Myth of Money: Quantitative Easing Not So Easy

Welcome to this week’s edition of the Myth of Money, a weekly newsletter on all things money, economics and technology read by 10,000+ investors, curated by Tatiana Koffman.

Disclaimer: The following is not intended as investment advice. Do your own research.

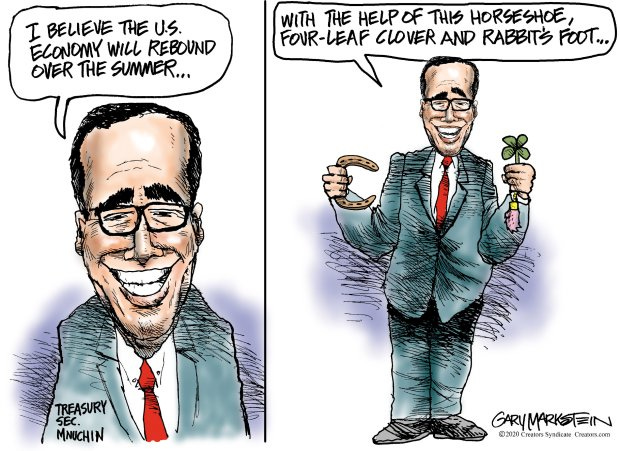

In a bailout plot twist, Treasury Secretary Steven Mnuchin ended Federal Reserve’s key emergency lending programs, and asked the Fed to return any unused funds, downsizing the next secretary’s ability to restart the economic support. According to the New York Times, this may impact Biden’s ability to use the central bank to cushion the economic fallout from the virus.

“Mr. Mnuchin on Thursday said he would not continue Fed programs, including ones that support the markets for corporate bonds and municipal debt and one that extends loans to midsize businesses. The emergency efforts expire at the end of 2020, but investors had expected some or all of them to be kept operational as the virus continues to pose economic risks.

The pandemic-era programs are run by the Fed but use Treasury money to insure against losses. They have provided an important backstop that has calmed critical markets since the coronavirus took hold in March. Removing them could leave significant corners of the financial world vulnerable to the type of volatility that cascaded through the system as virus fears mounted in the spring.”

The Fed’s emergency lending requires sign off from the Treasury. The 2020 emergency programs were backed by $454 billion that Congress appropriated in March as part of a broader pandemic response package.

“Mr. Mnuchin did agree to extend other emergency loan programs that are not backed by the congressional appropriation, including ones that service the short-term market for corporate debt, one for money market funds, and one that backstops government small-business loans.”

In follow-up interviews, Powell said it was too soon to pull funding, while Mnuchin argued that there was plenty of support left for the markets. It is unclear how the markets will react to the news in the coming weeks, as quantitative easing and lending programs were a crucial driver in the recent stock market recovery.

This Week By the Numbers

Investors are juggling negative news of lockdowns and rising COVID numbers, with positive news of a coming vaccine, while markets remain flat. There are still 10 million jobs lost since the pandemic started, with 35 consecutive weeks that jobless claims have been higher than at the peak of the Great Recession. Stimulus continues to be at a standstill, like to only be settled in 2021. The economy is projected to continue to contract in Q1. As uncertainty mounts, Bitcoin continues to be the best performing asset class week-over-week.

Top Stories

China borrows at negative interest rates for the first time

China is cashing in on fears that the West's faltering economic recovery will keep interest rates near record lows for a long time. The Chinese sale, which attracted final orders of about €16 billion ($18.9 billion) for the €4 billion ($4.7 billion) worth of bonds on offer, included 5-year debt priced with a yield of minus 0.152%. The bond sale that attracted significant investor interest, according to Deutsche Bank. European investors snapped up the bulk of the debt as they seek to gain exposure to the only major global economy expected to grow this year. Investors included central banks, sovereign wealth funds and global asset managers spanning Europe, Asia and the United States. Read Full Story.

Tesla stock jumps on carmaker’s addition to the S&P 500

S&P Dow Jones Indices announced on Monday that the carmaker will be added to the benchmark index prior to trading on Monday, Dec. 21. Based on Monday’s closing prices, Tesla would be one of the 10 most valuable companies in the index. Tesla shares spiked more than 13% in extended trading on the news, as money managers with funds that track the S&P 500 will need to buy the stock for their portfolios. The make-up of the S&P 500 is determined by what’s known as the “Index Committee” at S&P Dow Jones Indices, which analyzes quantitative as well as qualitative factors. Read Full Story.

BlackRock’s Rieder says bitcoin can replace gold ‘to a large extent’ and crypto is ‘here to stay’

The comments from Rieder, chief investment officer of global fixed income at the world’s largest money manager, come after high-profile Wall Street investors Paul Tudor Jones and Stanley Druckenmiller have in recent weeks offered positive comments on bitcoin. “I think cryptocurrency is here to stay. I think it is durable, and you’ve seen the central banks that have talked about digital currencies,” Rieder said on. “I think digital currency and the receptivity — particularly millennials’ receptivity — of technology and cryptocurrency is real. Digital payment systems is real, so I think bitcoin is here to stay.” Read Full Story.

Mexican Billionaire Reveals 10% of His Liquid Assets Are in Bitcoin

Founder of Grupo Salinas, Salinas Pliego stated that “Bitcoin protects the citizen from government expropriation.” The other 90% of his investments are tied up “in precious metals miners.” Latin American countries, namely Venezuela, have been plagued by hyperinflation in recent years, leading to a situation reminiscent of Germany’s 1920’s hyperinflation in the Weimar Republic. Investors looking to protect themselves from “government expropriation” and inflation have historically turned to alternative assets like gold to hedge against fiat currency devaluation. Now bitcoin looks to be increasingly finding a place as a digital alternative. Read Full Story.

The Only Bitcoin Resources List You Will Ever Need

I have received several requests for Bitcoin resources. I find that in this case - less is more. Here are a few of my favorites to help you make your investment decision.

Institutional Reports

Fidelity: Bitcoin As An Alternative Investment

The Great Monetary Inflation by Paul Tudor Jones

Videos

“Bitcoin in the Boardroom” with Michael Saylor, CEO of MicroStrategy

Introduction to Bitcoin by Andreas Antonopoulos

Books

Other

Thank you for reading this week’s edition of the Myth of Money.🚀

Until next week,

By Tatiana Koffman

Hi there and thanks for reading. If you stumble upon my newsletter, you will notice that I write about money, economics and technology. I hold a JD/MBA and spent my career in Capital Markets working across Mergers & Acquisitions, Derivatives, Venture Capital and Cryptocurrencies. I believe in empowerment through closing the financial education gap and creating equality of opportunity for the next generation. Check out my articles in Forbes here.

Enjoyed your reading experience?

Follow me on Twitter.

Hit reply with your feedback and ideas :)

Share this post with others.

Tips: BTC @ 1MgfRn8NHnc8ZE5kBvNgYbgpTFShJh5mKK

Disclaimer: This email does not contain financial advice and was created solely for informational purposes.

Received this email by accident? Unsubscribe below.