Myth Of Money: MMMMMeta

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

Dear Investors,

The big news this week was all about the Metaverse.

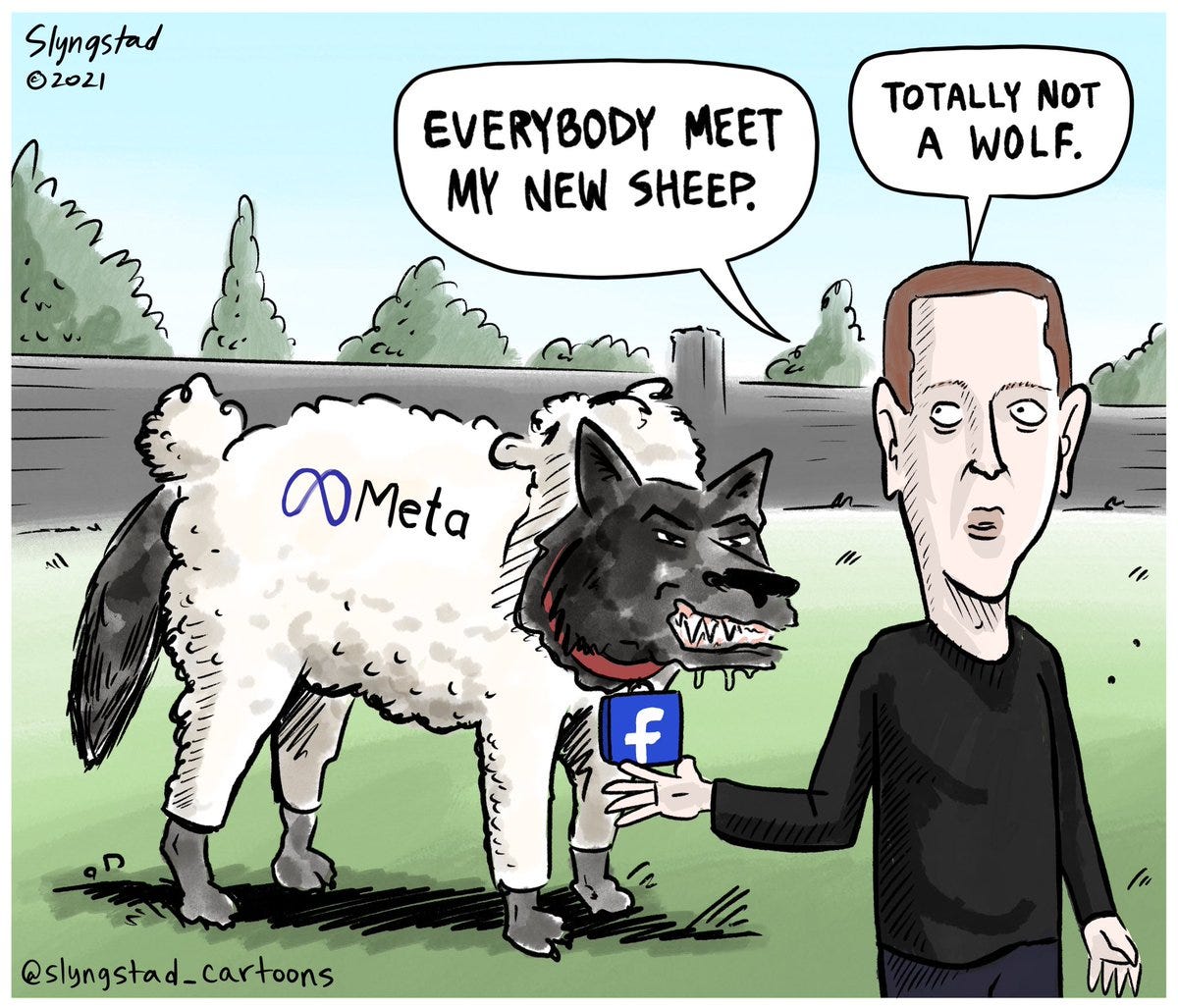

Mark Zuckerberg made a bold move to rebrand his company as “META” under a new trading ticker NASDAQ: MVRS. Facebook Expects Metaverse Project Will Cost At Least $10 Billion in 2021 alone. Facebook’s announcement sent Metaverse and gaming coins such as Decentraland (MANA) and Sandbox (SAND) to new all time highs.

What is the Metaverse?

According to Wikipedia:

The Metaverse is an iteration of the Internet part of shared virtual reality, often as a form of social media. The metaverse in a broader sense may not only refer to virtual worlds operated by social media companies but the entire spectrum of augmented reality. The term arose in the early 1990s, and has come to be criticised as a method of public relations building using a purely speculative, "over-hyped" concept based on existing technology.

