Welcome to this week’s edition of Myth of Money, a weekly newsletter on the digital asset markets read by 12,000+ investors.

Disclaimer: The following is not intended as investment advice. Do your research.

Dear Investors,

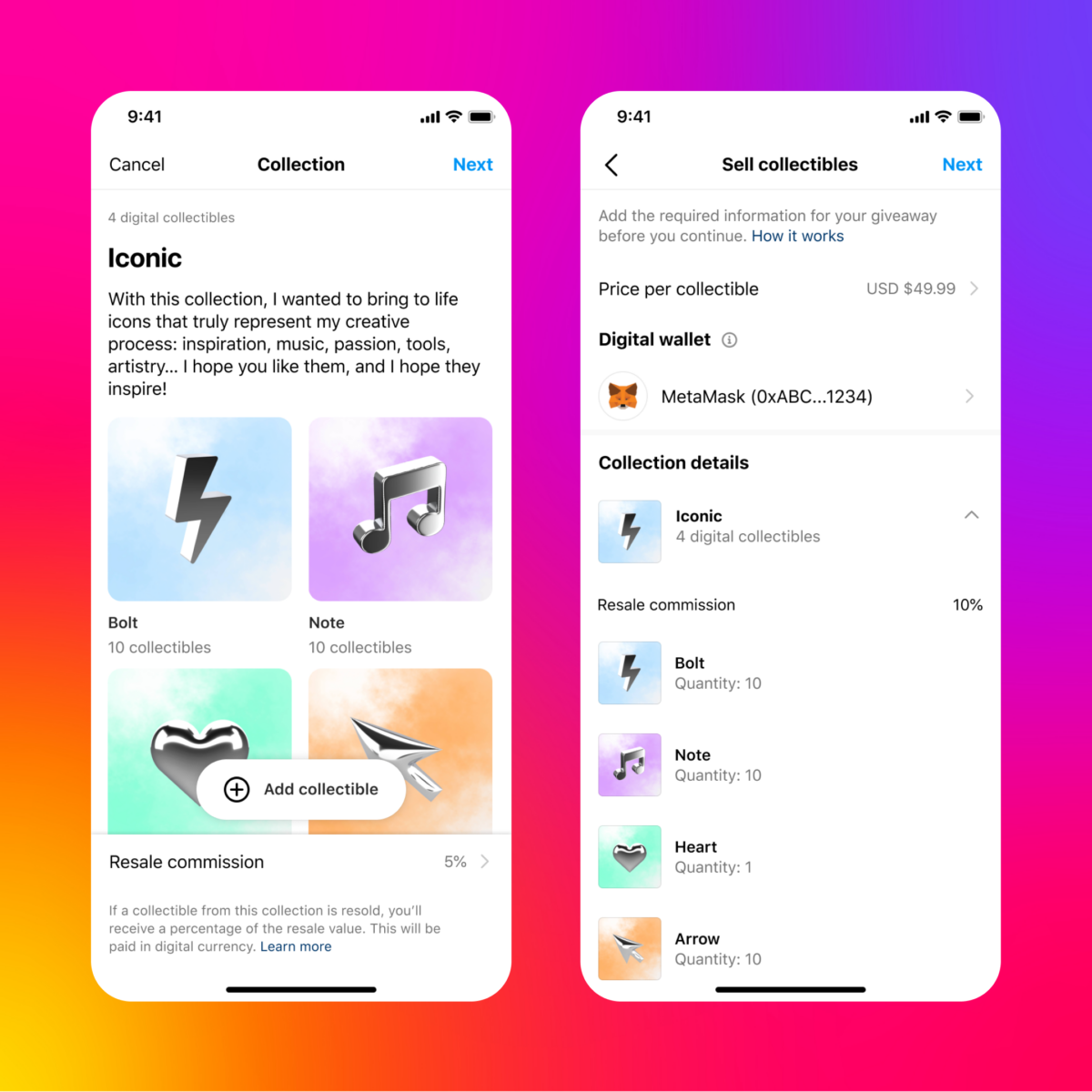

A few weeks ago, Instagram released the feature, “DIGITAL COLLECTIBLES”, which allows users to connect their wallets to their accounts with the function of NFTs display. This feature was released in 100 different countries.

In their latest update, Instagram said that starting this week it will begin allowing a select group of digital creators to mint and sell non-fungible tokens (NFT) directly from the social media platform. The latest update will allow creators to make their own digital collectibles and sell them both on and off Instagram. It will initially integrate the Polygon network and will be tested with a small group of American including Amber Vittoria, Refik Anadol, Jason Seife, Dave Krugman.

Prior to its launch on the Polygon network, the platform supported Ethereum and Flow blockchains, as well as connections to third-party wallets including Rainbow, MetaMask, Trust Wallet, Coinbase Wallet, and Dapper Wallet. The app will also allow video-based digital collectibles to be shown on its platform and will add support for the Solana blockchain and Phantom wallet at a later date.

In addition, it pledged that neither creators nor collectors will need to pay gas fees for digital collectibles bought on Instagram at launch. Parent company META noted that it will not charge fees for displaying and sharing a digital collectible on Instagram or Facebook and it will not charge any additional fees for selling digital collectibles until at least 2024.

“This move represents a remarkable milestone in the evolution of Instagram’s existing NFT functionality and a natural next step to bring Web3 to the mainstream,” said Polygon co-founder Sandeep Nailwal.

Twitter Will Allow Users to Buy and Sell NFTs Through Tweets

Social media platform Twitter also announced that it will let users buy, sell, and display NFTs directly through tweets in partnership with specific marketplaces.

