEO. The stock closed up about 1% on Friday. Bitcoin transactions have become a booming business for Square, which allows consumers to make purchases using the Cash App and store the currency digitally. Bitcoin revenue at the company climbed to $4.75 billion last year from $516.5 million in 2019. Read Full Story.

United Airlines is buying 15 supersonic aircraft from Boom Supersonic

United Airlines has agreed to purchase 15 supersonic aircraft from Boom Supersonic, with an option to increase that order to 50 jets, the companies announced Thursday. Boom claims its supersonic jets will eventually be able to travel from New York to London — normally a seven-hour flight — in just 3.5 hours, or Los Angeles to Sydney — typically a 15-hour trip — in six hours and 45 minutes. Boom has said that tickets will cost $5,000 per seat, but United says it’s too early to announce pricing. Read Full Story.

Product of the Week: GDA Lending

This week I’m giving a shout out to my friends at GDA Lending. Having recently worked on a loan with them, I can say that they offer the best rates for collateralized crypto loans at 4.5%, with the lowest counter-party risk. If you are looking to borrow against your BTC or ETH, ping me for an intro here.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.