Myth Of Money: Norwegian Oil Billionaire Joins Bitcoin Ranks

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

Join Us On Clubhouse 🎤

Join our CLUBHOUSE group and stay up to date on new and captivating discussions.

Oil billionaire Kjell Inge Rokke, Norway’s second-richest person with an estimated $5.4 billion net worth, has come out strongly in favor of Bitcoin, stating that “Bitcoin may still go to zero. But it can also become the core of a new monetary architecture.”

In a letter to the shareholders of his company Rokke’s Aker ASA, which controls oil and oil service companies and has more recently branched out into green tech and renewable energy companies, the CEO announced that the company participate in the Bitcoin ecosystem in the following ways:

Today we announced that Aker has established Seetee, a new company that will invest in exciting projects and companies throughout the Bitcoin ecosystem while keeping all of its liquid investable assets in bitcoin. The new company has a capitalisation of NOK 500 million, an amount we aim to increase significantly over time as we gain experience and identify exciting opportunities.

(1) Seetee will use Bitcoin as a Treasury Asset (like Tesla, Microstrategy, Square, etc.)

First, we will use bitcoin as our treasury asset and join the community. In Bitcoin speak, we will be hodlers. We will be different, but additive. Perhaps not as rebellious as the cypherpunks who invented Bitcoin. But much more progressive than most established corporates. The team at Seetee is already running open source bitcoin payment servers and will remain active contributors in the community.

(2) Seetee will apply the renewable energy approach to Bitcoin Mining

Second, Seetee will establish mining operations that transfer stranded or intermittent electricity without stable demand locally—wind, solar, hydro power— to economic assets that can be used anywhere. Bitcoin is, in our eyes, a load-balancing economic battery, and batteries are essential to the energy transition required to reach the targets of the Paris Agreement. Our ambition is to be a valuable partner in new renewable projects.

(3) Seetee will invest in thee Bitcoin ecosystem

Third, we will build and invest in projects and companies in Bitcoin’s ecosystem. This is where our true passion is! Our home game is industrial applications. But we also believe nicely designed modern user interfaces will enable new applications wherever transactions happen. I am particularly interested in micropayments and how these may enable us to avoid usernames, passwords, and our personal data being monetised with, and often without, our knowledge or consent.”

Why is this development important?

Bitcoin is now through the doors of speculation. Each week a set of new investment firms, industries and capital allocators are giving Bitcoin the credibility it deserves as a new store of wealth and a possible world reserve currency.

My inbox is full of folks asking me if it’s too late to buy. This is a scary question to answer. After an asset multiplies by almost 20 times its price in 12 months, we must be defensive. Applying all investment logic, we should be due for a correction. But Bitcoin has created a fundamentally new paradigm. Bitcoin is not a stock or a commodity that shot up in price unexpectedly and should therefore go through a correction. Bitcoin was not created as part of the traditional financial system. Bitcoin is here to replace the system, not participate in it. And if Bitcoin is successful, how do you value each of the 21 million units in a new global monetary standard?

The total money supply in circulation in the world is $37 trillion USD. If this entire supply was replaced by Bitcoin, each Bitcoin would be worth approximately $1.8 million per coin. This statement may seem like an exaggeration, but let’s put Bitcoin’s price appreciation into perspective.

10 years ago: BTC was $1.

1 year ago: BTC was $4,100.

Today: BTC is $60,000 (15x the previous year, 60,000x the previous decade)

Unknown Future Date: BTC is $1 million, only a 16.7x from today.