The integration, called NFT Tweet Tiles, displays the artwork of an NFT in a dedicated panel within a tweet and will include a button to let users click through to a marketplace listing.

Twitter previously supported NFTs as verified profile pictures through its Twitter Blue subscription service in January, but only on the Ethereum network.

The integration—which is still in testing—currently works with marketplaces from four specific partners: (1) Solana-centric marketplace Magic Eden, (2) multi-platform NFT marketplace protocol Rarible, (3) Flow blockchain creator Dapper Labs, and (4) sports-centric platform Jump.trade.

Collectively, these marketplaces span several blockchain networks, including Ethereum, Solana, Flow, Polygon, Tezos, and Immutable X.

The representative added that the “feature is currently being tested with select Twitter users across iOS and web,” and that those users will see the NFT Tweet Tile integration if they are within the test group. A Twitter Blue premium subscription is not required to use the feature.

This Week By the Numbers 📈

The Federal Reserve approved a fourth-straight rate hike of three-quarters of a percentage point on Wednesday as part of its aggressive battle to bring down USD inflation. The hike brings the central bank's benchmark lending rate to a new target range of 3.75%-4%, the highest the fed funds rate since January 2008. Wednesday's decision, which comes at the end of a two-day policy meeting of the Federal Open Market Committee, will likely deepen the economic pain for millions of American businesses and households by pushing up the cost of borrowing even further. Powell has iterated that a pivot is NOT coming anytime soon and that the Fed would rather overcorrect inflation than under-correct it.

The unemployment rate has risen to 3.7%, which is still close to a 50-year low. According to a report by the Guardian, “monthly job growth has averaged 407,000 in 2022, compared with 562,000 per month in 2021. In 2019, before the coronavirus pandemic struck the US, job gains averaged 164,000 a month.”

Top Stories 🗞️

Twitter slashes nearly half its workforce as Musk admits ‘massive drop’ in revenue

Elon Musk ended his first week as Twitter’s owner with an indelible mark by slashing, by some estimates, up to half of the company’s workforce with little notice and abruptly cutting off employees’ access to their computers and work systems. Many employees spent the day tweeting their goodbyes, as Musk revealed brands had begun pulling their advertisements, leading to what he said was a “massive drop in revenue”. He tweeted late Friday the cuts were needed as “unfortunately there is no choice when the company is losing over $4M/day”. Audi, General Motors, General Mills, and Pfizer were among those who halted advertisements, amid concerns Musk will scale back misinformation and security protections on the platform. Advertising accounts for 90% of Twitter’s revenues. Yoel Roth, Twitter’s head of safety and integrity appeared to confirm reports that 50% of the company’s global workforce of 7,500 was cut.

South African Supermarket Chain Pick n Pay Now Accepts Bitcoin Payments through the Lightning Network

Pick n Pay, which is one of South Africa's largest supermarket chains, is now allowing customers to pay with bitcoin (BTC) using any Lightning Network-enabled app, according to South Africa's The Times. The payment method was tested in 10 stores over the past five months and is now available in 39 stores across the country, according to The Times. “The transaction is as easy and secure as swiping a debit or credit card. Customers scan a QR code from the app and accept the rand conversion rate on their smartphone at the time of the transaction," a spokesperson for Pick n Pay said in the report, referring to South Africa's currency.

JPMorgan executes first DeFi trade on a public blockchain

The global financial giant JPMorgan completed its first-ever cross-border transaction using Defi on a public blockchain with the help of the Monetary Authority of Singapore’s (MAS) Project Guardian. DBS Bank started a trading test of foreign exchange (FX) and government securities using permissioned Defi liquidity pools. Apart from JPMorgan and DBS Bank, the Bank for International Settlements also said that automated market-making technology in Defi can serve as a “basis for a new generation of financial infrastructure.”

IRS prepares for an increase in crypto cases in the upcoming tax season

The United States Internal Revenue Service (IRS) criminal investigation division is ramping up for tax season with its sights set on the crypto community. According to a report from Bloomberg Law, the division chief Jim Lee said they are preparing “hundreds” of crypto-involved cases, many of which will soon be available to the public. Lee said in the last three years, there has been a major shift in digital asset investigations conducted by the IRS. Previously these investigations were mostly money-laundering related, whereas now tax-related cases make up nearly half. This includes what is often called “off-ramping” transactions where digital assets are exchanged for a fiat currency, along with not reporting crypto payments.

Coinbase reports better-than-expected user numbers even as third-quarter revenue plunges

Coinbase reported user numbers that topped analysts’ estimates even as third-quarter revenue missed estimates and the cryptocurrency exchange had a wider-than-expected loss. The stock popped in extended trading. Revenue plummeted more than 50% from a year earlier as traders turned away from cryptocurrencies. The company’s financials turned south, resulting in a loss of $545 million after Coinbase generated a profit of over $400 million a year earlier. “Transaction revenue was significantly impacted by stronger macroeconomic and crypto market headwinds, as well as the trading volume moving offshore,” Coinbase said in its investor letter.

Congrats to the Hashflow team! 🚀🚀🚀

One of the favorite portfolio companies, decentralized exchange Hashflow, has recently surpassed $10 billion in trading. The Hashflow token, HFT, launches tomorrow on Binance, with pools to let you earn free $HFT.

You can check more information below:

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

Tatiana Koffman

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics, and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital, and Cryptocurrencies. I believe in empowerment closing the financial education gap and creating equal opportunity for the next generation. I have invested in 20+ companies and funds. Check out my portfolio here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.

Shared!!!