Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

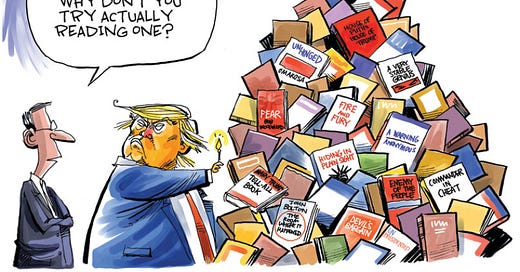

My Holiday Reading List 📚

This year was truly eye-opening. As the stock market crashed by more than 26% within a single week in March and the Federal Reserve introduced several rounds of monetary stimulus, many of us felt that we lacked the financial education needed to navigate this tough investment period. Some of us chose to double down on the stock market, while others shorted, and many more stayed on the sidelines.

I have taken 2020 as a time to further my own education. Here are the books that helped me understand the history and the future of the investment landscape.

Psychology of Money: Timeless lessons on wealth, greed, and happiness by Morgan Housel: How do rich people lose their wealth? How do those of us starting from bottom accumulate great wealth? This quick book can save you years of mistakes in growing your personal investments.

The Deficit Myth: Modern Monetary Theory and the Birth of the People's Economy by Stephanie Kelton: Great choice for anyone looking to understand how debt and money printing affects our economy.

The Ascent of Money: A Financial History of the World by Niall Ferguson: A brief history of money that provides a great base for understanding modern financial markets.

The Creature from Jekyll Island by Edward Griffin: A captivating, even if perhaps exaggerated, account of the creation and inner workings of the Federal Reserve.

The Theory of Money & Credit by Ludwig Von Mises: Originally published in 1912, Mises expands on his theory of the origins of money. The work is considered foundation to the Misean branch of the Austrian School of economic thought. This one is a bit dry so be patient getting through it :)

Firefighting: The Financial Crisis and Its Lessons by Ben Bernanke, Tim Geithner, and Hank Paulson: A reflection on the 2008 financial crisis and the policies implemented ten years since.

The Bitcoin Standard: The Decentralized Alternative to Central Banking by Saifedean Ammous: In depth explanation of Bitcoin and how it compares to the gold standard.

The Internet of Money: A collection of talks by Andreas M. Antonopoulos: I suggest listening to this one on audio. If you are still struggling with the concept of Bitcoin and digital assets, this is a great place to start.

What were your favorite reads this year?

This Week By the Numbers

The big market news this week was Bitcoin crossing $24,000 for the first time ever. The currency appreciated more than 220% since the start of the year and reached a market cap of $430 billion. This is quite the recovery after losing 50% in value during a single day in March during the liquidity crisis. The rally differs from previous bull markets as this time the interest is largely driven by institutions rather than retail mania. Covid-19 and subsequent parabolic monetary stimulus has given credit to the asset as a potential inflationary hedge.

Top Stories

Cryptocurrency Exchange Coinbase Says It Files for IPO

Coinbase Global Inc., the biggest U.S. cryptocurrency exchange, said it has filed confidentially with the Securities and Exchange Commission to go public it what’s anticipated to be a break-through moment for the industry. Coinbase was valued at more than $8 billion in 2018 after a $300 million funding round led by Tiger Global Management. The company, started in 2012, has raised more than $500 million from backers that also include Andreessen Horowitz, Y Combinator and Greylock Partners, according to its website. Coinbase said it has has more than 35 million verified users in more than 100 countries and more than $25 billion in assets on its platform. Read Full Story.

Canada’s CI Financial Completes $72 Million IPO of Bitcoin Fund

Canadian mutual fund manager CI Financial Corp. completed a $72 million initial public offering of a Bitcoin fund to help clients access the cryptocurrency in the midst of an eye-catching rally. The IPO consisted of units sold at C$12.88 ($10) apiece, CI Financial said in a statement Wednesday. The CI Galaxy Bitcoin Fund’s shares will start trading in U.S. and Canadian dollars on the Toronto Stock Exchange. Read Full Story.

Guggenheim’s Scott Minerd Says Bitcoin Should Be Worth $400,000

As Bitcoin surges to record highs, Scott Minerd of Guggenheim Investments believes the world’s largest cryptocurrency’s fair value still has a ways to go. Bitcoin’s scarcity combined with “rampant money printing” by the Federal Reserve mean the digital token should eventually climb to about $400,000. His comments came on the same day Bitcoin breached $20,000 for the first time, bringing its 2020 gain to 190%. “It’s based on the scarcity and relative valuation such as things like gold as a percentage of GDP. So you know, Bitcoin actually has a lot of the attributes of gold and at the same time has an unusual value in terms of transactions.” Read Full Story.

Ruffer Investment Confirms Massive Bitcoin Buy of $744M

U.K.-based Ruffer confirmed the size of its tremendous bitcoin investment from November. Based on current exchange rates, £550 million is worth $744.26 million or roughly 45,000 BTC based on November 2020 prices. The investment was "primarily a protective move for portfolios" to "act as a hedge" against "some of the risks that we see in a fragile monetary system and distorted financial markets." Read Full Story.

Product of the Week - Lolli.com

Buying last minute Christmas presents? Lolli.com lets you earn Bitcoin while you shop. You can earn Free Bitcoin by shopping at your favorite online retailers like Bloomingdales and Nike, and even while booking flights and hotels for the holidays on Expedia.

Check it out here and start accumulating Bitcoin today :) [Available only in the U.S.]

Interested in joining the Myth Of Money as a sponsor? Reply to this email to learn more :)

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Tips: BTC @ 1MgfRn8NHnc8ZE5kBvNgYbgpTFShJh5mKK

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.

I like your eclectic holiday reading list: it includes ideas far out on the left (No 2 on Modern Monetary Theory) to ideas way out on the right (No 5, von Mises' "Theory of Money and Credit"). I have not read No 2, but I have read No 5. I plan to read No 3 - Niall Ferguson's "Ascent of Money: Financial History of the World".

https://medium.com/rockstable/the-value-of-money-4e11209add1c