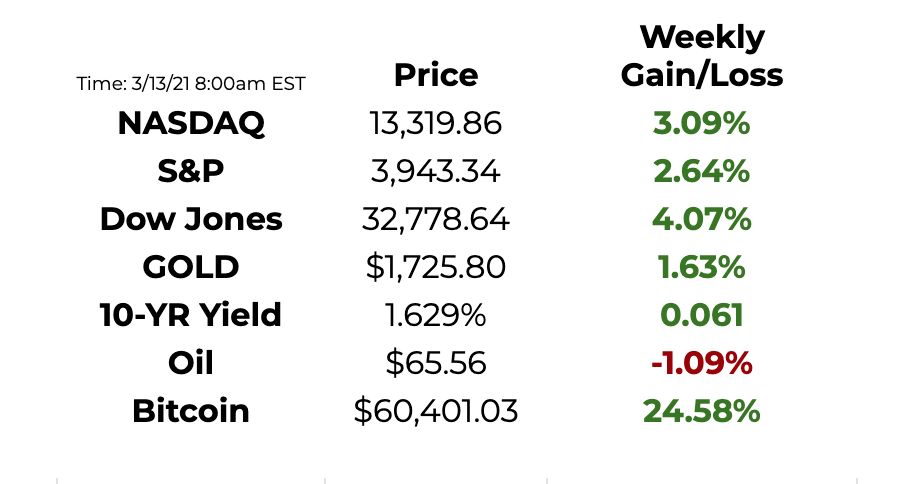

This Week By the Numbers 📈

The markets got a bump across the board as the U.S. approved the new $1.9 trillion stimulus package. U.S. hit a vaccine milestone of 100 million doses, as the world patiently awaits for the country to re-open.

*Bitcoin hit a new all time high of $60,000 🚀

Top Stories 🗞

Soros, Morgan Stanley Join $200M Investment in Bitcoin Firm NYDIG

NYDIG, the firm that facilitated MassMutual’s $100 million bitcoin buy last year, has raised $200 million from a cadre of big-name investors. The round included Stone Ridge Holdings Group, Morgan Stanley, New York Life, MassMutual, Soros Fund Management and FS Investments, NYDIG announced Monday. Past investors Bessemer Venture Partners and FinTech Collective also participated. Read Full Story.

JPMorgan to Launch ‘Cryptocurrency Exposure Basket’ of Bitcoin Proxy Stocks

Just weeks after JPMorgan Chase published a report warning that traditional financial companies are at risk of falling behind in digital finance, the largest U.S. bank is looking to issue debt linked to cryptocurrency-focused companies. J.P. Morgan Cryptocurrency Exposure Basket, the incoming debt instrument, is long on MicroStrategy (20%) Square (18%), Riot Blockchain (15%) and chipmaker NVIDIA (15%) with positions in 11 companies total. It does not invest directly in cryptos, according to the prospectus. Read Full Story.

Israeli Pension Giant Put $100M Into Grayscale Bitcoin Trust

Israeli pension company Altshuler Shaham has sunk $100 million into the Grayscale Bitcoin Trust (GBTC). Altshuler Shaham is one of the largest investment houses in Israel, with over $50 billion in assets under management. The firm made the investment into GBTC in the second half of last year, when bitcoin was trading at around $21,000, according to the report. Read Full Story.

US Lawmakers Make Third Attempt to Bring Legal Clarity to Cryptocurrencies

U.S. Representative Warren Davidson (R-Ohio) reintroduced his signature bill on Monday, marking the third attempt in three years to push through regulation that would provide a clearer legal standing for cryptocurrencies. According to a press release from Davidson’s office on Monday, the Token Taxonomy Act, first introduced in 2018, seeks to exempt certain cryptocurrencies and digital assets from federal securities laws. Read Full Story.

VIP Investor List 💰

I will start sending out occasional investment opportunities to those on my VIP investor list. Some of these will be fund investments, start-up investments, pre-IPO deals, crypto and digital assets opportunities, exclusive allocations… you get it. If you are an accredited investor and want to be on this list, send me a note.

Favorite Products 👀

Lolli.com - Earn Bitcoin while you shop at thousands of online retailers. [U.S. only]

Coinbase - Looking to make your first Bitcoin purchase in the U.S.? Use this code for a $10 sign-up bonus.

Binance - Looking to make your first Bitcoin purchase outside the U.S.? Use this code to get a 10% discount on trading fees.

Aspiration Bank - Join this climate-friendly bank, pay what you want in fees, and get a $50 bonus when you spend $250 by using this link.

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.