In theory, if you combine AR and VR with the world of crypto, you can build an entire world for people to gather in, spending digital currencies, buying land and creating NFTs.

“The metaverse will bring enormous opportunity to individual creators and artists; to individuals who want to work and own homes far from today’s urban centers; and to people who live in places where opportunities for education or recreation are more limited,” says Mark Zuckerberg, Founder of Facebook.

This is not the first time Zuck tried to make a move into crypto, the last being a failed attempt to build the Libra stablecoin.

The Metaverse hype trend is likely to continue. The truth is, there is simply too much money floating around in the system at this point and its taking turns looking for a new home going from Bitcoin to Ethereum to Alts to NFTS to Doggie Coins and now the Metaverse.

I would like to think that Metaverse will provide some real value to folks around the world beyond the price action we are seeing in crypto. Artists like Snoop Dogg and Ariana Grande are using the metaverse to build their brands, as are Gucci and Adidas. Metaverse real estate provides potentially a game-changing opportunity for brands, advertisers and vendors wishing to reach demographics in every corner of the globe.

The Metaverse will democratize time and space.

Imagine living in a developing country and being able to show up to meeting, an office, a concert or really anywhere else simply by putting on a headset. Businesses will truly become global for every corner of the world and so will opportunities for individuals.

This Week By the Numbers 📈

This Week in Forbes

Tokens.com Launches The First Publicly-Traded Company For DeFi And Metaverse Investments

Recently launched, Tokens.com (NEO Exchange Canada: COIN) (Frankfurt Stock Exchange: 76M) (OTCQB US: SMURF) is on a mission to connect public market investors to blockchain investments by investing in DeFi tokens such as BNB and DOT, and NFT-based cryptocurrencies. By staking the assets, the company is able to earn an additional ROI beyond regular price appreciation. The company prides itself on only investing in ‘proof-of-stake’ tokens, which are more environmentally friendly than Bitcoin’s ‘proof-of-work’ energy-intensive method.

The company closed a pre-IPO investment round from industry leaders Bitbuy, First Block Capital, HIVE Blockchain Technologies, PowerOne Capital Group, Matthew Roszak (the co-founder and Chairman of Bloq), Olaf Carlson-Wee (the founder of Polychain Capital) and CI Global Alpha Innovators Fund, the largest technology investment fund in Canada.

Top Stories 🗞

Tesla hits $1 trillion market cap for the first time after Hertz says it will buy 100,000 electric vehicles

Tesla hit a $1 trillion market cap on Monday following news that Hertz is ordering 100,000 vehicles to build out its electric vehicle rental fleet by the end of 2022. The company joins trillion-dollar market cap companies like Apple, Amazon and Microsoft. News of the deal brought Tesla’s stock to more than $1,045 a share midday, a new record high one trading day after the shares broke $900. The stock closed up 12.66% at about $1,024 a share. Read Full Story.

El Salvador adds nearly $25M in Bitcoin to state coffers

The Salvadoran government acquired 420 more bitcoin on Wednesday, President Nayib Bukele announced on social media, as the Central American doubled down on its splashy cryptocurrency experiment. The latest purchase of bitcoin, worth nearly $25 million at current prices, marks the first government acquisition of the cryptocurrency since Sept. 20, when Bukele said it had bought 150 bitcoins. Overall, El Salvador’s treasury holds 1,120 bitcoin, according to official data, worth nearly $66 million. Read Full Story.

FTX Founder Sam Bankman-Fried is The Richest 29-Year-Old

Four years ago, Bankman-Fried had yet to buy a single bitcoin. Now, five months shy of his 30th birthday, he debuts on this year’s Forbes 400 at No. 32, with a net worth of $22.5 billion. Save for Mark Zuckerberg, no one in history has ever gotten so rich so young. The irony? Bankman-Fried is no crypto evangelist. He’s barely even a believer. He’s a mercenary, dedicated to making as much money as possible (he doesn’t really care how) solely so he can give it away (he doesn’t really know to whom, or when). Read Full Story.

Join Our Syndicate 💰

Following the success of our last 3 deals, have spawn off a new venture - a hub for all future SPV’s under the brand of Moonwalker Capital on Angellist. To participate in future deals, SIGN UP HERE (LINK).

We are launching our first deal shortly, so don’t miss out.

If you are a founder looking for additional exposure and funding, please reach out. SPVs are a great way to open your deal to the investment community while keeping you cap-table squeaky clean ;)

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.